-

Whales accumulated over $9 million worth of ERC-20 tokens.

Pepe and LINK saw a more positive price trend than UNI.

As a crypto investor with some experience under my belt, I find the recent whale accumulation activities on Pepe, Uniswap, and Chainlink intriguing. The fact that these assets are all ERC-20 tokens adds an extra layer of interest, as their collective price trends could potentially impact Ethereum’s network.

Over the past period, large investors or “whales” have been actively purchasing large quantities of Pepe (PEPE), Uniswap (UNI), and Chainlink (LINK). Among these three tokens, Uniswap displayed a unique price trend, while PEPE and LINK showed similar price fluctuations.

As a researcher studying these digital assets, I’ve noticed an intriguing similarity: They all represent ERC-20 tokens on the Ethereum (ETH) blockchain. The continuous acquisition and increasing prices are perceived as positive indicators, which could potentially have significant implications for the Ethereum network.

Whales accumulate Pepe, Chainlink, and Uniswap

Based on information from Lookonchain, large investors or “whales” purchased large quantities of different ERC-20 tokens, totaling millions of dollars, on May 4th.

As a seasoned crypto investor, I came across an intriguing transaction where a significant player, or “whale,” withdrew an astounding amount of 322.48 billion Pepe tokens from Binance exchange. The value of these tokens at the time was roughly equivalent to a substantial $2.78 million.

A single whale transferred UNI tokens valued at around $3.75 million (equivalent to 500,000 units) and LINK tokens worth approximately $2.62 million (representing 183,799 tokens) from Binance’s exchange.

Pepe and Chainlink see uptrends

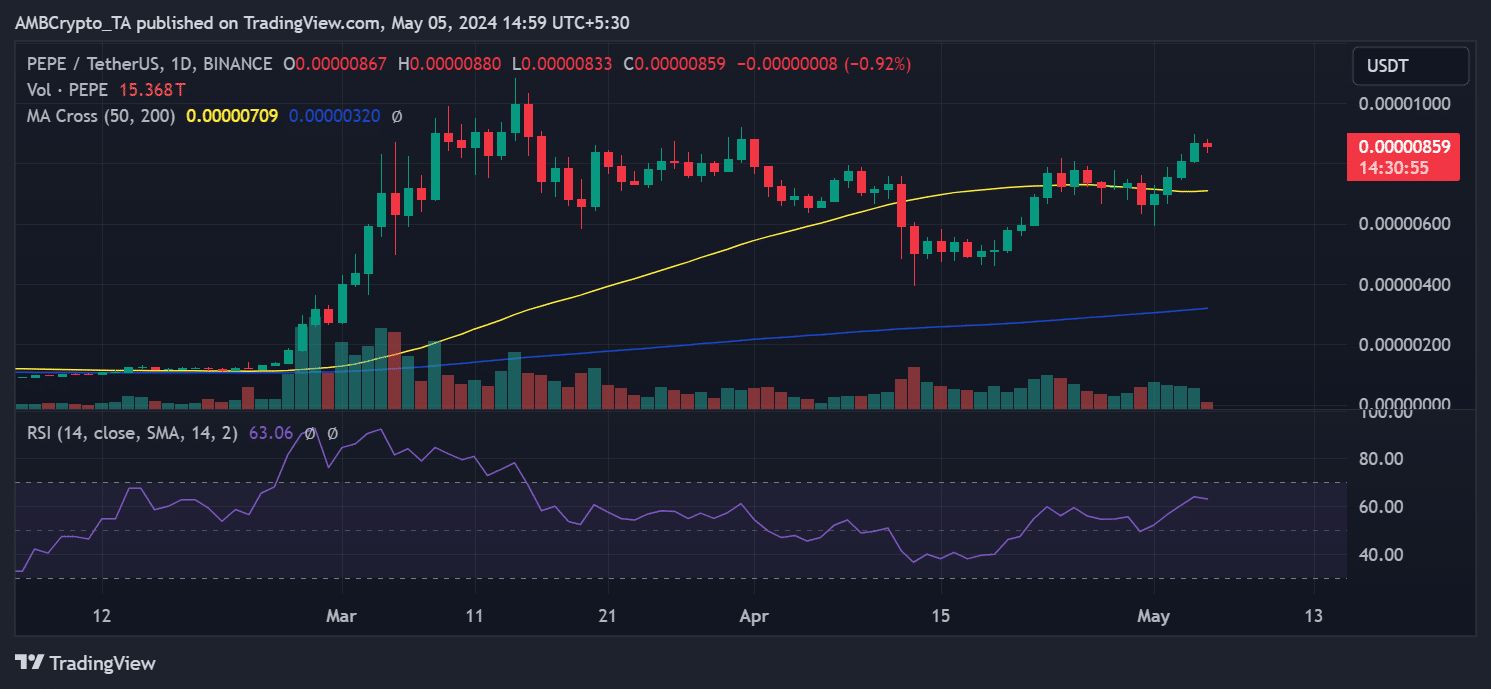

As an analyst, I observed that AMBCrypto’s examination of Pepe’s price trend on a daily chart indicated successive ascending patterns from the 1st to the 4th of May. On this particular day, May 4th, the value experienced a significant surge, increasing by approximately 7.30%.

