- Ethereum’s price surged to $3,380, marking a 4.6% hike within just 24 hours

- Recent whale deposits on Kraken, alongside rising OI, hinted at potential short-term price pressure

In the early part of 2025, Ethereum (ETH), the second-largest cryptocurrency by market value, is showing lively market fluctuations. Recently, a significant investor, often referred to as a ‘whale,’ transferred 20,000 ETH, equivalent to approximately $67.6 million, into Kraken. This deposit has sparked debates about the role and impact of large-scale investors on Ethereum’s price changes.

In September 2022, this particular whale (a large-scale cryptocurrency holder) removed approximately 217,513 Ether from various trading platforms. Since March 2024, it has been actively participating in transactions on the Kraken exchange.

These kinds of actions frequently suggest major changes in market opinion and resources, causing traders to reconsider crucial factors and ready themselves for possible fluctuations in prices.

A closer look at Ethereum’s market performance

Due to a lower-than-anticipated Consumer Price Index report, Ethereum’s price surged to $3,380, marking an almost 5% increase over the past day. This surge generated a remarkable trading volume of $26.2 billion within that timeframe, indicating lively market activity and high demand from both individual and institutional investors. Additionally, Ethereum’s market capitalization stood at $407.2 billion – a testament to unwavering investor confidence, even amidst volatile market conditions.

It appears the recent 20,000 ETH deposit by the mentioned whale coincides with Ethereum’s highest price point, possibly suggesting they are cashing out or preparing for a drop in value. In the past, such large deposits from whales have often been followed by periods of selling pressure on Ethereum’s price due to increased liquidity on the sell side. Nevertheless, this trend isn’t always conclusive.

Factors outside the control of Ethereum, like economic trends and the relationship between Bitcoin‘s price and Ethereum’s, significantly impact Ethereum’s direction. With Bitcoin holding steady above $95,000, traders may expect continued bullish tendencies for Ethereum. Moreover, the growth of ETH staking and the deflationary impact of EIP-1559 enhance its long-term attractiveness.

ETH’s price action and key indicators

The value of Ethereum has experienced noticeable fluctuations, influenced by a mix of technical elements and widespread investor behavior. In reality, over the last 12 months, ETH’s price has fluctuated between $1,500 and $4,500, showcasing both periods of optimism and pessimism.

As I delve into the analysis, it’s crucial to note that the deposit pattern of this particular whale offers some valuable clues regarding potential future price trends. Over the period from now to March 2024, this whale has deposited a total of 146,639 ETH onto Kraken, with an average purchase price of approximately $3,170. This strategic deposit pattern suggests that the whale may have been capitalizing on higher price levels by profit-taking.

Technical examination showed that Ethereum’s latest surge encountered a significant resistance point at approximately $3,400. If it manages to surpass this barrier, Ethereum might aim for the $3,500 to $3,600 region in the near future. However, should it fail to sustain its momentum, it could potentially drop towards the $3,200 to $3,100 support zone instead.

A look at significant moving averages suggests that Ethereum’s price trend has been persistently higher than its 50-day and 200-day average prices.

