So, BlackRock and the NYSE – those Wall Street titans, the guys who practically *invented* the concept of “looking serious in a suit” – are now all hot and bothered about something called “staked ETH ETFs.” Sounds thrilling, right? Think of it as the financial equivalent of a cat video, but with more jargon and significantly less adorable fluff. 😼

Apparently, this “staking” business is all the rage. It’s like a high-stakes game of digital musical chairs, except instead of chairs, it’s Ethereum, and instead of music, it’s… well, more jargon. Anyway, BlackRock’s saying their current ETH ETF is like a slightly soggy sandwich – perfectly edible, but lacking that certain *je ne sais quoi*. Enter staking: the secret ingredient that will apparently transform their ETF into a Michelin-starred extravaganza. ✨

Meanwhile, the NYSE Arca is throwing its hat (a very expensive, bespoke hat, no doubt) into the ring with a proposal to the SEC. It’s like they’re saying, “Hey, SEC, wanna join the party? We’ve got snacks (staking rewards!), and the music is… still jargon, but trust us, it’s *good* jargon.” 🎶

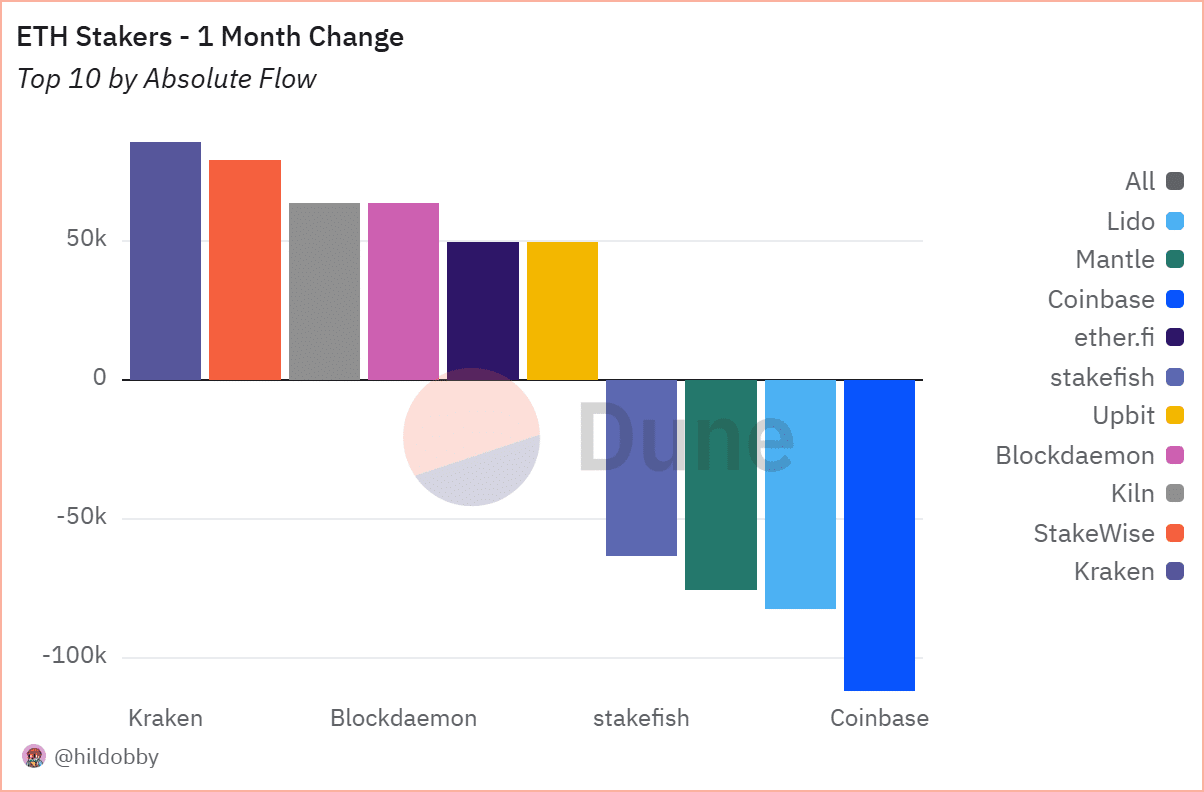

And the data? Oh honey, the data is a whole other circus. Kraken and Blockdaemon are apparently raking in the ETH like it’s going out of style, while Coinbase is experiencing a mass exodus of… well, let’s just say there’s a lot of digital weeping and gnashing of teeth. 😭

