Ah, the world of ethereum! It presents itself in a most intriguing manner. A recent report on staking reveals that the year 2025 was a veritable theater of technological marvels and burgeoning institutional embrace, all while the price of ETH languished in a stagnant pool, setting the stage for what can only be described as dramatic structural shifts in both staking and market dynamics as we approach the enigmatic 2026.

The Paradox of Ethereum in 2025: A Network Expands While Prices Stand Still

Oh, the irony! Ethereum’s journey through 2025 was painted with the starkest contrasts. The esteemed Ethereum Staking Insights & Protocol Analysis report by Everstake tells us of grand protocol upgrades and an unprecedented swell of institutional interest, while ETH prices remained as flat as a pancake left out in the sun. This curious disconnection serves to underline a most unsettling truth: ethereum is evolving at a breakneck speed, outpacing the sluggish valuations that tether it.

Two monumental upgrades dictated the narrative of the year. Pectra, like a benevolent wizard, conjured EIP-7251, elevating the maximum effective validator balance from a meager 32 ETH to a staggering 2,048 ETH. Meanwhile, Fusaka, in a display of technological prowess, activated PeerDAS (EIP-7594), a crucial upgrade that multiplied Layer 2 blob throughput by up to eight times! These advancements not only improved scalability but also fine-tuned validator efficiency, fortifying Ethereum’s stature as a global settlement layer amidst the chaos of speculation.

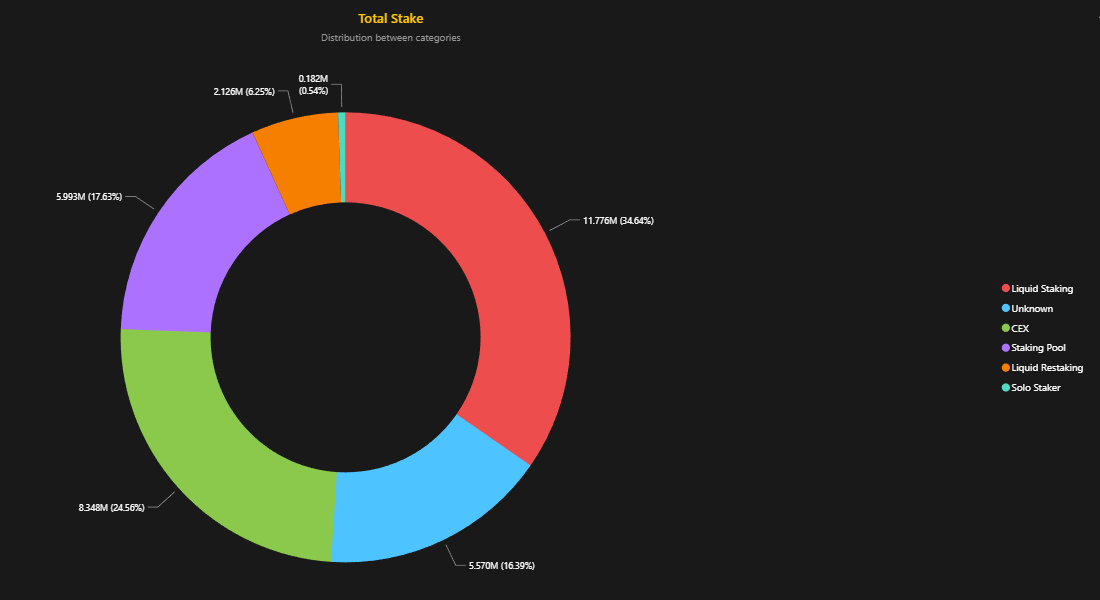

Consolidated validators burgeoned from a humble 2% to more than 11% of total staked ETH in a mere six months, a clear indication of a shift toward operational efficiency, especially among the behemoths of the institutional realm. By the end of the year, the total value staked swelled to approximately 36.1 million ETH, constituting 29.3% of the total supply, with net growth surpassing 1.8 million ETH. One might chuckle at the absurdity of it all!

But lo! The demand from the institutional realm surged forth like a tide. Digital Asset Treasuries (DATs) amassed a staggering 6.5-7 million ETH by December, a figure that encapsulates around 5.5% of the total supply! Many of these entities have taken to staking their corporate holdings, generating yield at the expense of liquidity, thus tightening the supply and contributing to a growing dilemma.

Bohdan Opryshko, Co-Founder and COO of Everstake, mused: “In 2025, as infrastructure improved and fees fell, ETH increasingly functioned as working capital, securing networks and generating yield. As we gaze into the crystal ball of 2026, we anticipate institutions will transcend passive exposure, treating ETH as a yield-bearing asset, where staking becomes less of an option and more of an obligation.”

On the usage front, Ethereum’s burgeoning Layer 2 ecosystem surpassed an impressive 300 transactions per second, while the Layer 1 activity saw a commendable 30% increase year over year, reaching 1.5-1.6 million daily transactions. Daily active addresses surged to around 450,000-500,000, largely propelled by ETF-related wallets and smart accounts, rather than the whimsical endeavors of retail transfers.

As we peer into the future of 2026, the report hints that Ethereum staking is becoming ever more formalized, aligning itself with the standards of traditional finance. While this may entice further institutional capital, it unfurls new questions regarding decentralization, client diversity, and systemic risk tolerance as Ethereum embarks upon its transformative odyssey.

FAQ🔗

- What characterized Ethereum’s performance in 2025?

A saga of major network upgrades and rising institutional staking amidst flat ETH prices. - Which upgrades were paramount?

The enchanting Pectra and Fusaka enhanced validator efficiency and Layer 2 scalability across the network. - How robust was institutional adoption?

Establishments staked up to 7 million ETH, reshaping the landscape of supply and demand. - What implications does this bear for 2026?

Ethereum staking grows more institutional and structured, heralding deeper market transitions.

Read More

- Best Controller Settings for ARC Raiders

- 10 Best Anime to Watch if You Miss Dragon Ball Super

- How to Get to Heaven from Belfast soundtrack: All songs featured

- 10 Most Memorable Batman Covers

- These Are the 10 Best Stephen King Movies of All Time

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- Star Wars: Galactic Racer May Be 2026’s Best Substitute for WipEout on PS5

- The USDH Showdown: Who Will Claim the Crown of Hyperliquid’s Native Stablecoin? 🎉💰

- Netflix’s Stranger Things Replacement Reveals First Trailer (It’s Scarier Than Anything in the Upside Down)

- Wife Swap: The Real Housewives Edition Trailer Is Pure Chaos

2026-01-28 08:57