🚨 AI Agents in Crisis: VIRTUAL Price Plummets 90%! 🚨

- Mon dieu! Since last quarter, Virtual protocol activity and revenue fell over 95%. C’est une catastrophe!

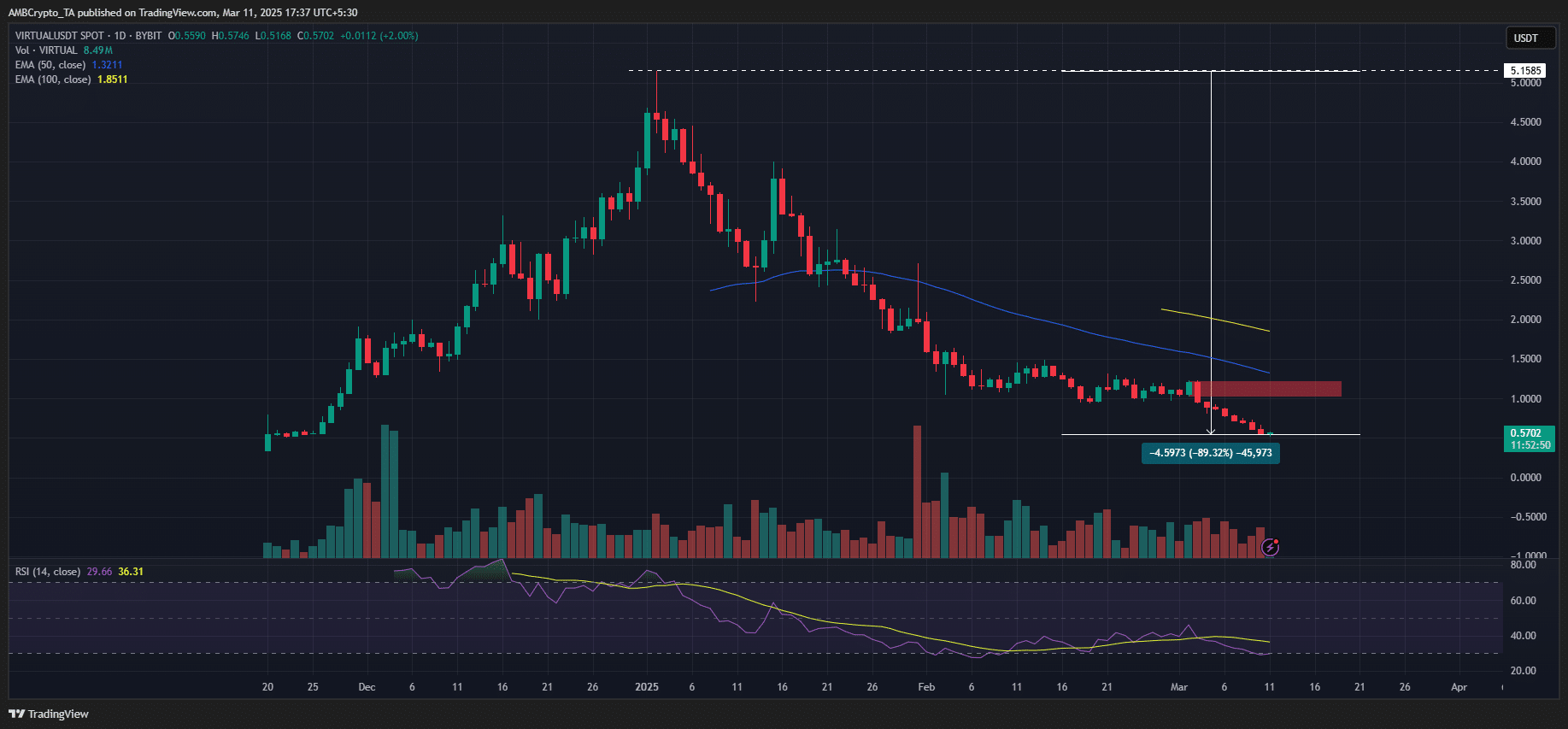

- And, oh la la! VIRTUAL price was down 90% from its record high of $5.1. Quelle horreur!

