- VeChain retested the $0.05561 resistance as bullish momentum rose, targeting $0.065 next.

- Social dominance and funding stability pointed towards sustainable growth.

As a seasoned analyst with over two decades of market observations under my belt, I’ve seen bull runs and bear markets alike. The current trajectory of VeChain [VET] is reminiscent of the early days of Bitcoin, when the world was captivated by the potential of blockchain technology.

VeChain (VET) has been surging with enthusiasm, managing to test and even exceed its significant resistance point of around $0.05561, reaching $0.06231 as we speak.

As an analyst, I’ve noticed a consistent rise in the daily trading activity of VET, sparking curiosity among traders and investors alike. The persistent bullish trend has ignited discussions about whether VET might surge even higher, potentially breaching the $0.10 mark. Let’s delve deeper to uncover the truth behind this intriguing possibility.

Strong momentum ahead?

At the moment, the value of VET is displaying a robust uptrend, having set a sturdy foundation at around $0.05561. The Relative Strength Index (RSI) stands at 61.34, suggesting that bullish energy remains steady without verging on overbought conditions.

Additionally, the Fibonacci retracement levels supported this strength, as VET regained the 38.2% level at $0.05672 and is moving towards the upcoming resistance around $0.065.

Consequently, it appears that VeChain’s upward momentum might continue to develop based on the current technological configuration.

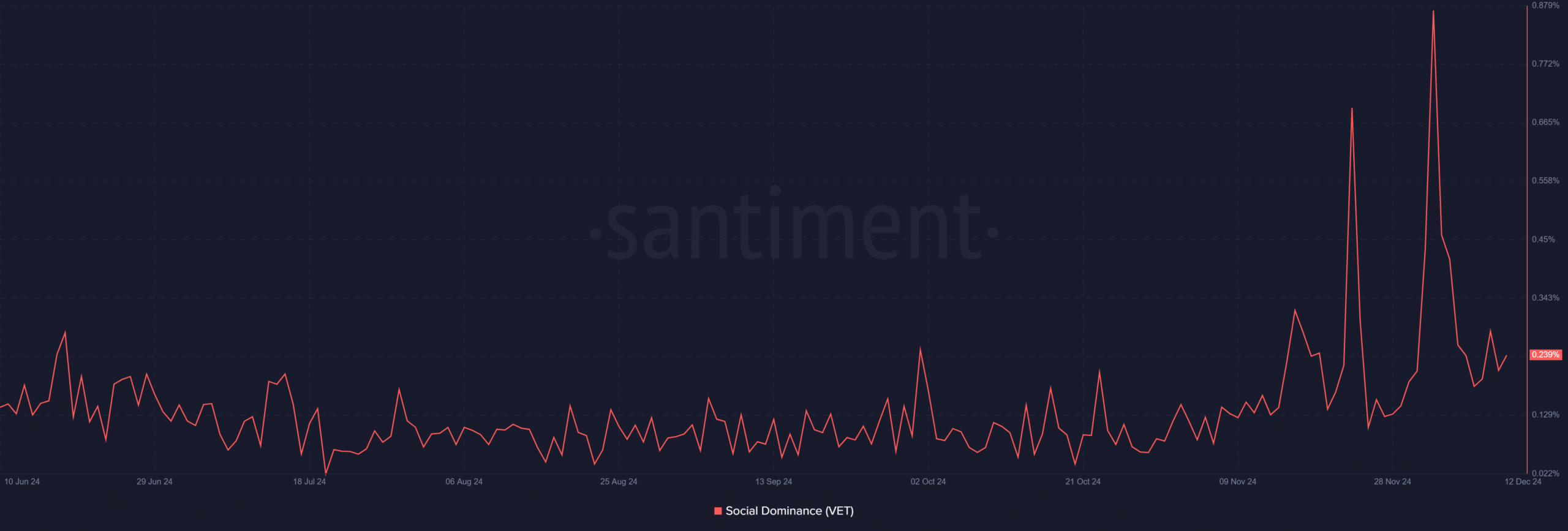

VeChain’s Social Dominance rises steadily

Furthermore, VeChain’s social influence has risen slightly to 0.239%, up from 0.211% yesterday. This increase suggests a rising interest in the cryptocurrency world, which usually paves the way for additional price growth.

Discussions among traders about VET’s progress might add extra momentum to its continued rise, due to the potential impact of this increased chatter, often referred to as “social buzz.

