-

SOL rallied 9% and hit $150 following VanEck’s SOL ETF application

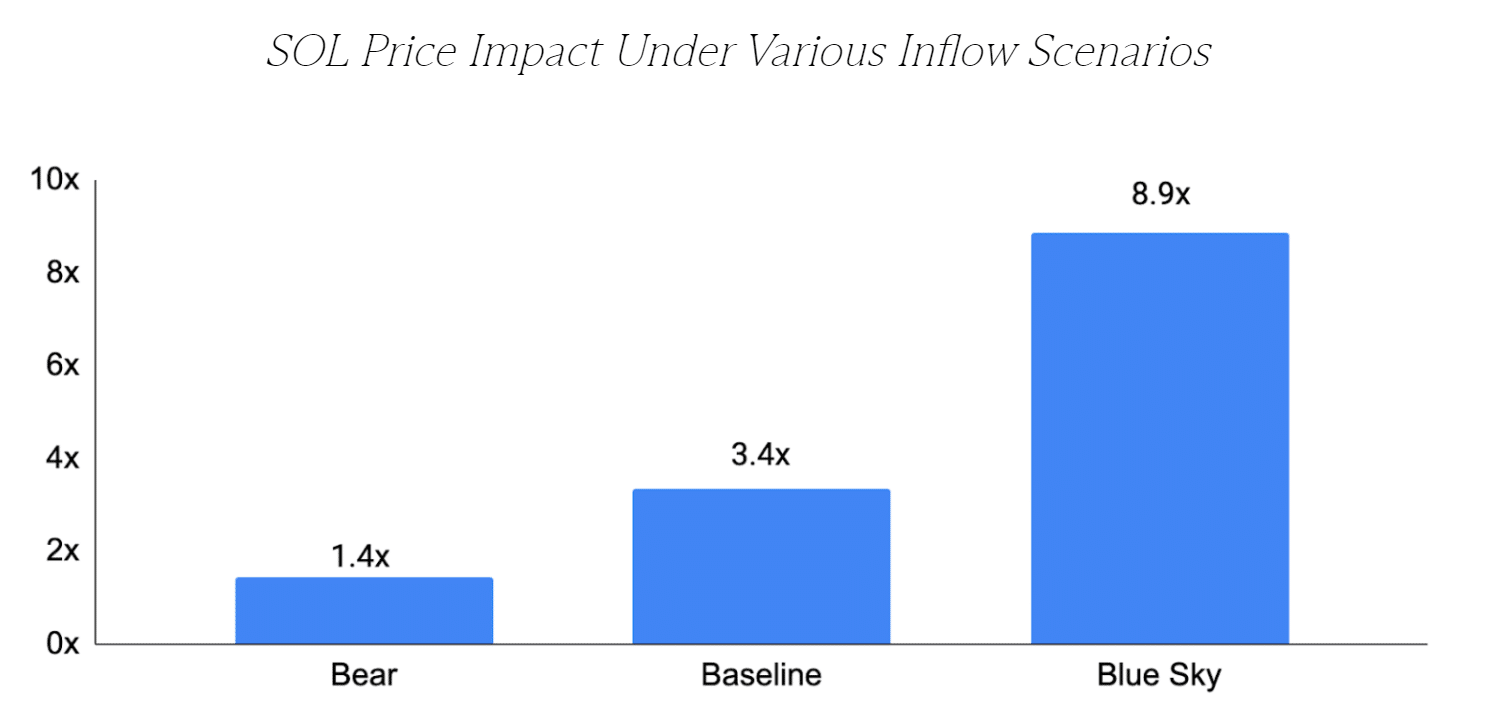

A market maker has since gone long on SOL, projecting its price could appreciate 8.9x.

As a seasoned crypto investor with a keen interest in the Solana (SOL) ecosystem, I’m excited about the recent developments surrounding the potential approval of the first US spot Solana ETF. The 9.4% price surge following VanEck’s application on June 27th was a significant boost for SOL bulls.

As an analyst, I’d rephrase it as follows: On June 27th, I observed significant enthusiasm among the crowd when VanEck, a US asset manager, filed the first application for a Solana [SOL] ETF. This optimism was reflected in the token’s price, which surged by 9.4% during intraday trading on that day.

As an analyst, I’d put it this way: Unlike Bitcoin and Ethereum, Solana doesn’t offer a tangible product that can be approved by the Securities and Exchange Commission (SEC) for future exchange-traded funds (ETFs).

Eric Balchunas, senior ETF analyst at Bloomberg, pointed out that the situation could shift under a new administration.

If there’s a change in the presidency, I believe anything could happen…I view this filing as an opportunity to buy a call option on the presidential election outcome. The election occurs, but the Securities and Exchange Commission (SEC) then has up to 240 days to make a decision.

SOL ETF to drive price 8.9x?

Another policy analyst, Scott Johnsson of Van Burien Capital, shared similar views as Balchunas. He noted that the approval of a Solana ETF might not necessitate the presence of a futures-backed counterpart like Bitcoin and Ethereum ETFs.

The Securities and Exchange Commission, under any new leadership, may modify the rules according to political convenience.

Based on their belief that a Solana Exchange-Traded Fund (ETF) may become a reality soon rather than later, the crypto market maker GSR has decided to invest in Solana (SOL) by taking a long position. In their latest announcement, they shared this information.

