- Vitalik Buterin has praised Ethereum for hitting key milestone in the execution layer client diversity.

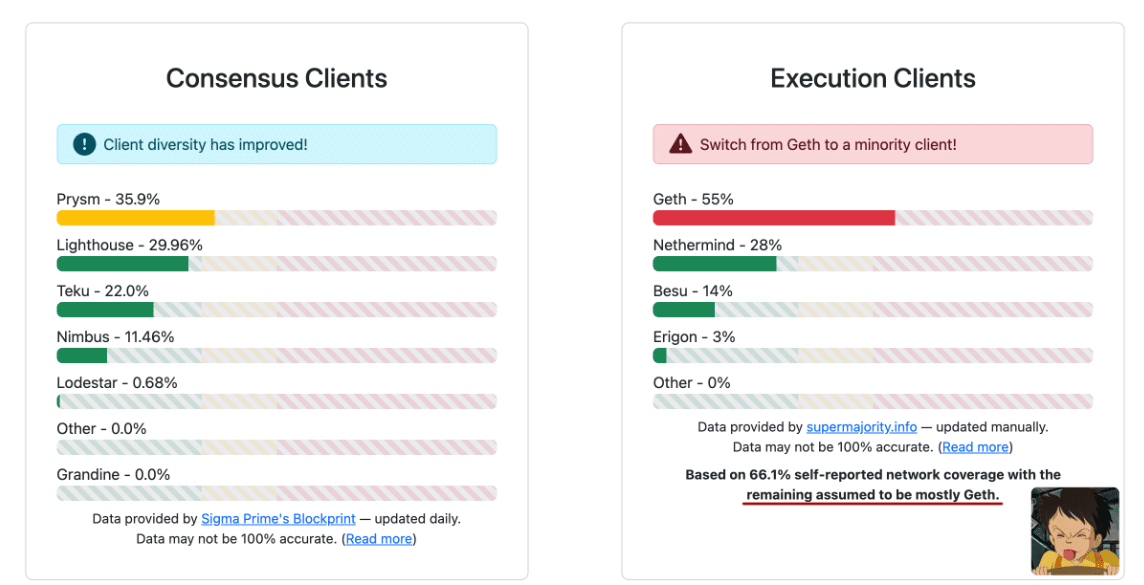

- Ethereum plans to have multiple execution clients to work in parallel while verifying blocks.

As a researcher with years of experience in the crypto space, I find the recent development in Ethereum’s execution layer client diversity truly encouraging. Having closely observed the risks associated with a supermajority client, I can attest to the importance of this milestone for the robustness and decentralization of the ecosystem.

Ethereum [ETH] has achieved a key milestone by limiting top execution clients run by validators from having a supermajority market share. Reacting to the update, Ethereum founder Vitalik Buterin termed it the ‘robustness’ of the ecosystem.

As a crypto investor, I’m delighted to note that no single execution client dominates more than two-thirds of the market. This is fantastic news, as it underscores the resilience and diversity of the Ethereum L1 ecosystem. The decentralized nature of its client base ensures a robust and thriving platform for all participants.

The problem with ETH supermajority client risk

In simpler terms, when it comes to Ethereum, the software that validators use for staking and pools is known as an execution client. If one particular execution client (the one used by most validators) holds more than two-thirds of the market share, it’s considered a “supermajority” client. This dominant position can potentially pose a risk to the entire Ethereum ecosystem.

