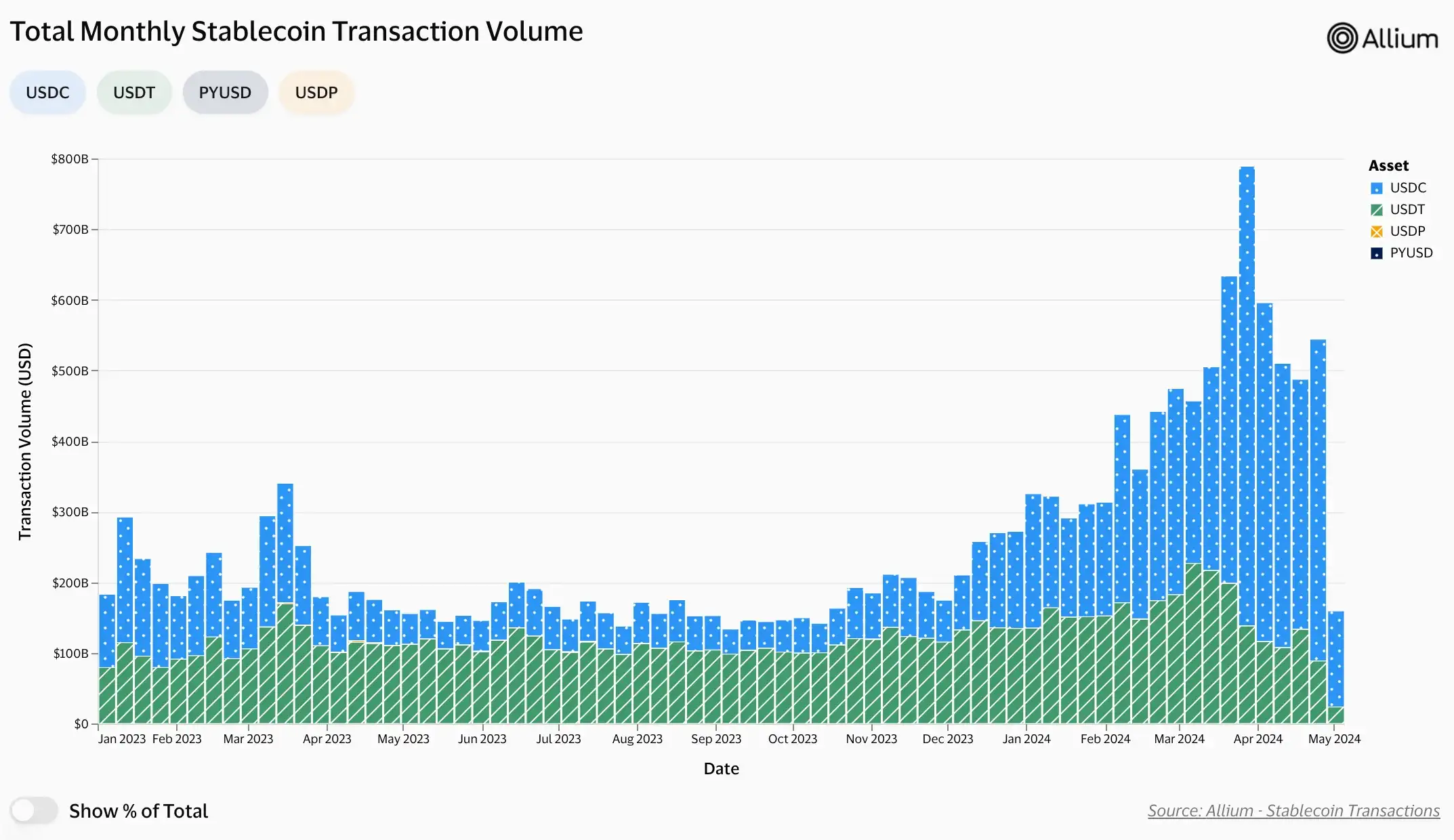

- USDC surpasses USDT, indicating a shift in stablecoin market dynamics.

- Leaders stress aligning stablecoins with democratic values and transparent regulations.

As a researcher with a background in finance and technology, I find these developments in the stablecoin market particularly intriguing. The fact that USDC has surpassed USDT in transactions signifies a shift in market dynamics, which could potentially lead to more competition and innovation in this space.

😱 Trump's Tariff Bombshell Could Crush EUR/USD!

Markets on edge — read the urgent new forecasts before it’s too late!

View Urgent ForecastAs a crypto investor, I’m thrilled to share that Circle’s USD Coin (USDC) has recently taken the lead over Tether (USDT) in terms of stablecoin transaction volume. This is an unexpected yet noteworthy turn of events in the cryptocurrency market. It represents a significant shift in the landscape, underscoring USDC’s growing strength and popularity amongst investors.

In April 2024, USDC saw a total of 166.6 million transactions according to Visa’s on-chain analysis, surpassing USDT with its 163.6 million transactions.

In light of recent advancements, an essential query arises: How can the sector guarantee that stablecoins adhere to democratic principles and abide by regulatory requirements?

USDC Circle founder’s insights

As a financial analyst, I’d rephrase Jeremy Allaire’s statement from the Bankless podcast as follows: During a recent interview on the Bankless podcast, I, Jeremy Allaire, the Founder of USDC Circle, shared some insights.

As a researcher studying the global financial landscape, I firmly believe that it’s essential for regulatory bodies to establish guidelines regarding stablecoins. It is crucial that issuers are held accountable for managing risks effectively and meeting their compliance obligations.

The sudden development serves to highlight the need for regulatory intervention against Tether, given its suspected involvement in illegal dealings. At the same time, it accentuates the rising popularity of USDC as a go-to option for stablecoin transactions.

As a researcher looking into the developments in the digital currency scene, I came across an interesting perspective from Caroline Hill, a senior executive at Circle, expressed in early February. She advocated for the adoption of dollar-pegged stablecoins as a means to uphold American values within this emerging financial landscape.

During my appearance before the House Subcommittee on Digital Assets, Financial Technology, and Inclusivity, I tackled the subject of this matter head-on in my testimony.

As a financial analyst, I strongly advocate for the notion that only companies embodying democratic values should be permitted to associate their operations with the US dollar or create US dollar-backed stablecoins.

She added,

As a crypto investor, I believe if the Treasury raises concerns about requiring more powers to regulate certain areas, it would be worthwhile for this committee to take that into consideration.

The crypto sector faces a notable challenge in striking a balance between fostering open competition and adhering to regulatory requirements to mitigate potential risks.

Importance of stablecoins

As a crypto investor, I strongly believe that clear-cut laws and regulations are indispensable for nurturing healthy competition and driving innovation within the stablecoin market. It’s crucial that these rules are transparent and accessible to all market participants. By doing so, we can create an environment where trust is fostered, risks are mitigated, and new ideas are encouraged to flourish.

When regulatory frameworks for stablecoins are established, a multitude of businesses, such as financial institutions, payments companies, and tech giants, are expected to enter the market in response. The ensuing competition is likely to intensify significantly.

Drawing parallels with the communications and internet industries in the late 90s. He added,

Currently, some individuals are hesitant to enter this market due to uncertainty regarding the rules. To foster healthy competition, it’s essential to establish clear regulations.

In summary, stablecoins are essential for executing speedy transactions in the cryptocurrency sector.

Having a collective market value surpassing $161 billion, they make up approximately 6.63% of the entire cryptocurrency market.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-04-30 23:35