With other cryptocurrencies already having or on the verge of exchange-traded funds (ETFs), it’s highly anticipated that Solana will soon follow suit. This development could potentially bring about significant impacts on Solana’s value, making GSR’s long position in SOL even more noteworthy.

As an analyst, I would interpret the GSR analysis as follows: According to their estimation, the newly launched Bitcoin ETF could potentially draw between 2% and 14% of its inflows towards a Solana-based ETF. If we consider the upper end of this range, and based on the market maker’s assessment, a Solana ETF might experience a significant price surge in a bullish scenario, potentially rallying as much as 8.9 times its current value (referred to as the Blue Sky scenario).

What’s next for SOL?

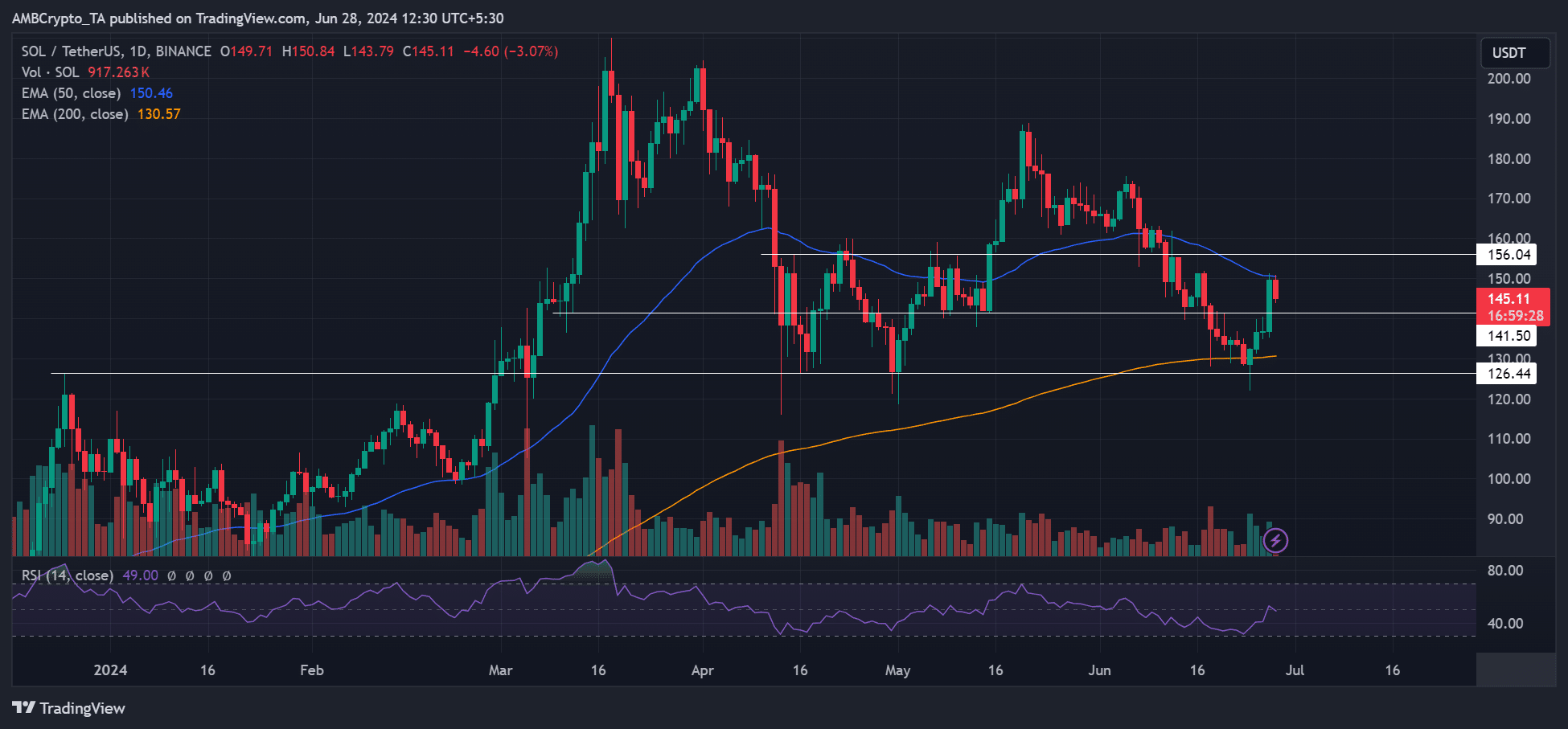

During this interval, SOL‘s price surged to reach $150 by Thursday. Nevertheless, this level coincided with the 50-day Exponential Moving Average (EMA), which might serve as a significant resistance point if market enthusiasm begins to fade.

At the moment of publication, Solana’s (SOL) price had retraced some of its Thursday advancements and stood at $145. According to Santiment, a data provider specializing in blockchain intelligence, this correction in SOL was anticipated following the announcement about the new Solana Exchange Traded Fund (ETF).

Traders experiencing fear of missing out (FOMO) are piling into SOL‘s rally, which may make it harder for the price to keep climbing.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Flight Lands Safely After Dodging Departing Plane at Same Runway

- Elden Ring Nightreign Recluse guide and abilities explained

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

2024-06-28 14:15