-

ETH looked bearish as it experienced a price drop of over 4% in the last 24 hours.

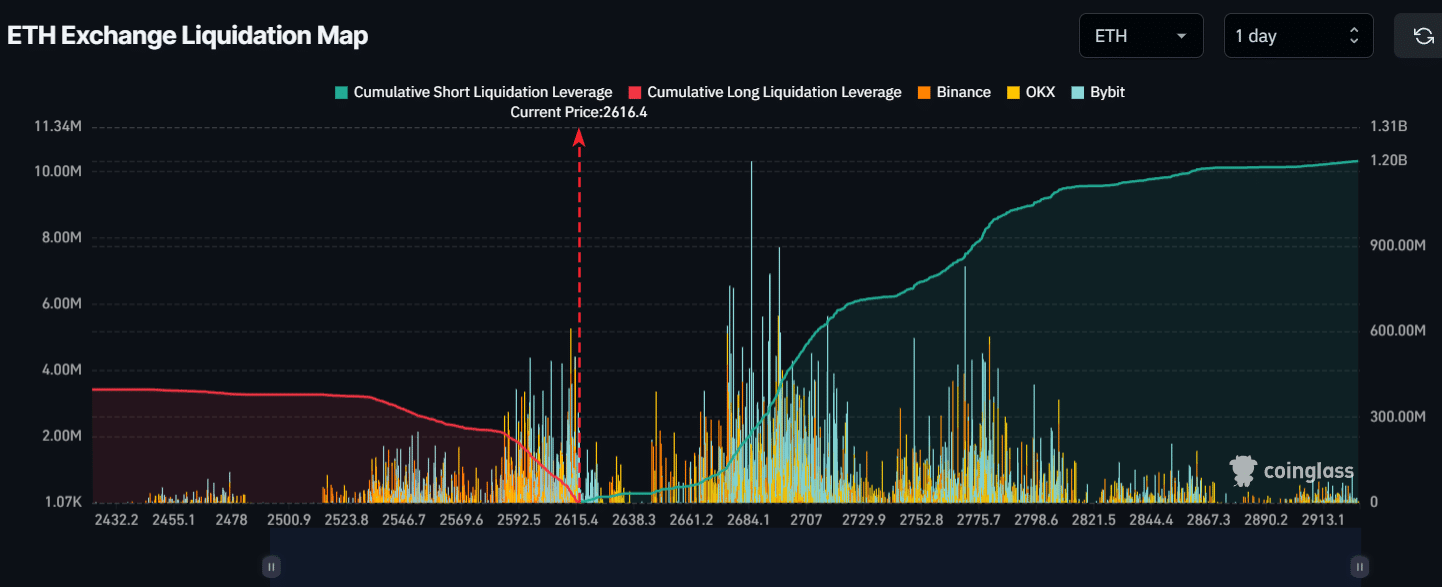

Nearly $163 million worth of short positions will be liquidated if ETH falls below $2,596.

As a seasoned analyst with over two decades of experience in the financial markets, I have seen countless ups and downs, bull runs, and bearish trends. The current state of Ethereum [ETH] has piqued my interest, as it seems to be following a familiar pattern.

Over the past day, there’s been a significant drop across most cryptocurrencies, affecting Bitcoin (BTC) and Ethereum (ETH) as well.

In the midst of market decline, on August 15th, an analytics company named Spot On Chain shared on their platform (previously known as Twitter) that Ethereum’s co-creator, Vitalik Buterin, transferred a substantial quantity of ETH to the exchange Kraken.

Significantly, Vitalik transferred approximately 200 ETH, equivalent to $530,000, into the Kraken digital asset platform. Moreover, this marks the first instance in 2024 that Vitalik has made such a deposit to any centralized cryptocurrency exchange (CEX).

Major figures in the crypto world, such as Vitalik, hold substantial sway over the market’s direction, and their investments can have a profound effect on the industry at large.

Yet, the Ether quantity appeared to be quite small, and it wasn’t clear if it was intended for donations, staking, or selling purposes.

In a recent development, Vitalik Buterin transferred approximately 3,200 Ether, equivalent to around $8.32 million, into two newly created multisignature wallets. These wallets might be intended for charitable contributions.

Ethereum’s price performance

As a seasoned cryptocurrency trader with over a decade of experience under my belt, I have seen countless market fluctuations, both big and small. At present, Ethereum (ETH) is currently trading near $2,620, representing a price drop of more than 4% in the last 24 hours. However, it’s essential to delve deeper into the data to truly understand the market’s pulse.

At the moment of reporting, the key points for Ethereum (ETH) liquidation stood almost at $2,596 on a downward trend and around $2,686 on an upward trend, as per data from the on-chain analytics company Coinglass.

If the general feeling continues and Ethereum (ETH) drops to approximately $2,596, it’s estimated that around $163 million in short positions will get closed out.

If the sentiment reverses and the price reaches $2,686, approximately $240 million in long positions would need to be closed out.

Given the present state of affairs, it seems that Ether (ETH) is experiencing a downtrend. Notably, experienced trader Peter Brandt expressed a pessimistic viewpoint regarding ETH on the 14th of August, employing technical analysis at both long-term and short-term levels.

In a post on X, Peter hinted at a bearish trade with a $1,651 target and $2,961 as a stop-loss.

In this current downturn in the cryptocurrency market, I’ve noticed an increased engagement from the crypto community regarding my recent post.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-08-15 14:16