- TRON gained 1.12% in seven days as altcoins suffered from high selling pressure.

- With TRON network massive adoption by USDT, positive market sentiment was gaining momentum

As a seasoned crypto investor with several years of experience in the market, I’ve seen my fair share of ups and downs. The recent market trend has been challenging for most altcoins, including TRON (TRX), as Bitcoin (BTC) experienced a significant decline. However, TRX has shown remarkable resilience, with a 1.12% gain in the last seven days and 4.67% increase in the past thirty days.

As a crypto investor, I’ve noticed that Bitcoin [BTC] has taken a hit, decreasing by around 6.7% over the past month and currently hovering around the $62k mark. Unfortunately, this downturn has affected altcoins particularly hard, with many experiencing significant losses.

Despite the overall market downturn, TRON (TRX) has bucked the trend, registering a gain of 1.12% over the past week and an impressive 4.67% increase in the last thirty days. At the moment of writing, TRX was priced at $0.1189, marking a minor decrease of 0.92% in the preceding 24 hours.

Concurrently, its trading volume surged by 22.38% to reach $205 million, based on data from CoinMarketCap. The market capitalization of TRX was reported as $10.3 billion.

TRX’s activities can be linked to several reasons, with the surge in USDT trading being a significant factor. As per the Tron Guy Project on X (previously Twitter),

“The users are choosing Tron.”

Also, another post by Lookonchain stated,

“The trading volume for USDT on the Tron network within a 24-hour period reaches an astounding $53 billion, surpassing Visa’s typical daily transaction amount.”

Another analyst @Currency Analysts, shared positive developments regarding TRX, stating,

“TRX dominates as it breaks records with highest daily users and weekly revenue.”

As a researcher studying the latest trends in the digital economy, I’ve noticed an exciting surge in cryptocurrency adoption recently. Surprisingly, TRON seems to be taking center stage in this transformation.

TRON posited for a recovery

As a TRX investor, I’ve noticed that recent market trends have significantly influenced my investments. After experiencing a prolonged slump, TRX is bouncing back with renewed energy due to the increasing optimism in the crypto market.

