- Whale activity highlighted market uncertainty as social volume and sentiment traced bearish trends

- Technical indicators and liquidation data confirmed persistent selling pressure and oversold market conditions

The buzz in the Dogwifhat market is still centered around whale activities, with a major investor recently selling off approximately 11.8 million dollars’ worth of WIF at an average price of one dollar and seventy-three cents. This move resulted in a substantial loss of about three million two hundred seventy thousand dollars.

Later on, the whale returned approximately $17.5 million to Binance, prompting speculation about their plans. Currently, WIF is valued at $1.45 per token, having dropped by 6.58% over the past day.

The increasing number of major deals along with the falling prices suggests a rising doubt about the success of WIF’s market operations.

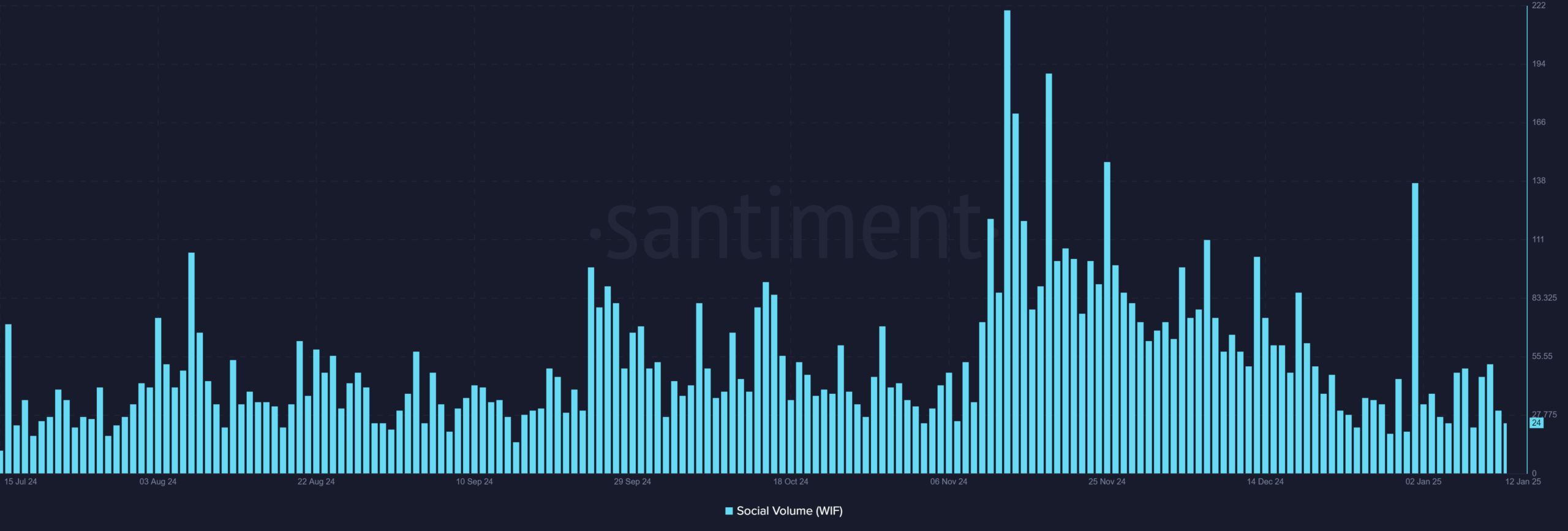

WIF social volume analysis reveals fading enthusiasm

Recently, there’s been a noticeable decrease in engagement around WIF, an essential indicator reflecting community involvement. As of now, the metric shows only 24 references, which is a significant drop compared to its highest point in November, where it exceeded 200 mentions.

1) This decrease shows a diminishing enthusiasm and involvement among traders and investors. As a result, this drop in social interaction might make it challenging for WIF to generate new energy and maintain trade activities in the near future.

2) The reduction indicates a decreasing fascination and contribution from traders and investors. This decrease in engagement on social platforms could potentially hinder WIF’s capacity to create momentum and sustain trading action over the short term.