Ethereum’s network resilience

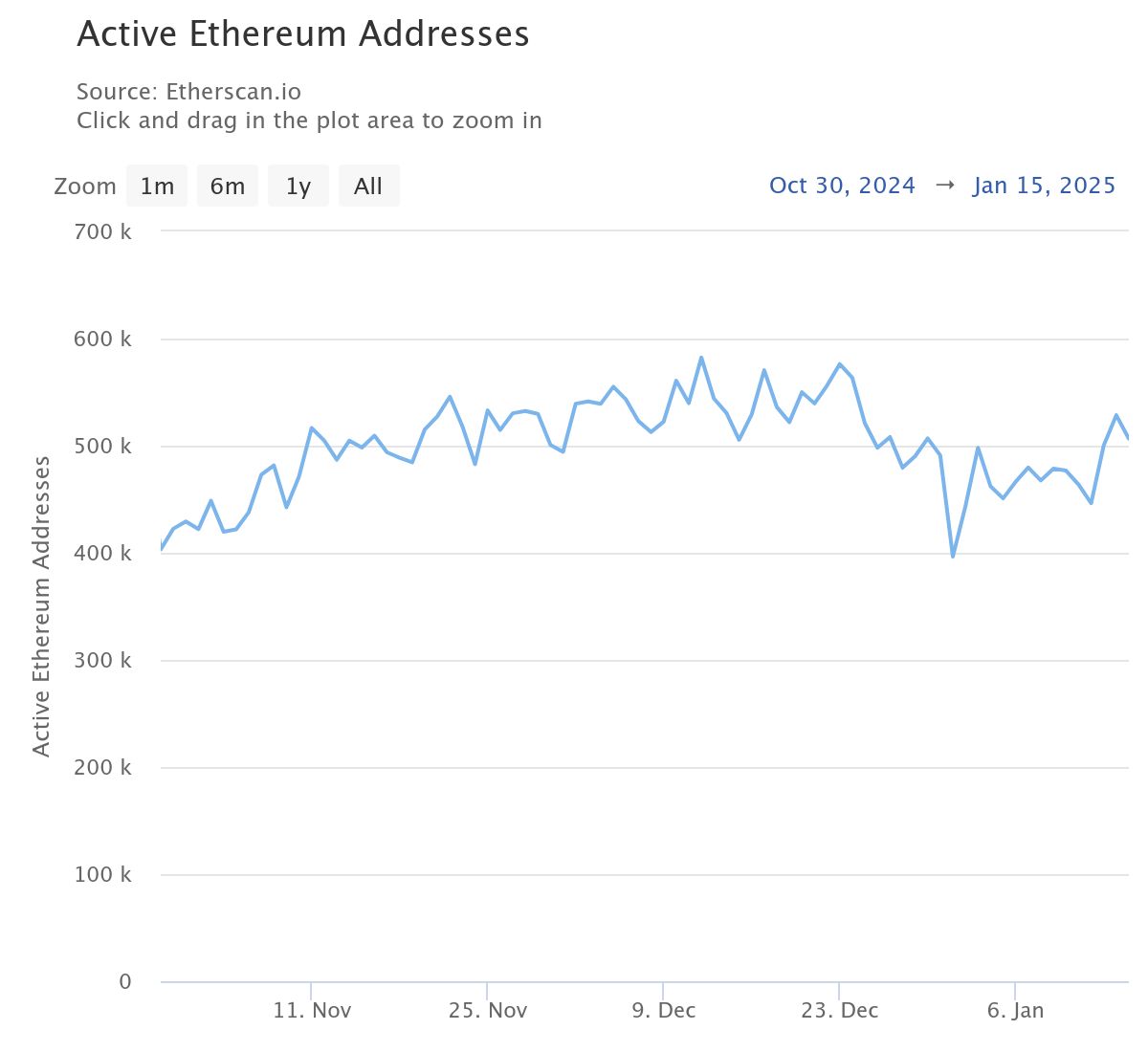

Furthermore, there has been a persistent increase in the number of active Ethereum addresses lately. Notably, on-chain information shows that these addresses typically reach about 400,000 every day, indicating substantial engagement within the community.

Upon closer examination, it’s clear that increases in active addresses on the network frequently correspond with market uptrends – an indication of rising demand and enhanced network value. For instance, the recent spike in active Ethereum addresses coincided with its price spiking to $3,380, underscoring the connection between network activity and market success.

Conversely, a decrease in this measurement could signal less network usage and possible negative influence on Ethereum’s price. Given Ethereum’s strong developer community and constant advancements, network activity is likely to serve as a dependable indicator of market opinion and upcoming price fluctuations.

Signals for Ethereum’s next move

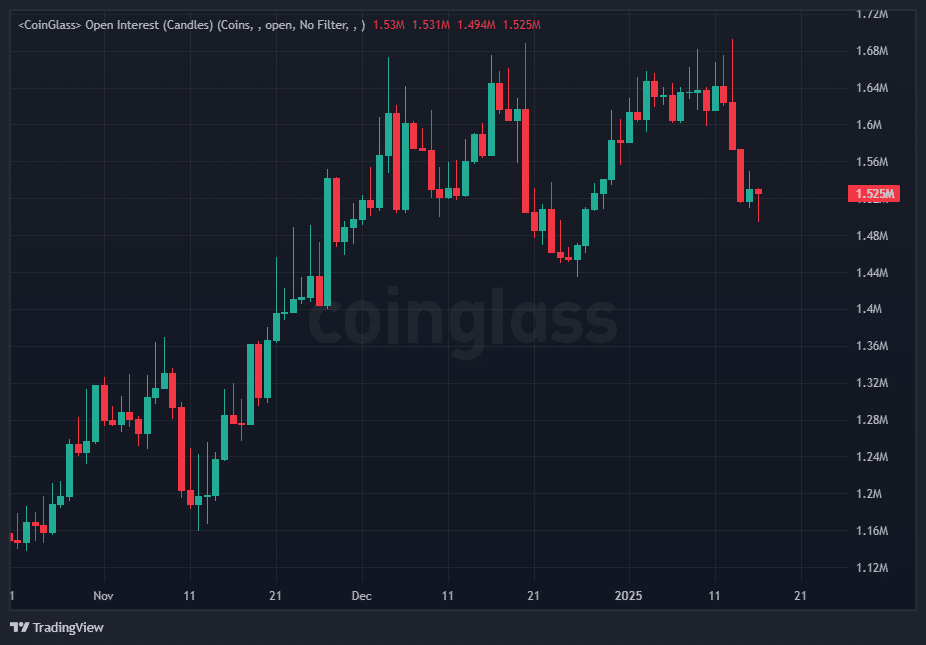

The current level of open interest (OI) for Ethereum on major exchanges has experienced substantial changes, suggesting increased action within the derivatives market. As I write this, the OI for Ethereum is approximately $1.52 million after a considerable increase over the past week. This surge in OI coincides with ETH’s recent price surge, indicating that traders are opening new positions in expectation of further market volatility.