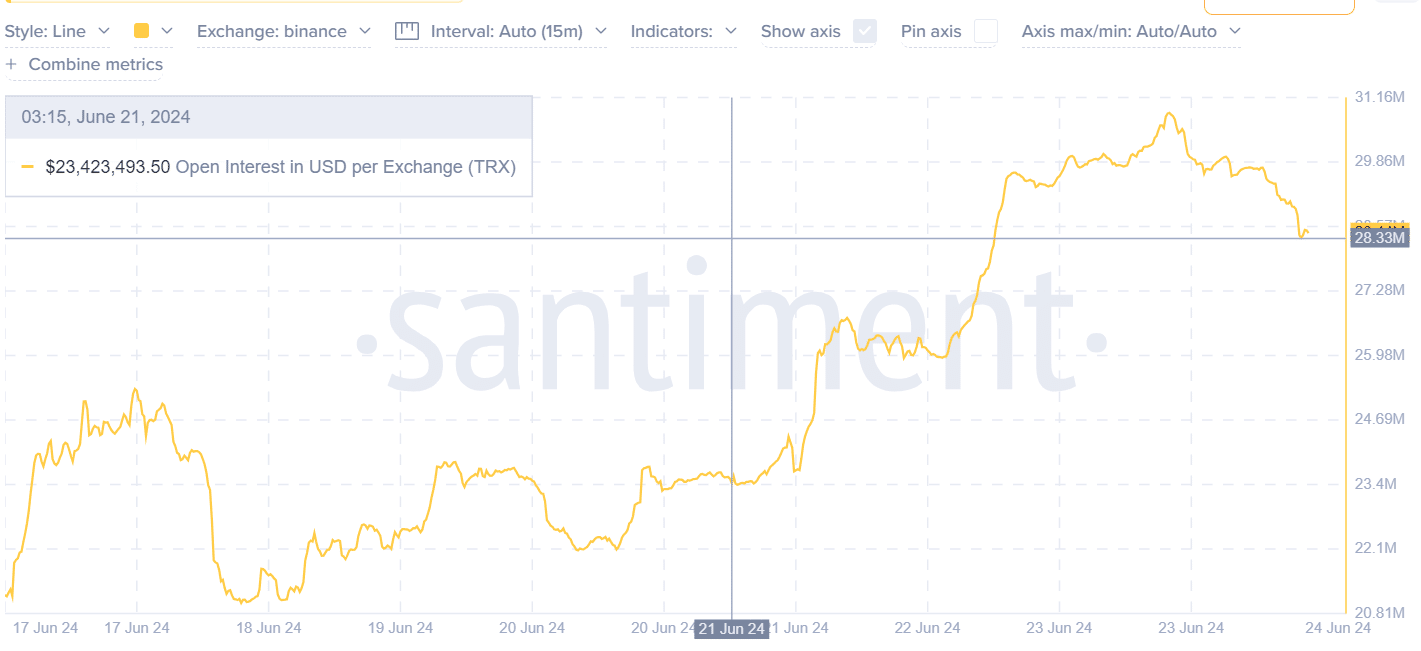

As an analyst, I’ve examined the latest data from Santiment and found that Tron (TRX) has experienced a notable increase in open interest over the past week. Specifically, the open interest for TRX has grown from $21 million to $28 million within this timeframe.

Traders were more active on the exchanges, as indicated by a rise in Open Interest – this means they were either initiating fresh trades or adjusting their current positions.

As a crypto investor, I’ve noticed an uptick in market activity and heightened interest in cryptocurrencies. This trend suggests that the current upward trajectory is likely to persist.