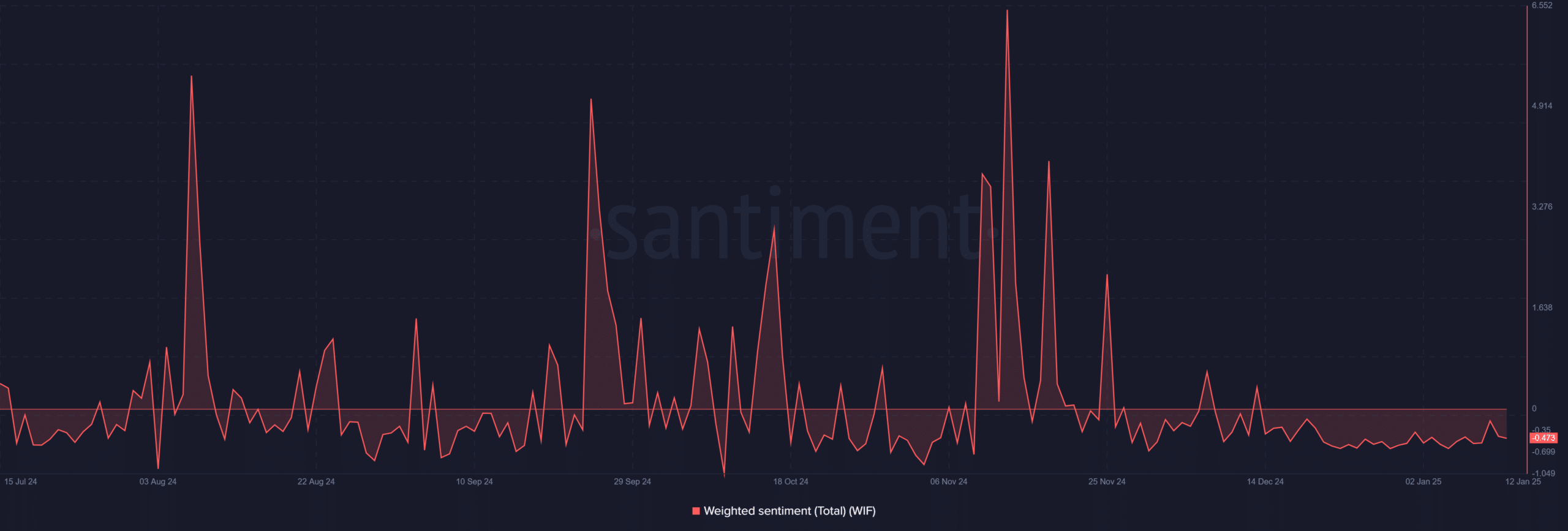

Sentiment trends underline cautious trader behavior

The sentiment analysis for WIF showed a significant move towards caution among investors on January 13th, as the metric dropped to -0.473, indicating a bearish outlook. This is quite different from the high volatility periods when the sentiment soared above 6.5.

Moreover, it seems that traders are persistently cautious about opening new positions, which might be slowing down the short-term rise in prices. This trend appears to indicate a rising level of doubt or uncertainty among traders, suggesting a more skeptical market overall.

