- Tether USDT market share drops from 82% to 74%

- Regulated stablecoins such as USDC gains market share depicting changing market preferences.

As a seasoned analyst with extensive experience in the crypto market, I have witnessed the dynamic nature of this rapidly evolving industry firsthand. Tether (USDT) has long held a dominant position in the stablecoin market, but recent developments suggest that its reign may be coming to an end.

As cryptocurrencies gain more acceptance and become more mainstream, stablecoins have risen in popularity among investors and function as a reliable form of value storage for numerous crypto users.

In recent times, Tether has held the leading position in the relatively monopolized market of stablecoins. However, there’s been a change in investor sentiment, causing Tether’s market supremacy to gradually weaken.

At the present moment, the trading volume for Tether’s USDT has decreased by 8.8% within the last 24 hours, reaching a total of $38.65 billion.

Tether USDT market share declines

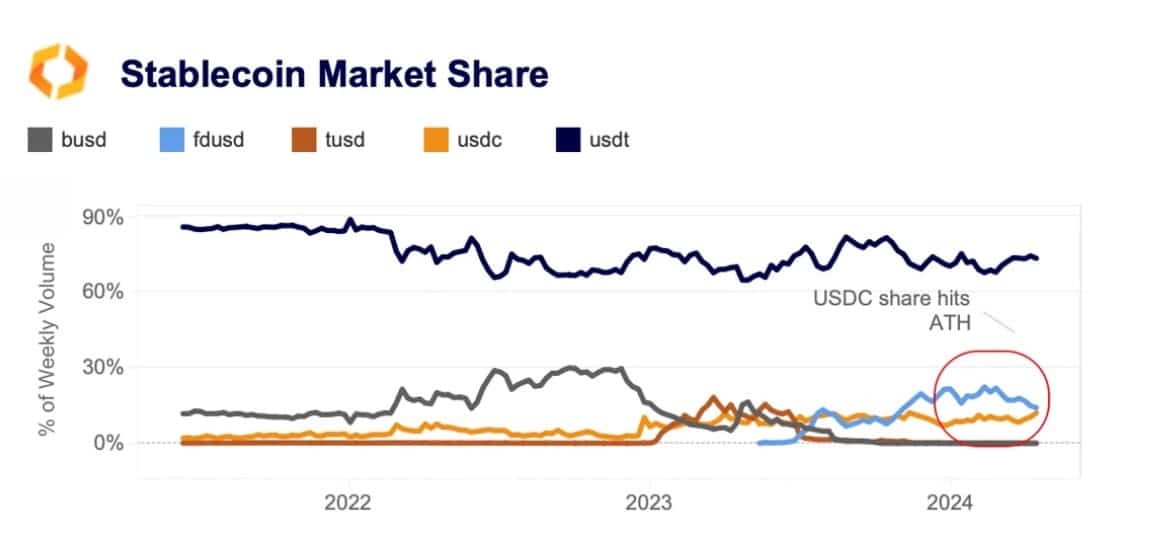

As a crypto investor following the latest market trends, I’ve noticed a significant shift in Tether’s (USDT) market dominance according to Kaiko’s report. In particular, USDT’s market share on centralized exchanges decreased from a commanding 82% in previous years to just 74% in the year 2024.

The cause of the decrease can be attributed to a growing trend in market attitudes and regulatory focus towards stablecoins. Over the past twelve months, alternative stablecoins like FDUSD have gained significant traction, primarily due to their collaborations, such as the one with Binance.

These factors have pushed Tether’s market dominance to a test.

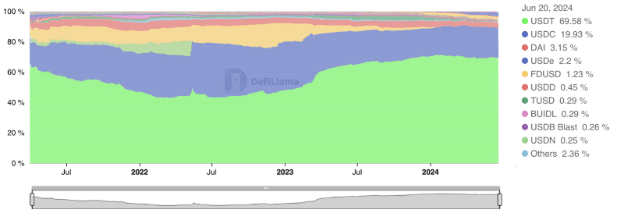

Increased competition

According to AMBCrypto’s reports, the USDC trading volume experienced a significant jump from $9 billion in 2023 to an impressive $23 billion in 2024. This increase can be attributed to the growing market need for stablecoins that adhere to regulatory requirements.

