- Virtual Protocol has unveiled a buyback program to boost its ecosystem agents

- VIRTUAL’s mindshare soared with 25% gains on the price charts

The AI Agent Launchpad Virtual Protocol has announced intentions to spend approximately 13 million VIRTUAL (valued at around $48 million) to purchase and destroy their ecosystem tokens. This action could potentially trigger a deflationary effect, benefiting both VIRTUAL and its associated tokens.

The firm’s statement revealed that the burn program will run for 30 days.

Since October 16th, 2024, we’ve earned approximately $12,990,427.85 from our post-bonding trading activities. This income will be utilized for a buyback-and-burn process of the related tokens over a 30-day Time-Weighted Average Price (TWAP) period.”

Or more concisely:

“We’ve made around $12,990,427.85 from trading since October 16th, 2024, which we’ll spend on a buyback-and-burn of relevant tokens over the next 30 days using a TWAP method.

VIRTUAL reacts to buyback program

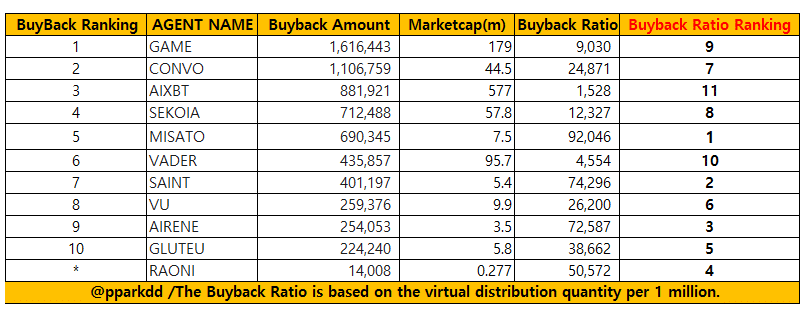

Under the terms of the buyback program, some of the most advantageous recipients include GAME, CONVO, AIXBT, SEKOIA, and MISATO.

Just as anticipated, the agent tokens experienced an immediate spike following the update. Notably, AIXBT, a crypto influencer on the X platform (previously known as Twitter), and GAME, a token native to a gaming-centric platform, soared by approximately 40%. Additionally, VIRTUAL saw a rise of 25% and revisited the $4.0 mark.

Worth noting, however, that the buyback program was received with mixed feelings.

One group views this development as a positive sign for the VIRTUAL platform and its environment, as it strengthens its self-reinforcing cycle (flywheel effect) and draws more developer-agents towards it. Consequently, this could lead to an uptick in demand for VIRTUAL, as it serves as the primary currency within the ecosystem.

However, due to concerns over how the accumulated VIRTUAL fees were being utilized, some users expressed apprehension towards the altcoin temporarily. A user even voiced this concern, stating…

I believe in this long-term bullish scenario, but it appears that their current revenue must be adjusted due to the platform underwriting. This move is intriguing, and I’m eager to observe how the market responds over the next few days and weeks.

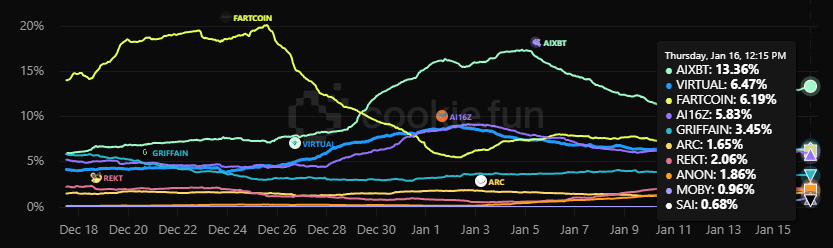

In terms of popularity, AIXBT led with a 13% share, while VIRTUAL claimed 6.4%. This suggests that the agent influencer in the social sphere held stronger social influence and garnered greater market attention compared to its initial token launched on its own platform.

