-

Bitcoin’s whale activity recorded a major decline

BTC broke above a descending triangle pattern, signaling a hike in buying pressure

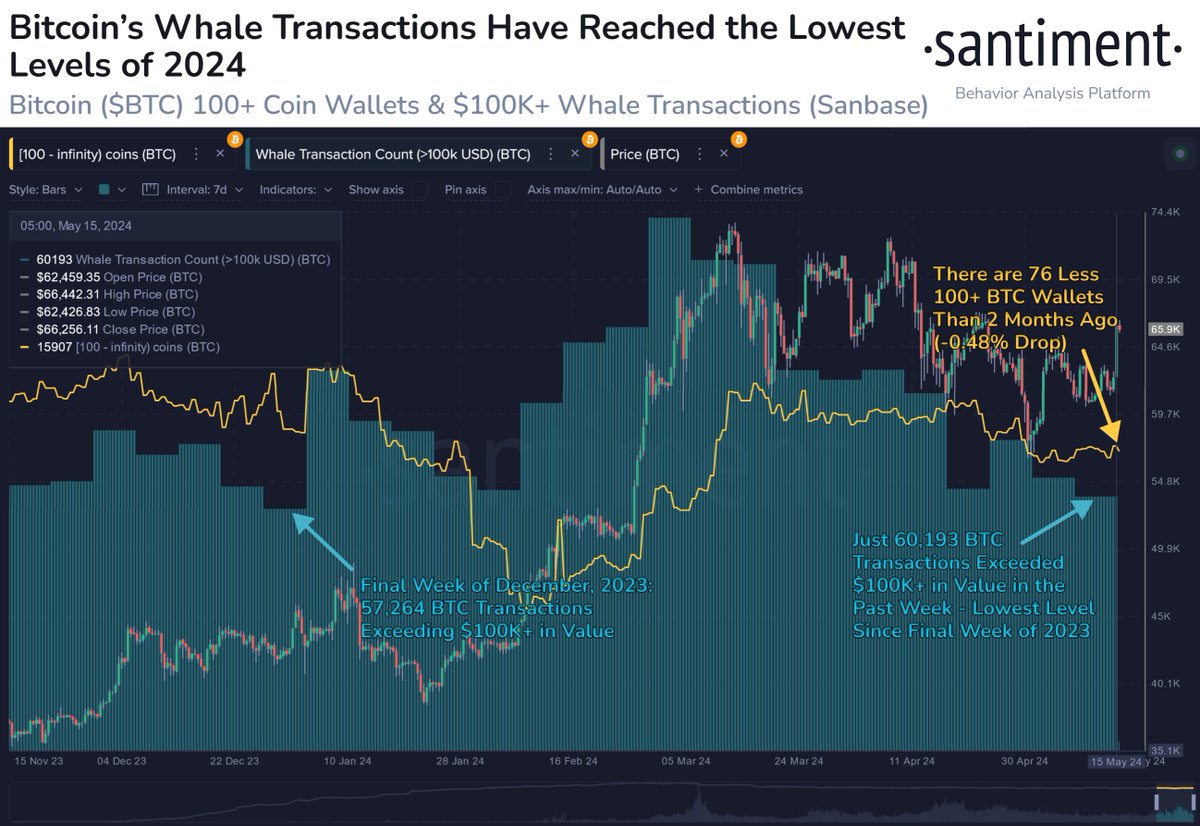

As a seasoned crypto investor, I’ve seen my fair share of market volatility and price movements in Bitcoin (BTC). The recent decline in Bitcoin’s whale activity, as reported by Santiment, is concerning but not entirely unexpected. Whales, who typically hold large amounts of BTC, have been reducing their transactions since the start of the year. This trend could be due to profit-taking or simply a shift in market sentiment.

The number of significant Bitcoin transactions by large investors, or “whales,” has reached a yearly low. Concurrently, Bitcoin’s price has established notable resistance and support zones near the $65,000 mark.

Approximately 60,193 Bitcoin transactions worth over $100,000 each occurred during the last seven days, which is the smallest number recorded since the last week of 2023, according to data from Santiment.

As a researcher studying the Bitcoin market, I’ve noticed an intriguing development: The percentage of BTC whales, who own more than 100 coins, has decreased by approximately 0.48% within the last two months. This reduction could be indicative of increased profit-taking behaviors among this investor group.

