- Bitcoin survived the 13th largest capitulation across the financial market

- Tether treasury drove $1.3B USDT into exchanges too

As a seasoned researcher who has witnessed numerous financial market fluctuations, I must admit that this week’s Bitcoin crash was quite the rollercoaster ride. Having survived the 13th largest capitulation event in global financial history, it’s evident that Bitcoin is becoming more integrated into the broader financial system, which means we can expect more significant downturns in the future.

As a long-time investor with a keen interest in Bitcoin and other cryptocurrencies, I can’t help but feel a sense of déjà vu as I watch this week’s market crash unfold. Over the years, I have witnessed numerous ups and downs within the crypto space, and while it’s never easy to see my investments take a hit, I have learned to expect these events with the territory.

Despite facing significant lows last month, it’s worth noting that the cryptocurrency market has shown remarkable resilience, as leading cryptocurrencies such as Bitcoin and Ethereum surged by more than 20% in value, according to the price charts.

Indeed, the data based on adjusted losses for each entity shows that Bitcoin bounced back from the fall, and currently, its worth surpasses a staggering $1.3 billion.

USDT $1.3B onto exchanges

On August 5th, when Bitcoin experienced a plunge, Tether’s Treasury moved approximately $1.3 billion worth of USDT to various cryptocurrency exchanges. It is believed that this large injection contributed significantly to the robust comeback observed in the digital currency market.

Market analyst Pro Blockchain pointed out that Tether’s actions boosted the availability of USDT on exchanges, which could impact future cryptocurrency prices. This increased supply might even push prices upward in the charts.

Historical data projections for USDT dominance v other cryptos

As a crypto investor, I’ve noticed an interesting pattern: When the dominance of Tether (USDT) increases, it seems that the overall price of cryptocurrencies tends to decrease. Conversely, when USDT dominance decreases, the prices of cryptos generally rise. This inverse relationship is something I keep a close eye on in my crypto investment strategy.

Over the course of three days, both USDT and various other cryptocurrencies have mirrored similar price movements closely. A significant event occurring on October 13, 2023, for example, revealed a decline in USDT’s influence, which subsequently caused an increase in the prices of other digital currencies.

If the fall of USDT’s increasing pattern occurs, it could signal a reversal in the cryptocurrency market, potentially leading to increased prices. Essentially, the recent refusal at the peak of the USDT dominance chart may hint at an upcoming surge in crypto values.

Bitcoin retail inter at 20%

currently, Bitcoin is being exchanged at about $60,000. But the enthusiasm among retail investors has decreased to roughly 20% of its earlier figures. Despite this decrease, Bitcoin appears resilient after the latest market downturn and may potentially experience additional price surges in 2021.

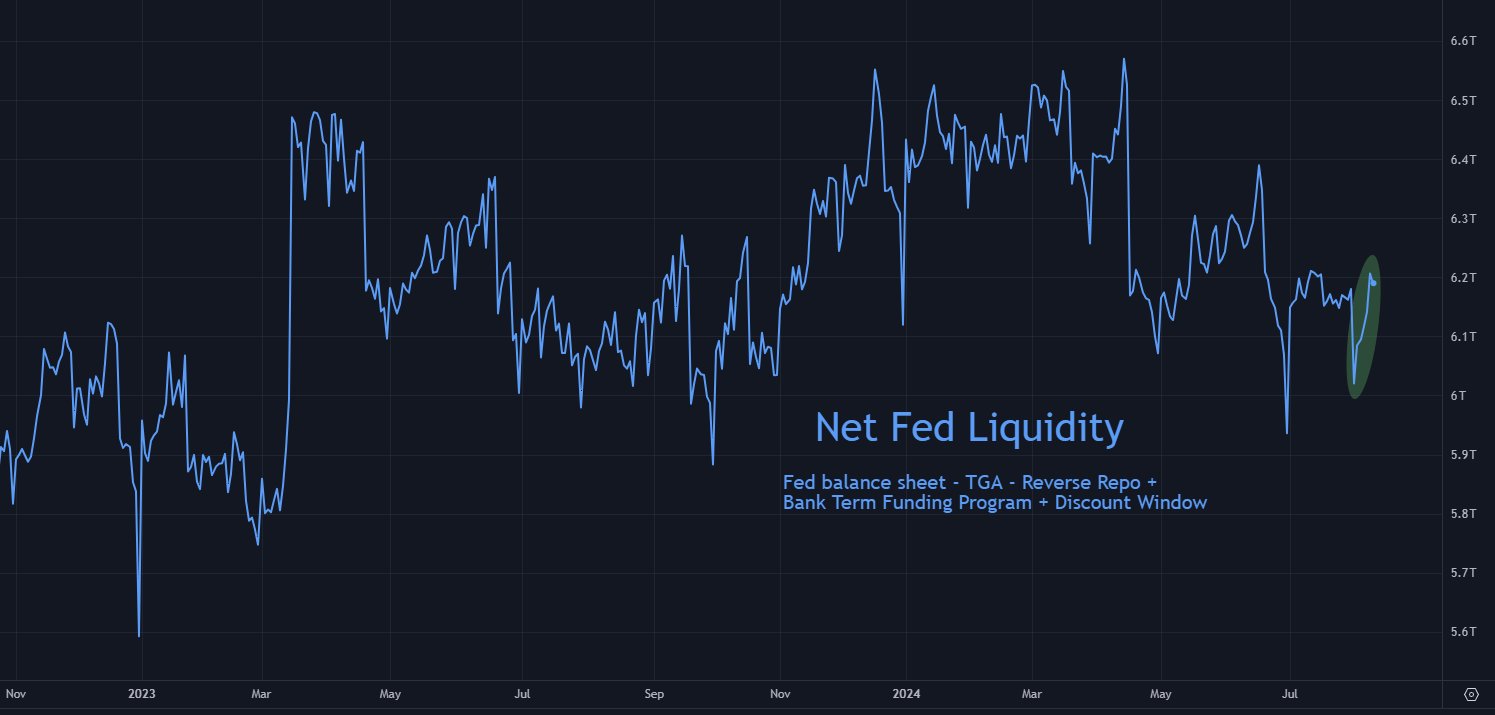

Fed Liquidity rebounds strongly

In the end, although Net Fed Liquidity decreased by $160 billion last week, it swiftly rebounded by an impressive $170 billion.

In a noticeable drop, both the S&P 500 and Bitcoin saw substantial decreases. The S&P 500 fell by 3%, while Bitcoin plummeted by approximately 30%.

As someone who has been closely following the financial markets for several years now, I have to say that this week has been particularly exciting. The S&P 500 and Bitcoin, two assets that I have been keeping a close eye on, have both rebounded in a big way. The S&P 500 is up an impressive 4%, while Bitcoin has seen an even more astonishing increase of 22%. This surge in the crypto market could be sustained by the rise in USDT on exchanges, which I believe has the potential to drive growth across the board for other cryptocurrencies. It’s always fascinating to see how these digital assets can move so quickly and dramatically, especially when compared to more traditional investments. As someone who values staying up-to-date with the latest market trends, it’s important to keep a close eye on such developments and make informed decisions based on the data at hand.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-08-11 01:12