- XRP saw massive whale accumulation, fueling discussions about its market trajectory and network dynamics

- On-chain metrics revealed significant trends in network growth, holder activity, and price performance

Over the past two days, a notable increase has occurred as XRP whales have amassed more than one billion tokens in their possession. This substantial growth in holdings has sparked curiosity about what impact it might have on XRP’s network stability, price direction, and overall market standing.

XRP whale accumulation – A closer look

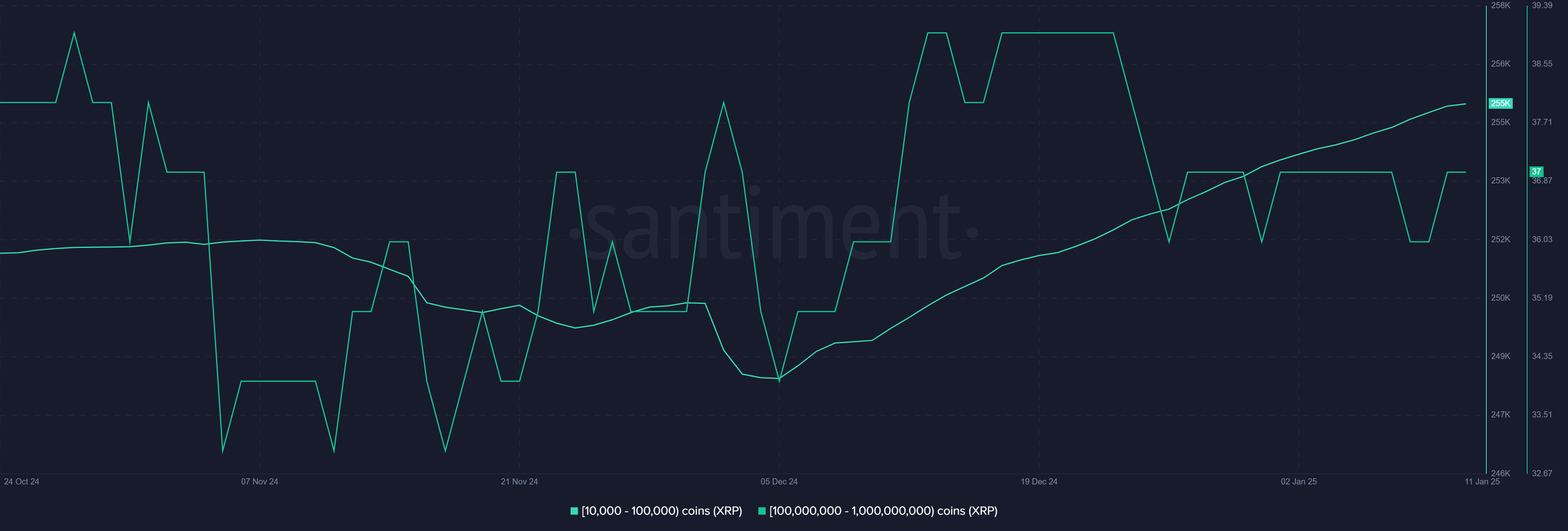

A significant increase in the storage of 1 billion XRP by large investors, as shown on a wallet distribution chart, indicates growing trust in this digital asset, as these whale addresses have seen a notable surge in their XRP balances exceeding 10 million units.

Possibly, this action might indicate that they are preparing for an increase in prices within the next few weeks, or it could be a tactical maneuver in response to the latest market compression.

The pattern of growth impacts both the market’s fluidity and the confidence of small-scale investors. In the past, large investors or “whales” have significantly influenced market trends, and their actions tend to coincide with major shifts in the market.

Network growth – Signs of strength?

