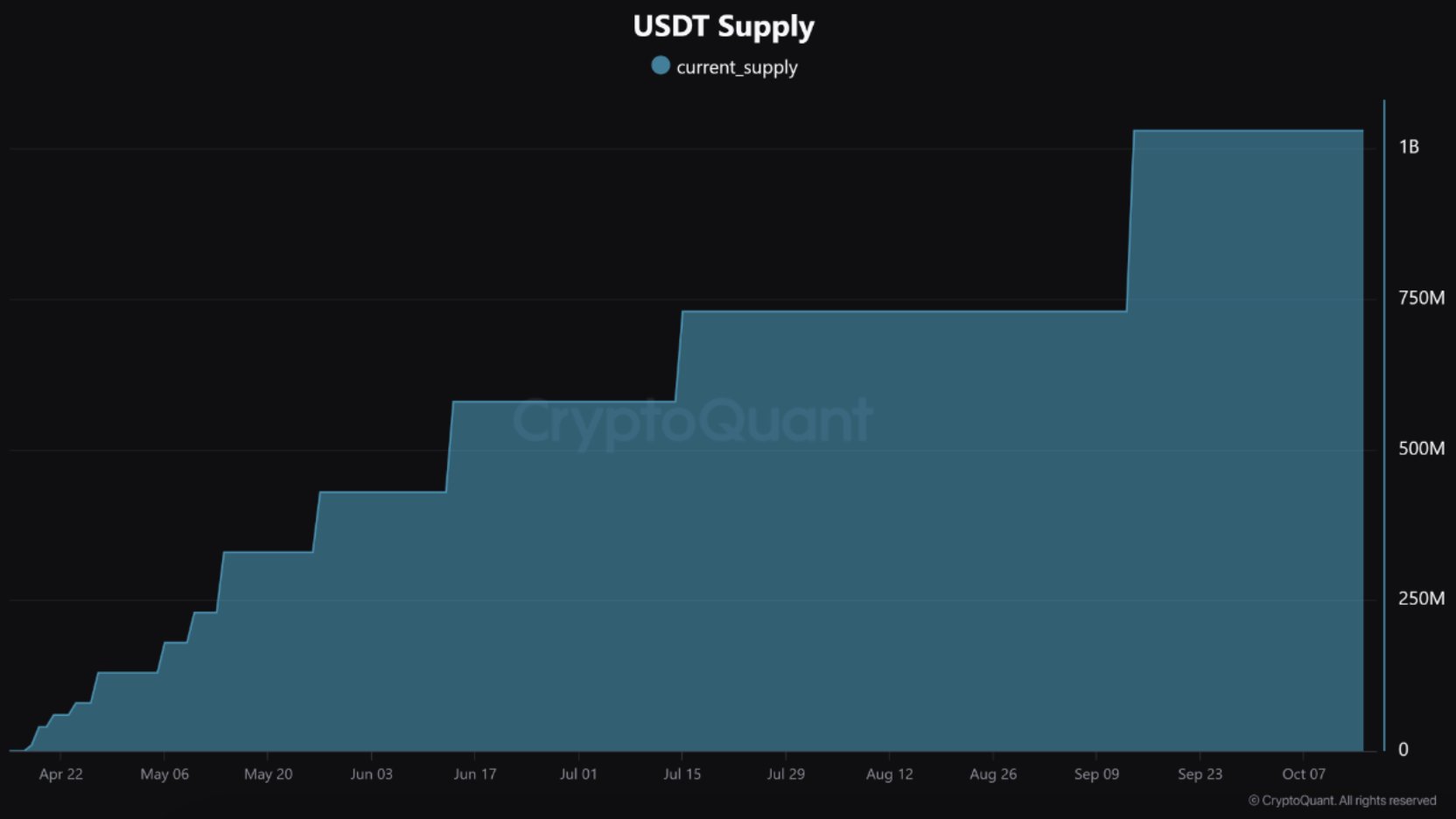

- USDT’s popularity on TON increasing steadily.