As a researcher observing the market trends, I’ve noticed an intriguing development with this particular asset. The price line has recently surpassed its short-term moving average (represented by the yellow line). Remarkably, this moving average has shifted roles and now functions as a support level. This transition signifies a bullish trend in the asset’s price movement.

However, Pepe was experiencing a decline of over 1% in its trading value at the time of writing.

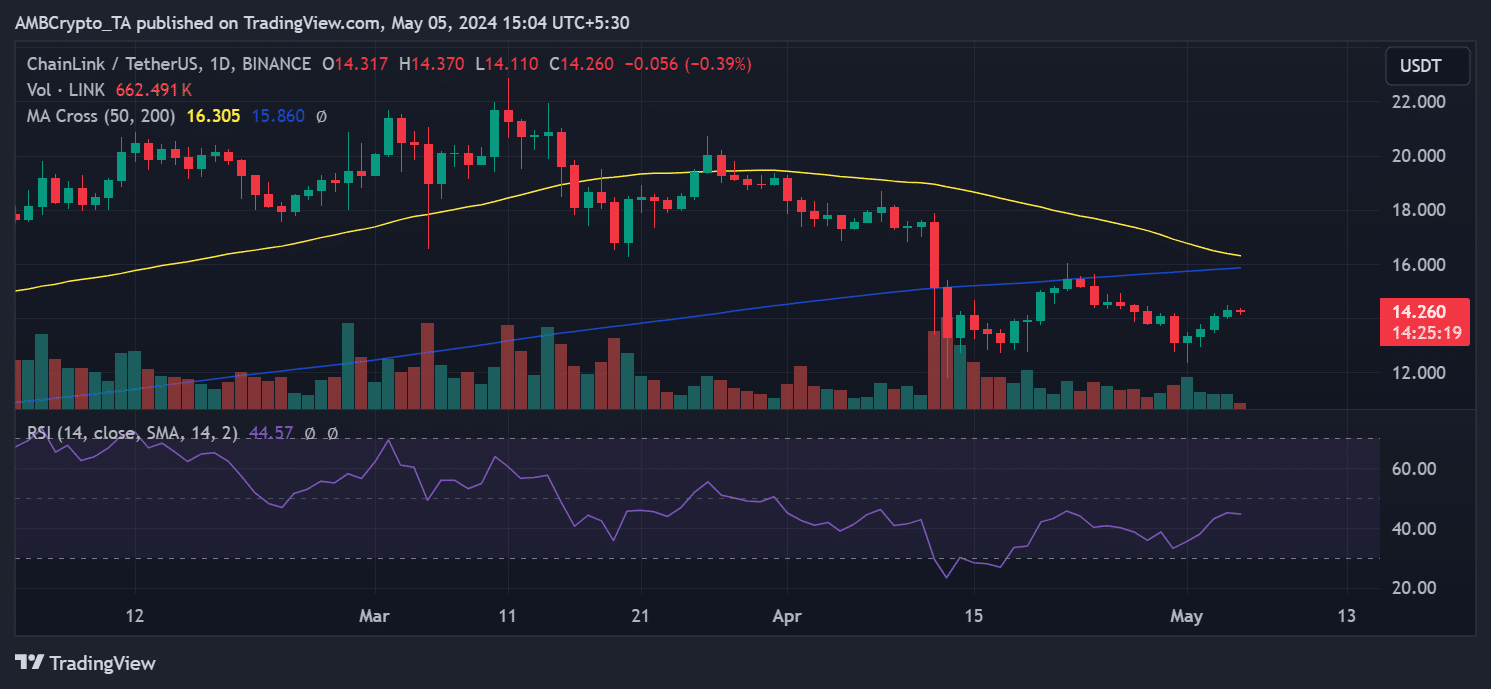

AMBCrypto found that Chainlink also exhibited consecutive uptrends from the 1st of May.

The price jumped from around $13 to more than $14, ending up at roughly $14.3 on the 4th of May. This represented a price hike exceeding 1%.

Although Chainlink showed some improvement, its performance was still less favorable compared to Pepe’s. Its price stayed below both the short-term and long-term average prices (represented by the yellow and blue lines).