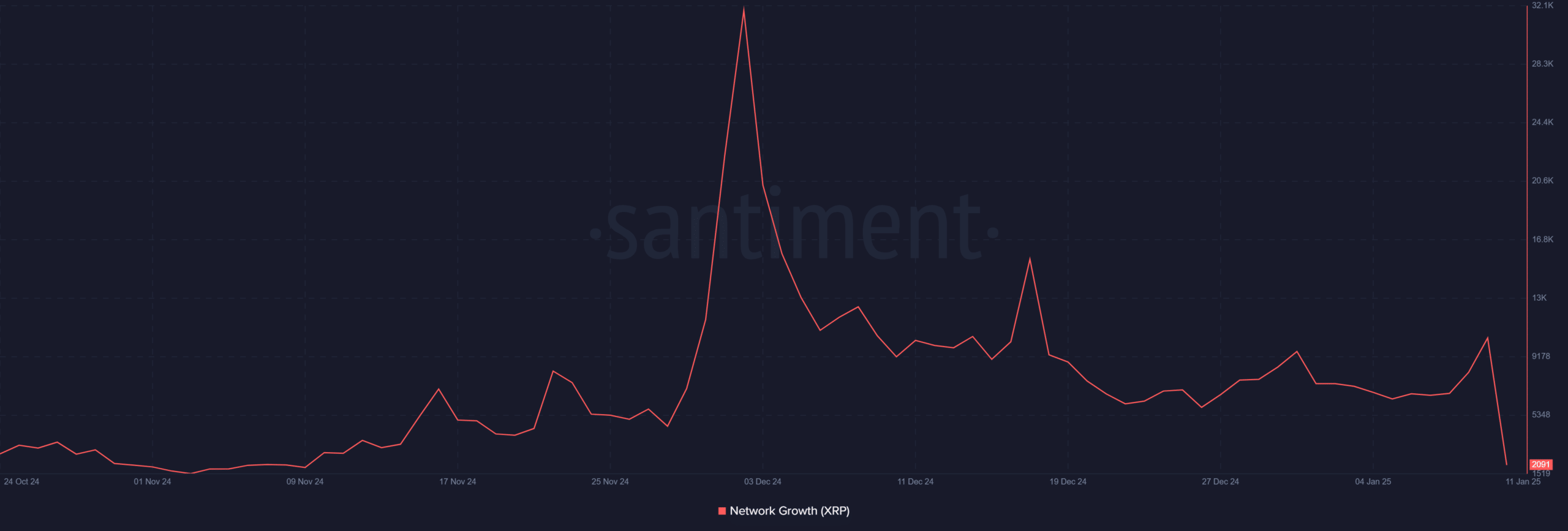

It’s noteworthy to mention that the graph of network growth presented an interesting storyline. The number of new wallets created saw a significant surge in December 2024, suggesting increased curiosity about the XRP ledger. However, the subsequent decrease implies that the market might be experiencing a slowdown or cooling off.

Despite a decline following an initial surge, it’s clear that XRP is still drawing in new users daily, as evidenced by the continuous increase in unique addresses. Interestingly, the analysis showed a significant spike of more than 10,000 on January 10th, which later decreased to current levels at the time of press.

This pattern hinted at a mix of speculative and long-term interest.

As an analyst, I’ve observed that the surge in whale activities could have fueled temporary expansion. However, the consistent increase in new addresses being created might indicate a more comprehensive adoption. This growth could potentially be due to the growing usefulness of the XRP ledger in facilitating cross-border transactions.

