- Data reveals that VIRTUAL’s Open Interest has dropped by 18% in the past 24 hours.

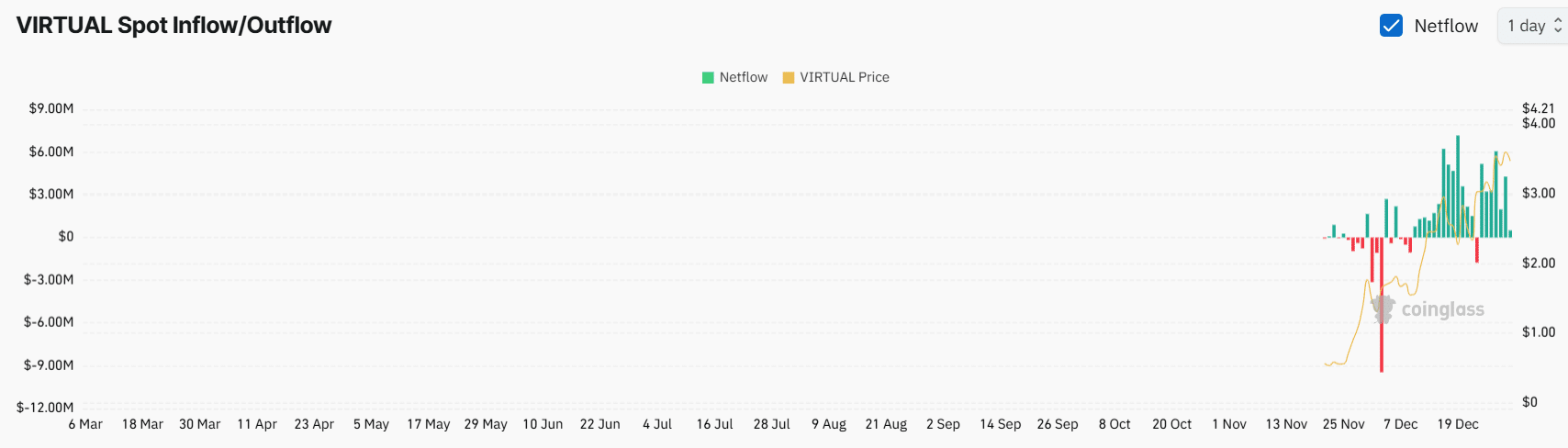

- Exchanges have witnessed an outflow of $4.80 million worth of VIRTUAL.

As a seasoned crypto investor with over five years of experience navigating the volatile and unpredictable world of digital assets, I have learned to keep a level head amidst market fluctuations and never let emotions guide my decisions. With the recent developments in the price action of Virtual Protocol [VIRTUAL], I find myself cautiously optimistic.

I’ve seen many promising projects come and go, some skyrocketing to unimaginable heights only to plummet back down just as quickly. VIRTUAL has demonstrated an impressive performance in the past, but its recent struggle to maintain momentum alongside Bitcoin [BTC], Ethereum [ETH], and XRP is concerning.

