- Ah, the whales, those grand lords of the oceanic crypto depths, continue their dance of withdrawal from exchanges, yet alas, their efforts have not reversed the melancholic bearish trend.

- Exchange netflows resemble a tragicomedy of accumulation and selling, as our illustrious large holders engage in a delightful game of asset redistribution.

Just a few days past, the Shiba Inu’s [SHIB] whale activity was akin to a Shakespearean tragedy, with wallets holding between $1 million and $10 million reducing their balances by a staggering 31% in a single day. Oh, the drama! 🎭

This unfortunate turn of events created a veritable tempest of selling pressure, plunging the price below $0.000014 and leaving SHIB gasping for stability like a fish out of water.

The absence of new whale entries has weakened liquidity, ensnaring SHIB within a descending triangle formation, a fate most dire indeed.

Whales Return: A Comedy of Errors

Lo and behold! The latest data reveals that, despite recent sell-offs, our dear whales have returned to the stage, ready for their encore.

Etherscan data has tracked a series of grandiose SHIB transactions, with some exceeding 7 billion tokens in a single transfer. These movements involve the likes of Binance and OKX, the titans of the exchange world.

On-Chain Data: The Great Outflow Mystery

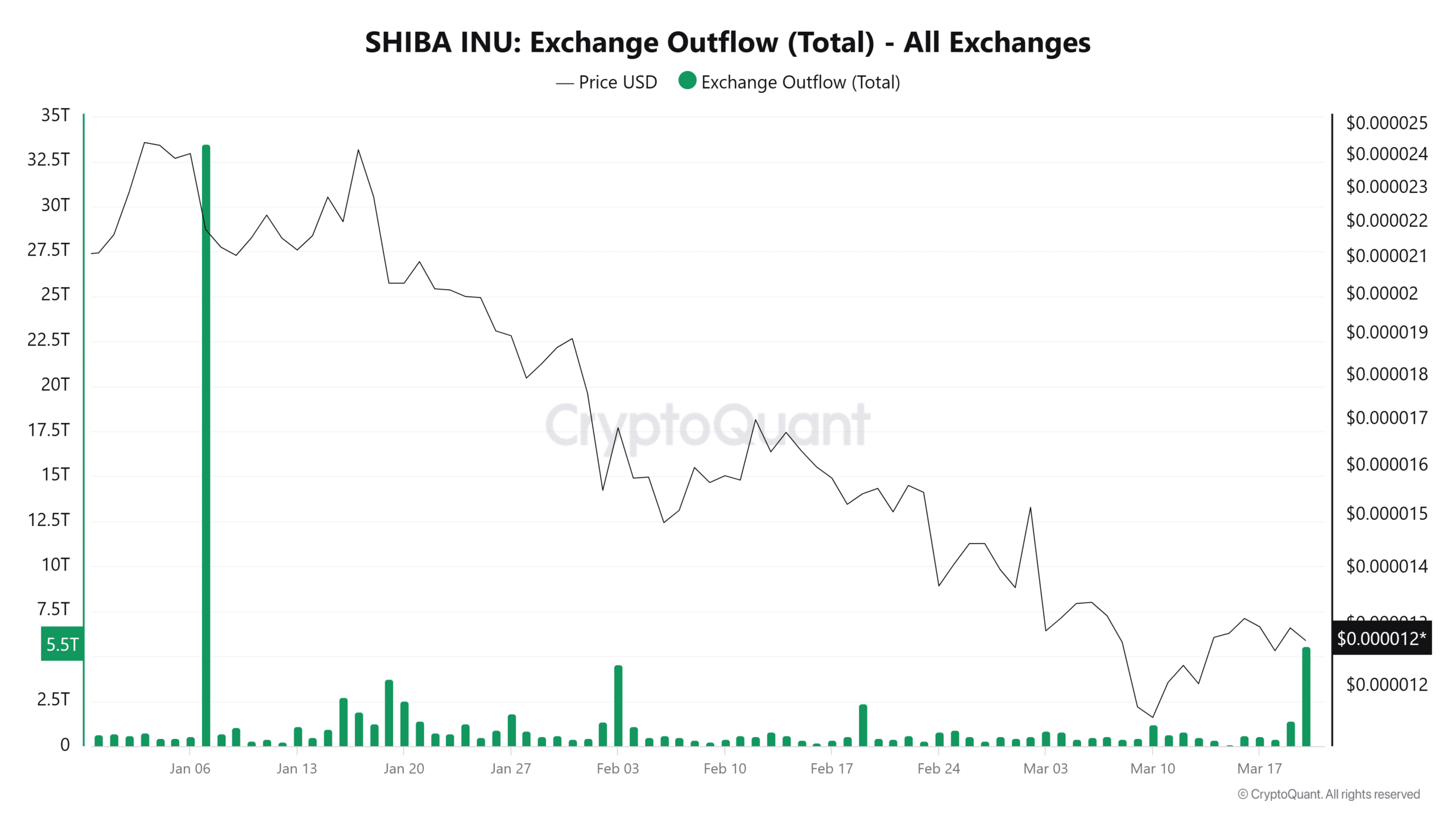

To illuminate this curious affair, we turn to CryptoQuant’s exchange outflow data, a veritable oracle of the blockchain.