As a researcher studying investment trends, I’ve observed a noteworthy shift among major investors, including institutions, towards utilizing legally accepted stablecoins. This transition is being driven by the need to adhere to stringent operational requirements, particularly within the regulatory framework of the European Union.

As reported by Kaiko, USDC’s market share has increased to 12%, nearing FDUSD at 14%.

Trade on prominent cryptocurrency exchanges like OKX, Binance, and Bybit has surged, making USD Coin (USDC) a formidable rival to Tether. Additionally, the approval of Circle by the Monetary Authority of Singapore (MAS) has significantly increased USDC’s market presence and trading activity.

Additionally, according to keyrocktrading’s post on X, US Dollar Coin (USDC) offers more flexibility and ease of use compared to Tether in terms of transactions.

As a financial analyst, I would express it this way: “I have observed that US Dollar Coin (USDC) has a more elastic supply than Tether. This flexibility stems from its zero-fee minting feature and wider accessibility. In contrast, dealing with Tether involves longer transfer times to smaller banks located in the Virgin Islands.”

EU regulation of Stablecoins

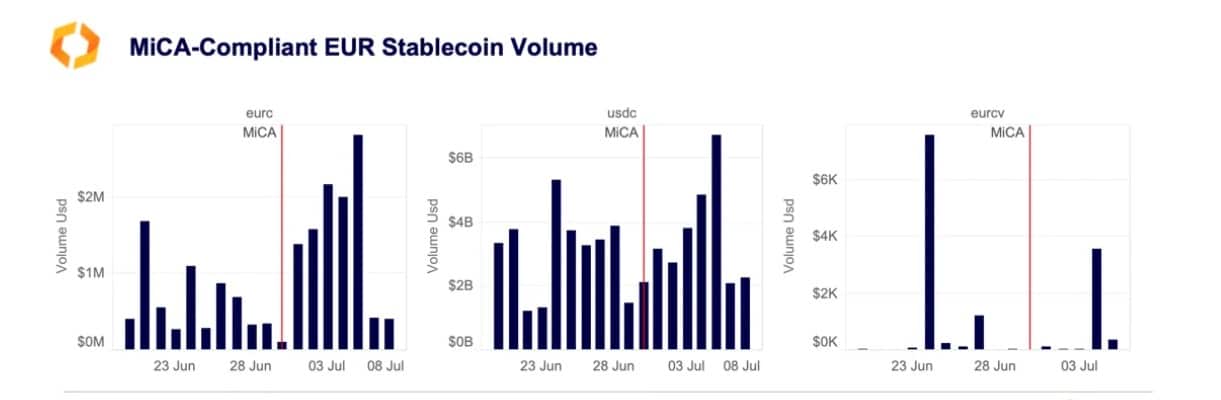

Europe’s Markets in Crypto Assets Regulation (MICA) is poised to disrupt the reign of non-compliant stablecoins with its regulatory framework.

Due to MICA’s new regulations, exchanges like Kraken may need to reevaluate their support for stablecoins such as Tether. These rules have raised concerns among industry leaders about the implications for their European business dealings, even for stablecoins that have been approved.

The CEO of Tether proposed that these conditions could create complexities for those who issue stablecoins.

As a researcher studying the cryptocurrency landscape, I can tell you that MICA’s recent actions have set a new standard that may significantly impact current crypto operations within the European Union.

Tether awaits suspension of USDT redemptions

Based on the information I’ve gathered from authoritative sources, Tether is projected to halt USDT redemptions on major blockchains by September 2025.

Francesco noted this development on X (formerly Twitter), sharing that,

Starting from today, Tether has declared that it will no longer produce USDT tokens on EOS and Algorand. Nevertheless, users can still exchange USDT tokens for their original value on these blockchains within the next twelve months.

As a crypto investor, I’d put it this way: Starting in 2023, Tether, the issuer of USDT stablecoin, will temporarily halt its operations on various blockchains including Bitcoin, Kusama, and Bitcoin Cash. For the following 12 months, this decision is aimed at enhancing network efficiency and ensuring a superior user experience and overall stability for USDT.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-07-15 05:12