- USDT often presents conflicting demand and supply signals, making it crucial to keep a close eye on.

- With the market in the red, stablecoins might be becoming an increasingly attractive alternative.

As a seasoned crypto investor who’s weathered more market storms than I care to remember, I’ve learned to keep a close eye on USDT and its conflicting demand and supply signals. With the current bearish trend, stablecoins like USDT are becoming increasingly attractive as an alternative for those seeking safety in these volatile times.

If Bitcoin [BTC] is digital gold, Tether [USDT] is the digital dollar, firmly holding its $1 peg.

Originally a specialized financial asset, USDT (Tether) has experienced an enormous increase in popularity, now serving as a preferred method for smooth transactions – be it small daily expenditures or vast international transfers.

It’s clear that this growth trend is unmistakable, as the worldwide total of stablecoins has reached an all-time high of $190 billion, marking a significant increase of approximately $60 billion since the beginning of 2024.

However, in the crypto world, the demand/supply dynamic takes on a whole new meaning.

Exploring the two sides of the coin

In the world of cryptocurrencies, USDT, which is well-known as the most commonly used stablecoin, often serves as a reliable cushion when market feelings are uncertain or unstable. At present, this pattern appears to be repeating itself.

To start December off, Bitcoin broke through the $100K barrier and even reached an unprecedented peak of $104K within just the initial five days. This remarkable surge caused the dominance of USDT to dip to its lowest point in six months at 3.80%.

Meanwhile, as the peak of Bitcoin’s next market rise remains unclear, volatility is on the rise. This situation might attract more investors towards the stability offered by USDT, particularly since a bearish MACD crossover adds credence to this trend.

Additionally, from an economic standpoint, supply increases to meet rising demand.

The increasing supply of stablecoins has now reached approximately $190 billion, with a significant portion of $60 billion added just this year. This surge in supply underscores the rapidly escalating interest in Tether (USDT), especially among large-scale investors.

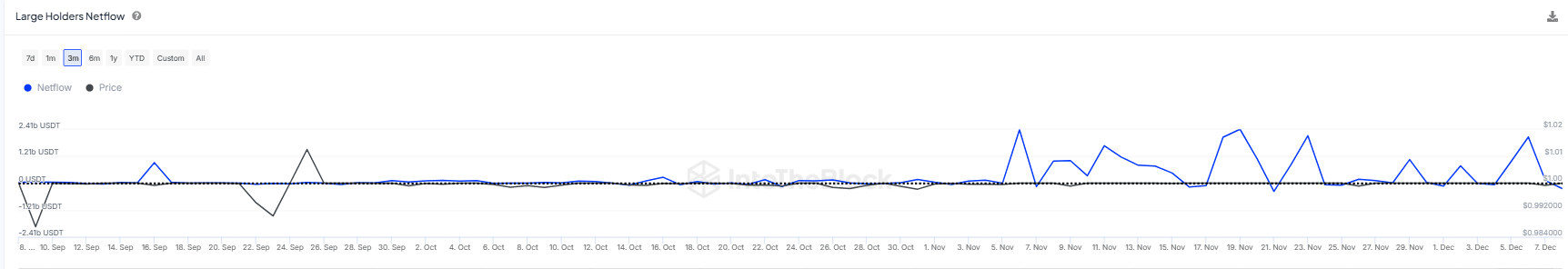

Source : IntoTheBlock

During the month of November, whales significantly increased their holdings of USDT, amassing approximately $2 billion in four distinct phases. This accumulation underscores the increasing importance of USDT as a protective measure against riskier investments.

On the other hand, increased USDT demand might not be a harbinger of disaster for the market. Instead, it could potentially indicate a positive trend.

Similar to how large whales acquired approximately $2.5 billion in USDT following the election, potentially preparing to exchange it for Bitcoin, this pattern might signal an upcoming significant surge.

So, does high USDT demand signal correction or rally?

It seems there are two possible scenarios unfolding: either investors are selling large amounts of USDT due to expectations of an imminent strong market rise and increasing the USDT supply, or there’s growing concern about a potential market correction causing them to stockpile USDT as a secure asset.

Based on the graph presented, it appears that the total holdings of whales in USDT have decreased substantially over the last two days. Initially, their holdings were valued at more than $2 billion, but they now find themselves in a negative position to the tune of approximately -$240 million. This suggests a strong belief among these large investors that substantial profits are imminent.

