- Vitalik Buterin marked block creation and staking as key centralization risks.

- The team was exploring some solutions to address these risk factors.

As a seasoned researcher with extensive experience in blockchain technology and digital currencies, I have always been intrigued by Vitalik Buterin’s insights into Ethereum [ETH]’s centralization risks and proposed solutions.

Vitalik Buterin, a key figure behind Ethereum (ETH), delved into possible issues related to centralization within the network and proposed strategies the team is considering for resolution.

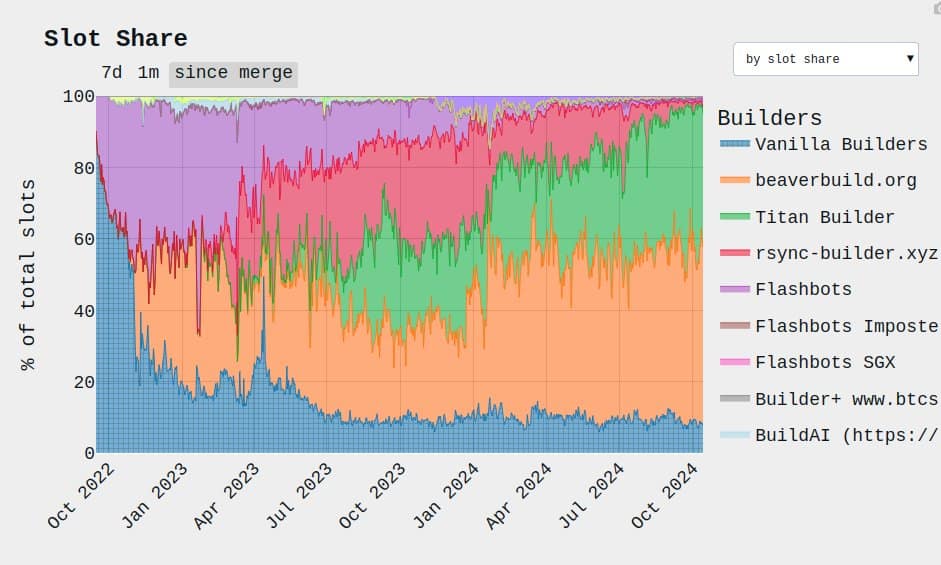

According to Buterin, the creation of blocks and the practice of staking were identified as significant risks that could lead to centralization. To illustrate the potential severity of this situation, it’s worth noting that two entities, Beaver and Titan, accounted for almost 90% of Ethereum block production in October.

What could possibly go wrong with such a level of centralization?

Additionally, Buterin pointed out that the increased power of significant validators might lead to a rise in network attack and censorship vulnerabilities. He expressed this concern explicitly.

“This (large stakers dominance) leads to higher risk of 51% attacks, transaction censorship, and other crises. In addition to the centralization risk, there are also risks of value extraction: a small group capturing value that would otherwise go to Ethereum’s users.”

Possible solutions

Over the past year, these previously discussed risks have increased, largely due to an upsurge in the application of sophisticated algorithms like MEV (Maximum Extractable Value) by block producers to boost their earnings.

As a crypto investor, I’ve noticed that larger players have an edge due to their ability to execute more advanced strategies, such as “Maximal Extractable Value (MEV) extraction.” This allows them to generate blocks more frequently, resulting in a higher return on investment per block.

Regarding the challenge with creating blocks, Buterin proposed that an “inclusion lists” method might offer a viable solution. In this approach, both proposers and constructors would be responsible for executing the task.

To simplify the main issue, we’re planning to divide the block production task: the person who proposes (or ‘stakes’) will be responsible for selecting transactions, while the builder can only arrange these selected transactions and add a few of their own. This is essentially what ‘inclusion lists’ are designed for.

The group delved into multiple aspects of inclusion lists, considering their diverse advantages and disadvantages, aiming to select one unified method.

On staking risk, 34M of 120M circulating supply is staked, which is nearly 30% of ETH in supply.

As per Buterin’s explanation, the continuous expansion of staking might lead to one Liquid Staking Token (LST) becoming more prominent, thereby possibly reducing overall liquidity.

As an analyst, I proposed addressing this issue by considering a reduction in staking rewards and imposing a limit on the Ethereum (ETH) that could be staked. This adjustment aims to strike a balance between incentivizing participation while preventing excessive concentration of staked ETH.

As a analyst, I can summarize that Buterin repeatedly emphasized his commitment to avoid exploiting users for financial gain through centralized control. Furthermore, he continues to work towards ensuring Ethereum remains decentralized and resists any tendencies toward centralization.

