-

Velo joined a growing list of protocols leveraging BlackRock’s tokenized short-term treasury fund for their ecosystem offerings.

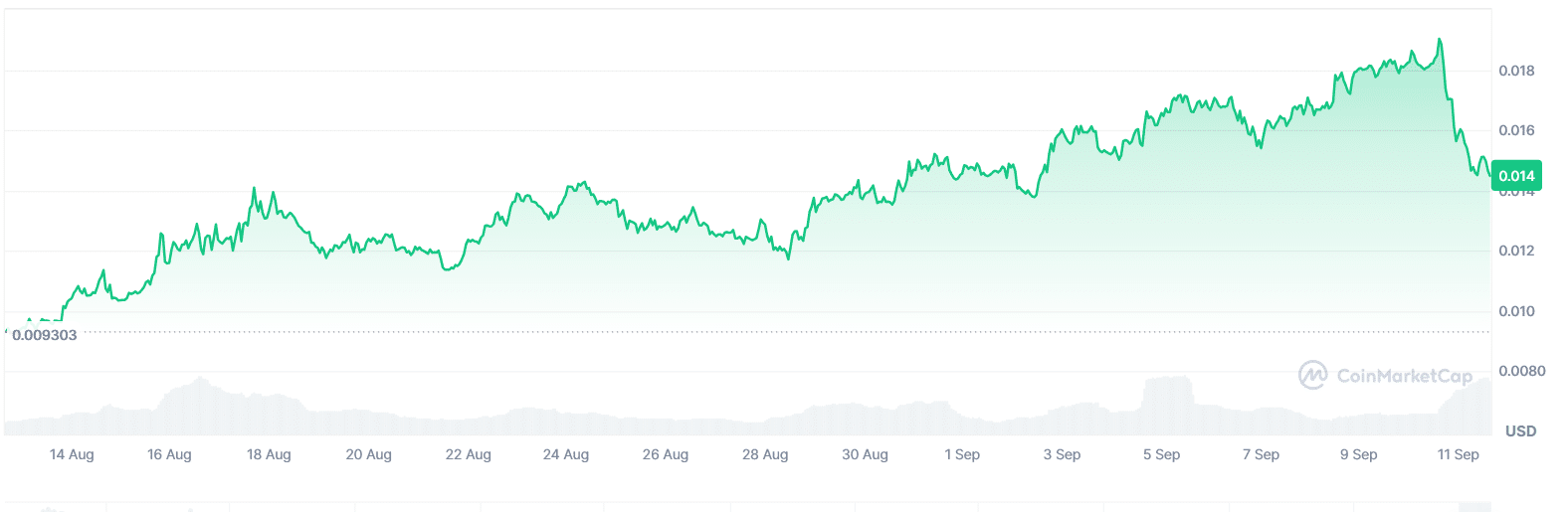

VELO was among the top losers today, down more than 22% in the last 24 hours, after a disruption to its decent run this month.

As a seasoned analyst with years of experience observing the cryptocurrency market, I see Velo Labs’ decision to leverage BlackRock’s tokenized short-term treasury fund as a strategic move that could potentially propel VELO Protocol [VELO] into new heights. However, the immediate market reaction seems to indicate a classic case of “sell the news,” with the price of VELO plummeting following the announcement.

Velo Labs, creators of VELO cryptocurrency, has become the most recent company in the crypto field to leverage BlackRock’s initial tokenized investment fund, aiming to bring cutting-edge financial solutions to their clientele.

On September 10th, the company announced that their USDV stablecoin is supported financially through an investment in BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), as detailed in a blog post.

The strategic move is aims to bolster the stablecoin’s utility and its appeal as both a store of value and yield-bearing asset.

Market reaction

Initially, Velo’s announcement ignited curiosity, as it was viewed by many as confirmation of Velo Labs’ ambitious plan to broaden their market influence.

After the announcement, it appears that Velo’s utility token, VELO, followed a typical pattern known as “selling the news.

Following the announcement, speculators swiftly cashed in on their earlier gains from the upward trend, effectively ending a steady rise of VELO over the past month, during which it made substantial progress.

Significantly, Velo joins other cryptocurrency initiatives that are leveraging BlackRock’s tokenized fund to create consumer-oriented products or offer exposure to income-producing possibilities.

Back in March, I decided to shift the collateral supporting my U.S. Treasury-backed token (OUSG) from Ondo Finance to their BUIDL fund. This move was aimed at strengthening the security and stability of my investments.

