- Less than a day after causing a ruckus with a $4 million loss in Hyperliquid’s HLP Vault, that same whale trader decided to waltz back in.

- Seems like if whales can play with liquidation engines, the little fish are left floundering in the deep end.

Well, well, well! The whale who sent Hyperliquid’s vault into a tailspin is back, and this time he’s not just fishing for compliments. He’s diving into high-leverage trades like a kid in a candy store! 🍭

Our friend deposited a whopping $4.08 million USDC into GMX. He started off shorting Ethereum [ETH], but quicker than a cat on a hot tin roof, he flipped to a long position, pocketing a tidy $177,000 profit. Talk about a quick change artist! 🎩

After cashing in on that GMX trade, our whale friend decided to splash $2.3 million USDC into Hyperliquid [HYPE], opening a 25x long position on ETH and a 40x short position on BTC. It’s like he’s playing poker with the market, and boy, does he have a big stack! 🃏

Now, the return of this whale raises some eyebrows – is he just a savvy trader, or is he trying to pull a fast one on the liquidation mechanics? 🤔

On-chain data unveils a high-risk playbook

Lookonchain’s data reveals our whale’s latest antics. He’s been making strategic moves on GMX and Hyperliquid, leveraging large sums like a circus performer juggling flaming torches. 🔥

On GMX, he shorted ETH/USD with $4.08 million USDC, then flipped to a long position, raking in $177,000. It’s like watching a magician pull a rabbit out of a hat! 🐇

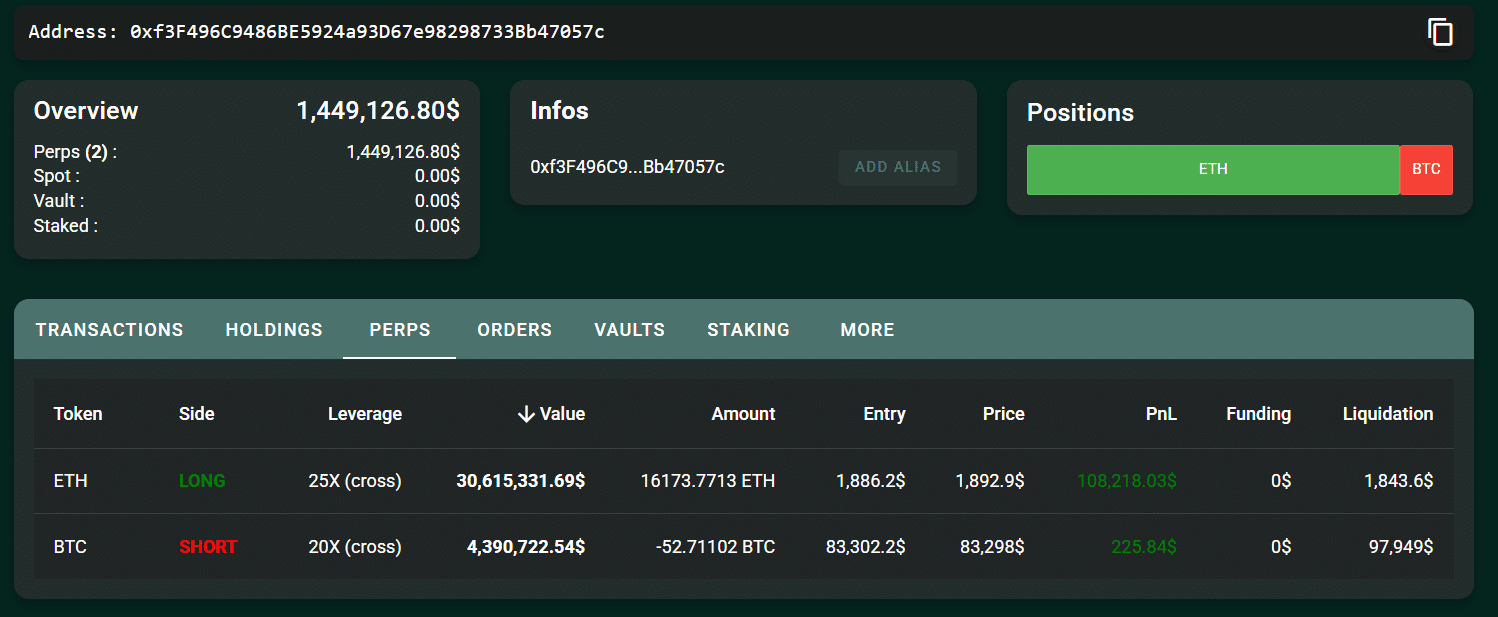

On Hyperliquid, he opened a long ETH position with 25x leverage. The position size? A staggering $30.54 million, with an entry price of $1,886.20. His liquidation price is set at $1,804, and at press time, he’s sitting on a profit and loss of $35,436.05. Talk about living on the edge! 🎢

For Bitcoin [BTC], he took a short position with 40x leverage, with a position size of $19.09 million, entry price of $83,156.45, and a liquidation price of $88,844. His press time profit and loss? A mere $13,880.49. Just another day at the office for our whale! 🐳

This trader’s aggressive leverage use signals a high-risk, high-reward approach. Millions in USDC are swimming between GMX and Hyperliquid like fish in a barrel. 🎣

It seems he’s got a liquidity-optimized strategy, allowing him to deploy capital faster than a cheetah on roller skates! 🛼

Déjà vu? Same tactics, bigger positions

The uncanny resemblance between today’s trades and yesterday’s liquidation event is hard to ignore. Just a day ago, this same whale withdrew margin from Hyperliquid before the liquidation, leaving the HLP Vault to take the hit. It’s like he’s playing chess while everyone else is playing checkers! ♟️

Now, he’s back with even larger positions, profiting from his precise entry and exit points. The rapid transitions from short to long on GMX and Hyperliquid suggest he’s got a sixth sense for liquidation engine behavior, possibly exploiting the inefficiencies in automated risk management systems. 🧙♂️

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Masters Toronto 2025: Everything You Need to Know

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

2025-03-14 12:10