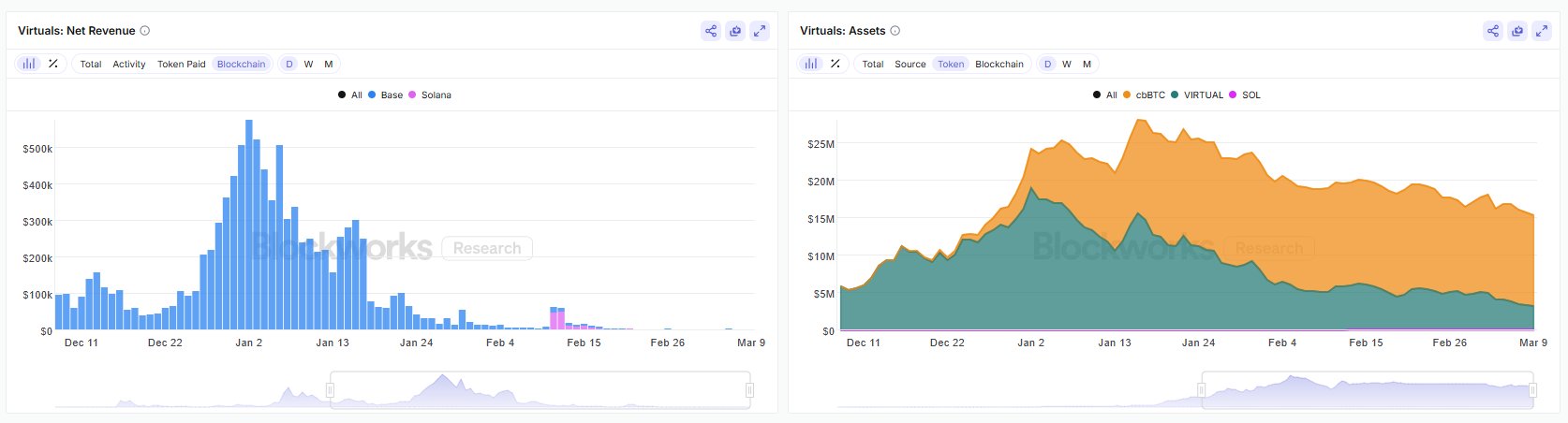

Alas, dear readers, Virtual Protocol’s [VIRTUAL] revenue has dropped 98% alongside network activity as demand for AI agents wanes. It’s a tragedy, a true disaster!

According to Dune Analytics, Virtual protocol trading revenue has fallen from a $976K peak in mid-January to $13K. Mon dieu, what a precipitous drop!

And, if that weren’t enough, the number of daily AI agents created on the launchpad flattened in March. Notably, daily AI agents jumped to 1,365 last November but have now dropped below 10 per day. C’est une décadence!

That’s a whopping 99% decline in activity. Oui, c’est un désastre!

VIRTUAL price drops 90%

The bearish on-chain readings were also evident on VIRTUAL, the native token for the AI agent launchpad. Ah, les mauvaises nouvelles!

After peaking at $5.1 in early January, the token retraced nearly all its last quarter gains and was valued at $0.56 at press time. That’s an 89% decline in Q1 2025. Mon dieu, quelle perte!

Even so, the market rout didn’t affect VIRTUAL only but the entire AI agent category. According to Flipside data, the weekly AI agent tokens trading volume dropped from nearly $2.5B in December to $54M in early March. C’est un véritable désastre!

This suggested that the trader’s overall appetite and interest in the segment also waned significantly over the past three months. Ah, les temps difficiles!

However, in an X post, Blockworks research analyst Dan Smith stated that the Virtual Protocol was ‘smart’ to have diversified its revenue into wrapped Bitcoin. Ah, mais oui!

“But the team was smart to diversify revenue out of its own token. They now hold $12.1m of cbBTC, extending runway to iterate on their product.”

That said, VIRTUAL’s price recovery could face a headwind unless the broader market sentiment improves and the AI agent narrative dominates mindshare again. Ah, les chances sont minces!