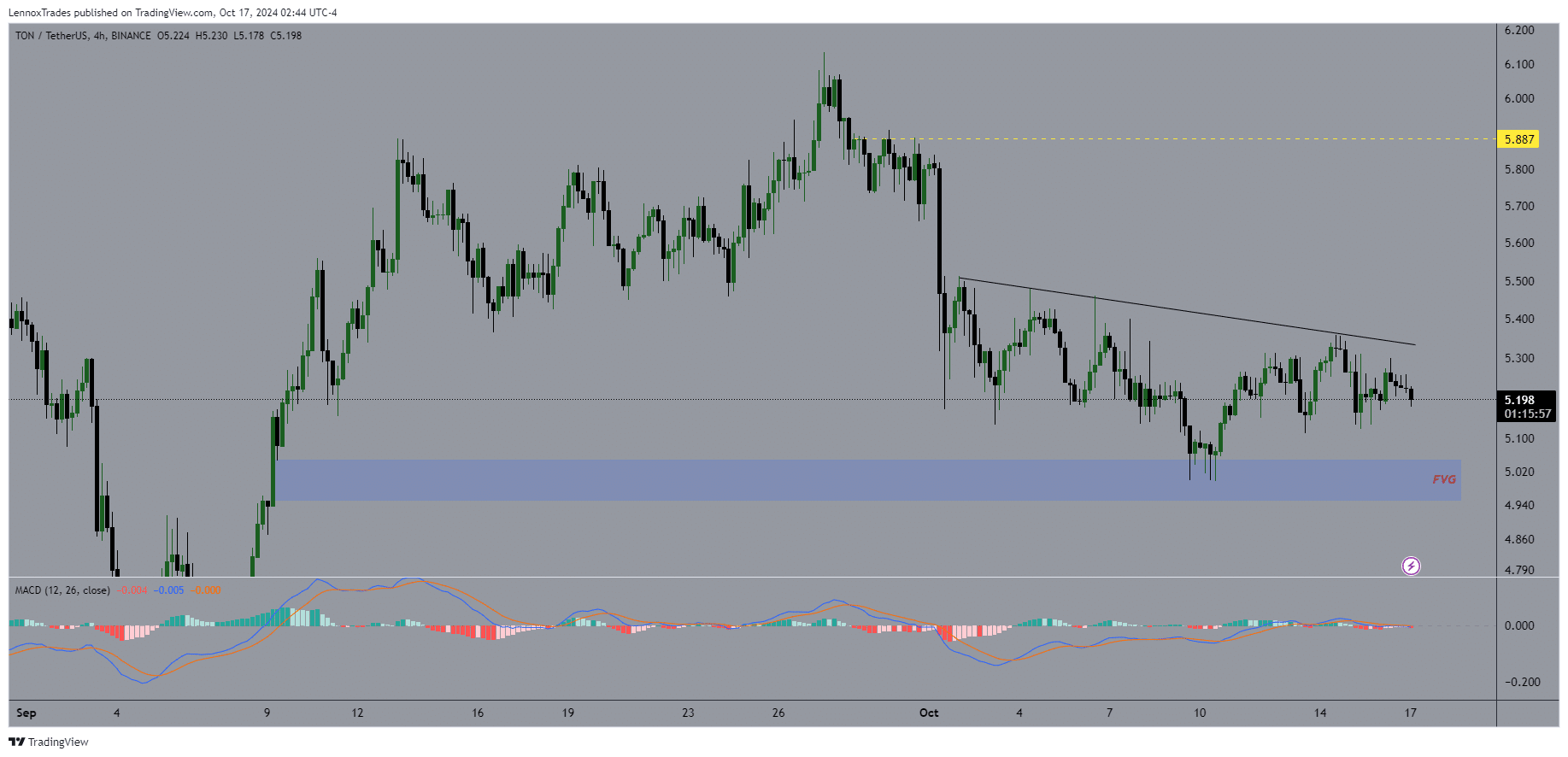

- TON price action consolidating while respecting down trendline.

As a seasoned researcher with a knack for deciphering the intricacies of the crypto market, I find myself intrigued by the current state of Toncoin [TON]. Having closely observed its trajectory over the past few months, it’s evident that TON’s association with stablecoins, particularly USDT, is playing a pivotal role in its growth.

toncoin (TON), the digital currency linked to the open-source The Open Network blockchain, is steadily growing in popularity among cryptocurrency enthusiasts due to recent advancements.

The TON network is significantly contributing to the broader acceptance of digital currencies, largely due to its backing of stablecoins. These stablecoins, like USDT, are crucial because they function as a gateway into the world of cryptocurrency.