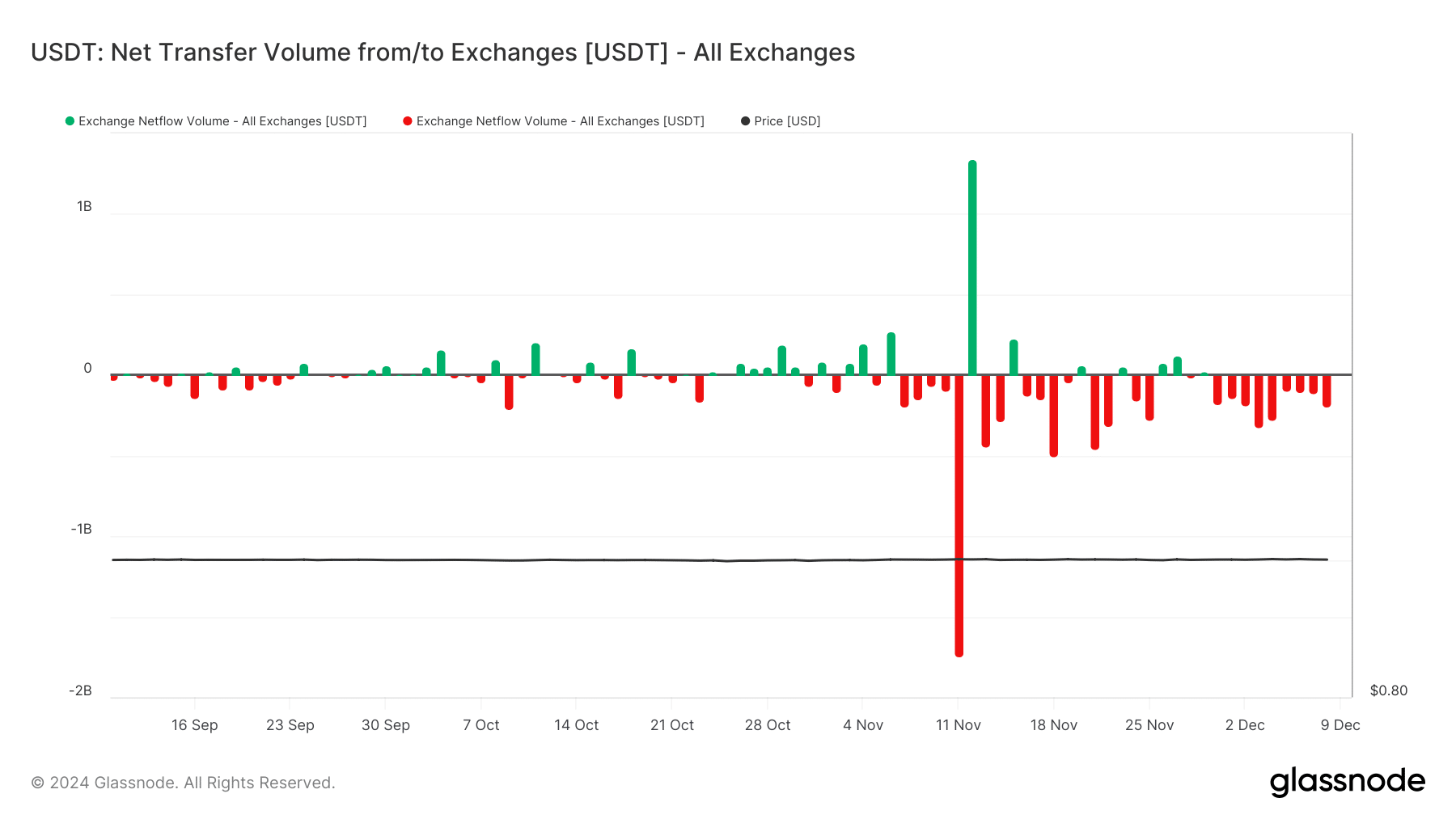

As an analyst, I’ve noticed an interesting trend in the retail sector. Starting from early December, there’s been a consistent pattern of USDT being withdrawn from exchanges, as signified by the recurring red bars on my charts.

Source : Glassnode

Previously, an increase in USDT (Tether) accumulation often indicated a bullish trend for Bitcoin. However, recently, investors might be opting for USDT as a safer alternative rather than signaling a bullish outlook for Bitcoin.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Investors are growing more wary due to Bitcoin’s unsuccessful attempts to surpass the $100,000 mark on four occasions, concerns about potential overvaluation, and a decreasing sense of fear of missing out (FOMO).

In the face of increased market turbulence, traders are either pursuing swift, substantial profits by investing in mid and lower-valued cryptocurrencies, or opting for stablecoins as a more secure alternative.

Read More

2024-12-09 16:08