- Ah, dear friend, BNB’s tale unfolds as its unique address count blooms like an unexpected spring—ever climbing, with a whimsical nod to fate.

- Upon the daily chart, those trembling traders with fragile stop-orders may be unceremoniously swept away, heralding a rally as unpredictable as life itself. 😜

In a mere span of twenty-four hours, the market—like a capricious Russian summer—has given a modest 3.57% dip. One might almost laugh at its audacity! 🤭

Yet, it seems that powerful investors, with holdings as notable as a well-worn novel, might have orchestrated this decline, only to set the stage for a delightful buyback, promising that Binance Coin [BNB] shall again ascend among the choicest of gains.

Gradual Awakening of BNB’s Spirit

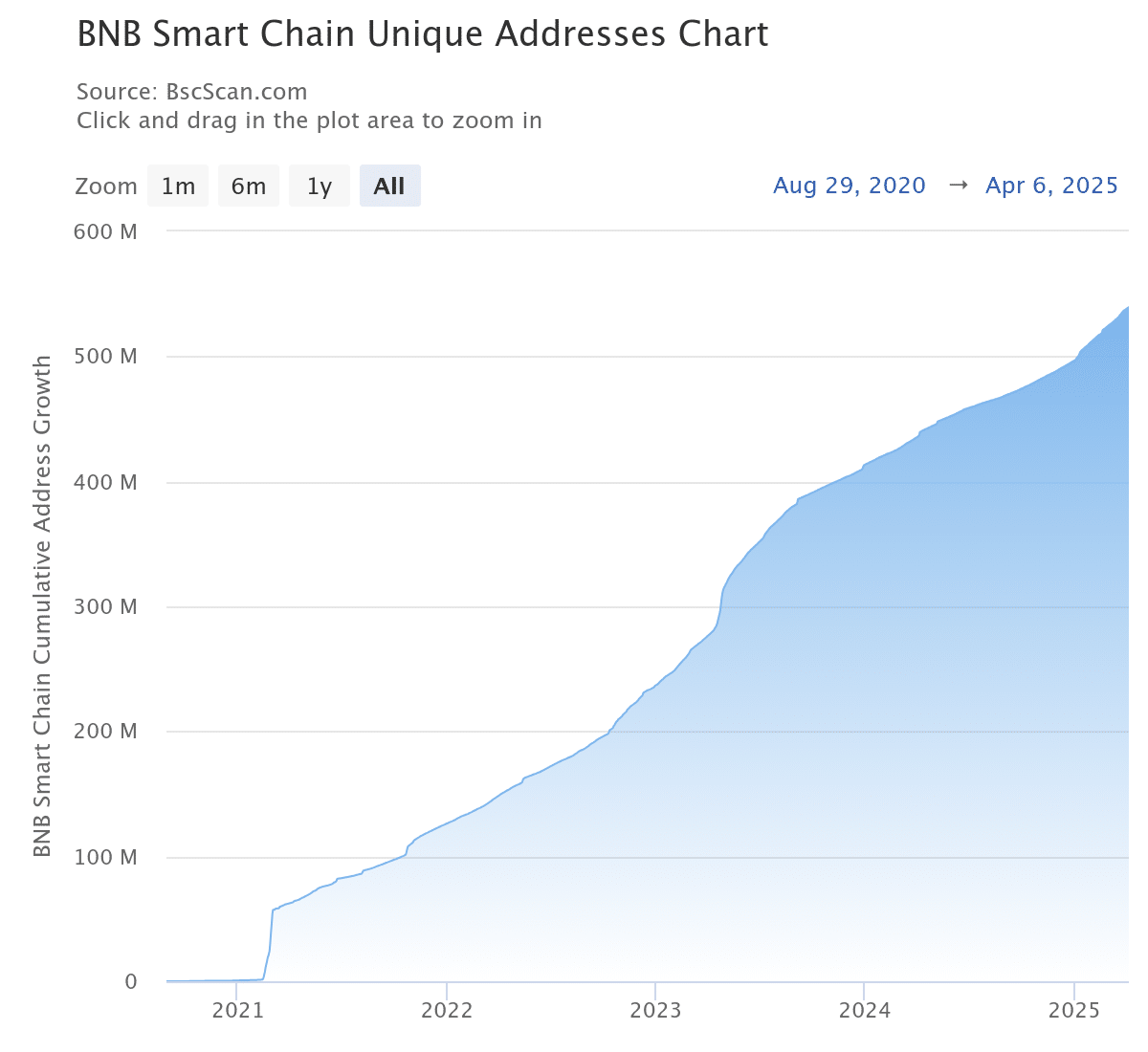

Over the past day, the adoption of BNB has stirred like a gentle breeze across the Russian plains. Unique addresses reached an unprecedented 539 million—a charming increase of 268,000 since the previous day’s quiet murmur.

These unique addresses, akin to earnest travelers setting foot upon the BNB Smart Chain for the first time, engage in the noble art of sending and receiving BNB, a quiet measure of the chain’s burgeoning community.

