Two long-dormant Bitcoin wallets holding a combined 20,000 BTC—worth over $2 billion at current prices—were reactivated today.

These wallets transferred their balances to new addresses, sparking fears of long-term holder capitulation.

Two Dormant Bitcoin Wallets Move $2 Billion in BTC

BeInCrypto reported earlier that on-chain sleuth analytics platform Lookonchain identified the source of one of the transfers: a wallet created on April 3, 2011, when BTC was trading at just $0.78.

At the time, the owner acquired 10,000 BTC for under $7,805. The wallet remained inactive for over 14 years until the early hours of July 4, when the full balance was moved to a new address.

//beincrypto.com/wp-content/uploads/2025/07/Bitcoin-BTC-12.18.19-04-Jul-2025.png”/>

A decline in trading volume alongside a price drop indicates weakening market conviction. In such cases, sellers dominate. This dynamic can set the stage for further BTC declines, as low volume often means less liquidity, making the coin’s price more sensitive to large sell orders.

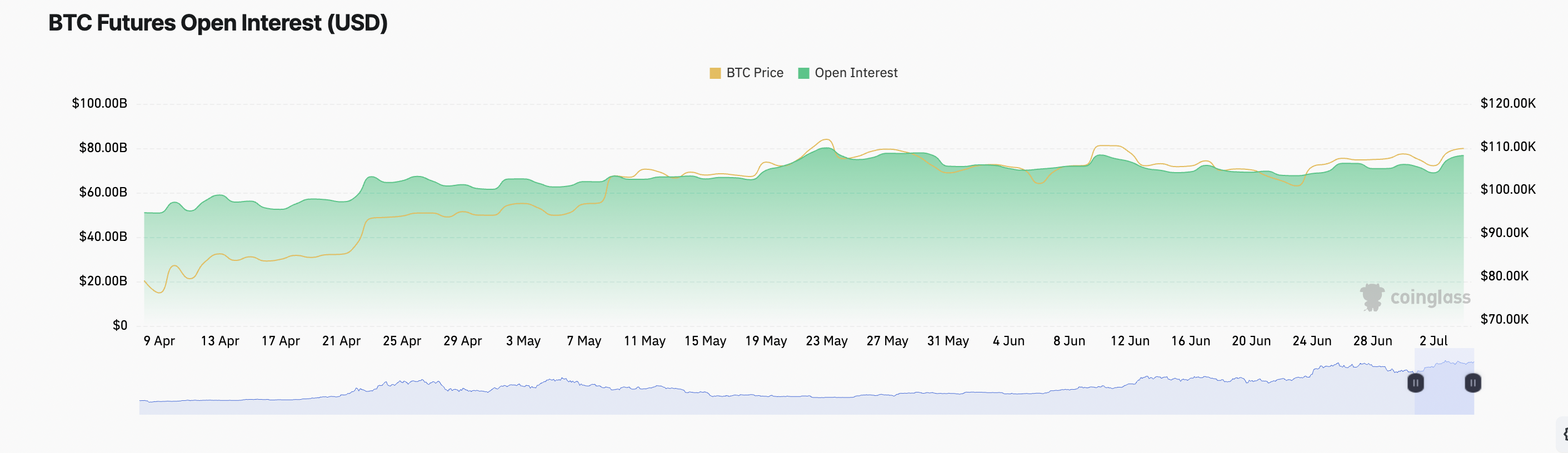

Furthermore, BTC’s price has dipped by roughly 1% amid the drop in trading volume. But, this decline comes alongside a rise in futures open interest (OI), signaling that traders are still placing leveraged bets despite reduced spot market participation.

At press time, this is at $76 billion, a 1% rise in the past day.

Rising OI during a period of low volume and falling prices often suggests an influx of speculative positioning, particularly from short-sellers anticipating further downside. This setup increases market fragility, increasing the likelihood of liquidation if price volatility increases.

With this setup, even small BTC price swings can trigger significant stop-losses or margin calls, increasing the downward pressure on the coin’s price.

Bitcoin Price Hangs in the Balance

At press time, BTC trades at $108,978, hovering just below its recent highs. However, the market remains on edge following today’s movement of 20,000 BTC from the whale wallets.

If a significant portion of these coins are deposited onto exchanges and sold, it could intensify bearish pressure and push Bitcoin’s price down toward $106,295.

Conversely, if the whales opt to hold and broader market sentiment turns bullish, the coin could find fresh upward momentum. A decisive break above $109,267 may pave the way for a rally toward the $110,422 mark.

But fear not, dear reader, for amidst the chaos, we can always find solace in the fact that Bitcoin is never boring. 😜

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Best Controller Settings for ARC Raiders

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- The Best Members of the Flash Family

- Goat 2 Release Date Estimate, News & Updates

- Best Thanos Comics (September 2025)

- Duffer Brothers Discuss ‘Stranger Things’ Season 1 Vecna Theory

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

2025-07-04 15:37