- Large holders, commonly referred to as whales, have started offloading their ENA tokens amid waning confidence in the asset.

- The past 24 hours saw a significant spike in active addresses, suggesting increased selling activity among traders.

Over the past month, Ethena (ENA) has experienced a significant decline, losing approximately 22.58% of its worth, primarily because of widespread pessimism in the market.

In the last day, despite ongoing difficulties, the token saw a temporary rebound. The price escalated by 10.66% and the trading activity increased by a significant 53.77%, suggesting a change in investor attitudes.

Yet, ongoing selling actions by investors have restricted ENA’s upward momentum, making it susceptible to additional drops.

Whales persist in ENA sell-off, extending pressure

According to AMBCrypto, a significant investor, owning between 0.1% and 1% of Enjin Coin’s (ENA) total tokens, has just offloaded approximately $6.46 million worth of the cryptocurrency. This transaction caused a drop in the token’s price by about 9.84%.

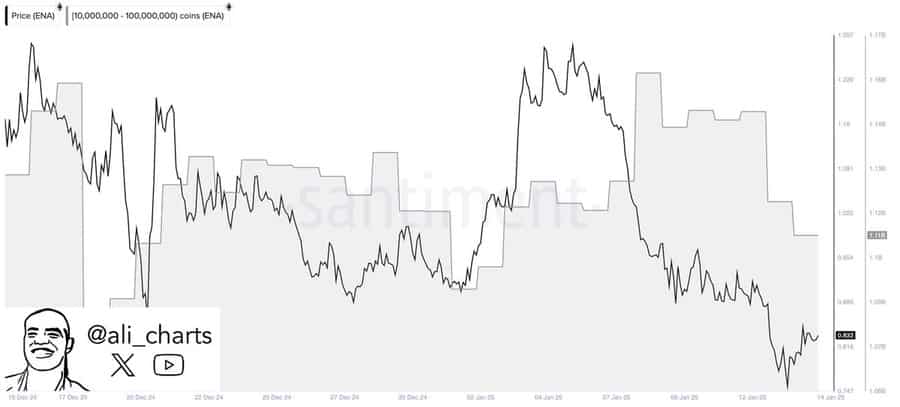

Over the last 24-hour period, I’ve observed a notable pattern – major players have been dumping approximately 50 million ENA tokens, based on the data I’ve seen from Santiment.

Santiment identified these large investors as addresses holding between 10 and 100 million ENA.

Large-scale selling from these groups frequently triggers additional price drops, limiting the asset’s ability to gain momentum and rise.

AMBCrypto looked into additional data to gain deeper insights into the situation.

Whales drive ENA sell-off as new entrants exit

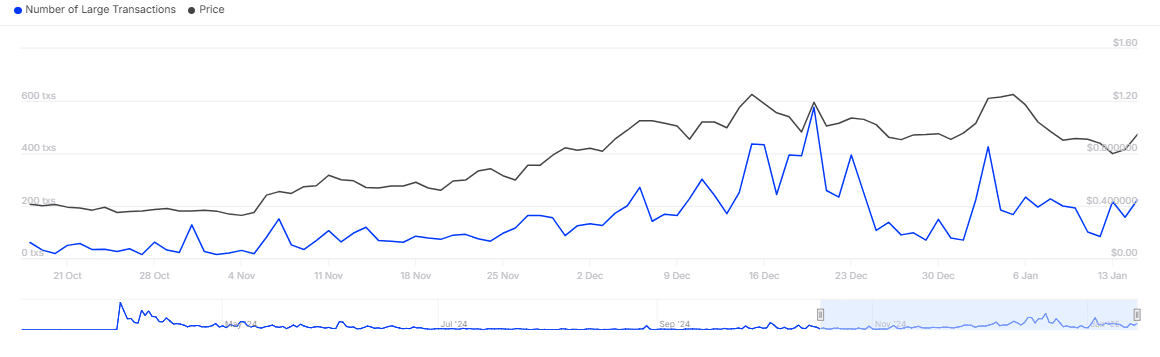

Over the past week, there has been a significant increase in whale-induced sell-offs, as evidenced by 224 transactions, which is the most we’ve seen in this timeframe based on data from IntoTheBlock.

Approximately 50.64 million units of ENA, worth around $47.9 million, were sold during this downward trend that included significant investors and market players.

