- The USDT exchange reserve has surged to its highest in history.

- The surge coincides with BTC’s ATH and general market capitalization.

As a seasoned analyst with over a decade of experience in the financial markets, I find myself intrigued by this recent surge in USDT exchange reserves. Having weathered many market cycles and navigated numerous bull and bear runs, I can confidently say that this development is a significant milestone in the cryptocurrency landscape.

In the last week, Tether (USDT) has reached an impressive achievement by exceeding $1.5 billion in daily exchange inflow and outflow on two separate occasions.

As I delve into this torrent of recent developments, I find myself pondering over the potential impact on market fluidity, purchasing capability, and the possible waves it might create within the realm of Bitcoin and other digital currencies.

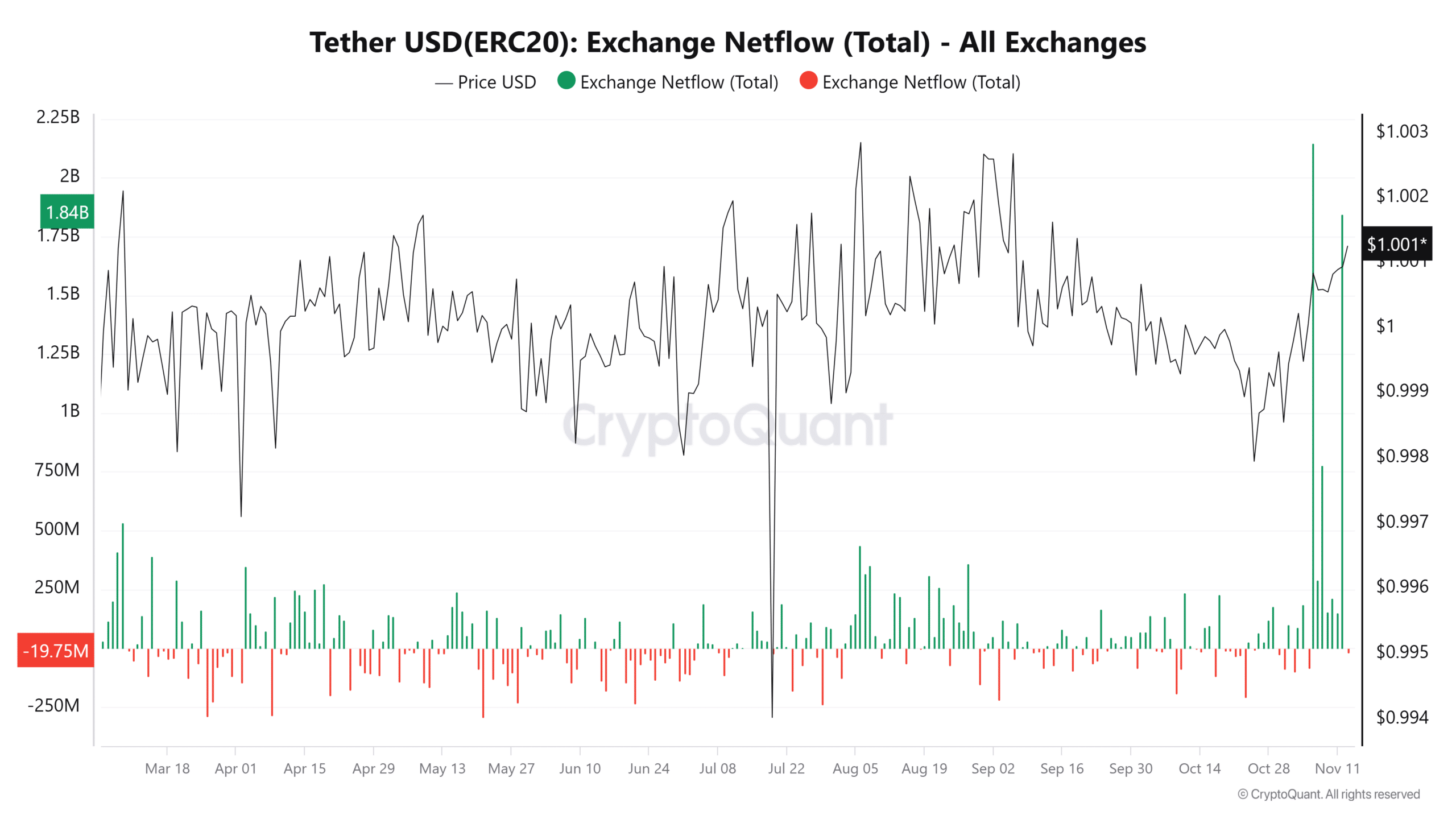

USDT exchange netflow hits historic levels

A significant increase in USDT exchange transactions suggests a strong flow of liquidity towards the cryptocurrency market. According to data from CryptoQuant, this total netflow amounted to approximately $1.84 billion across major platforms, suggesting a large injection of USDT.

This flow indicates a rise in capital flowing towards exchanges, probably due to traders preparing to take advantage of anticipated market shifts.

