-

Buterin’s transfer amid market downturn sparked speculation on ETH’s sentiment impact.

ETH held steady with moderate losses, contrasting sharply with other cryptocurrencies’ declines.

As a researcher with extensive experience in the crypto space, I’ve closely followed the recent speculation surrounding Vitalik Buterin’s significant transfer of Ethereum (ETH) during a market downturn. The initial assumption was that this move could potentially impact ETH’s sentiment. However, upon further investigation, it appears that ETH held steady with moderate losses compared to other cryptocurrencies, such as Bitcoin [BTC], Solana [SOL], and Ripple [XRP], which experienced more significant declines.

Vitalik Buterin, a co-founder of Ethereum (ETH), ignited great curiosity among cryptocurrency enthusiasts by making a notable transaction.

Some people believed that Buterin was making a calculated decision or perhaps offloading some of his assets.

Clearing the air around Buterin’s move

However, things got clear when Wu Blockchain shared more details.

As an analyst, I find it intriguing that Buterin’s announcement came at a time when the overall cryptocurrency market was experiencing a downturn. The market cap stood at $2.05 trillion according to recent reports, representing a 2.67% decrease in value within the past day.

As a researcher studying the cryptocurrency market, I can’t predict for certain how Vitalik Buterin’s recent actions will impact Ethereum’s market sentiment. It’s still uncertain whether these actions will shift the community’s perception from bearish to bullish.

I’ve checked the most recent market data, and currently, the biggest altcoin is priced at around $2,946.55. This represents a modest 1.98% decrease in value compared to the previous 24-hour period.

As a researcher examining the cryptocurrency market, I’ve observed that while Solana [SOL] and Ripple [XRP] experienced more substantial declines with a loss of approximately 4.1% for Solana and 3.2% for Ripple, the decrease in value for Bitcoin [BTC] was relatively mild at 2.40%.

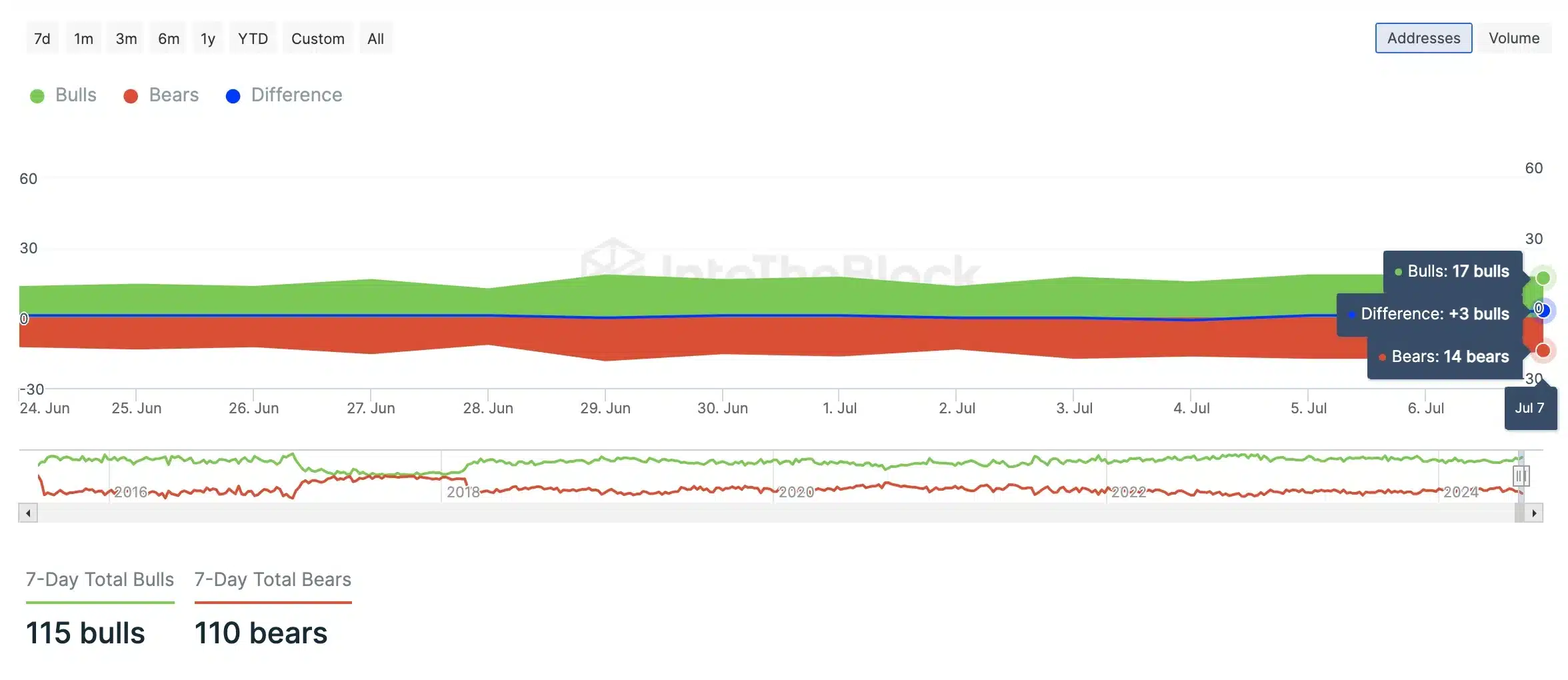

Based on my analysis of the latest market trends using data from IntoTheBlock, I’ve discovered that buying activity has persistently outpaced selling activity among both bulls and bears, despite the recent downturn in the cryptocurrency market.

Is crypto adoption on the rise?

It’s worth noting that the introduction of Bitcoin ETFs has brought significant focus to Bitcoin in recent times. This digital currency has piqued the interest of Wall Street, prominent institutions, and even political circles.

As a crypto investor, I’ve noticed that the recent price surge has been predominantly driven by Bitcoin. Although this development is frequently viewed as progress in the realm of cryptocurrency acceptance, my focus remains on the larger crypto market. Yet, it’s essential to acknowledge that Bitcoin holds significant influence over the entire space at present.

Amidst this scenario, Buterin’s latest moves may significantly increase the use of Ethereum, given that investor enthusiasm for ETH has waned due to the ongoing postponement of an ETH Exchange-Traded Fund (ETF) approval by the Securities and Exchange Commission (SEC).

Vitalik Buterin’s financial influence

As an analyst at Arkham Intelligence, I’ve recently come across some intriguing findings from our latest report. It appears that Vitalik Buterin currently holds the largest individual stash of Ethereum (ETH) based on available on-chain data.

His net worth has climbed from $552.86 million at the start of 2024 to $834.66 million.

His holdings of approximately 245,279 ETH fluctuate with Ethereum’s market prices.

As an analyst, I observed that during the peak of the 2021 bull market, Ethereum’s value significantly increased my net worth to surpass the $2 billion mark. However, the subsequent bear markets in 2022 led to a decrease of approximately 75% in value, consequently reducing my net worth.

In spite of the unstable market conditions, Buterin’s shrewd investments and significant contributions to Ethereum have strengthened his financial power.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-07-08 20:08