- U.S. Bitcoin ETFs experience the third-largest sell-off, highlighting the contrasting moves in the crypto markets.

- History is set to repeat itself as analysts predict a bull run similar to that of 2021 after FED cuts interests rate this September.

As a seasoned researcher with over two decades of market analysis under my belt, I’ve witnessed numerous market ebbs and flows, from the dot-com bubble to the global financial crisis. The recent sell-off of Bitcoin ETFs is reminiscent of those turbulent times, but it also brings to mind the adage: “Sell in May and go away.”

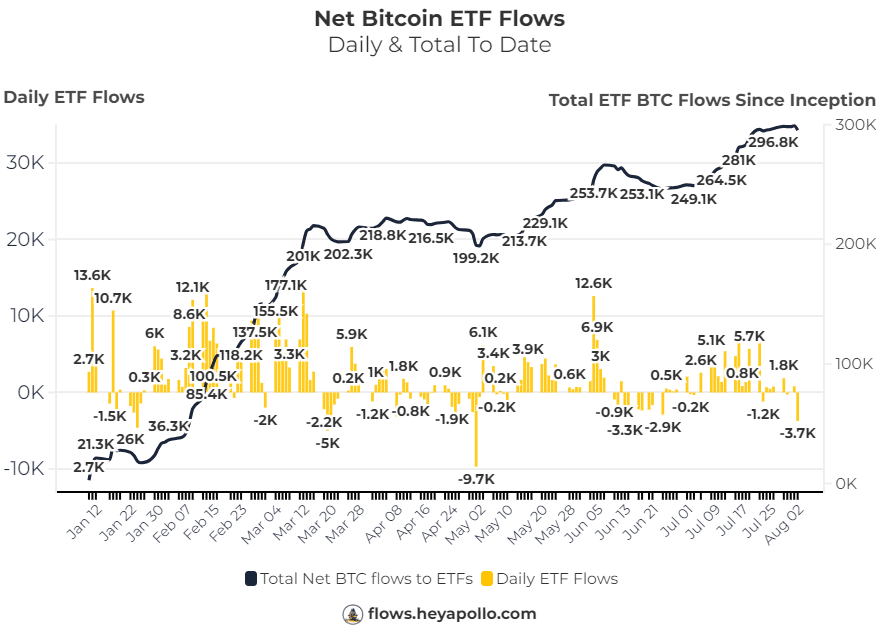

3,750 Bitcoins were recently sold off through U.S.-based ETFs, making it the third-largest Bitcoin sell-off since these funds began operation. However, BlackRock defied this trend by purchasing 683 Bitcoins instead.

In the ETF market, key players like Fidelity, ARK, Grayscale, Bitwise, and VanEck were among those who disposed of substantial amounts of Bitcoin. Specifically, Fidelity got rid of 1,646 BTC, ARK sold 1,387 BTC, Grayscale divested 569 BTC, Bitwise offloaded 465 BTC, and VanEck parted with 364 BTC.

The significant reduction in Bitcoin holdings by these major financial institutions, as indicated by the Net Bitcoin ETF Flows on Flows.heyapollo.com, shows diverse strategies and viewpoints about the market.

The contrasting moves highlighted the ongoing volatility and differing outlooks within the cryptocurrency market, particularly among institutional investors.

This may result in short-term decline on the Bitcoin market.

Will August see Bitcoin reach $44k?

The cryptocurrency market could experience a significant downturn in the coming week, yet it’s essential to remain optimistic rather than during periods of strong price increases following Bitcoin’s strategic reserve announcement.

From mid-March until April, Bitcoin exhibited a downward trend, but it couldn’t surpass its peak in May. Starting from mid-June, it resumed its bearish behavior once more.

The bias remains unchanged, expecting a low in August though we don’t know exactly where this low will land, but soon it will be bullish again.

Initially, it’s crucial that we aim for the target area (demand zone) where potential opportunities lie. The BTCUSD chart indicates a possible surge in price if we can reach around $44k, which could potentially soar up to $100k.