Moreover, this marked the second instance within the month where we observed an upsurge in inflows, with the initial surge occurring on November 6th at over $2 billion. These substantial inflows frequently foreshadow heightened market activity, as traders usually deposit stablecoins such as USDT to set themselves up for potential buying opportunities.

This situation might lead to an increase in the desire for Bitcoin and other digital currencies, especially if people continue to have a positive outlook on them.

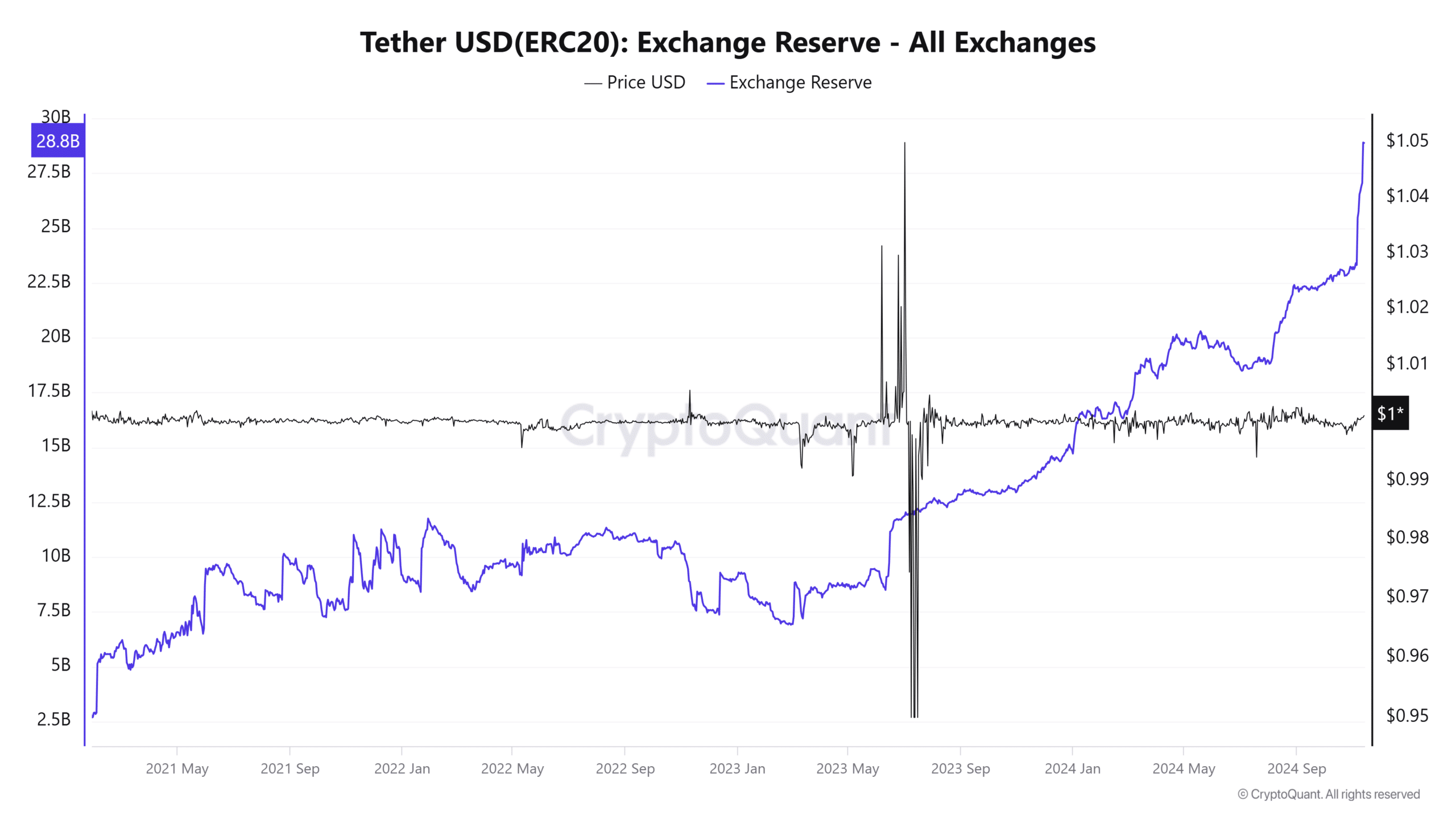

Exchange reserves reflect a shift in market dynamics

The chart displaying exchange reserves indicates a consistent rise in USDT deposits on trading platforms, reaching a record peak of $28.8 billion. This significant surge in stored funds corresponds well with the substantial inflows.

It suggests a growing pool of USDT liquidity that is ready for deployment.

Having a growing reserve in an exchange suggests that traders and institutions are proactively getting ready to seize market chances. This could be for immediate purchases or margin trading. The presence of ample stablecoin liquidity serves to underscore the market’s capacity for positive growth trajectory.