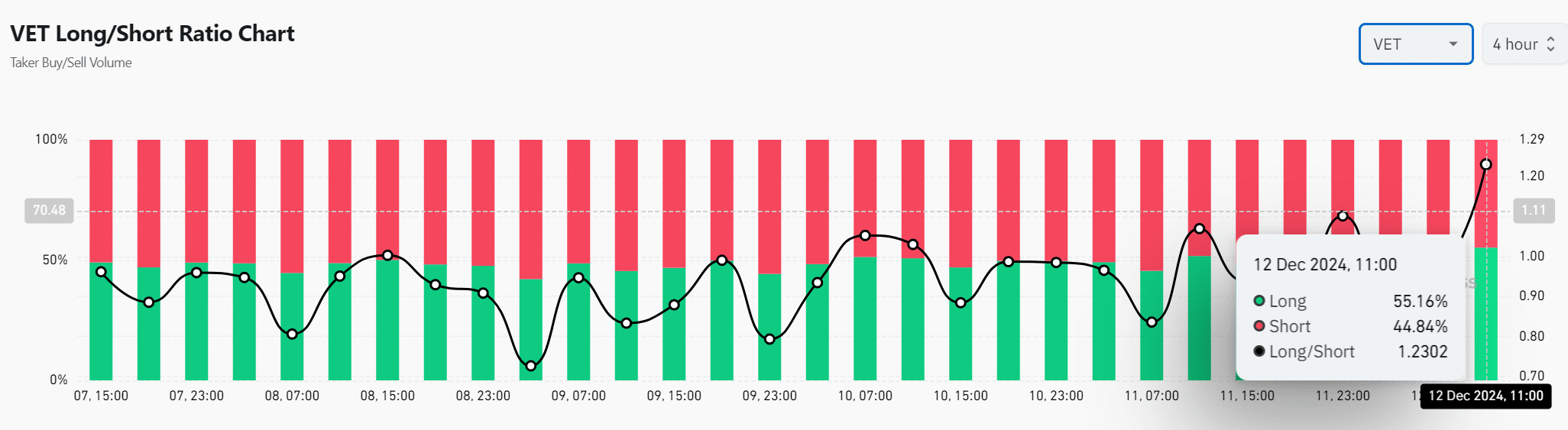

Long/Short Ratio shows bullish sentiment

At the point of this writing, the Long/Short Ratio stood at approximately 1.23. This means that about 55.16% of traders were long, while only 44.84% were short positions. This data indicates a strong leaning towards optimism or bullish sentiment among traders.

On the other hand, the fairly even distribution between bullish (long) and bearish (short) positions suggested a cautious optimism among traders, implying potential volatility in prices over the near future.

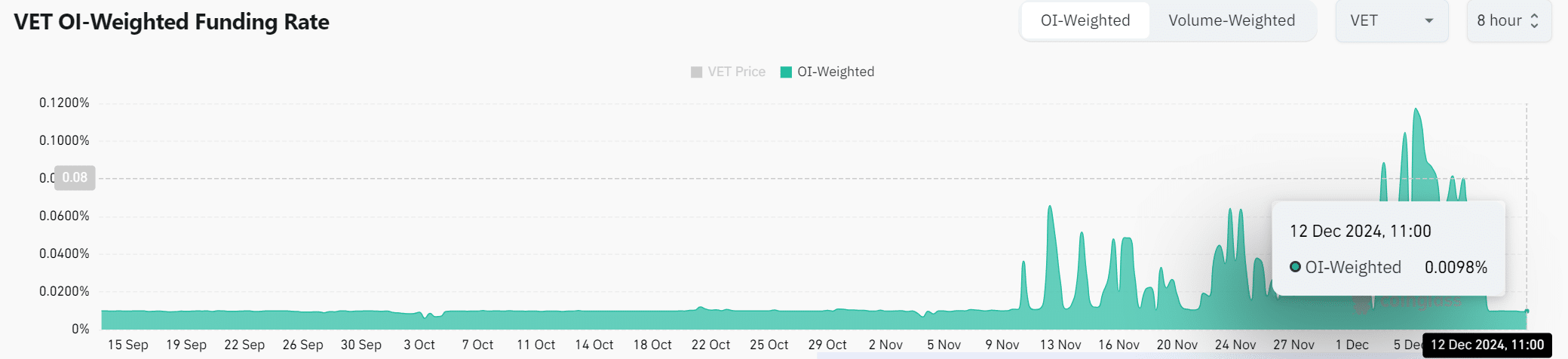

Funding Rate remains stable

VET’s OI-Weighted Funding Rate remained stable at 0.0098%, signaling neutral market conditions.

In contrast to markets that are highly leveraged and susceptible to sudden drops, the low Funding Rate indicated a harmonious blend of speculative and natural market activities.

Therefore, VET’s growth appears to be sustainable, with no immediate risk of overheating.

Read VeChain’s [VET] Price Prediction 2024-25

VET is on track to reach $0.10?

Based on VeChain’s positive market signals, rising public attention, and robust technical backing, it appears to be heading towards a potential price of $0.10.

As I observe the current market trends, if VeChain (VET) manages to surpass the $0.065 resistance level in the near future, it seems that this significant milestone might be attained quicker than anticipated. Given the current outlook, the prospects for this altcoin remain extremely promising.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-13 03:03