-

VanEck analysts believe BTC could benefit more from a ‘hostile’ Harris administration.

Polymarket showed Harris maintained a 3-point lead on Trump.

As a seasoned crypto investor with a knack for deciphering market trends and political nuances, I find myself intrigued by the conflicting predictions surrounding BTC and the 2024 US elections. While Trump has been vocal about his support for Bitcoin, analysts like Mathew Sigel suggest that a Kamala Harris administration might inadvertently provide more favorable conditions for BTC’s growth.

Based on predictions from VanEck analysts, it’s expected that no matter which candidate emerges victorious in the 2024 U.S. elections, Bitcoin [BTC] should remain unaffected.

On the other hand, analyst Mathew Sigel opines that Bitcoin may gain more advantage under a Kamala Harris presidency compared to the Trump administration.

“I do think it is possible that an unfriendly Democrat White House could inadvertently help BTC.”

VanEck analysts further divulged the above outlook in the latest September BTC review.

In our opinion, a Kamala Harris presidency could potentially be more beneficial for Bitcoin than another term for Trump. This is because we believe her administration may expedite several underlying factors that foster Bitcoin adoption.

Biden-Harris admin vs BTC

If Trump is elected, it’s likely that he would support Bitcoin (BTC) more strongly, which could lead to less restrictive regulations in the sector being perceived as positive or bullish news.

Nevertheless, the analysts pointed out that a potentially antagonistic Harris administration might contribute to Bitcoin’s continued market leadership.

If such an event transpires, the distinct regulatory transparency of Bitcoin could very well make it more attractive compared to other digital currencies.

The structural problems raised were linked to rising US debts and fiscal deficits. The analysts noted that these issues will persist regardless of whether Trump or Harris wins the election.

Analysts Matthew Sigel and Nathan Frankovitz pointed out that such a move could potentially devalue the U.S. dollar, an economic scenario that in the past has often favored Bitcoin growth.

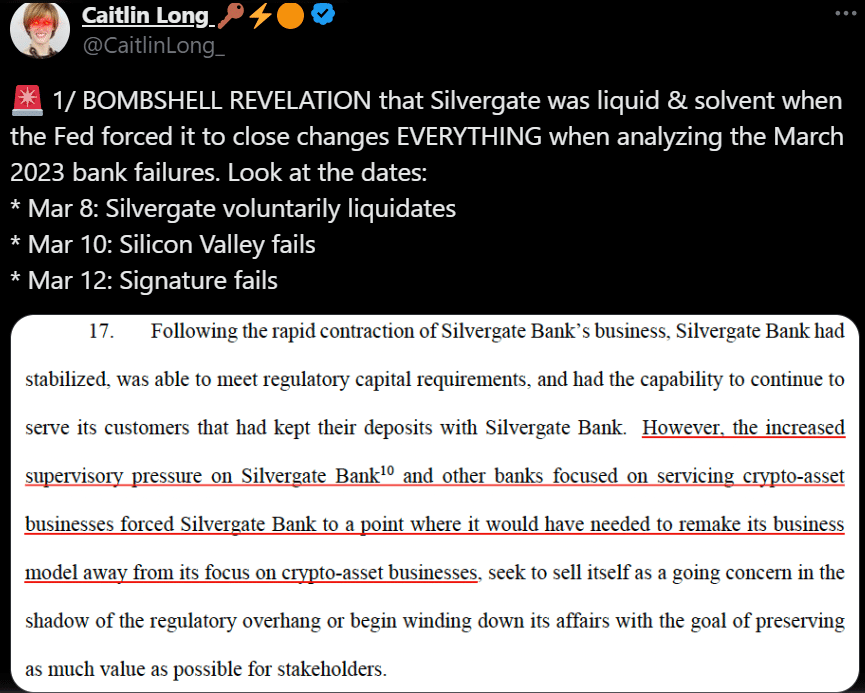

Despite some analysts’ warnings, it seems possible that Operation ChokePoint 2.0 (OCP), a controversial move seen as limiting crypto companies’ access to the US banking system, could be prolonged, especially with a Harris administration taking office. This is the essence of your statement, but

It’s been reported that despite being financially sound and capable of fulfilling its commitments, Silvergate Bank – known for its focus on cryptocurrency – faced a closure mandate from the Federal Reserve, leading to its eventual shutdown.

In August, the Federal Reserve issued a warning to Customers Bank, which has been supportive of cryptocurrencies. Tyler Winklevoss, a co-founder of Gemini, expressed concern that if these restrictions continue, they could effectively stifle the growth and development of the crypto industry within the United States.

