- UNI showed strong on-chain signals with significant growth in large transactions and network activity

- UNI, at press time, was testing its key resistance at $13, with potential for further gains if breakout occurs

As a seasoned crypto investor with over a decade of experience under my belt, I’ve seen more market fluctuations than I care to remember. However, the recent surge of Uniswap [UNI] has certainly piqued my interest. The massive $38 billion in monthly volume across various Ethereum Layer-2 networks is nothing short of impressive, and the strong bullish sentiment it’s generating is hard to ignore.

As a researcher delving into the dynamic world of cryptocurrencies, I’ve noticed a remarkable surge in the popularity of Uniswap [UNI]. This momentum appears to be driven by an impressive $38 billion in monthly transactions on Ethereum Layer-2 platforms such as Base, Arbitrum, Polygon, and Optimism. The increased activity seems to have sparked a positive outlook among investors, with UNI currently trading at $12.95 – marking a 2.16% increase over the past 24 hours.

With its popularity and use growing steadily, UNI now stands at a pivotal point. Will it sustain this progress and break through significant barriers, or might it experience a dip in the coming days instead?

Are the on-chain signals signaling more bullish action?

As a researcher, I’ve been delving into Uniswap’s on-chain data and found several bullish signs. The network growth has shown a steady increase of approximately 0.34%, which indicates a growing number of users embracing this platform. Furthermore, in-the-money transactions have risen by about 1.56%, signaling that more investors are now enjoying profitable positions on Uniswap.

Furthermore, the concentration increased by 0.04%, suggesting that holders were becoming more confident.

The significant increase, worth noting, appeared to be the rise in substantial trades, which experienced a 6.92% boost. This leap underscored the escalating participation of institutional investors and major traders, suggesting that influential figures are readying themselves for possible price increases in UNI.

What does UNI’s price action say about the future?