Indeed, there’s been a significant surge in the usage of USDT on the TON blockchain recently. In just the past month, the number of USDT transactions on TON has surpassed 4.5 million, and the total volume of these transactions has exceeded a staggering $300 million.

Examining more closely the growing influence of USDT within the TON blockchain, we delve into USDT’s market supremacy and how it impacts TON’s pricing trends.

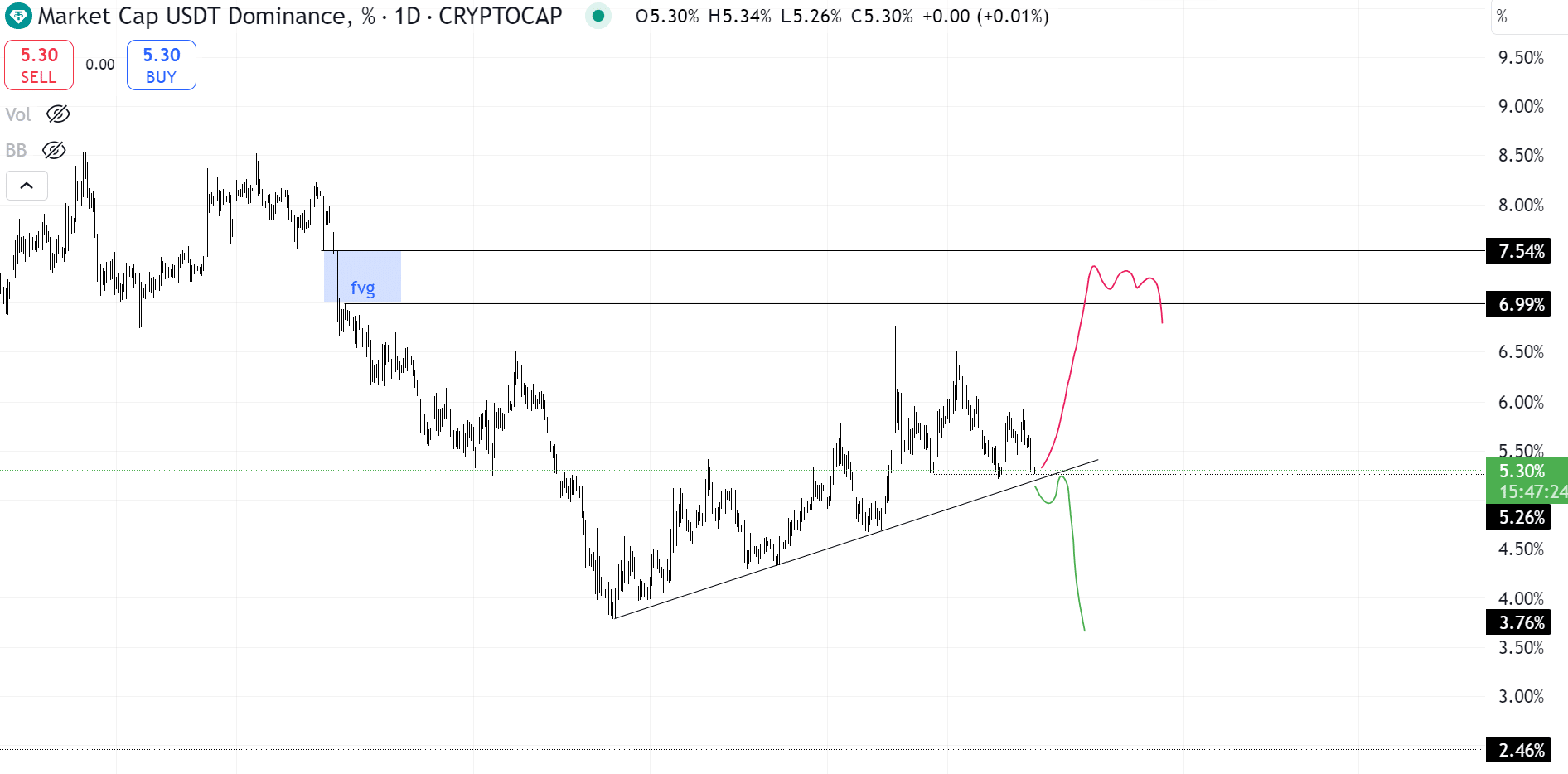

Currently, USDT’s influence stands at 5%. During the market crash in August, which saw many cryptocurrencies experience substantial drops, USDT reached its peak dominance.