Amidst the widespread de-banking among cryptocurrency companies in the U.S., analysts at VanEck believe that Bitcoin’s regulatory clarity could strengthen its position. As of now, Harris (51%) holds a 3-point advantage over Trump (48%) in terms of predicted victory in the upcoming U.S. elections, according to prediction site Polymarket.

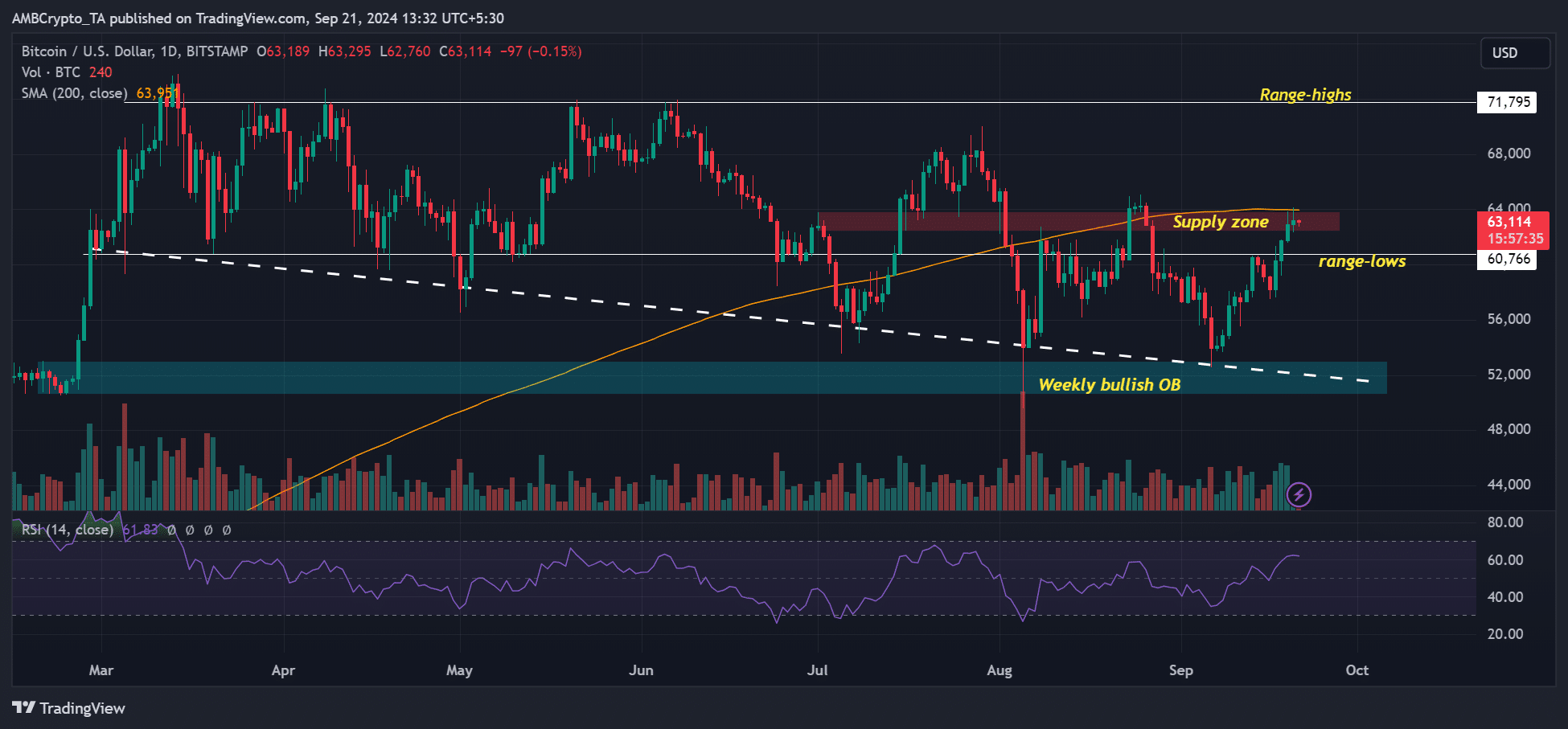

Currently, Bitcoin’s value stood at approximately $63,100, and it was poised to surpass its 200-day Moving Average (MA) again.

Based on Coinbase’s analysis, the asset might draw increased attention and popularity from traders if it breaks through the 200-day Moving Average, thereby strengthening a longer-term upward trend.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-21 21:11