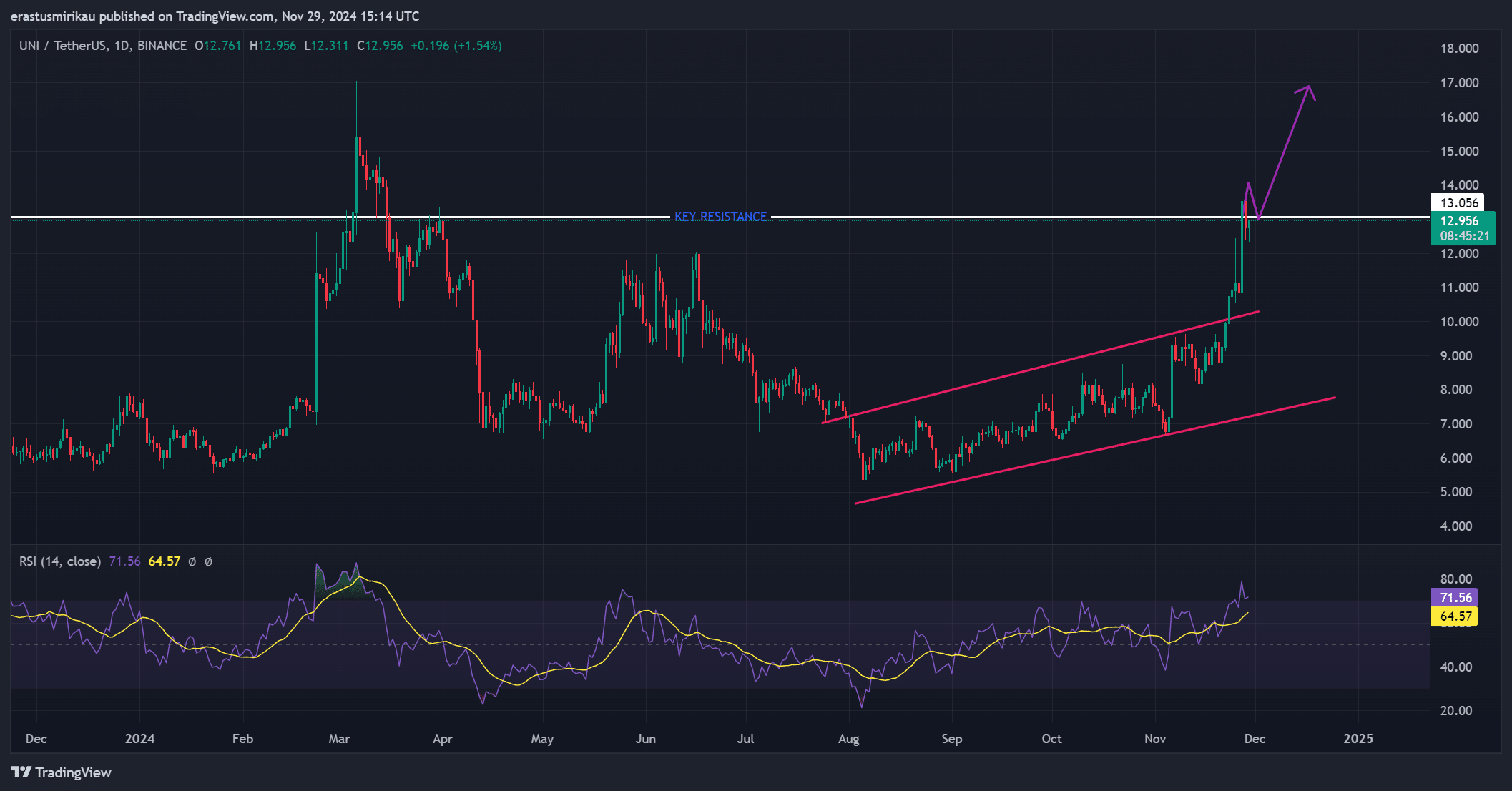

At the moment, I’m observing a significant test of the $13 resistance for Uniswap’s price. If we manage to breach this barrier, it might catapult UNI all the way up to around $17. There appears to be another potential resistance level at that point.

However, RSI had a reading of 71.56, which suggested that UNI was nearing overbought conditions.

In other words, as long as the upward trend continues, it’s wise for investors to stay vigilant about possible temporary dips or pauses in growth before any significant advance.

Exchange reserves and liquidations – Mixed signals ahead?

In the past day, there was a slight increase of approximately 0.12% in the reserves of UNI tokens, now totaling 68 million units. This rise could indicate that investors are either choosing to keep their tokens or possibly planning to sell them, depending on their perspective about the market’s future direction.

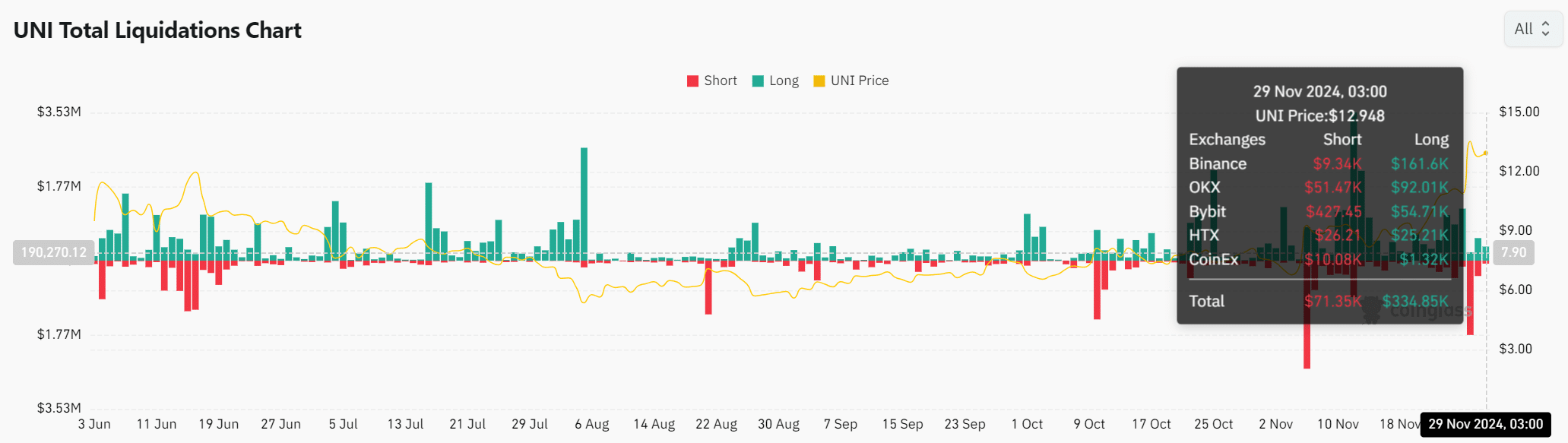

At the same time, it was clear from the total liquidations that there were more long positions held, specifically $334,850 compared to only $71,350 in short positions. This significant difference suggested that most traders are wagering on a prolonged bullish trend.

Moreover, this situation makes UNI susceptible to being targeted by short squeezes if the market trends negatively for the long investors.

Realistic or not, here’s UNI’s market cap in BTC’s terms

Will UNI continue its upward trend?

Based on Uniswap’s recent price surge, along with robust on-chain indications and an increase in large transactions, there seems to be a bullish trend for the token. Yet, as the Relative Strength Index (RSI) nears overbought levels and exchange reserves present mixed signs, traders are advised to exercise caution.

If UNI manages to surpass the $13 mark, it might push UNI prices upwards; however, there’s still a chance for a dip. So, if UNI maintains its current momentum and successfully breaches the resistance level, more growth could ensue.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-11-30 12:07