On-chain data reveals large exchange outflows, including a staggering 33.48 trillion SHIB withdrawn on the 7th of January, the largest single-day removal. A feat worthy of applause! 👏

Then, on the 3rd of February, another 4.53 trillion exited, while the 20th of March recorded 5.55 trillion in outflows. A veritable exodus!

Typically, removing tokens from exchanges would reduce selling pressure and support price stability. Yet, in SHIB’s case, the price has plummeted by approximately 43% since January. A tragic irony, wouldn’t you agree?

This suggests that, despite our whales pulling tokens from exchanges, the overall sell pressure remains the dominant force, like a villain in a classic tale.

So, dear reader, what is truly afoot?

Are Whales Buying or Just Shuffling Their Decks?

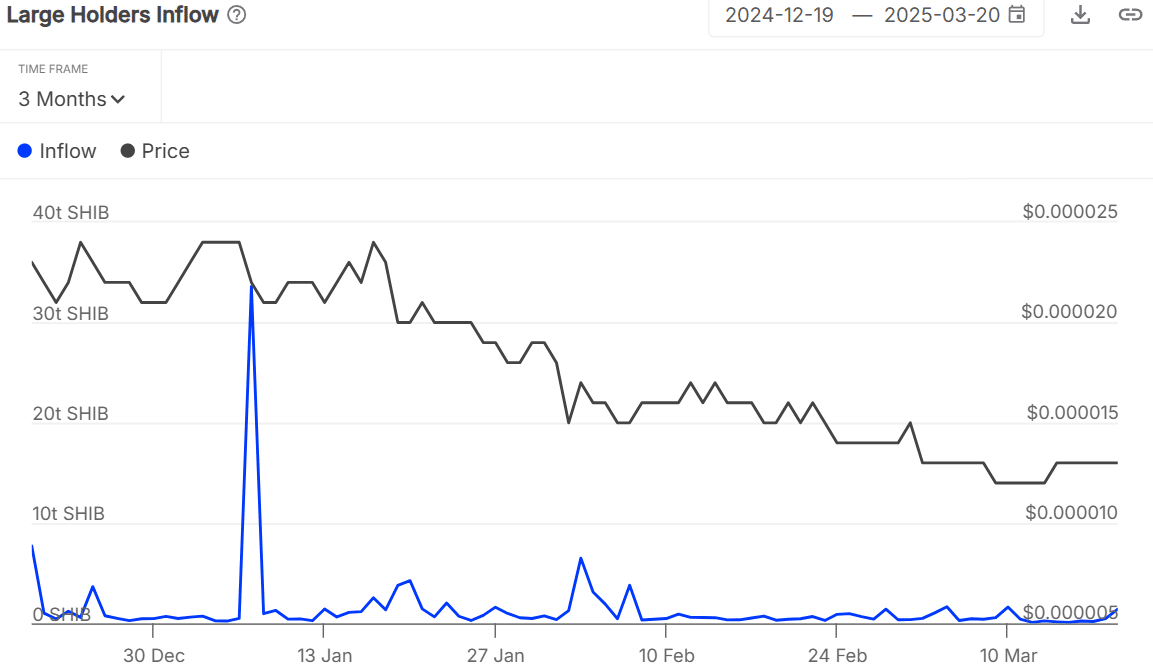

Whale activity in SHIB remains a dynamic spectacle, with IntoTheBlock data revealing large-scale inflows and outflows, a veritable ballet of finance.

On the 28th of February, a net inflow of 1.16 trillion SHIB signaled accumulation, but by the 12th of March, a -561.99 billion SHIB net outflow suggested sell pressure. Oh, the fickleness of fortune!

A smaller 143.81 billion SHIB inflow on the 19th of March hinted at renewed holding interest, a glimmer of hope amidst the chaos.

This back-and-forth suggests that our whales are not merely buying; they are actively managing their positions, redistributing tokens based on the whims of the market rather than committing to long-term accumulation. A most strategic maneuver!

Indeed, just five addresses control a staggering 58.39% of SHIB’s supply, with one holding a jaw-dropping 41.68%. These high-activity wallets contribute to market volatility as SHIB’s overall holder base grows. A true oligarchy of the sea! 🐳

While our whales continue their grand ballet of position shifting, SHIB’s overall holder base has expanded, a curious juxtaposition.

SHIB’s Holder Base Grows: Is It Enough? 🤔

The Shiba Inu official Twitter account has confirmed that SHIB holders now exceed 1.5 million, a sign of growing adoption. How delightful! 🎉

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- LPT PREDICTION. LPT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2025-03-20 21:17