-

There is a high possibility that ETH could fall 4% to the $2,400 level.

ETH’s reserve on the exchanges has been increasing, indicating higher selling pressure from investors.

As a seasoned crypto investor who’s been through more market cycles than I can count on my fingers, I must admit that the current situation with Ethereum [ETH] has me slightly worried. The recent transaction by WazirX exploiters transferring 2,600 ETH to Tornado Cash, coupled with the 59,156 ETH they still hold across nine different wallets, is a cause for concern. If these holdings are sold off, we could be in for a significant price decline, possibly even falling below the $2,200 level in the coming days.

As a researcher studying market trends, I’ve found myself in a state of alert upon observing a significant transaction of Ethereum [ETH] by entities associated with the WazirX platform. This action, made in this bearish market climate, has sparked apprehension about a potential large-scale sell-off, which could significantly impact the current market dynamics.

On September 3rd, Spot On Chain, an analytics company, posted on their platform (previously known as Twitter), that hackers moved approximately 2,600 Ether, equivalent to around $6.54 million, into the cryptocurrency mixer service, Tornado Cash.

Meanwhile, they retained approximately 59,156 ETH valued at around $148.8 million, distributed among nine distinct cryptocurrency wallets, as of the latest update.

If they sell off their holdings, ETH may witness a significant price decline in the coming days.

Ethereum price action

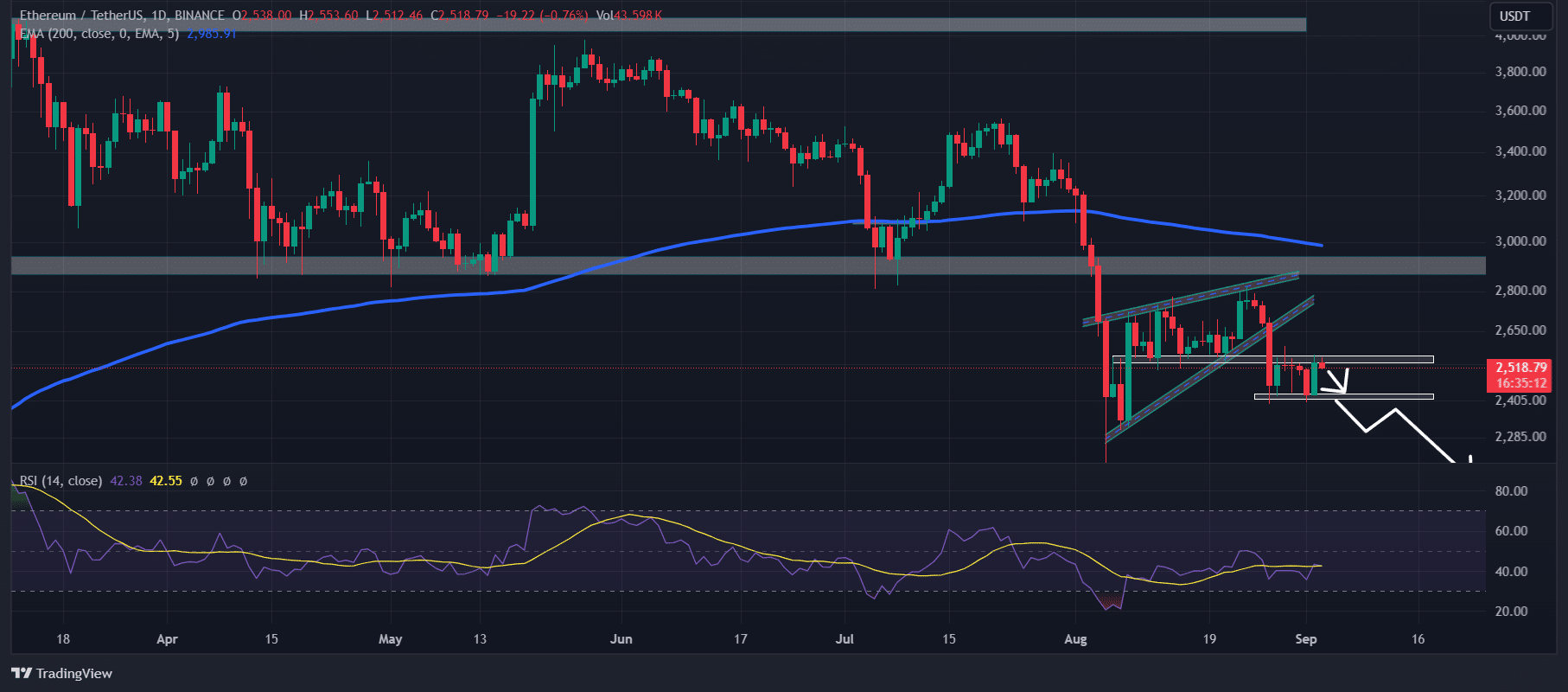

Based on an analysis by AMBCrypto using TradingView data, after the break of a bearish rising wedge formation in its price movements, Ethereum appeared to be holding steady within a narrow band, fluctuating between approximately $2,400 and $2,555.

Should Ether (ETH) breach its current consolidation area and finish the daily chart beneath the $2,400 mark, it’s likely we might see it drop towards the $2,200 range within the upcoming days.