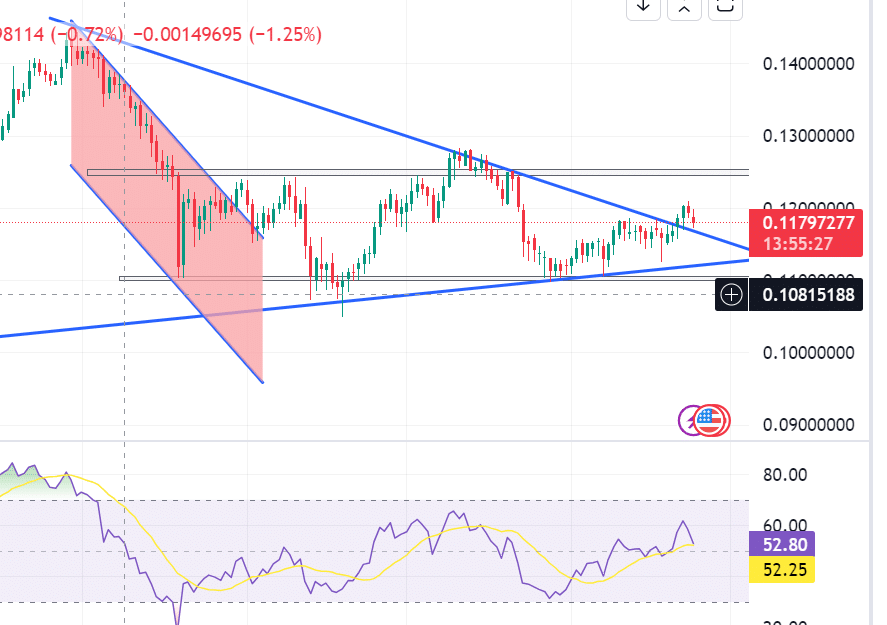

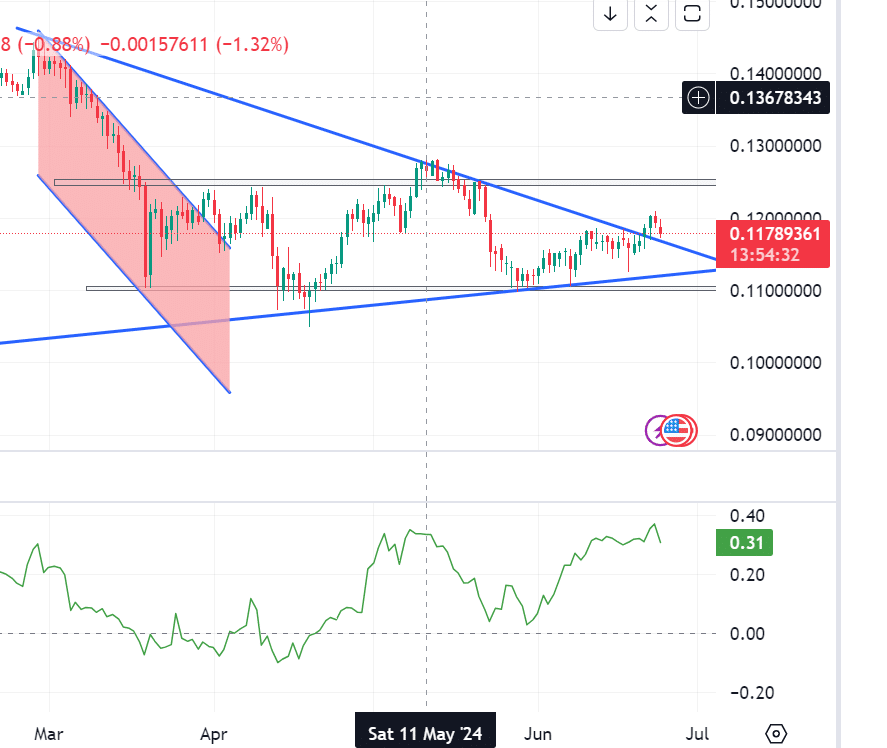

As a crypto investor, I’ve noticed that the Relative Strength Index (RSI) reading of 56 suggests that the bulls are currently in control of the market. The RSI value being above its moving average (MA) indicates a robust uptrend, implying a potentially strong and prolonged bullish market.

Additionally, the Chaikin Money Flow (CMF) indicator registered a value of 0.33, signifying stronger buying activity. This implies that buying power prevailed over selling pressure, resulting in prices ending the day near the upper end of their daily range, indicating accumulation by investors.

Equally, it indicated bullish market sentiment with an increased inflow in investments.

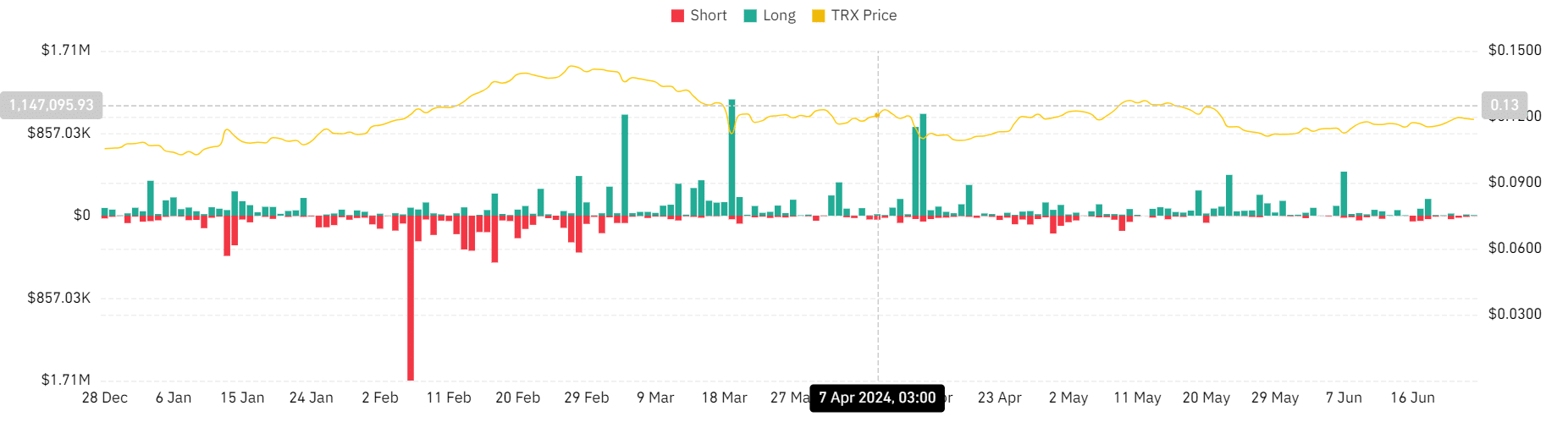

Based on Coinglass data, TRX has experienced a significant drop in liquidations over the past week. The amount for long positions went from $457,000 on June 18th to just $6,700 by June 24th.

As a seasoned crypto investor, I’ve noticed a decrease in liquidations recently, which is a promising sign of optimistic market sentiment. Long-term investors are keeping their positions and even adding new ones to their portfolios.

Realistic or not, here’s TRX’s market cap in BTC’s terms

TRX bulls set to take over?

TRX has managed to surpass the $0.120 resistance and escape the confines of the descending triangle. Subsequently, it aims to tackle the upcoming resistance at approximately $0.125.

If the price doesn’t maintain its position at approximately $0.110 as support, further price adjustments could potentially lower it to around $0.098.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-06-24 19:36