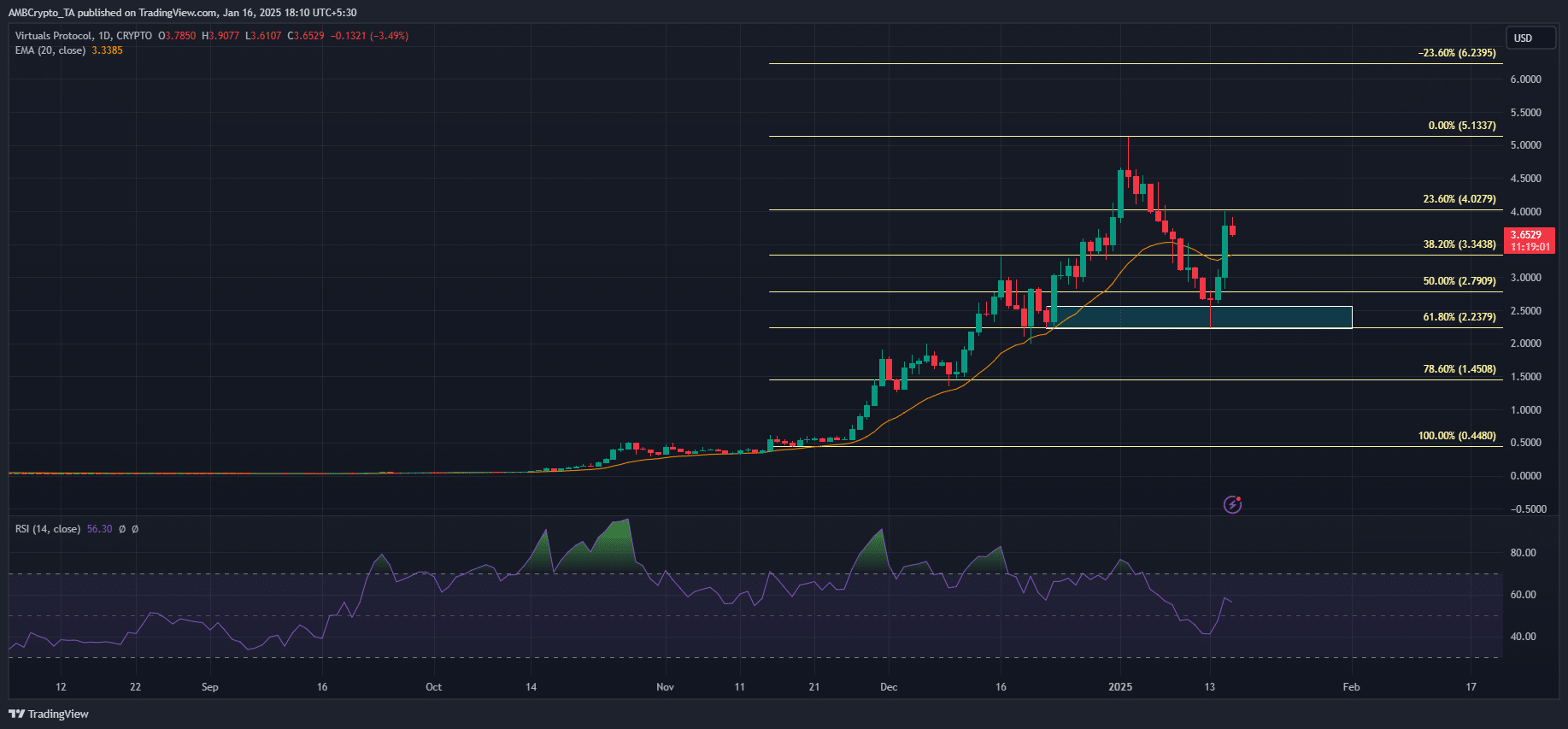

On the price charts, VIRTUAL bounced from the golden 61.8% Fibonacci retracement level.

If the $4 level is removed, the token might regain its peak value of $5. Additionally, the Relative Strength Index (RSI) on the daily chart has climbed above 50, suggesting a surge in buying activity. If this momentum continues, it could boost VIRTUAL upward.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Solo Leveling Arise Tawata Kanae Guide

2025-01-16 17:27