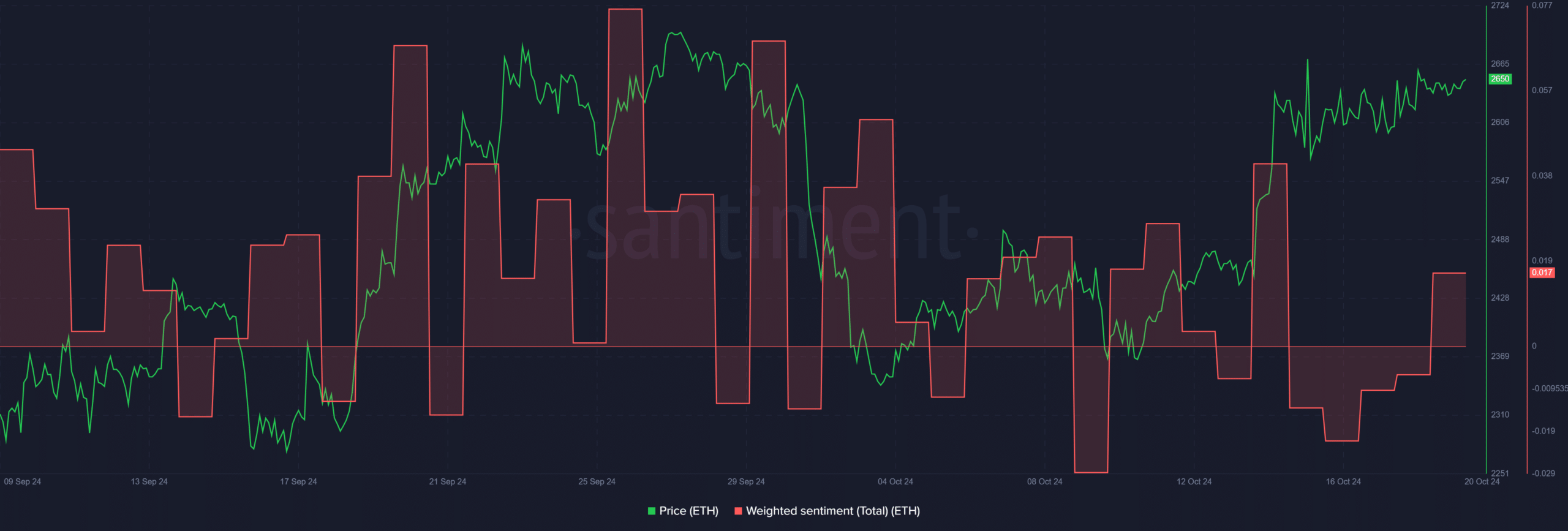

After the update, there was a noticeable increase in positive feelings towards ETH, indicating that investors were optimistic about the potential rise in its value.

Despite the uncertainty about which strategies the team might ultimately choose to resolve the problems, this decision could strengthen Ethereum’s worth in the future.

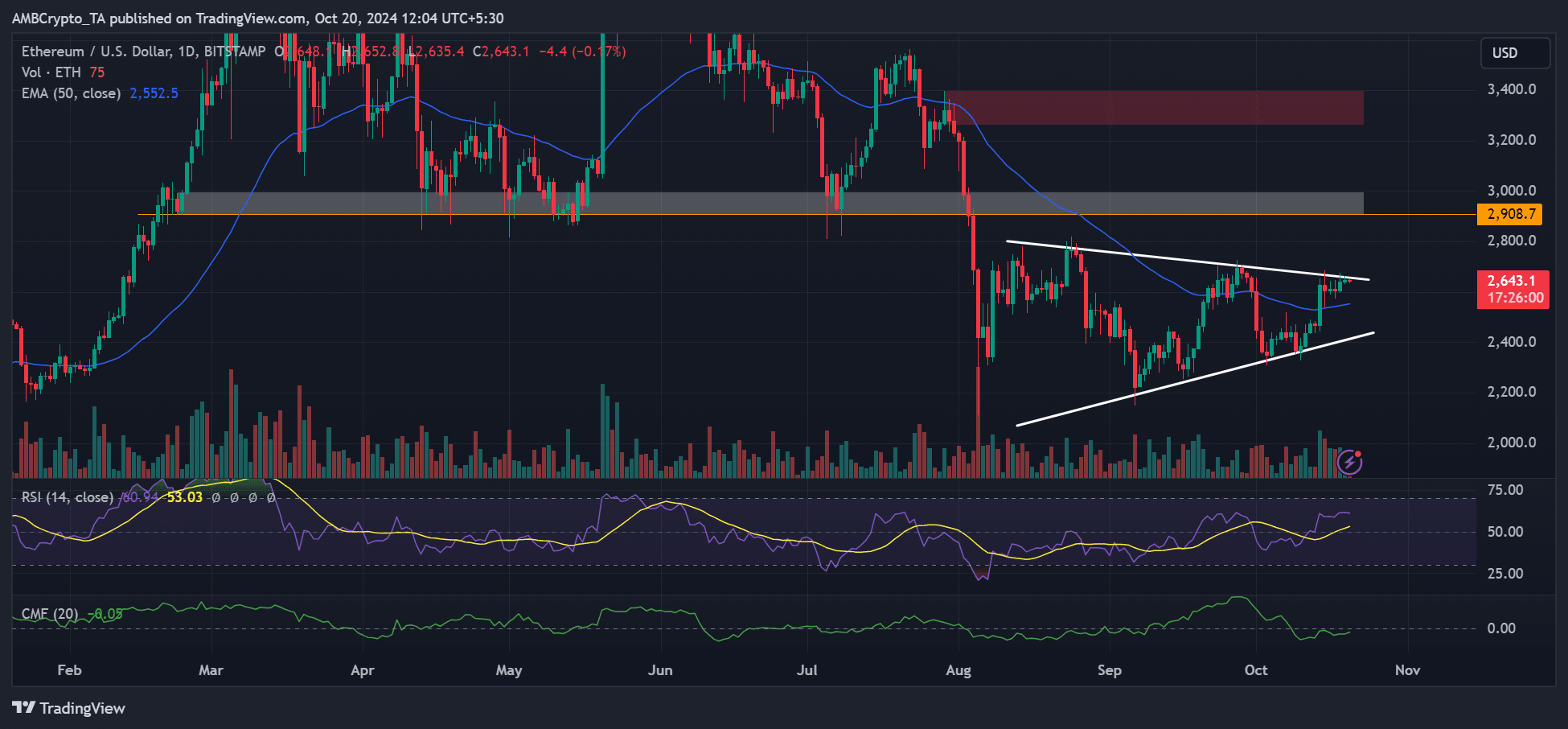

At press time, ETH’s price was $2.6K, below a key roadblock away from its $2.9k bullish target.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-10-20 16:08