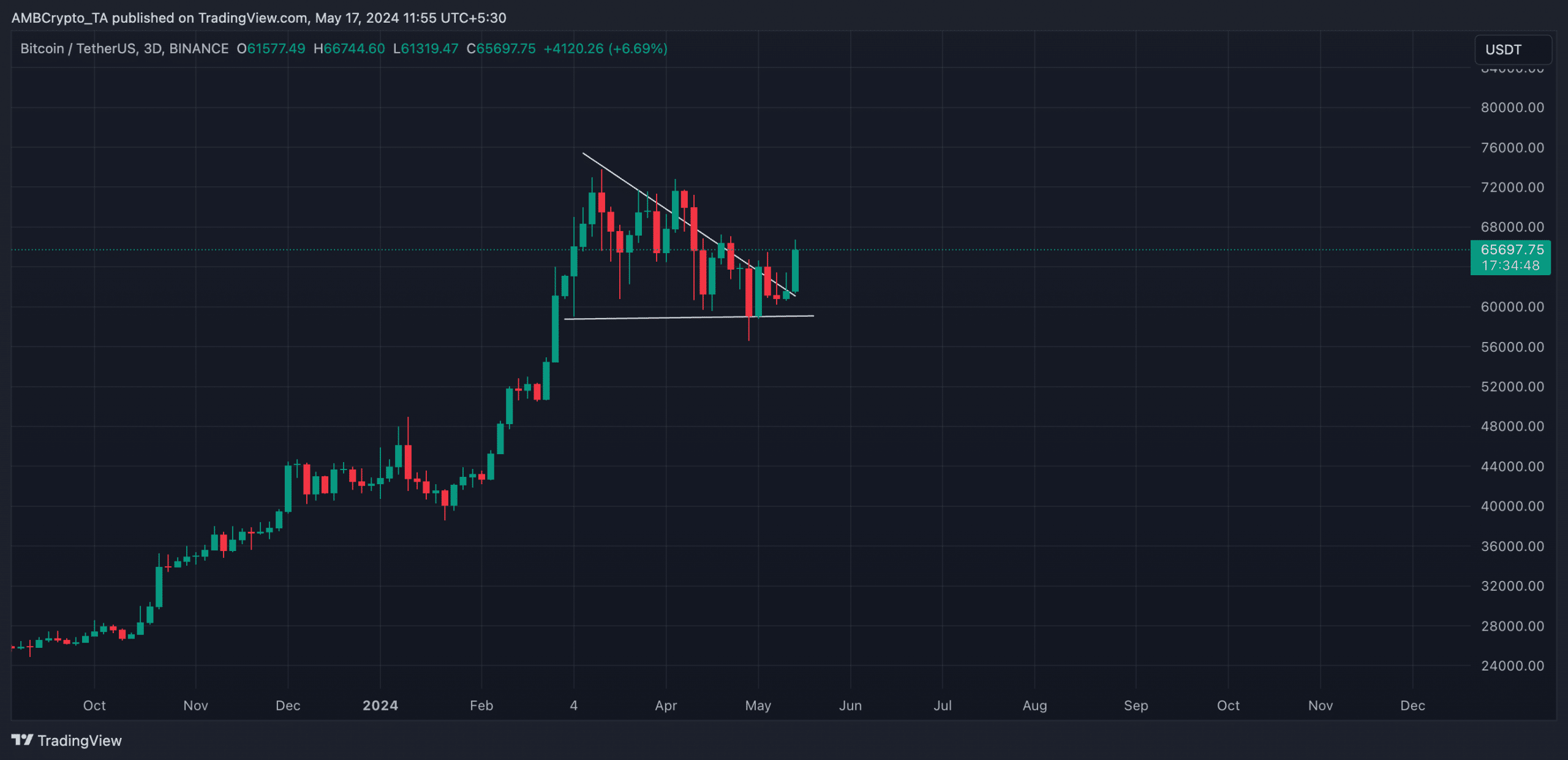

Bitcoin’s descending triangle pattern

After reaching its peak of $73,750 – a new record high for BTC, the cryptocurrency’s price has taken a downturn on the charts. Consequently, it created a series of progressively lower high points, forming what is known as a descending triangle.

Despite breaking above the triangle’s upper trendline at around $70,000 in April, Bitcoin’s price has remained contained within this triangular pattern for the past three months.

The price drop could be the reason behind the decrease in significant Bitcoin transactions by large investors over the recent fortnight. Currently, Bitcoin is valued at $65,696 and hovers above the triangle’s upper boundary.

As a researcher studying financial markets, I would interpret a break above the upper resistance level of a descending triangle in an asset’s price chart as a bullish sign. This implies that the buying force has grown strong enough to surmount the previous selling pressure, potentially marking the beginning of an uptrend.

Affirming the change in perspective regarding Bitcoin, its calculated sentiment came back as a favorable 0.99.

