-

VeChain broke out of a descending channel, approaching the $0.05 resistance level at press time.

Growing volume and Open Interest indicated potential upside as VET eyed a key resistance level.

As an experienced crypto investor with a knack for spotting promising opportunities, I find VeChain’s recent surge particularly intriguing. The token has been stuck in a descending channel for quite some time, but its breakout above the $0.05 resistance level is a bullish sign that catches my attention.

Currently, VeChain’s token (VET) is experiencing a positive rally, currently valued at $0.02225 per token, representing a 2.14% rise over the past day.

The token is drawing significant interest because it might breach the crucial resistance point at $0.05, a mark that could trigger more price growth.

Market observers are keeping a close eye on the token’s upcoming actions, specifically if there’s a possibility that VeChain (VET) could possibly double in value, given its current 24-hour trading volume of $18.85 million and an increasing Open Interest by 3.48%.

Bullish breakout and technical indicators

In simpler terms, VeChain has just burst free from a downward trendline that controlled its price fluctuations for several months. This breakout coincides with a rise in trading volume and price acceleration.

The value of VET has significantly increased, exceeding important technical markers like the 9-day Exponential Moving Average (EMA) at approximately $0.02170. This suggests a possible change in investor attitudes, leaning more toward a bullish outlook.

As a researcher, I find that the current resistance level at $0.05 has been a critical focus for traders in our market. Should VeChain (VET) manage to break through this barrier, it may catalyze additional buying interest and potentially pave the way for even greater returns.

On the other hand, it’s important to exercise some caution for a brief period since the Relative Strength Index (RSI) on the 1-hour graph currently stands at 50.68, suggesting no clear direction in the price movement.

The slight pullback from recent highs suggested consolidation before any potential move higher.

At the current moment, I’m observing a subtle crossover of the MACD line beneath the signal line. This could indicate a brief period of reduced momentum, hinting at a possible short-term deceleration.

On the other hand, the histogram suggested only slight variation, which might mean the trend will continue horizontally for a while.

VET surges in volume

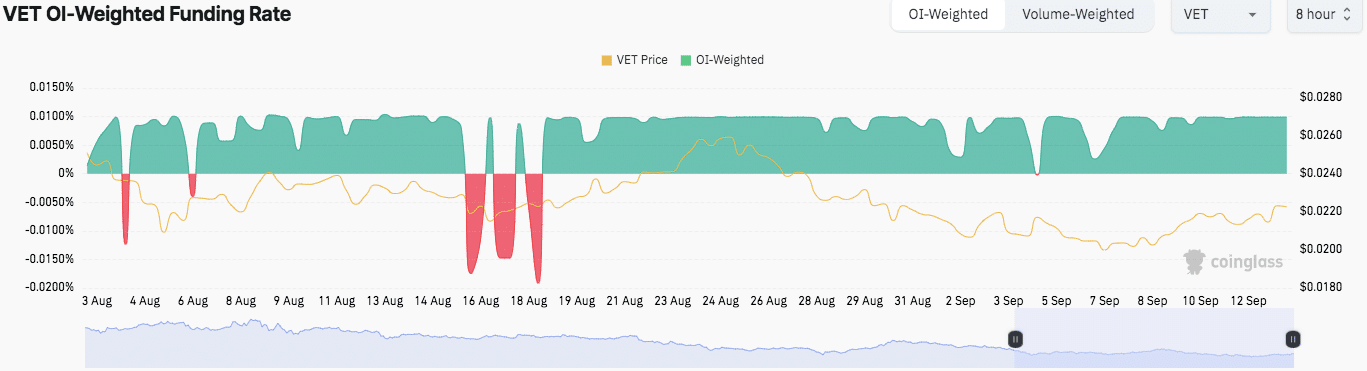

At the moment, the Open Interest-weighted Funding Rate for VET remains at a favorable 0.0099%, implying that individuals holding long positions are currently paying fees to those with short positions.

The favorable Funding Rate implies that traders generally maintained a bullish outlook towards the coin’s future, despite temporary drops into negative values around mid-August, which hinted at temporary pessimism or bearish feelings in the short term.

Over the past period, the trading volume for VeChain has experienced a significant jump by approximately 26.58%, reaching around $18.21 million. Additionally, the Open Interest in its Futures contracts has grown to an impressive $28.70 million, indicating an increase in market engagement and activity.

Read VeChain’s [VET] Price Prediction 2024–2025

As reported by DefiLlama, the Total Value Locked (TVL) for VET stood at approximately $80.26 billion when last written, underscoring its strong presence within the blockchain industry.

The data points towards an increasing curiosity towards the token, yet the market is hesitant since investors are looking for verification of a jump surpassing the significant $0.05 barrier before becoming more optimistic.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Masters Toronto 2025: Everything You Need to Know

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- The Lowdown on Labubu: What to Know About the Viral Toy

2024-09-13 21:43