As a researcher, I’m excited to share that our strategic move of allocating $95 million towards BlackRock’s tokenized fund is designed to enhance the user-friendliness of OUSG. This decision is also aimed at streamlining instant settlement processes, ensuring smoother transactions for all parties involved.

Just last week, the Layer 1 blockchain initiative known as Injective debuted a tokenized version of the BUIDL Fund’s index, offering retail investors an opportunity to invest in this fund.

VELO/USDT technical analysis

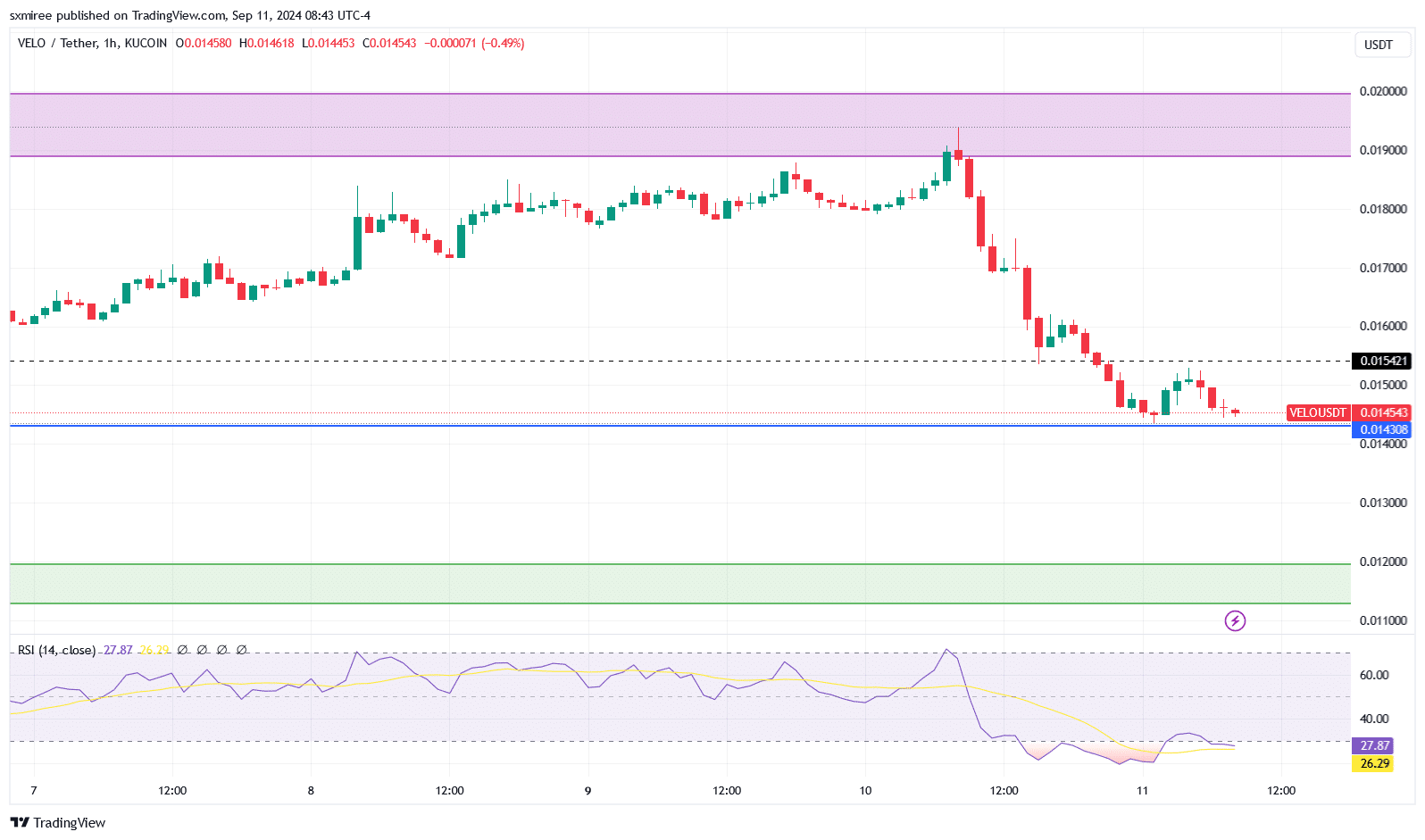

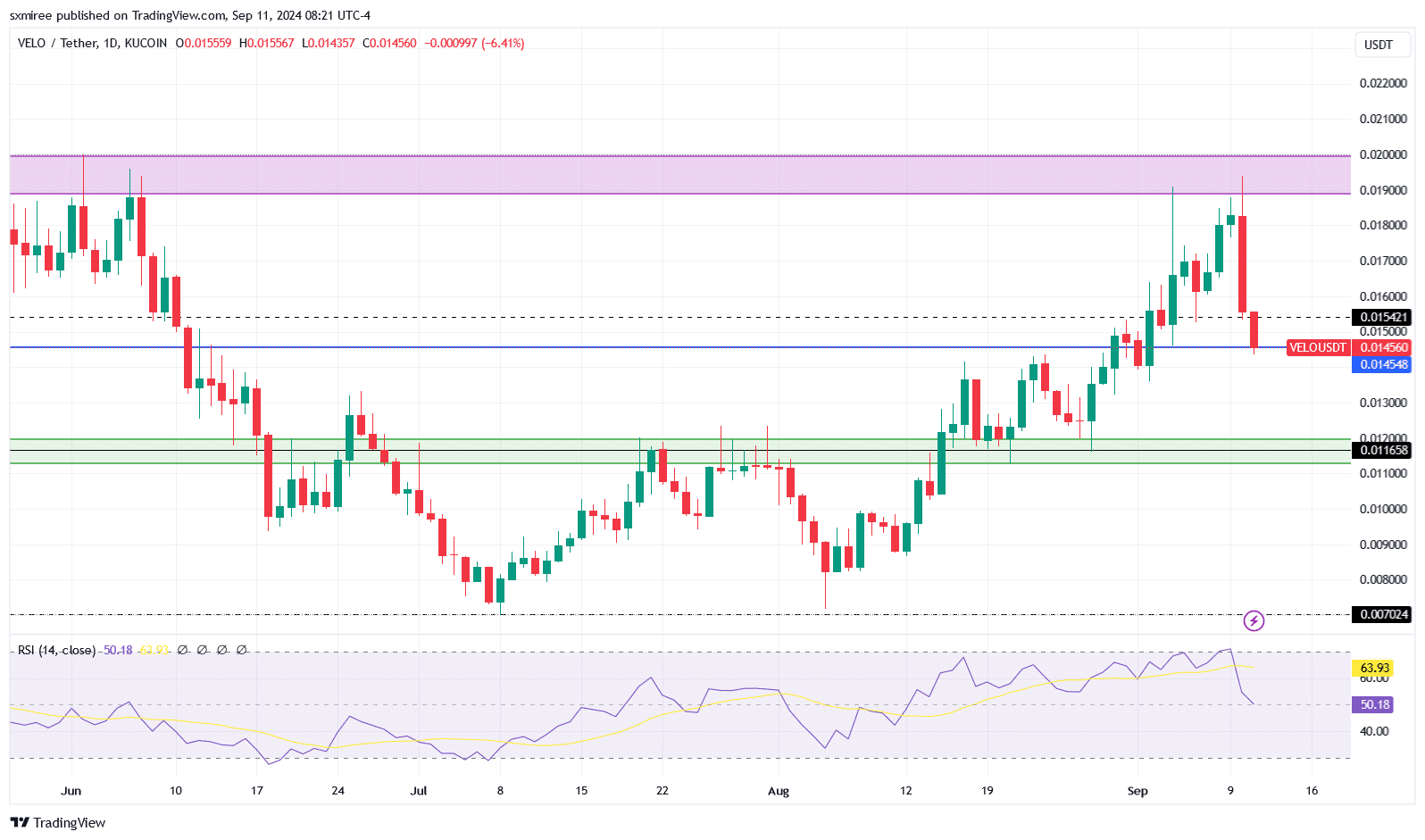

According to the data from TradingView, the value of VELO dipped below its previous support level of $0.0155 during the night, falling to $0.01436. From there, it has been holding steady in a period of consolidation.

Despite VELO recovering slightly following its steep decline from a peak of $0.0193 earlier today, it has still experienced a 15% decrease over the past 24 hours.

Over the past few hours, the VELO/USDT pair has been trying to mount a recovery following its transformation of the previous resistance at $0.0143 into instantaneous support.

At present, the RSI for VELO remains below the oversold area, currently showing a value of 27. This suggests that VELO is undergoing intense bearish influence and is heavily oversold.

Read Velo’s [VELO] Price Prediction 2024–2025

Moving forward at $0.015 per day could indicate a possible extension of the previous upward trend, but this progress might be hindered near $0.02 – a level that gave Velocity trouble in June. This upper limit may pose a challenge.

Should there be further declines beneath the present resistance level, it would suggest a potential break in the uptrend, triggering a response towards the more robust support established at $0.011 during August.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-09-12 06:16