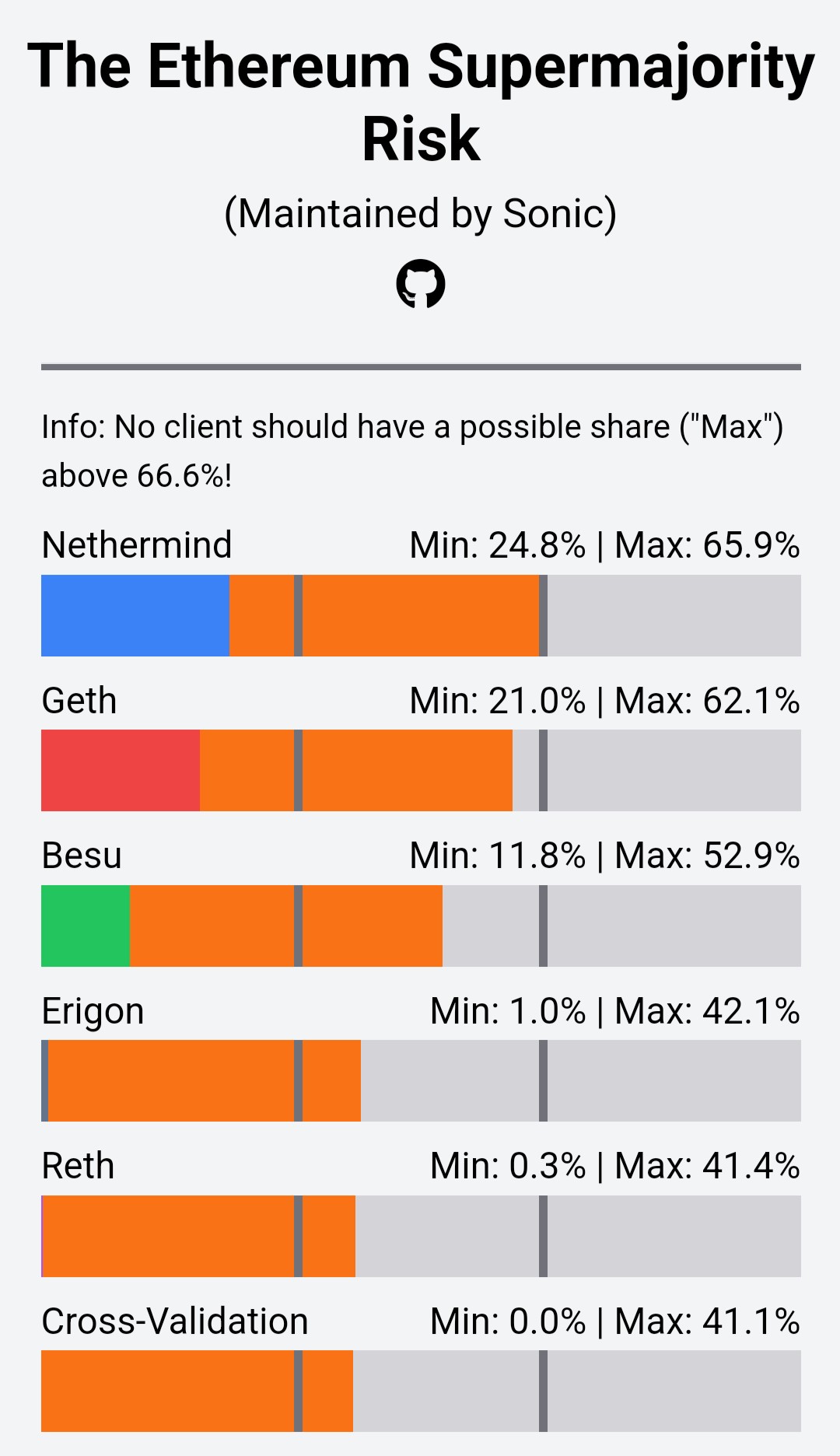

Based on data from the Supermajority tracker, a client with a majority vote could potentially lead to a division within the network and even financial losses due to software glitches.

‘This entity can independently complete transactions without needing approval from other users. If a consensus issue arises within an individual user’s system, it could lead to severe consequences like a network divide, loss of resources, and potential harm to its reputation.’

Furthermore, having a majority of powerful clients in the system might result in incorrect decisions or errors by validators, potentially leading to hefty penalties due to slashing – a process that involves burning a part of their staked assets.

To put it simply, a large number of clients using one particular risky method (supermajority client risk) can lead to an overall risk for the entire system (centralization risk). As per Ethereum’s Team Lead, Peter Szilágyi, this could have severe consequences, potentially hindering the chain’s growth and adoption.

‘More troubling still, if most validators make mistakes, the incorrect blockchain could be finalized, causing complex governance problems about how to rectify the error. This situation could potentially discourage the wider use of Ethereum due to the perverse incentives for the majority of validators not to correct their mistakes.’

Previously, Geth (Go Ethereum) held the position as the most prominent and widely-used Ethereum execution layer client. However, this has changed in recent times.

To mitigate the risk, the ecosystem advocated for client diversity and urged users to opt for minority execution clients. Currently, Nethermind is the most dominant client, surpassing Geth. However, Nethermind was not a supermajority client at the time of writing.

It’s worth noting that a fresh idea is circulating aimed at empowering validator nodes to check multiple blocks simultaneously across various clients. This strategy could potentially reduce the risks associated with the supermajority even more.

For now, the price of Ethereum has stabilized under $2800 following its strong surge on Friday. Whether the investor’s aggressive attitude toward risk-taking persists into the coming week is yet to be determined.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- The Lowdown on Labubu: What to Know About the Viral Toy

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- PlayStation Believes Competition from Xbox is “Healthy and Pushes Us to Innovate”

2024-08-26 04:07