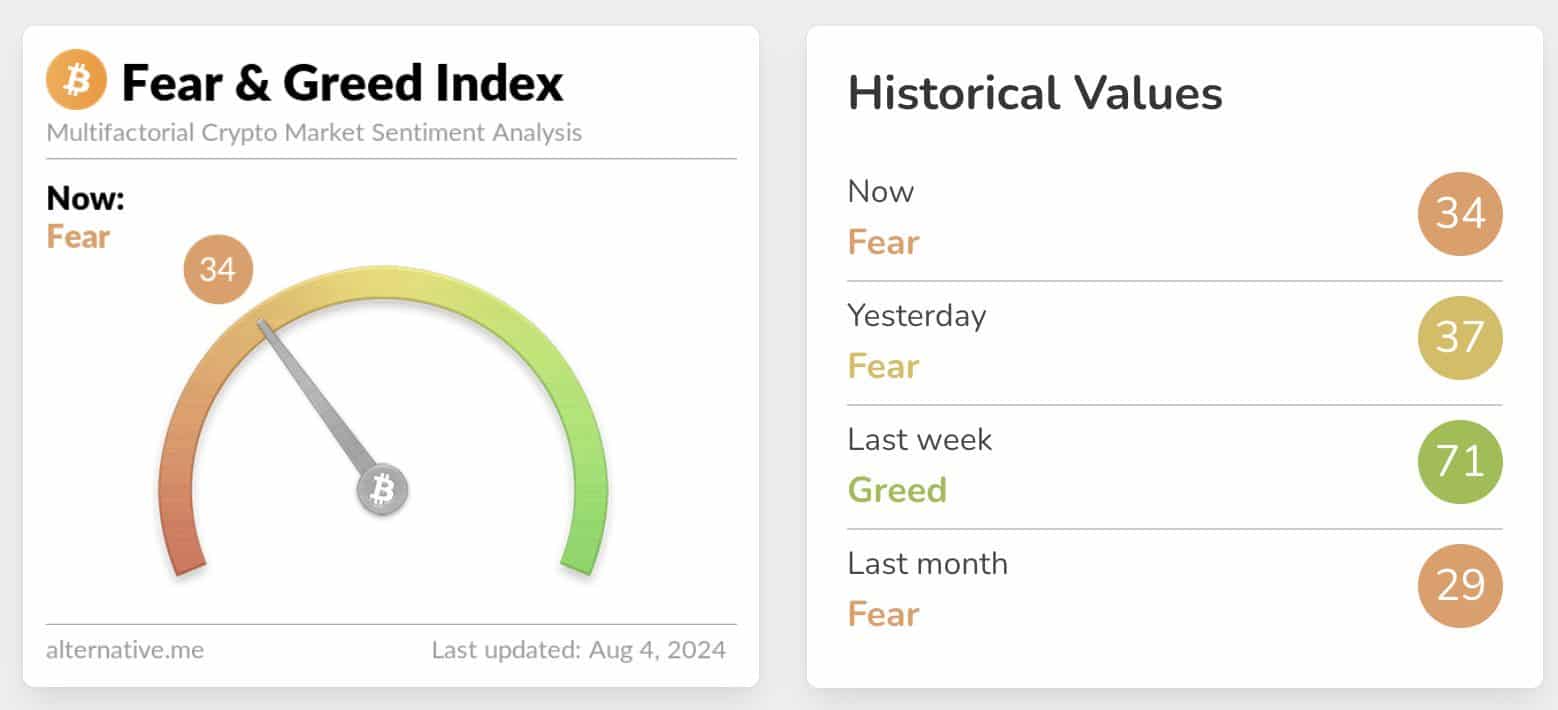

Moreover, over a span of two weeks, the Fear & Greed Index has moved from a high of 71 (indicating excessive greed) to a low of 34 (showing intense fear). This change suggests an increasing number of investors are selling off their assets due to growing market apprehension.

Will the 2021 crypto bull run repeat itself?

2020’s market history appears set to mirror past events as a crash occurred due to economic anxiety caused by COVID-19 and subsequent economic downturn, followed by a recovery.

In response, the Federal Reserve reduced interest rates and enacted quantitative easing policies to bolster the economy, which contributed significantly to the surge in the cryptocurrency market during 2021.

Today, markets are once more experiencing a steep drop as investors express concern over a subpar employment report and potential economic downturn.

Read Bitcoin’s [BTC] Price Prediction 2024-25

It’s anticipated that the Federal Reserve will lower interest rates in September and restart quantitative easing again.

According to AMBCrypto’s analysis based on data from TradingView, it appears that the same economic worries and monetary actions might be at play, which could lead to another market rebound similar to the one experienced after 2020.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-08-05 11:03