-

A whale dumped 200,000 BNB tokens worth $103 million on the world’s biggest cryptocurrency exchange.

Despite the massive token dump, BNB is moving above the 200 EMA, showing bullishness in the chart.

As a researcher with experience in the cryptocurrency market, I’m keeping a close eye on recent developments, particularly the massive deposit of $103 million worth of BNB tokens by a Binance whale. Despite this significant deposit, BNB is still experiencing selling pressure due to continuous token dumps by other whales and governments.

As a researcher studying the cryptocurrency market, I’ve observed that there’s been intense selling pressure driving down prices recently. Large investors, or “whales,” have been offloading large quantities of Bitcoin (BTC), while both the U.S. and German governments have made significant sales in the past few days.

During the persistent selling trend, on the 8th of July, a major Binance (BNB) investor, identified as capybara_bnb, transferred a substantial amount of 200,000 BNB tokens, equivalent to approximately $103 million, into Binance, according to Wu Blockchain’s report.

Whale dumps $103 million worth of BNB tokens

The enormous contribution made by the whale to this market has drawn considerable interest from investors and financial institutions during this extended period of selling activity in the cryptocurrency sector.

With a significant stake of 204.6K BNB tokens, valued at approximately $105 million, this large investor continues to possess a considerable amount of BNB in their holdings despite having made a substantial deposit.

Alongside the BNB deposit, the token market has witnessed significant sell-offs of other cryptocurrencies. For instance, the German government disposed of 1,000 Bitcoins, and the large investor with the wallet address “3G98jS” sold off 809 Bitcoins.

This continuous dumping of tokens in the market signals significant selling pressure.

Lately, a new finding emerged indicating that the Crypto Fear and Greed Index has reached its lowest point since the beginning of 2023, reflecting intense fear among investors in the cryptocurrency market.

However, if this dump doesn’t stop, we may see more sell-offs in the coming days.

