-

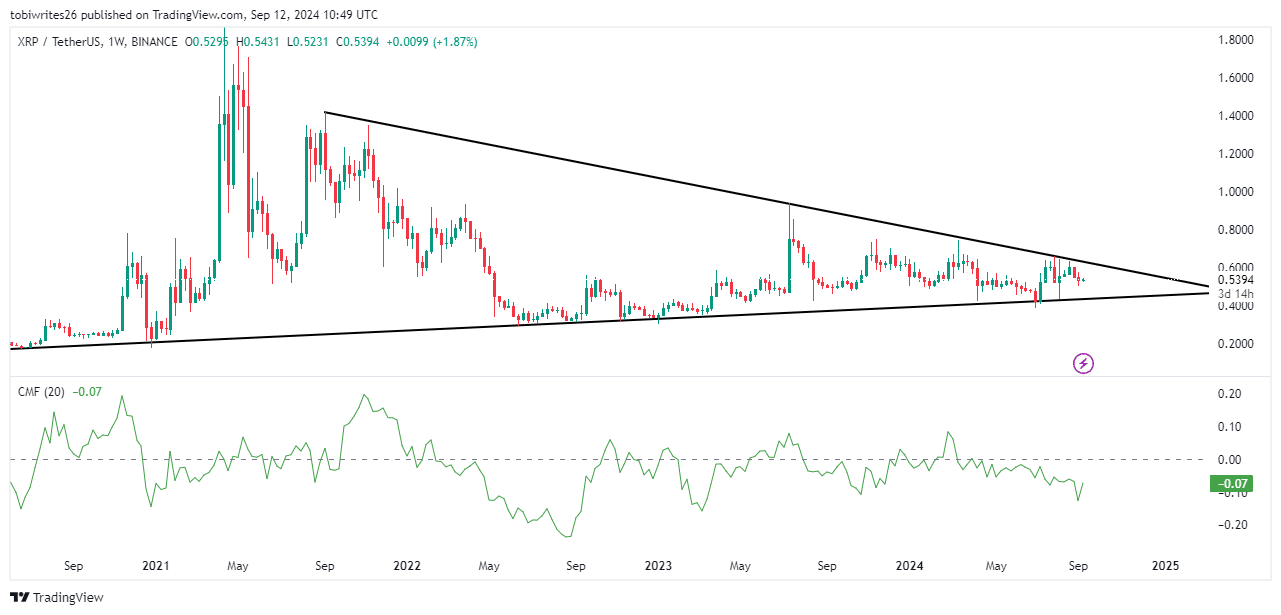

XRP was trading within a symmetrical triangle at press time.

Nonetheless, whales were applying downward pressure through considerable sell-offs, which, in turn, could affect retail investors.

As a seasoned researcher with years of experience navigating the complex world of cryptocurrencies, I must say that XRP‘s current situation presents both hope and apprehension. The symmetrical triangle formation indicates a potential surge, but the downward pressure from whales could be a game-changer.

As I analyze the current market trends, I’ve noticed a promising 0.92% rise in XRP‘s daily trading session, which could be a sign of potential growth. However, my research indicates that at this point, XRP seems not to be primed for the significant surge that many have been eagerly awaiting.

The absence of forward progress is clear in its recent monthly drop of 5.93% and weekly decrease of 2.79%, with XRP rebounding from the upper limit of a triangle structure it has formed.

More signs of a rally surfaces

On the weekly chart, XRP appears to be shaping a symmetrical triangle, which could indicate an impending price increase. Typically, this geometric figure is viewed as a positive sign, implying that there may be a shift towards a stronger buying trend as the selling pressure lessens.

Enhancing the optimistic outlook indicated by the chart, we also have the Chaikin Money Flow, a tool that calculates the average of buying and selling activity (accumulation and distribution) over a specific timeframe, taking into account both volume and price movements.

It showed that XRP was being accumulated at press time, as it headed for the positive zone.

However, the formation of a symmetrical triangle is not the sole bullish signal. Further analysis revealed that retail investors were actively contributing to the likelihood of a rally.

Retailers are a major force for XRP’s rally

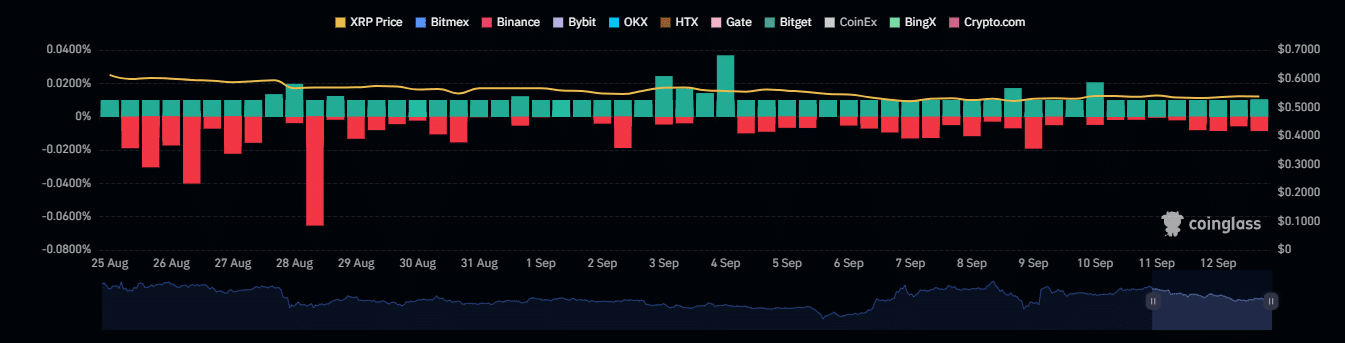

As a crypto investor, I’m witnessing a surge of confidence among retail investors in XRP. This optimism is clearly reflected in the rising Funding Rates and Open Interests on multiple exchanges, as per the data I’ve observed from Coinglass.

In simpler terms, when the Funding Rate is positive, it means traders holding long positions are actually paying a small fee to those who have short positions, as compensation for the advantage of having borrowed funds.

In this situation, it often indicates that the price of the Futures contract is higher than the current market price (the Spot price), which underscores a significant appetite for buyers to hold long positions.

Furthermore, there’s been a noticeable rise in Open Interest, up by approximately 1.15% over the last day.

As a crypto investor, I’ve noticed a growing tendency among traders to open long positions, even though there are still a few contracts waiting to be settled.

Despite the apparent readiness for an upward move, there is a risk of a decline.

As a researcher, I’ve observed an intriguing market pattern: the “whales,” or large-scale investors, seem to be trimming down their holdings significantly. There’s also a discernible increase in liquidation activities by long traders, suggesting a potential shift in market sentiment.

Whale withdrawal is a potential sell-off sign

Based on information from Lookonchain, it appears that some major investors (often referred to as “whales”) have been moving significant quantities of XRP from their personal wallets to exchange wallets.

Usually, such a buildup suggests that someone might be planning to cash out, since adding larger amounts of a cryptocurrency to trading platforms is often a precursor to a mass sell-off. This could lead to the price decreasing.

Lately, large-scale transfers of XRP have been observed. For instance, a significant whale transferred approximately 28 million XRP, equivalent to around $14.99 million, to the Bitso exchange. Similarly, another substantial transaction saw 18.82 million XRP, valued at about $10.11 million, being moved to Bitstamp.

Read XRP’s Price Prediction 2024–2025

If these sell-offs continue, there’s a good chance that XRP might fall back towards the base of its symmetrical triangle, an area where strong buying activity has occurred in the past.

However, if this support level fails, a further decline in XRP’s price could occur.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

2024-09-13 00:08