Total holders – The bigger picture

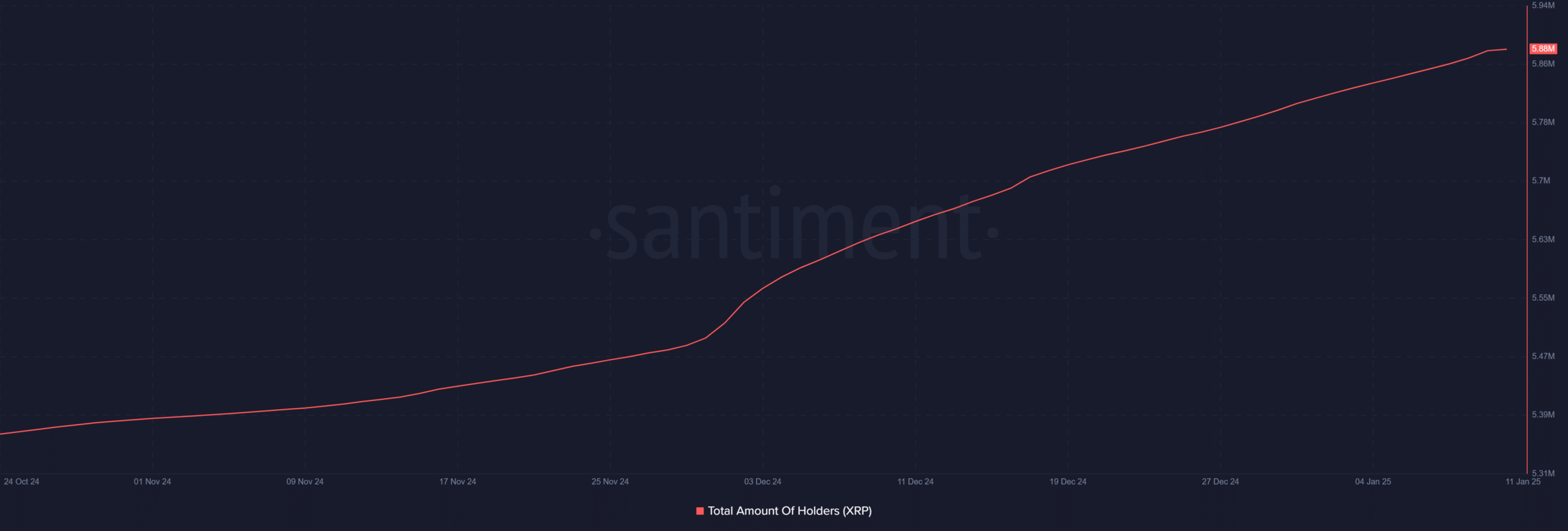

Over the last few months, there’s been a consistent increase in the number of individuals holding XRP, as indicated by a nearly straight-line graph. By January 2025, this figure surpassed 5.88 million, indicating a growing community of investors.

It’s intriguing to note that the hike appeared to coincide with times when whales tend to amass, implying a cascading impact theory where significant whale investments may stimulate retail engagement.

By spreading out the ownership of XRP among various categories of holders, this distribution could potentially strengthen market stability.

Price analysis – Can XRP sustain its momentum?

Upon examining the price chart for XRP, I’ve gathered some interesting insights about its current trend. Having reached a high of $2.50, it subsequently entered a consolidation phase and is currently trading around $2.33 at this moment. The accumulation/distribution (A/D) line suggests a consistent buying pressure, which lends credence to the idea that whales are supporting XRP.

Based on various indicators like the 50-day moving average and the Relative Strength Index (RSI), it appears that XRP is maintaining its position above important support thresholds. At the same time, the RSI remains close to a neutral zone, suggesting that the overall momentum is fairly evenly balanced.

For XRP to maintain its upward trajectory, breaking resistance at $2.50 will be crucial.

Market implications and future outlook

Over the past few weeks, the expansion of XRP has been significantly influenced by the accumulation and network growth instigated by large whales. Yet, the interaction between these whale activities, retail adoption, and external factors like regulatory decisions will determine XRP’s development in the intermediate to long term.

– Realistic or not, here’s XRP market cap in BTC’s terms

To summarize, the network’s expansion and holder patterns indicate robustness, with price movements pointing out crucial points to observe. If large investors (whales) persist in accumulating and more users join the network, XRP could maintain its bullish trend, provided there are no significant economic disruptions.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-01-12 00:08