Furthermore, over a span of four hours, Ethereum (ETH) appeared to be leaning towards bearish territory since it reached the upper boundary of its consolidation range, hinting at a possible 4% decline that could take its price down to approximately $2,400.

Simultaneously, the altcoin’s Relative Strength Index (RSI) was indicating an oversold condition, possibly suggesting a change in direction for its price.

Bearish signs ahead?

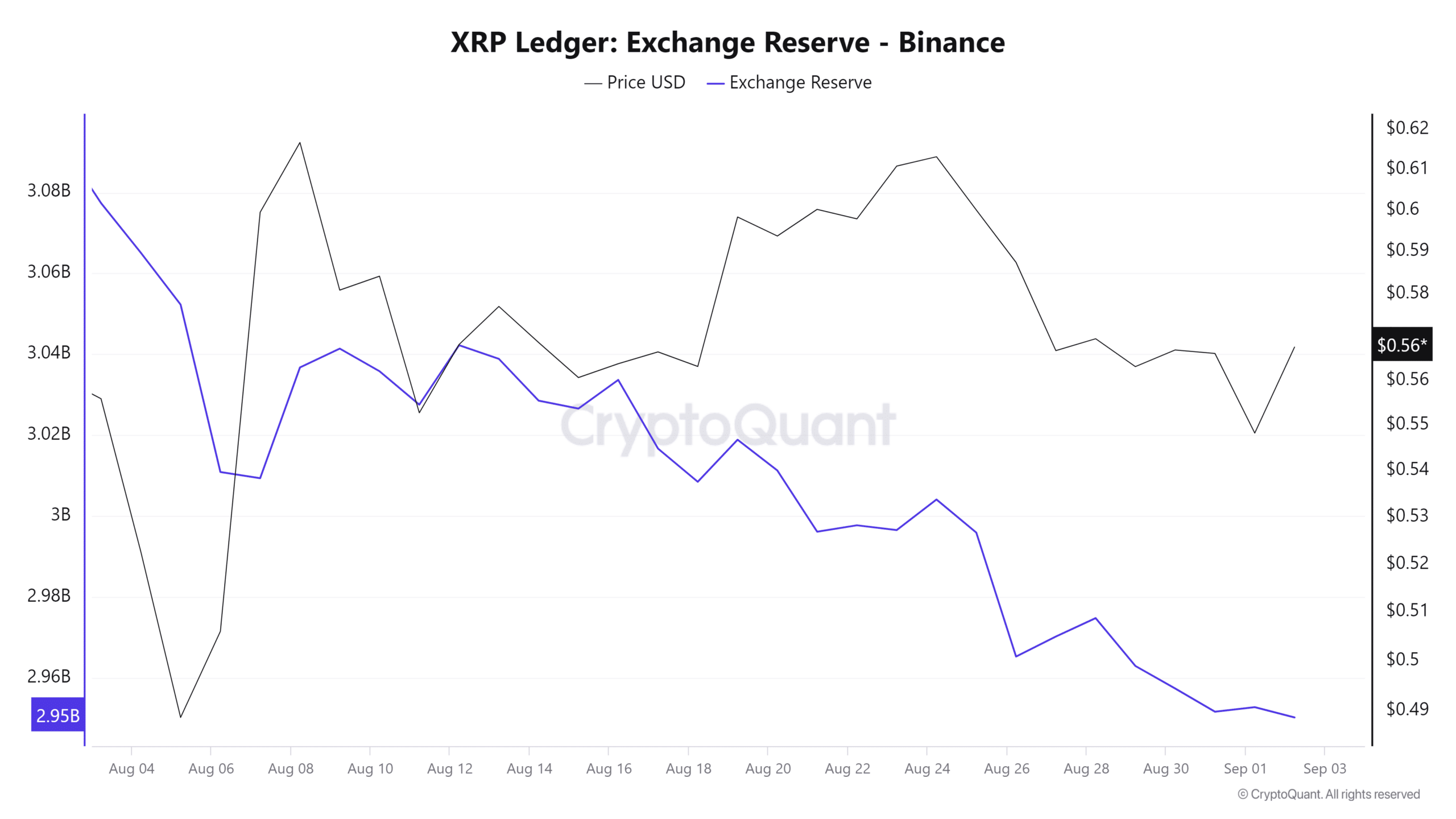

According to AMBCrypto’s analysis using CryptoQuant, the current state of Ethereum exchanges indicates a potential bearish trend for Ethereum, which could lead to a drop in its price.

Starting from August 29th, there’s been a steady rise in Ethereum (ETH) held on exchanges. This suggests that sellers, including investors and institutions, are putting more pressure to sell ETH.

When investors or institutions plan to liquidate their assets, they often move their holdings from their wallets to exchanges first, a action that generally increases the exchange reserve.

At this moment, the key selling and buying points were approximately $2,490 and $2,550 respectively, based on data from Coinglass. It seems that day traders had taken on a significant amount of leverage at these price points.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Right now, I’m seeing Ethereum (ETH) hovering around the $2,510 mark. It’s had quite an upward momentum, with its value increasing by more than 2.7% in the past day.

During the same timeframe, there was a 3.5% rise in Open Interest, suggesting that investor attention is growing, even amidst the recent drop in prices.

Read More

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Solana – Long or short? Here’s the position SOL traders are taking

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- We Ranked All of Gilmore Girls Couples: From Worst to Best

2024-09-03 11:35