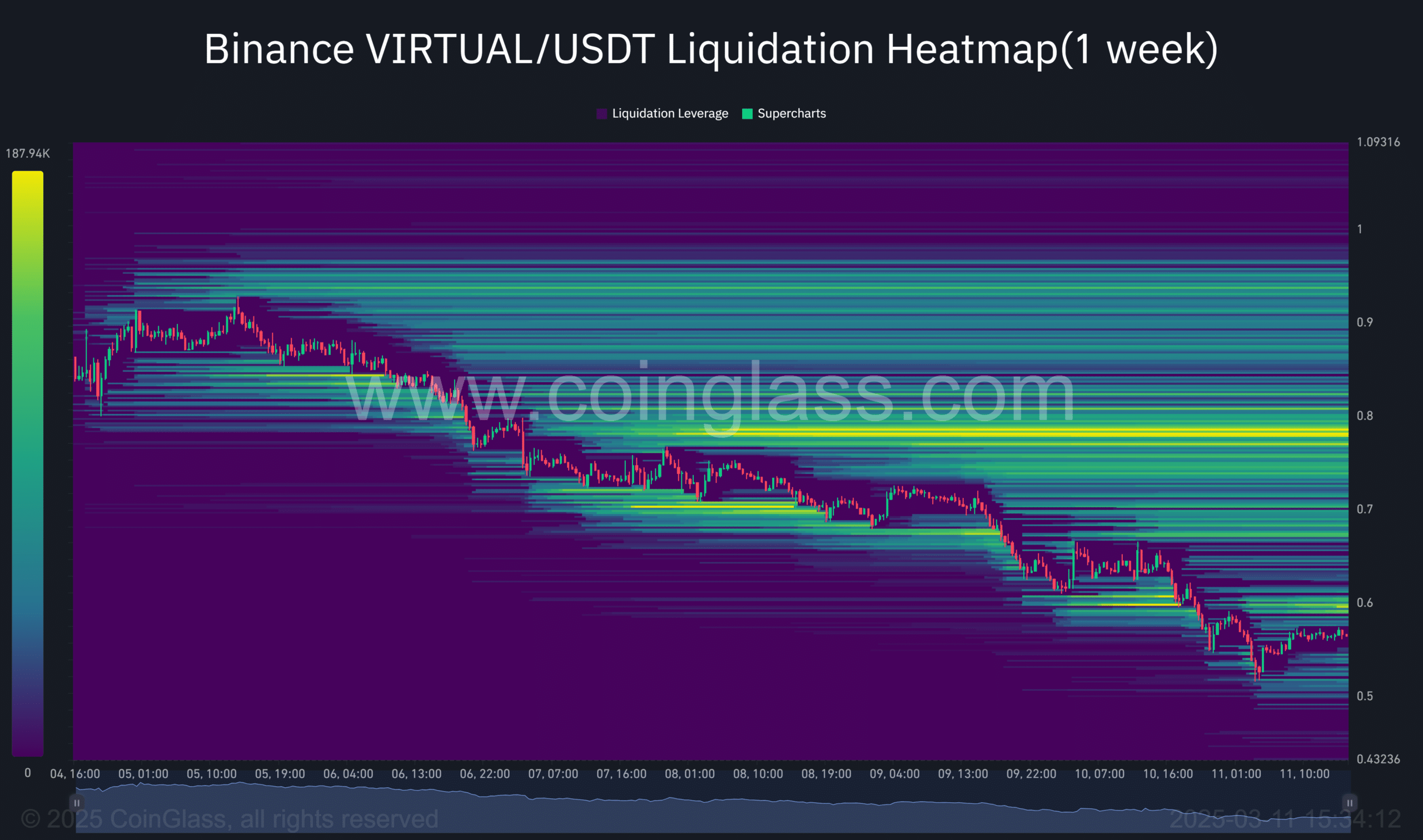

Meanwhile, key liquidity pockets were at $0.8 and $0.6 on the liquidation heatmap. In most cases, liquidity-driven rallies tend to tap levels with high liquidity. Ah, mais peut-être!

As such, the overhead pockets at $0.8 and $0.7 could be tapped during a relief rebound. Oui, c’est possible!

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2025-03-12 05:14