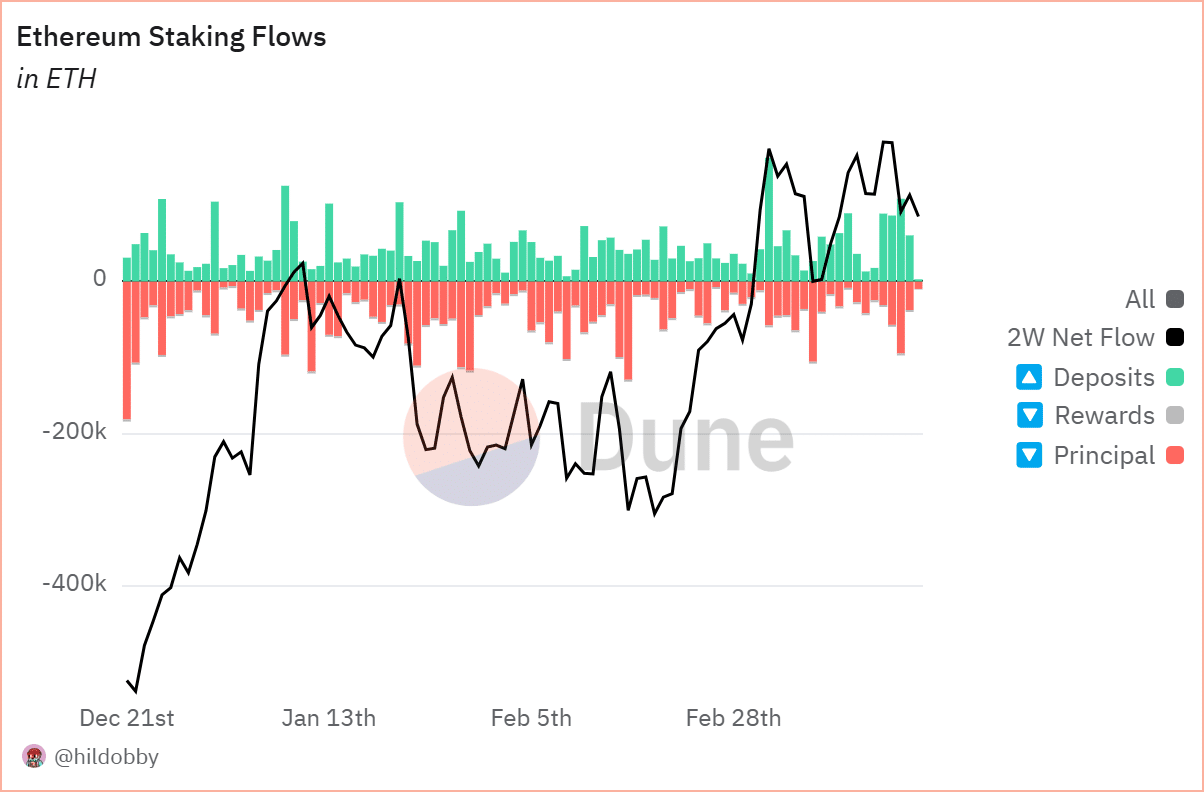

Then there’s Chart #2, which is basically a graph whispering secrets about Ethereum staking. It’s all upward trends and decreasing withdrawals, which, translated into plain English, basically means a bunch of people are betting big on Ethereum’s future. Because, you know, what could possibly go wrong? 🤔

So, there you have it. Wall Street is embracing cryptocurrency with the enthusiasm of a toddler discovering a mud puddle. Will it end in tears? Probably. But hey, at least it’ll be *interesting* tears. 😂

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-03-22 06:17