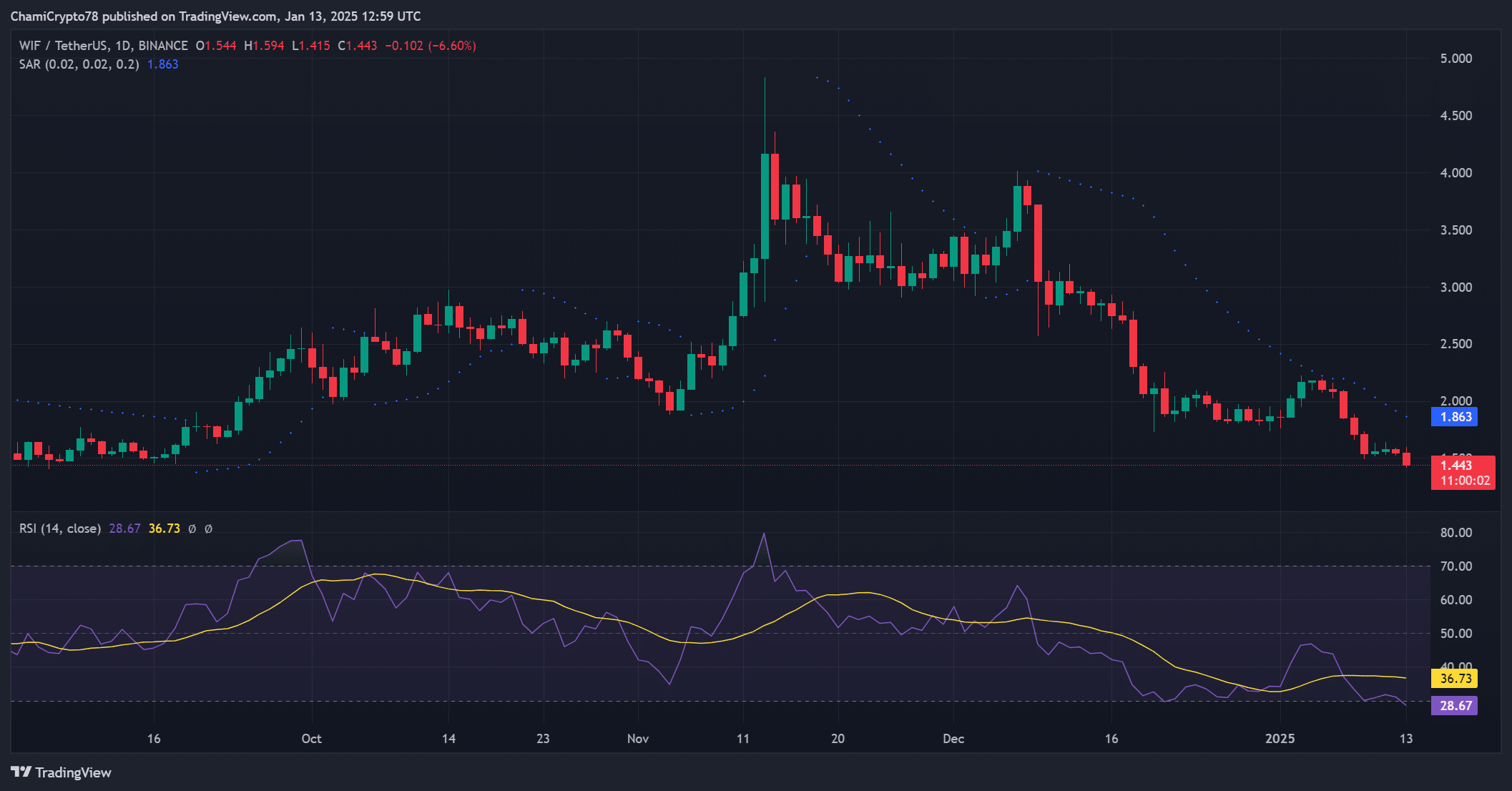

Technical indicators point to a bearish trend

Looking at it technically, WIF’s trend continues to be downward. The Parabolic Stop and Reverse (SAR) suggests a potential resistance level near $1.86, while the Relative Strength Index (RSI) has dipped to 28.67 – Indicating that the market might be overbought at this point.

Additionally, the 24-hour price decrease to $1.45 underscores persistent selling activity. Consequently, although oversold situations might lure bargain hunters, the overall technical outlook indicates that the downward trend could continue if there’s no substantial event to alter the direction of momentum.

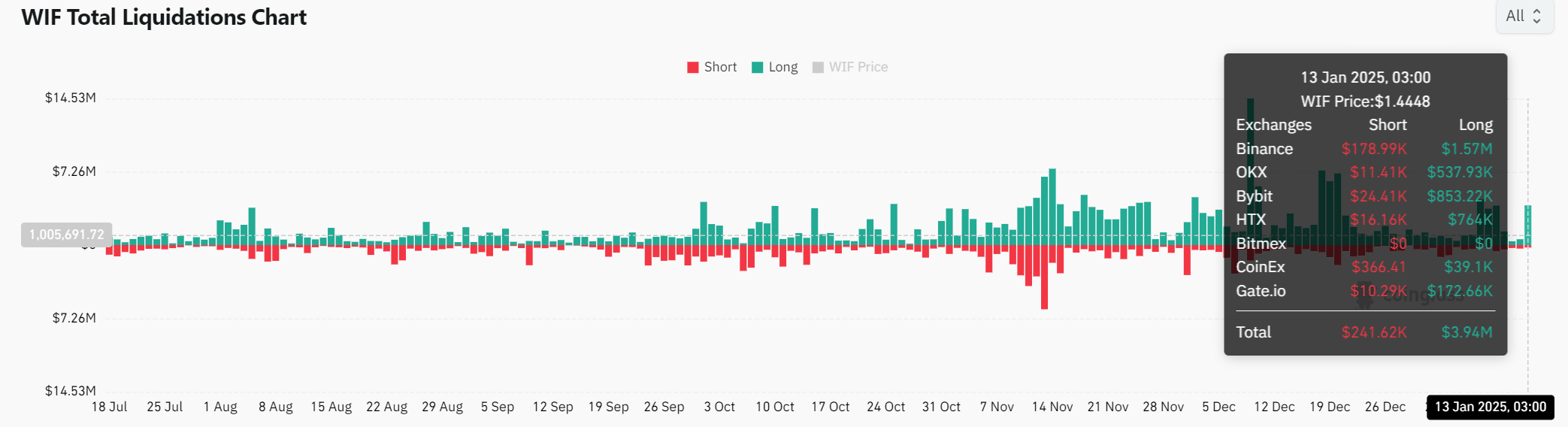

WIF liquidations reveal dominance of long positions

Ultimately, the liquidation figures revealed an imbalance in the WIF market risk, as a significant $3.94 million was liquidated from long positions versus just $241,000 from short ones. This disparity underscores the ongoing optimism among traders regarding the market’s upward trend, even amid recent drops in price.

In other words, the continuous drop in prices indicates that numerous long-term investments might be at risk of being sold off, intensifying the potential for additional price decreases. This underscores the importance of adopting careful trading tactics in the present market conditions.

Read dogwifhat’s [WIF] Price Prediction 2024–2025

The Women’s Fintech (WIF) market is encountering major obstacles. Pessimistic technical analysis, dwindling investor sentiment, and decreased social activity are making it tough going. Although the whale’s recent deposit has sparked optimism about strategic maneuvering, overall market signs suggest that the downward trend will persist.

In other words, if essential factors such as sentiment and social activity don’t show improvement soon, it seems that WIF might experience more declines over the immediate future.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2025-01-14 09:11