The rise in Bitcoin’s price up to $88,000 aligns with these recent advancements, suggesting a strong relationship between the activity of stablecoins and market movements.

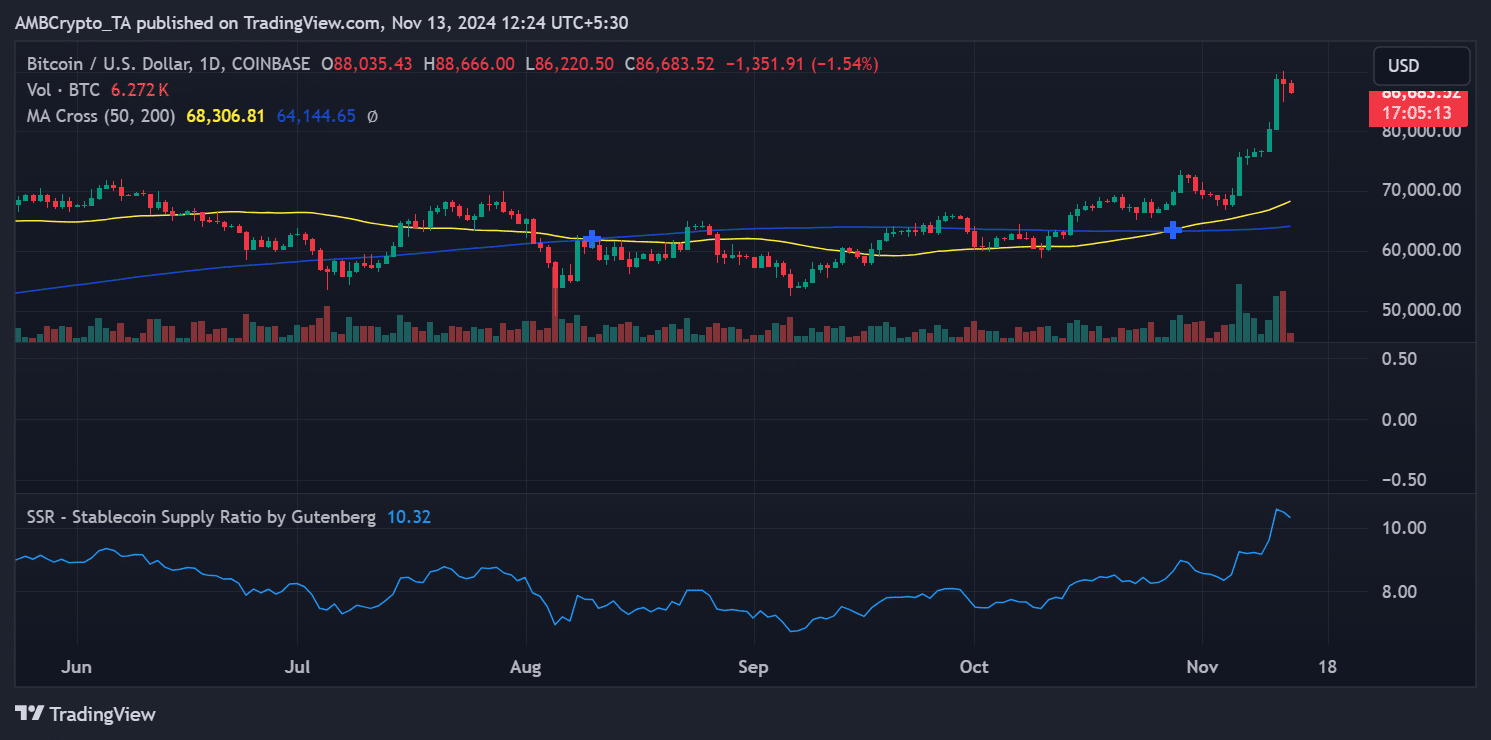

Stablecoin supply ratio indicates high purchasing power

The Stablecoin Supply Ratio (SSR) provides an extra level of understanding. With a current reading of 10.32, the SSR indicates that the buying power of stablecoins compared to Bitcoin is still high.

In simpler terms, a smaller Systematic Risk Rating (SSR) tends to mean more stability in the liquidity of stablecoins compared to Bitcoin’s total market value. This situation could suggest that there is increased potential for buying activity.

Under current circumstances, there’s a substantial amount of Tether (USDT) on various cryptocurrency exchanges and a strong Supply-Side Ratio (SSR). This setup seems to be conducive for continued growth or increases in the digital currency market.

In the coming days, the release of this liquidity could hinge on broader economic trends and the feelings or attitudes of traders.

Implications for the market

The rapid increase in USDT and its substantial holding amounts suggests that there’s a strong possibility of increased market action ahead. Although Bitcoin has already reached a peak of $88,000, the influx of stablecoin could prolong this trend or trigger a shift towards other cryptocurrencies (altcoins).

Monitoring USDT flows and the SSR will be crucial for traders in predicting the next market moves.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- Quick Guide: Finding Garlic in Oblivion Remastered

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

2024-11-13 17:12