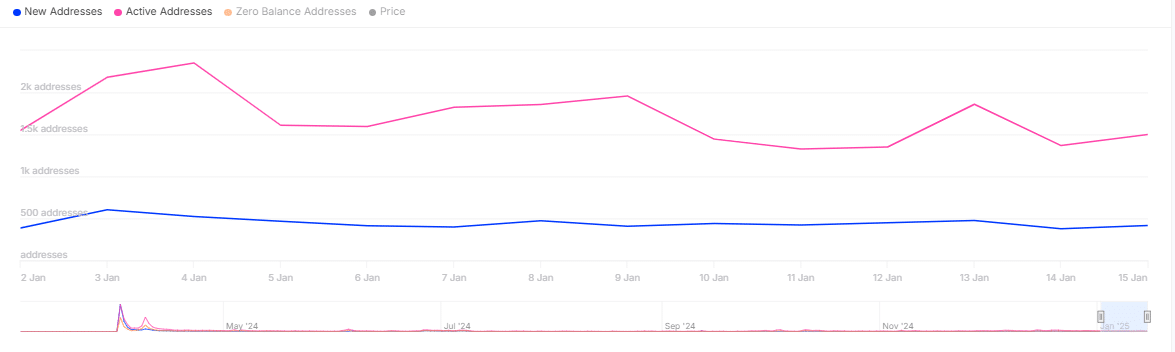

Remarkably, there was a significant increase in the number of active addresses within the past day, yet it still falls short by 19.27% compared to the numbers from a week ago.

It seems that a fresh group of major investors could be behind the current selling spree, adding substantially (approximately 1,500) to the total number of active accounts, with more and more retail investors jumping on the same bandwagon.

Further, there’s been a decrease in active addresses over the last week, along with a 11.81% drop in newly created addresses. This suggests that the overall market feeling is leaning significantly towards pessimism or ‘bearishness’.

Further decline could be on the horizon

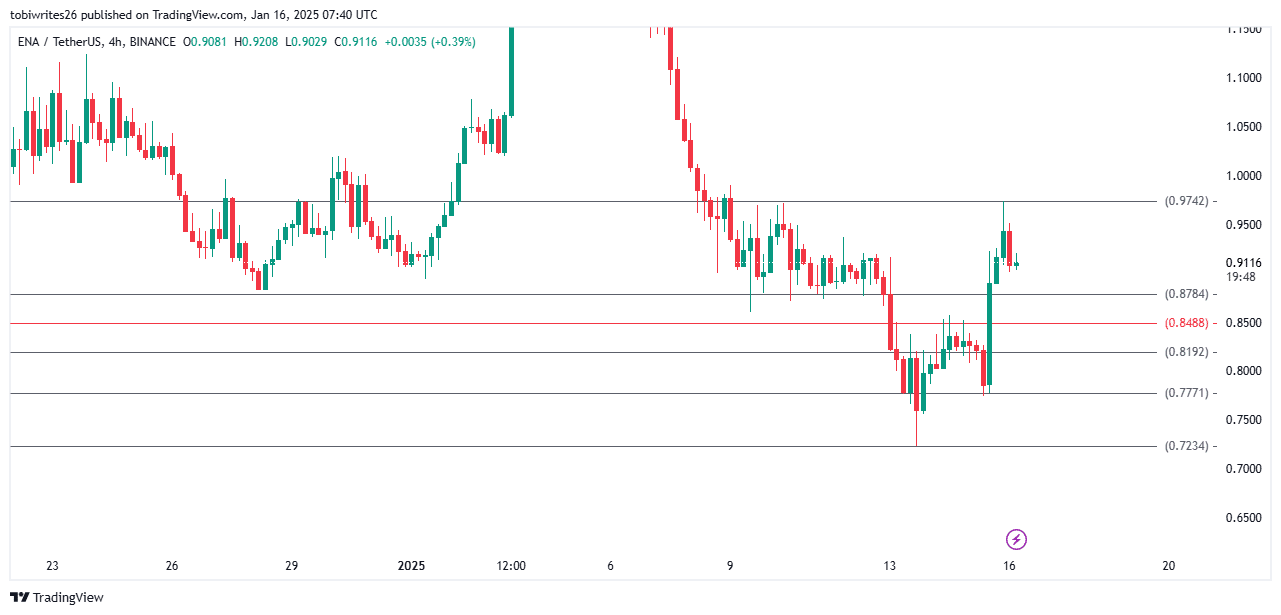

ENA currently faces a challenging situation on its graph. The upward momentum from yesterday came to a halt at the $0.9742 resistance point, which was marked using the Fibonacci retracement.

As I observe the market trends, the path ahead for ENA appears critical, particularly as it nears the $0.8784 support level. My analysis suggests that the company’s next move could significantly influence its trajectory moving forward.

If the current level doesn’t get maintained or bounces back, it could suggest a substantial decline in traders’ trust. This decrease in confidence might push the price towards more robust support areas at approximately $0.7771 or even $0.7234. Such a move could result in additional losses for investors.

Read Ethena [ENA] Price Prediction 2025-26

If whales continue to offload their holdings, combined with retail sellers and a decrease in the creation of new user accounts, ENA may experience additional price drops, potentially leading to more severe devaluation.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-01-17 07:04