As of this writing, it was trading at around $14.2, reflecting a decline of less than 1%.

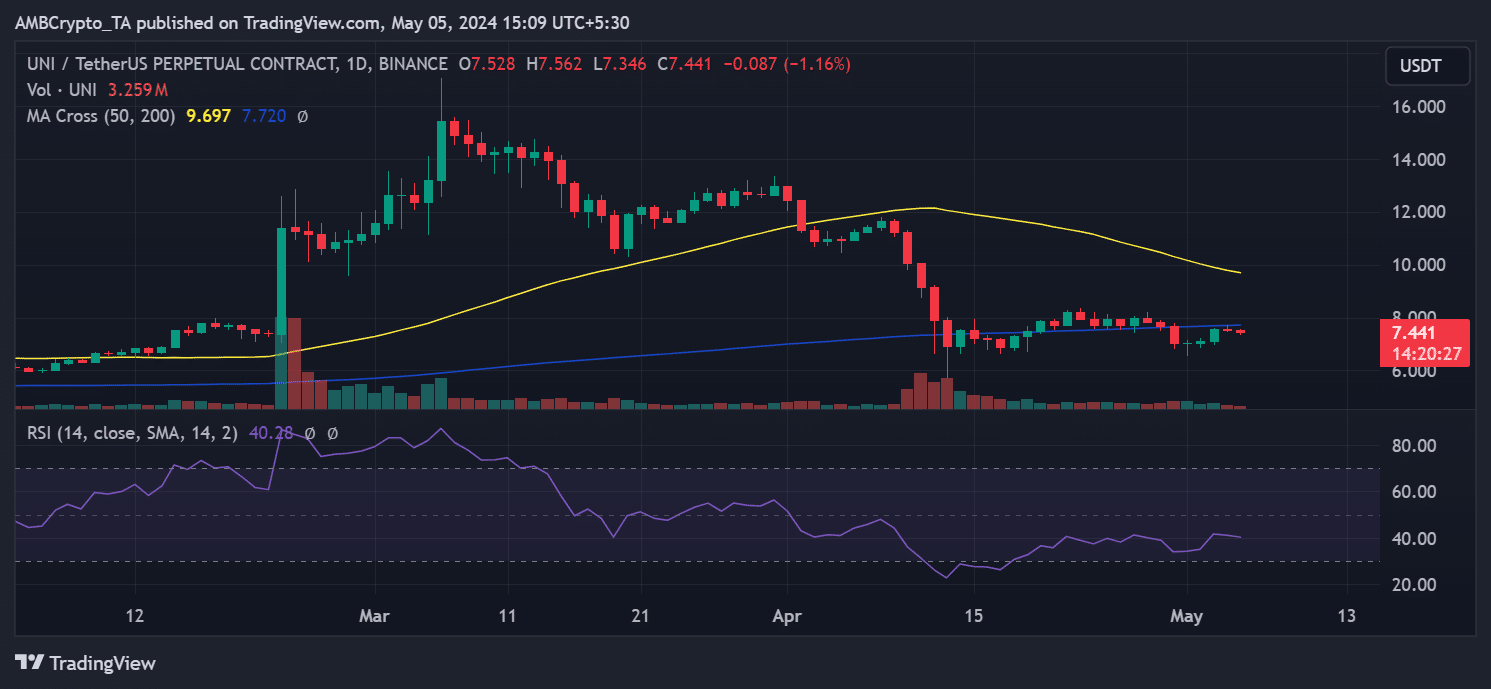

Among the various Ethereum tokens held in large quantities by “whales,” Uniswap had the weakest price trend.

As a crypto investor, I’ve observed notable price growth since the beginning of May. However, it wasn’t until the 4th that we witnessed a daily surge of over 1%. The price jumped by approximately 6.66% and settled around $7.5.

Despite the rise, the stock’s blue and yellow lines served as hurdles for further price advancement. At around $7.4, it showed a decrease of more than 1% compared to its previous value.

Additionally, its Relative Strength Index (RSI) hovered close to 40, suggesting a bear trend.

Will Ethereum face the effects?

Having Pepe, Chainlink, and Uniswap amass in value is a favorable indication for these Ethereum tokens. It implies that investors are optimistic about future price growth, making this development inherently bullish.

If the price of these tokens suddenly increases significantly, the sales made by these large holders (whales) could lead other traders to buy more, causing even more accumulation.

As an analyst, I can assert that a noticeable surge in trading activity on the Ethereum network could lead to substantial changes in its total transaction volume. Furthermore, such a rise in trading volume is expected to influence the fee structure of the network.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

2024-05-06 02:15