At the moment, USDT’s influence seems to be decreasing and nearing a significant floor. Should it fall beneath this point, it might indicate an upward trend in the crypto market, potentially benefiting coins like Toncoin as well.

In my analysis, if USD Tether (USDT) maintains its stability, this could suggest a persistent trend in the market. Consequently, such stability might exert downward pressure on the value of Toncoin (TON), as the market’s focus remains on USDT.

TON in a range

Toncoin’s price movement has been confined to a specific price range, following a downward trajectory along a trendline that started in the fourth quarter.

Even though there seems to be consolidation happening with TON, it looks like it might have hit its lowest point around the FVG zone. The growing use of stablecoins, particularly USDT, within the TON blockchain indicates that a long-term optimistic perspective for TON could be developing.

The drop in Toncoin’s price after its bullish surge in early September has sparked excitement amongst traders, who are now eagerly waiting to see what happens next.

As USDT’s reputation continues to rise, there may be an increasing trend of exchanging other stablecoins for TON. This shift could potentially boost the demand for this cryptocurrency.

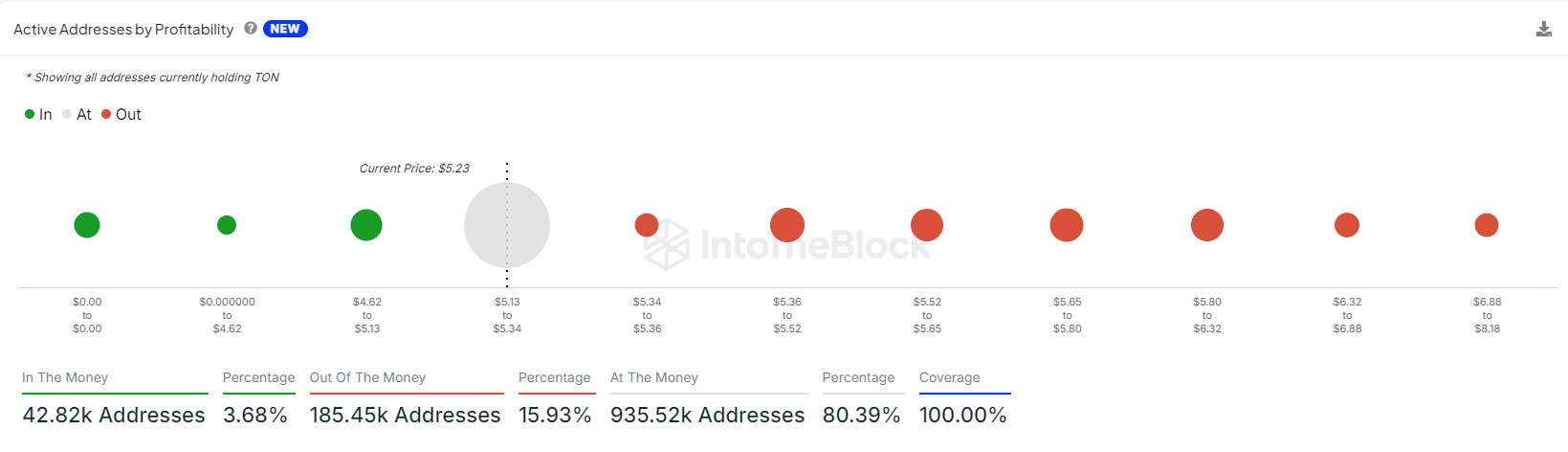

A closer examination of the earnings from active accounts on the TON blockchain indicates that around 80% of these accounts break even, showing no net profit or loss.

Currently, about four out of every ten Toncoin addresses show a profit, while sixteen percent are experiencing a loss. This suggests that many Toncoin holders likely purchased their tokens at around the current price of $5. Consequently, this price level could be enticing for individuals considering an investment.

Read Toncoin’s [TON] Price Prediction 2024–2025

Keep in mind that traders need to be careful since falling beneath this point might indicate a continued downward trend followed by a possible rebound.

As Toncoin increasingly connects with stablecoins like USDT, it strengthens a positive, long-term forecast. Nevertheless, traders are advised to stay alert for any temporary price adjustments that might occur in the short term.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-10-17 23:35