BNB technical analysis and key levels

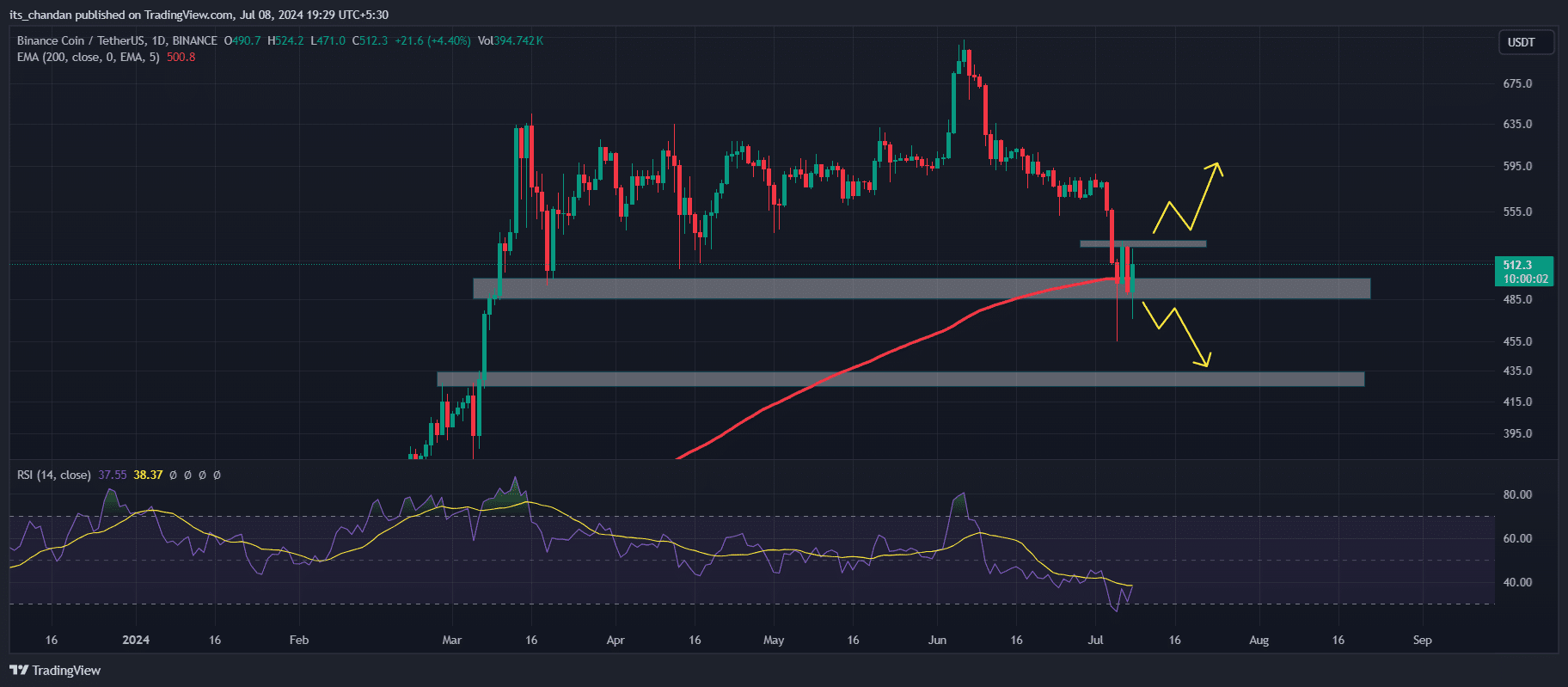

As a researcher studying the cryptocurrency market, I’ve identified that BNB was currently hovering around a significant support point of $500 based on my technical analysis. Additionally, a noteworthy development was taking place in the form of BNB surpassing its 200-day Exponential Moving Average (EMA) on the daily chart.

The price BNB above 200 EMA indicated that the asset was still in the bullish zone.

As a crypto investor closely monitoring Binance Coin (BNB) on a daily chart, I’ve noticed that if BNB forms a candle with a closing price below the 200 Exponential Moving Average (EMA) and falls below the $500 level, it could indicate a significant sell-off on the horizon.

As a researcher studying the cryptocurrency market, I’ve identified that BNB could potentially reach a price level of $430 based on current support structures. However, it’s important to note that the Relative Strength Index (RSI) also indicated signs of recovery at the oversold zone during my latest analysis.

BNB price-performance analysis

Although there’s a positive market sentiment after a recent price drop, Open Interest for Binance Coin grew by 1.4 percent, implying a modest level of trader and investor engagement.

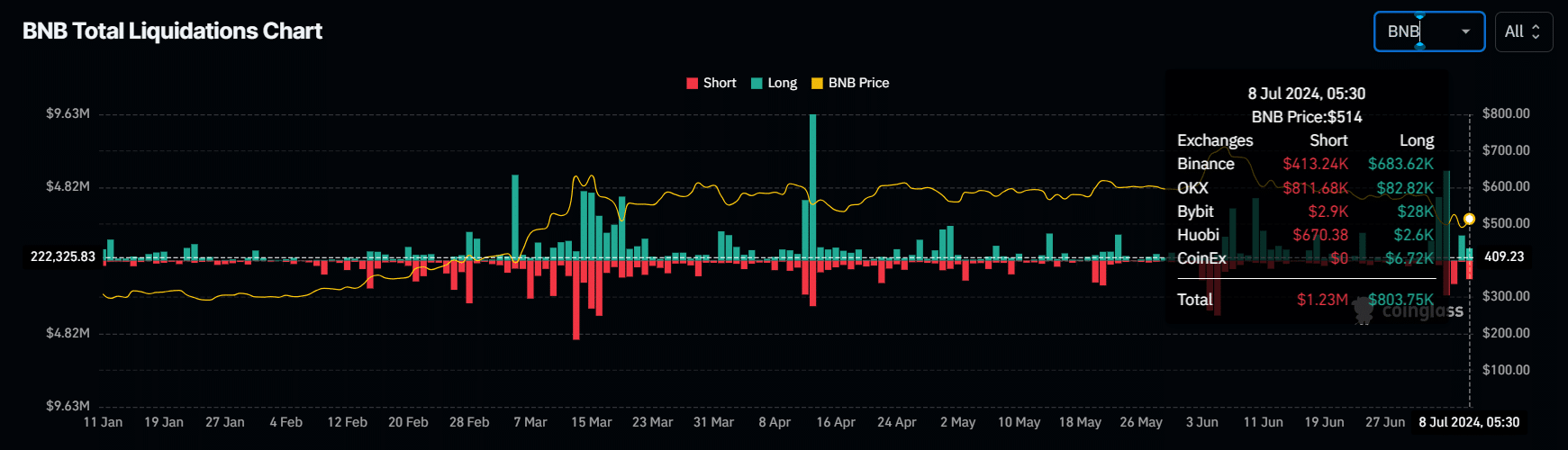

Over the past day, bulls have seen over $803,000 worth of their positions closed against their will, while short sellers have faced a forced closure of approximately $1.23 million in losses, as reported by Coinglass, an on-chain analytics company.

At present, the price of BNB was hovering around $513, marking a 3.2% increase over the previous 24-hour period.

Realistic or not, here’s BNB’s market cap in BTC’s terms

As a researcher observing the market trends, I’ve noticed an intriguing development: The trading volume for BNB has surged by 26% within the past 24 hours. This significant rise suggests that there’s been increased engagement from investors and traders in the face of prevailing bearish sentiment.

Over a prolonged timeframe, BNB experienced a decline of 11% in value within the past week. However, this represents a more substantial decrease of approximately 25% when considering its value change over the previous month.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2024-07-09 09:43