-

Vitalik Buterin’s offer proposals that could speed up Ethereum transactions

ETH’s price maintained its downtrend amidst overall negative sentiment.

As an analyst with extensive experience in the crypto market, I have closely followed Vitalik Buterin’s latest proposals to improve Ethereum’s [ETH] transaction confirmation speeds. While these suggestions offer promising solutions, it is essential to recognize that ETH’s price has not shared the same optimistic outlook.

Vitalik Buterin, the founder of Ethereum (ETH), has put forth several ideas for quickening the confirmation process on the second-largest blockchain platform.

After the Ethereum Merge, confirmation times in the network shortened significantly, ranging from 5 to 20 seconds according to Buterin’s observation.

As a researcher, I acknowledge his belief that there’s room for enhancing the current speed. Particularly noteworthy is the intricate consensus mechanism in place, which can necessitate as long as 12.8 minutes to securely confirm transactions.

As a crypto investor, I’ve learned that Ethereum’s co-founder Vitalik Buterin has put forth various solutions to enhance the network’s transaction confirmation process. Among these proposals are Single Slot Finality (SSF), Based, and rollup pre-confirmations. With SSF, the network can validate transactions even when there are fewer validators online. In his explanation of SSF, Buterin mentioned,

“In a single-slot finality setup, the blockchain can continue functioning even if over one-third of validators are offline, enabling recovery.”

More ways to reduce Ethereum confirmation time

Buterin proposed employing Layer 2 solutions (L2s), such as rollups, to expedite transaction confirmation processes. In this setup, a small number of validator groups would swiftly confirm transactions within these L2s. Subsequently, these confirmed transactions would be finalized on the Ethereum main chain (Layer 1).

As a crypto investor, I’d describe it this way: The pre-confirmation approach, which is somewhat comparable to Solana’s [SOL] priority fees, empowers validators to levy an additional fee if they expedite the confirmation process for high-priority transactions.

Buterin proposes a comparable system with the addition of consequences for validators or proposers who breach their commitments to users.

‘If the proposer violates any promise that they make to any user, they can get slashed.’

Buterin admitted that the aforementioned design improvements and proposals were not flawless, yet served as a strong foundation for advancing confirmations faster.

How about ETH’s price?

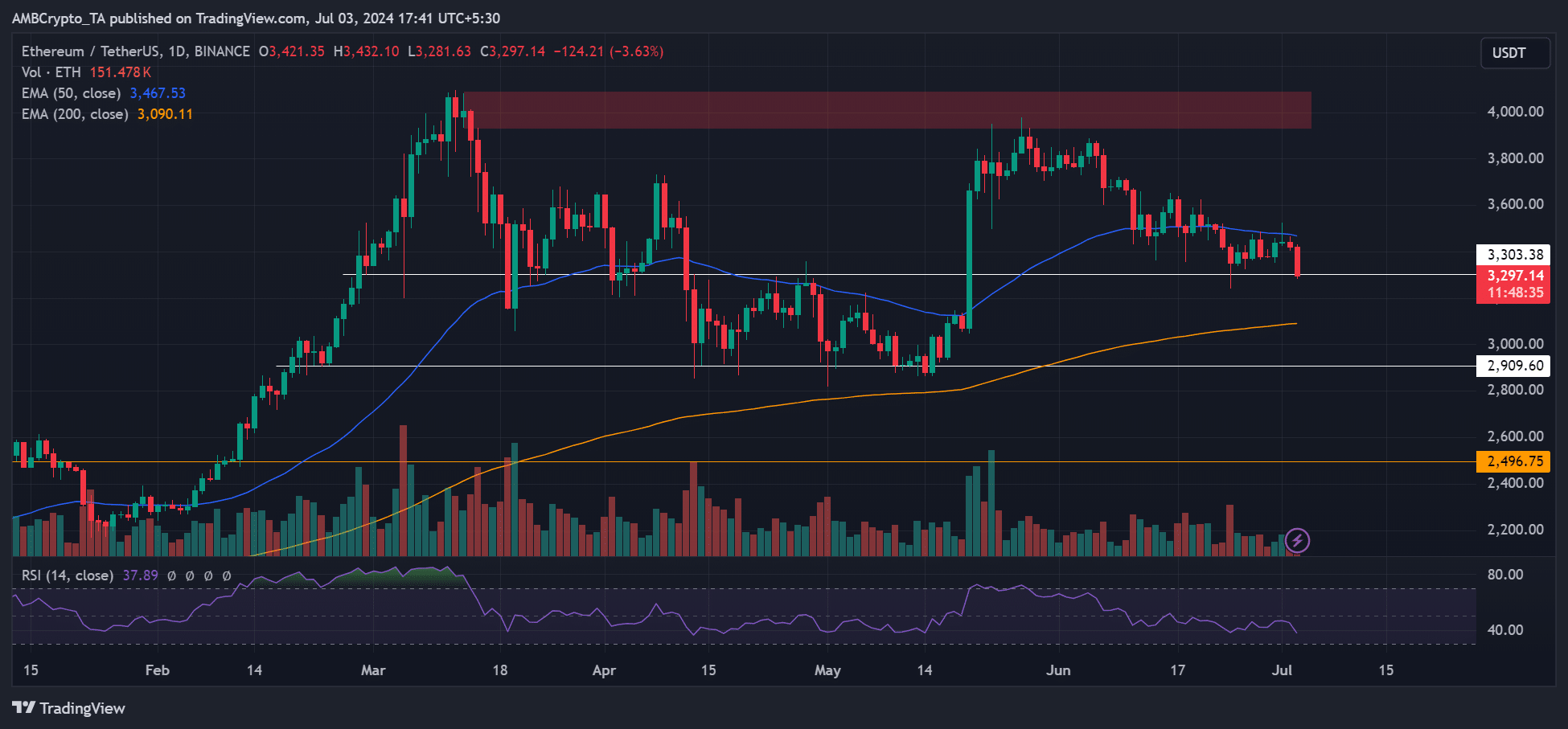

During this period, the Ethereum price hadn’t significantly increased as depicted on the graph. It faced challenges in surpassing the 50-day Exponential Moving Average (EMA), a significant barrier since mid-June.

At the current moment, the market structure showed bearish signs on both short-term and long-term charts. Furthermore, the RSI reading, which reflects the comparative strength of buyers versus sellers, was below average, suggesting that sellers held more power in the market.

Despite the recent pullback in price, Ether has found support at the significant level of $3300. The postponement of the Ethereum ETF’s approval and debut may negatively impact investor sentiment, but buyers might try to shield this level.

As a researcher studying the cryptocurrency market, I’ve noticed that if Bitcoin [BTC] experiences significant losses and falls below the $60K mark, Ethereum [ETH] could be at risk of breaking its support at $3300. In such an unfavorable scenario, the 200-day Exponential Moving Average (EMA) for Ethereum, which is around $3000, may serve as the next bearish target.

If the market sentiment leaned towards Ethereum bulls, the $4000 level would serve as an important resistance point and potential buy target.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- You Won’t Believe Today’s Tricky NYT Wordle Answer and Tips for April 30th!

2024-07-04 09:12