- We explore what the ascending USDT macro trend means for the market.

- Assessing the level of liquidity held by whales, retail, and the investor class.

As a seasoned researcher who has weathered numerous market storms and witnessed the ebb and flow of crypto trends, I find the recent ascending USDT macro trend to be a fascinating development. The correlation between USDT dominance and FUD in the market is a recurring theme that I’ve observed over the years, and this latest uptick seems to align with that pattern.

🔥 Trump Tariffs Shock Incoming! EUR/USD in the Crosshairs!

Massive forex shifts expected — don't miss the crucial insights now unfolding!

View Urgent ForecastOver the weekend, I noticed a notable surge in the value of Tether (USDT) in my crypto portfolio. This increase seems to align with the return of selling pressure that’s been affecting most digital currencies.

This was no mere coincidence and could be a sign of things to come.

As a researcher, I’ve observed an interesting trend: When fear, uncertainty, and doubt (FUD) permeate the cryptocurrency market, the dominance of Tether (USDT) tends to increase significantly. This surge in USDT dominance often coincides with a widespread selloff of other crypto assets.

During the recent cryptocurrency downturn, USDT experienced a surge that exceeded a significant resistance level, only to subsequently retreat.

Last week’s market downturn saw USDT’s influence surge as high as 6.77%. On August 12th, it peaked at 5.83%, but subsequently dropped to its current level of 5.60% by the time of this press release.

Observe that USDT has been climbing steadily since March, reflecting a general market instability or downturn during this period.

Despite expectations for a robust crypto market growth in August, recent financial trends hint at a significant potential for sell-offs.

Such an outcome could potentially push up USDT dominance in the weeks or months to come.

Flight to safety?

The rapid decline in global stock markets following Japan’s decision to raise interest rates was like a stranglehold, leading to mass selling of high-risk investments across all markets.

After hearing many experts’ opinions, it appears that they generally agree that the full scope of what’s happening remains uncertain and may continue to unfold.

If the situation continues as it is and further hazards lie ahead, it’s quite possible we may witness additional drops in the market.

If that occurs, it might lead to increased influence for USDT as investors may choose to exchange their holdings to reduce potential risk exposure within their portfolios.

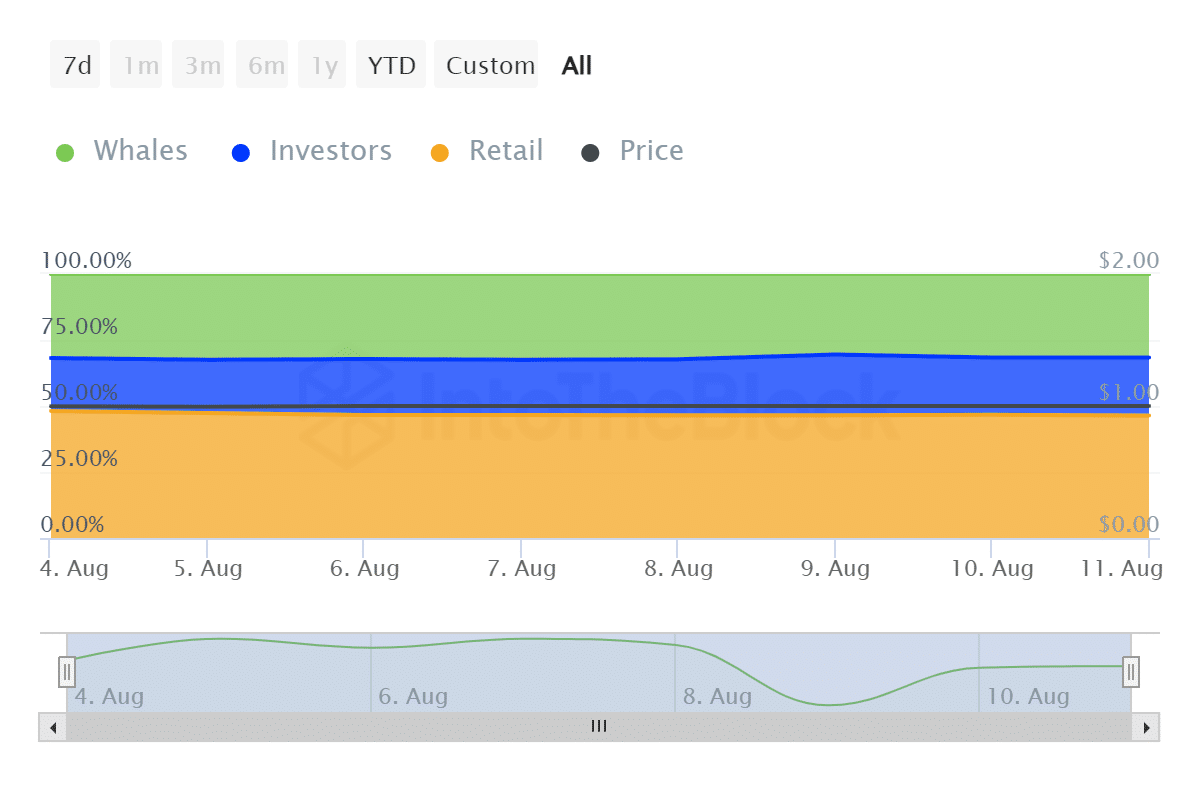

To examine if the recent trends with stablecoins were following a similar pattern, AMBCrypto analyzed their distribution over the past week.

On the 11th of August, my analysis indicated that whales were holding approximately 16.52 billion USDT, marking a minor 0.18% decrease in their holdings over the past week. Conversely, investors saw a significant 1.91% increase in their USDT holdings, with a total of 11.47 billion USDT as of the same date.

In the past week, retail and large investors collectively held about $24.23 billion in stablecoins, marking a 1.74% decrease compared to the previous seven days. Interestingly, data showed that both whales and retail participants lowered their stablecoin holdings, whereas investors increased theirs.

Although these results don’t automatically indicate a move towards safer investments, they hint at something potentially intriguing instead.

Cryptocurrency investors held approximately $52.22 billion in USDT (Tether) that they could potentially use for investment, waiting for suitable opportunities. This amount might increase if the economy deteriorates further.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- The Battle Royale That Started It All Has Never Been More Profitable

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

2024-08-13 08:08