The blossoming growth of these addresses may well be linked to recent trading escapades, as participants—half in jest, half in earnest—purchased or received the cherished asset.

Furthermore, transactions on the chain have surged to 4 million, a veritable soirée of activity that amplifies BNB’s overall allure.

The chart narrates a story most enchanting: BNB now pirouettes within a historic buy zone, hinting at a major upward waltz.

A Fateful Realm—Will the Timid Be Cast Aside?

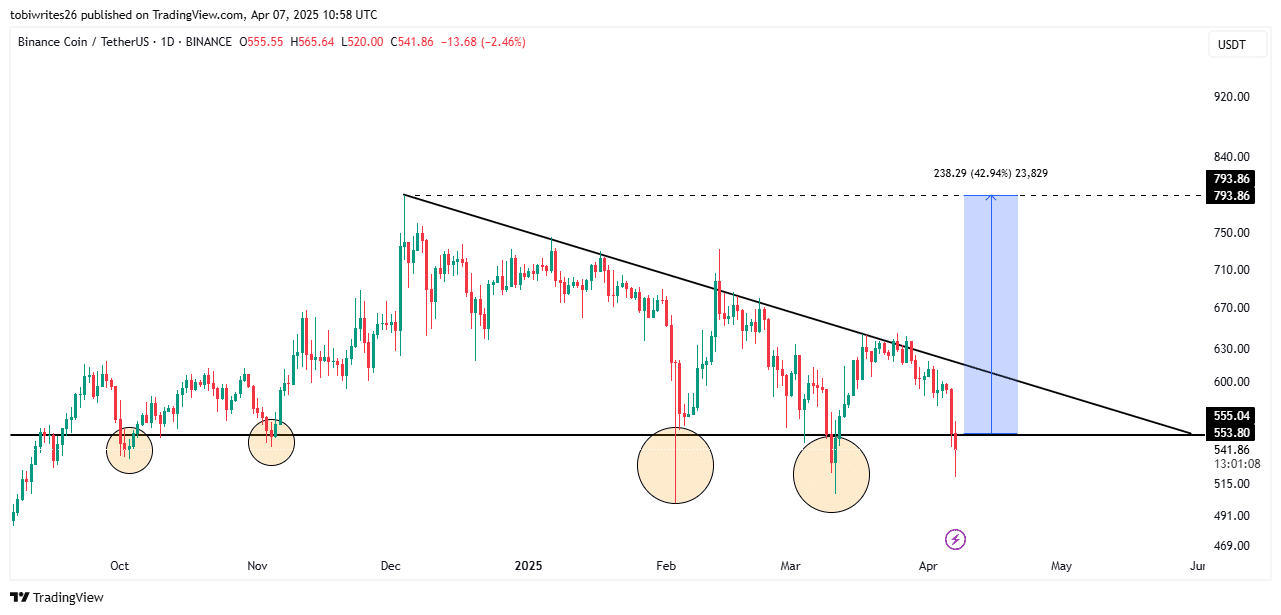

On the daily canvas, BNB has ventured into a significant support level, gracefully etching a bullish triangle—a motif suggesting a grand increase on the horizon.

This very realm, enchanting as it is, has in former times sparked exhilarating price surges; yet in recent chapters, it has also evoked liquidity sweeps akin to tragic stop hunts, with downward wicks stretching long before a swift reversal. 🤨

Such a scenario mercilessly expels those faint-hearted ‘paper hand’ traders, whose stop-losses shiver near support, leaving behind only the resolute investors who, with a wry smile, seize BNB at delightfully discounted prices as the market stumbles.

If robust momentum follows this merry accumulation, BNB might well defy the descending resistance, rallying a remarkable 42% to the fabled $793—a spectacle reminiscent of December 2024’s grand pageant. 😆

The market’s reaction, analyzed by those astute chroniclers at AMBCrypto, reveals that both spot and derivative enthusiasts have embraced a mood of buoyant accumulation, as if the very spirit of adventure guides their hearts.

Opportunity Beckons the Daring

In the sphere of spot transactions, the buying fervor has reached a crescendo. A cool $9.83 million in BNB was amassed amidst a downward price dance—totaling an impressive $21.04 million over the past three days. It seems traders have found a bargain that even the most cautious may not resist!

This act of accumulation, a veritable banquet for the speculative soul, underlines traders’ resolve to seize BNB at prices that now appear as modest whispers of potential.

Similarly, in the realm of derivatives, the spirit remains buoyant, buoyed by the ever-optimistic Open Interest (OI)-Weighted Funding Rate—a metric that today cheerfully rests above the neutral line.

At the time of this chronicle, the OI-Weighted Funding Rate, modest at 0.0020%, whispers of bullish intent, as long traders, with a twinkle in their eyes, wager upon an imminent, radiant rally.

Should this buoyant sentiment continue to swell, BNB may indeed soar to heights rivaling its December apex—a scenario as ironic and charming as any tale spun by fate. 😄

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2025-04-08 11:08