-

Metaplanet buys another $3.3 million worth of BTC.

The recent purchase is a part of the company’s Bitcoin accumulation strategy.

As a seasoned crypto investor with a knack for spotting trends and following the footsteps of major players, I find Metaplanet’s Bitcoin accumulation strategy intriguing and promising. Over the past seven months, it has been fascinating to witness how institutional interest in Bitcoin has grown, particularly with companies like Metaplanet leading the charge.

Over the past seven months, major crypto companies have turned to Bitcoin to boost their stock.

As a crypto enthusiast, I’ve been actively capitalizing on the escalating institutional attention towards Bitcoin, with major corporations wagering on its potential future worth. Following suit, Japanese Metaplanet has embarked on an aggressive acquisition strategy, aiming to amass as much Bitcoin as they can get their hands on.

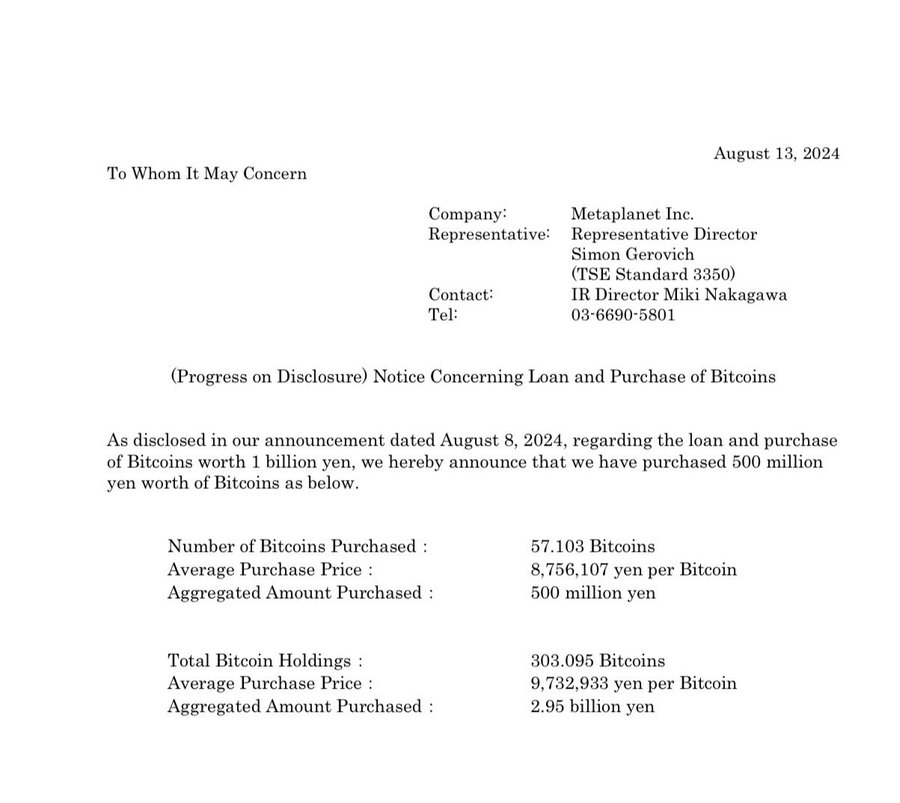

Metaplanet buys BTC worth ¥500 million

Approximately a week past, Metaplanet obtained a ¥1 billion loan primarily for purchasing additional Bitcoin. Their CEO, Simon Gerovich, disclosed this news via his official social media platform (previously known as Twitter).

“Always be staking #bitcoin.”

As a seasoned investor with over two decades of experience in the financial markets, I have witnessed numerous trends come and go, but none quite like the meteoric rise of Bitcoin (BTC). The recent acquisition by my company is not just another investment move; it’s an informed strategic decision based on my extensive understanding of market dynamics.

Metaplanet’s BTC Strategy

According to previous reports from AMBCrypto, Metaplanet has been actively purchasing Bitcoins to boost its overall BTC holdings as part of a long-term accumulation strategy.

In a recent development, the company has acquired Bitcoins valued at approximately $3.3 million, which now adds up to a total of 303.95 Bitcoins worth around $18 million in today’s market. This purchase is one among several acquisitions made over the past few months.

As a seasoned investor with years of experience under my belt, I have always been intrigued by the dynamic nature of cryptocurrencies, particularly Bitcoin (BTC). On May 28th, I made a strategic move to invest $1.6 million in BTC, sensing an opportunity that could potentially yield significant returns. Fast forward to July, I found myself investing another substantial sum of $1.7 million, this time purchasing 19.87 BTC. The market was showing signs of bullish sentiment, and I didn’t want to miss the boat.

As an analyst, I’ve observed that our latest transaction involved the acquisition of 21.877 Bitcoin. This strategic move underscores our commitment to maintaining and growing our Bitcoin holdings, demonstrating a persistent approach in building and retaining our Bitcoin reserves.

Impact on Metaplanet

Significantly, Metaplant’s approach to Bitcoin investment has positioned the Japanese as significant contributors within the global institutional market.

Based on information from CoinGecko, it appears that Metaplanet ranked 20th amongst major institutions holding Bitcoin.

As a result, it seems clear that the implemented strategy has proven successful, given the substantial increase in the company’s stock. According to Google Finance, the stock has surged by an impressive 82.87% over the last five days.

As a seasoned investor with years of experience under my belt, I can confidently say that a surge like this one, where a stock has risen by an astounding 600.63% over the year-to-date (YTD), is always a heartening sight. It serves as a validation of the strategy I’ve been employing and reinforces my belief in its potential for success. Such impressive gains are not just numbers on a screen, but rather tangible indicators that my hard work and careful analysis have paid off. This surge, therefore, fills me with optimism for the future and underscores the importance of patience and perseverance in the world of investing.

Over the last seven months, Metaplanet has seen significant growth, and given Bitcoin’s anticipated value, this accumulation could establish Metaplanet as a major player in the industry.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-08-14 03:04