Read Bitcoin’s [BTC] Price Prediction 2024-25

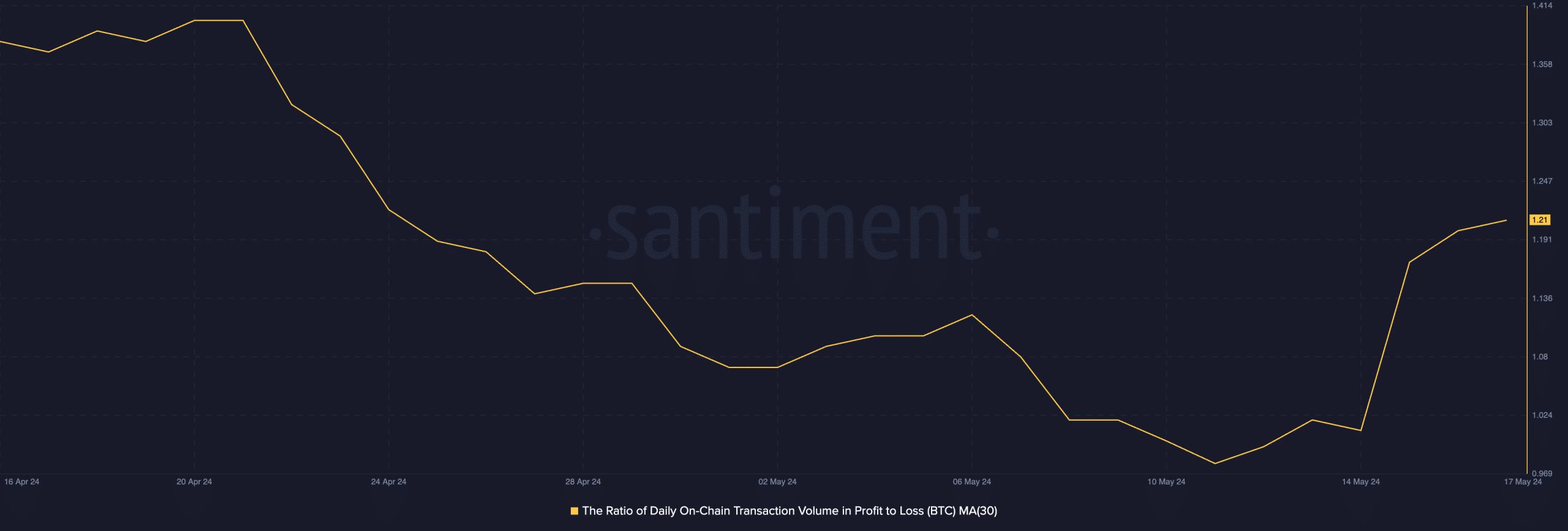

The change in direction could be attributed to the persisting profits that daily traders have been making from Bitcoin’s recent price fluctuations.

Based on an analysis by AMBCrypto, the daily ratio of Bitcoin’s transaction volume with profits versus losses was calculated using a moving average of 30 days, resulting in a figure of 1.21. In simpler terms, for every Bitcoin transaction that resulted in a loss during the previous month, approximately 1.21 transactions generated profits.

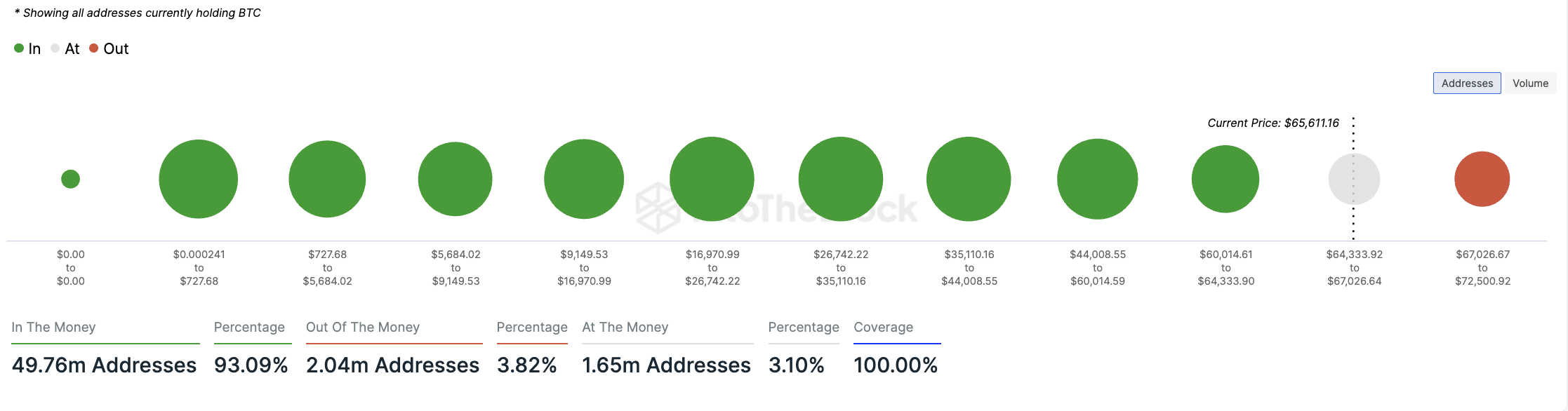

As a financial analyst, I can tell you that at the current moment, approximately 50 million Bitcoin wallet addresses represent around 93.09% of all BTC owners who are currently experiencing a profit on their investment. Conversely, roughly 4% of all coin holders find themselves in a negative position, holding Bitcoins at a loss.

As a crypto investor following market trends closely, I’d like to highlight an interesting finding based on data from IntoTheBlock. Specifically, it reveals that there is a significant group of Bitcoin (BTC) holders who purchased coins within the price range of $67,000 to $72,000.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2024-05-18 01:11