Increases in open interest tend to come before substantial price changes, since they suggest increased involvement and borrowing power within the market.

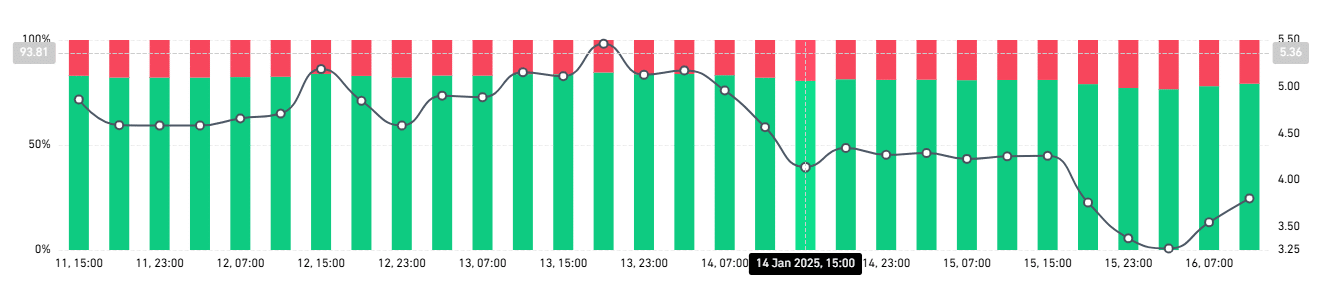

Lately, large whale transactions on Kraken combined with increasing Open Interest suggest possible short-term price compression. If most positions are bullish, a swift market drop could cause liquidations, speeding up the fall. Alternatively, continuous buying power might lead to a short squeeze, boosting ETH’s value significantly.

Gauging Ethereum’s market sentiment

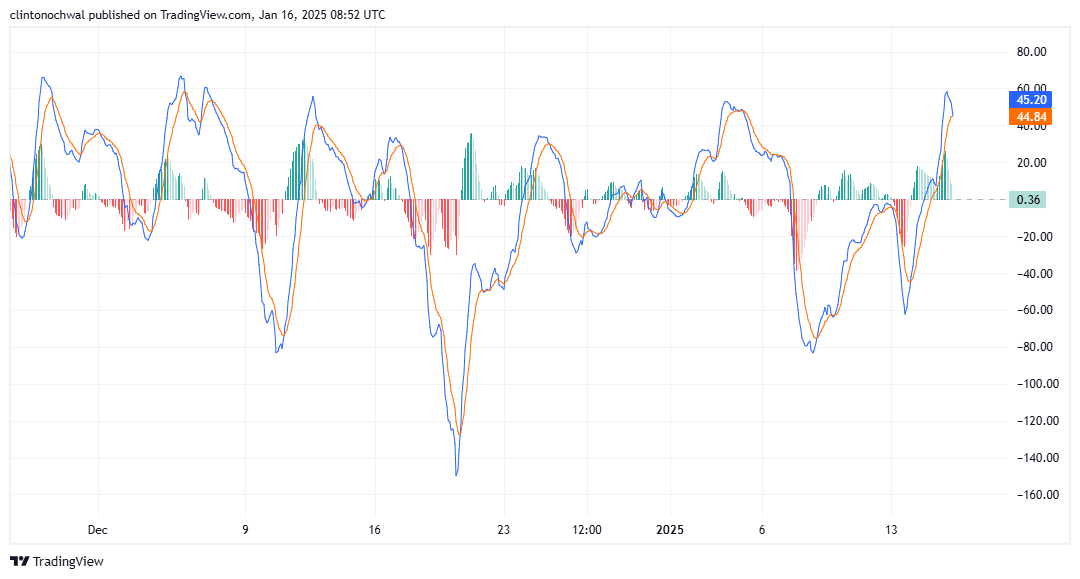

In summary, it seems that long-term Ethereum investors are enjoying substantial profits according to the MVRV ratio, while short-term holders find themselves in a more squeezed position. This contrast suggests a strong bullish trend in the market, as the long-term investors reap benefits from the recent price increase.

When the Mean Value Realized Value (MVRV) ratio for long-term investors reaches its peak, it usually signals an upcoming local price peak. This is because these investors may start selling their assets, which can lead to increased selling pressure in the market.

In simpler terms, when the MVRV (Market Value to Realized Value) ratio for short-term Ethereum holders decreases, it could suggest that Ethereum is undervalued and may present opportunities for buying. Currently, Ethereum’s MVRV ratio seems close to levels where long-term holders might choose to cash out their profits, which could lead to a temporary decrease in Ethereum’s value.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2025-01-17 05:45