USD1’s Wild Ride: 10x Spike & Its Celebrity Centralization 🚀🤪

Since Binance threw USD1 into the ring, it’s like everyone suddenly woke up and said, “Hey, I wanna trade this now!” The transaction volume exploded—like a balloon at a clown convention—up tenfold. Meanwhile, BNB Chain is hustling to get more buddies onboard, trying to turn USD1 into the next big ecosystem darling. Oh, and WLFI? They’re busy trying to turn USD1 into a meme coin superstar. Because nothing says stability like meme coin swagger, right? But don’t get too excited; the token’s still centralised enough to make your grandma blush.

USD1 Transactions Spike Thanks to Binance

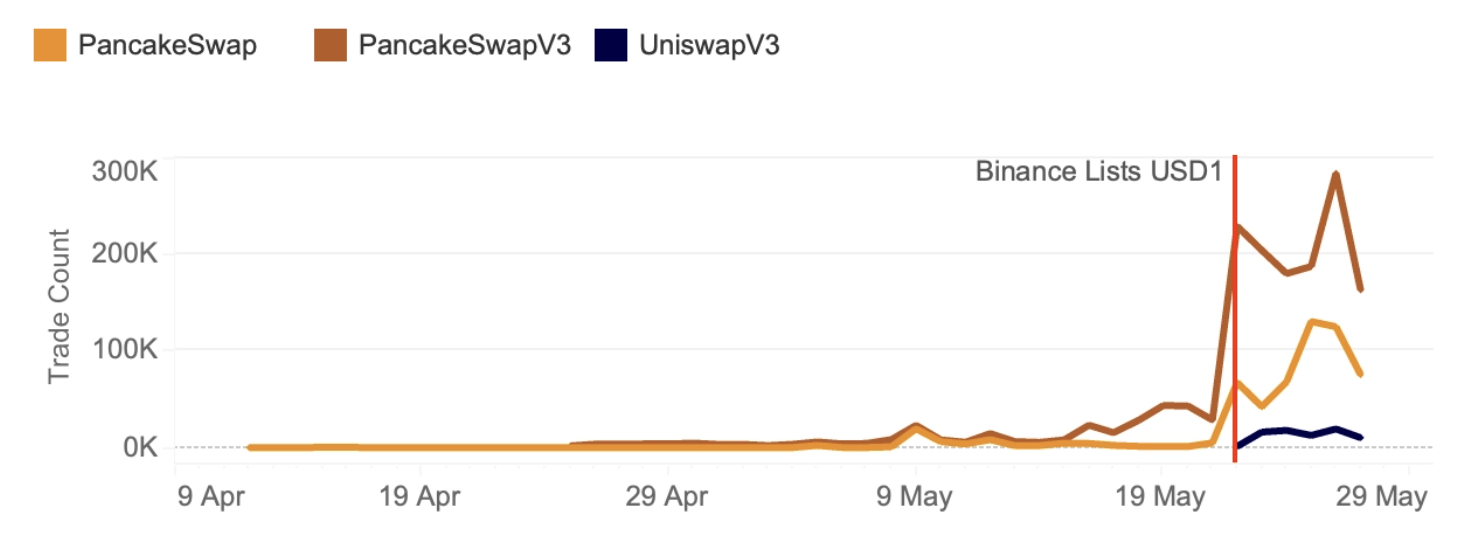

Remember when President Trump was dabbling in crypto? Well, USD1 is now joining that circus. Since Binance slapped it on their platform in late May, transaction volumes shot up faster than TikTok trends. Talk about a glow-up. According to some fancy report from Kaiko, here’s how much USD1 has been partying lately:

Yep, this little stablecoin has been busy. World Liberty Financial’s card-carrying crypto enthusiasts are now throwing USD1 into the mix, with WLFI throwing restaking into the ring—because why not? BNB Chain’s also getting in on the fun, bringing in more partners who want in on this stablecoin rollercoaster.

$USD1 (@worldlibertyfi) is on FIRE on BNB Chain!

From exchanges to wallets, everyone’s jumping on the bandwagon for lightning-fast, gas-free stablecoin transfers. Woohoo! — BNB Chain (@BNBCHAIN) June 3, 2025

It’s clear Binance isn’t just watching this happen—they’re pushing it hard through onboarding all kinds of partners. You know, so USD1 can become the official “big deal” in payments. A love story in the making? Maybe. Or just crypto’s version of a soap opera.

WLFI, not one to sit on their hands, recently hopped on the meme coin bandwagon—pumping USD1 on PancakeSwap to keep those transaction numbers soaring. Traders love memes, so why not mix them with stablecoins? It’s the crypto version of mixing beer with wine—destined to be *interesting*.

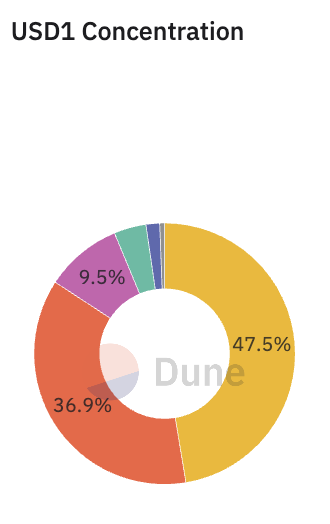

Market cap? Over $2 billion—more than enough to fuel this circus. But, of course, there’s the tiny issue of the tokenomics: over 93% of USD1 is held by three wallets. Yes, three. It’s like having your entire family own the company—trust issues, anyone?

Despite its family-sized concentration, things look pretty bullish. WLFI’s teasing some big giveaways that might just make the centralization less, uh, cozy. If USD1 keeps riding this wave, it could become a serious contender in the stablecoin universe—brace yourself, crypto world.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-06-04 01:31