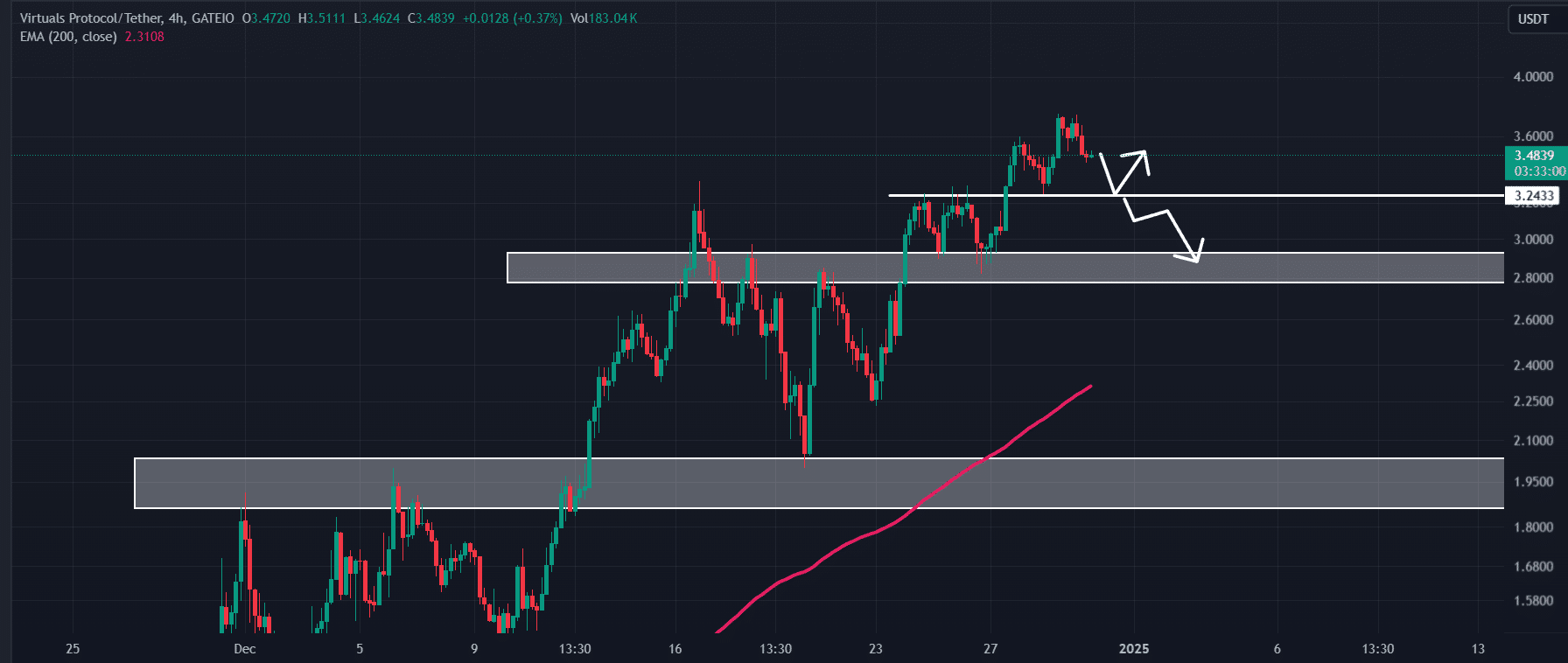

The technical analysis suggests a potential price correction, with a possible decline of up to 7% if the support at $3.24 fails to hold. However, I remain optimistic about VIRTUAL’s long-term potential, as evidenced by its strong community and innovative technology.

I remember investing in Bitcoin back when it was trading for less than a dollar, so I know that even the most promising projects can face temporary setbacks. The on-chain data shows mixed sentiments, with a decrease in open interest and an outflow of assets from exchanges, but also evidence of long-term holder accumulation.

Investing in cryptocurrency is like riding a rollercoaster – exhilarating, terrifying, and always unpredictable. But if you’re willing to hold on tight and keep your cool, the ride can be incredibly rewarding. So, I’ll continue to watch VIRTUAL closely and adjust my strategy accordingly, knowing that even the most successful investments require patience and a thick skin.

Oh, and remember: never invest more than you’re willing to lose – especially in a market as volatile as this one!

In the midst of market turmoil, Virtual Protocol (VIRTUAL) is generating buzz with its outstanding results.

On the 30th of December, it appears that VIRTUAL, as well as Bitcoin [BTC], Ethereum [ETH], and XRP, are experiencing difficulties in building up speed, leading some to speculate about an upcoming price adjustment.

After years of closely monitoring market trends and observing various asset classes, I believe it’s clear that short-term traders are reaping significant profits following a staggering 42% increase in the past week for a particular asset. The price skyrocketed from $2.44 to $3.47 within this period, which has caught my attention and piqued my curiosity. As someone who’s experienced both bullish and bearish market cycles, I know that such rapid growth often signals an opportunity for profit-taking among long-term holders. It will be interesting to see how the market behaves in the coming days and whether this surge marks the beginning of a new upward trend or a temporary spike before a correction.

It’s important for investors to figure out if the current price will hold steady or if there might be a possible drop in the near future.

VIRTUAL price prediction

As a crypto investor, I’ve noticed that, based on AMBCrypto’s technical analysis, VIRTUAL seems to have burst through a compact four-hour holding pattern it formed around the $3.70 price point recently.

After this division, the value of the asset might lose a significant area for liquidation, potentially giving bears the leverage to push the asset’s price down by approximately 7%, taking it to the next support level at $3.24.

Should VIRTUAL reach that particular threshold, it might prompt a possible price increase. However, if it doesn’t, market participants might observe a potential fall in price down to the $2.90 mark in the time ahead.

Mixed sentiments, on-chain

Given the possibility of a potential price dip and the recent downward trend I’ve noticed, I find myself hesitant to establish new investment positions, as suggested by the insights from the on-chain analytics firm Coinglass.

Data showed that VIRTUAL’s Open Interest has dropped by 18% in the past 24 hours.

Meanwhile, long-term holders were accumulating the asset, reflecting their confidence and interest.

During the specified timeframe, information gathered by VIRTUAL’s spot inflow/outflow system indicated a relatively small withdrawal of approximately $4.80 million in VIRTUAL tokens from various exchanges.

When it comes to cryptocurrencies, an “outflow” is a term used to describe the transfer of digital assets from trading platforms (exchanges) into the personal wallets of investors who plan to hold their crypto for a long time. This movement might suggest that these investors are accumulating more assets and increasing the overall demand, leading to higher buying pressure in the market.

By taking into account these on-chain measurements along with traditional technical analysis, it seems clear that the asset could be trending downward in the short term, potentially leading to a price adjustment.

Looking ahead on a larger time scale, investors continue to be optimistic about the asset. If the current price correction proves successful, it could lead to an increase in the asset’s value in the future.

Read Virtuals Protocol’s [VIRTUAL] Price Prediction 2025–2026

Currently, VIRTUAL is hovering around $3.46, having experienced a drop of more than 6.45% in the last day.

Over the given timeframe, there was a 3.5% boost in the trading volume, suggesting an uptick in involvement from both traders and investors, as opposed to the preceding day.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-12-30 17:12