-

SHIB risks dropping to $0.000014 as a lot of addresses keep selling some of their holdings.

Activity on Shiba Inu dropped even as the network became overvalued.

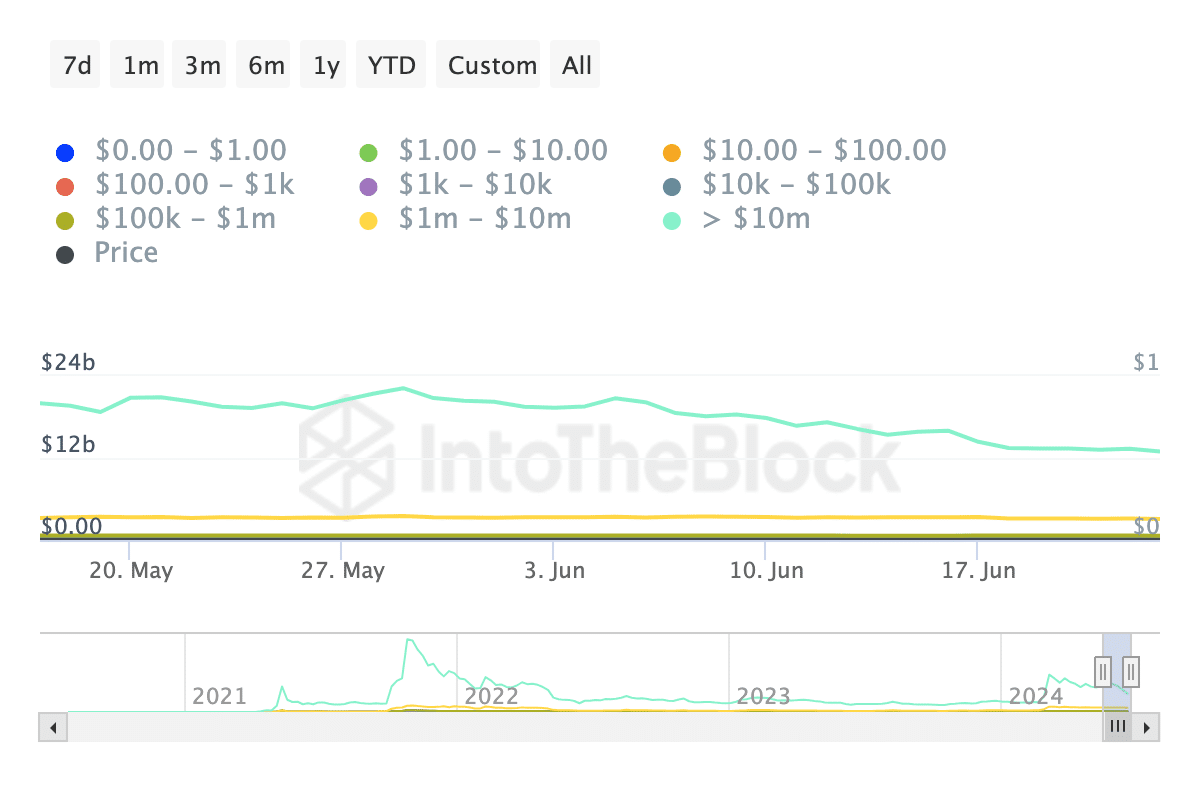

As an experienced analyst, I’ve closely monitored the Shiba Inu (SHIB) market and based on the latest on-chain data, I have concerns about its near-term price performance. The Holdings Distribution metric shows that whale investors are selling off their SHIB holdings, which is a bearish sign for the memecoin’s price.

Based on my observation as a crypto investor, I’ve noticed that according to AMBCrypto’s on-chain analysis, Shiba Inu (SHIB) might face some challenges in bouncing back from its recent slump. Upon examining the Holdings Distribution of this memecoin, it became clear that there could be a significant obstacle to a swift recovery.

The primary emphasis was on examining the Balance by Holdings figure. This indicator signifies whether current investors are boosting their stakes or divesting some of their assets.

No one wants the memecoin

As an analyst, I’ve observed that at the current moment in the market, both small-scale retail investors and large-scale whale investors have been trimming down their Shiba Inu holdings. Amongst the retail investor base, some have opted to acquire additional tokens. Conversely, none of the whales have followed suit by purchasing more tokens during this period.

Individuals with a Shib value exceeding $10 million decreased their holdings by 35.22% over the past thirty days.

In the income bracket of $10,000 to $100,000, there was evidence presented of a significant decrease, amounting to 31.68%, in their holdings. The individuals in the $1 million to $10 million income group exhibited a smaller reduction, at a rate of 4.56%.

As a crypto investor, I’ve come to realize that whales are significant players in the market, holding vast quantities of a cryptocurrency. Their influence on prices is undeniable. Unfortunately, with the latest downturn, Shiba Inu’s price may be at risk for another dip, regardless of its previous trends.

Currently, the price of SHIB is at $0.000016. This marks a 14.88% downward shift over the past week.

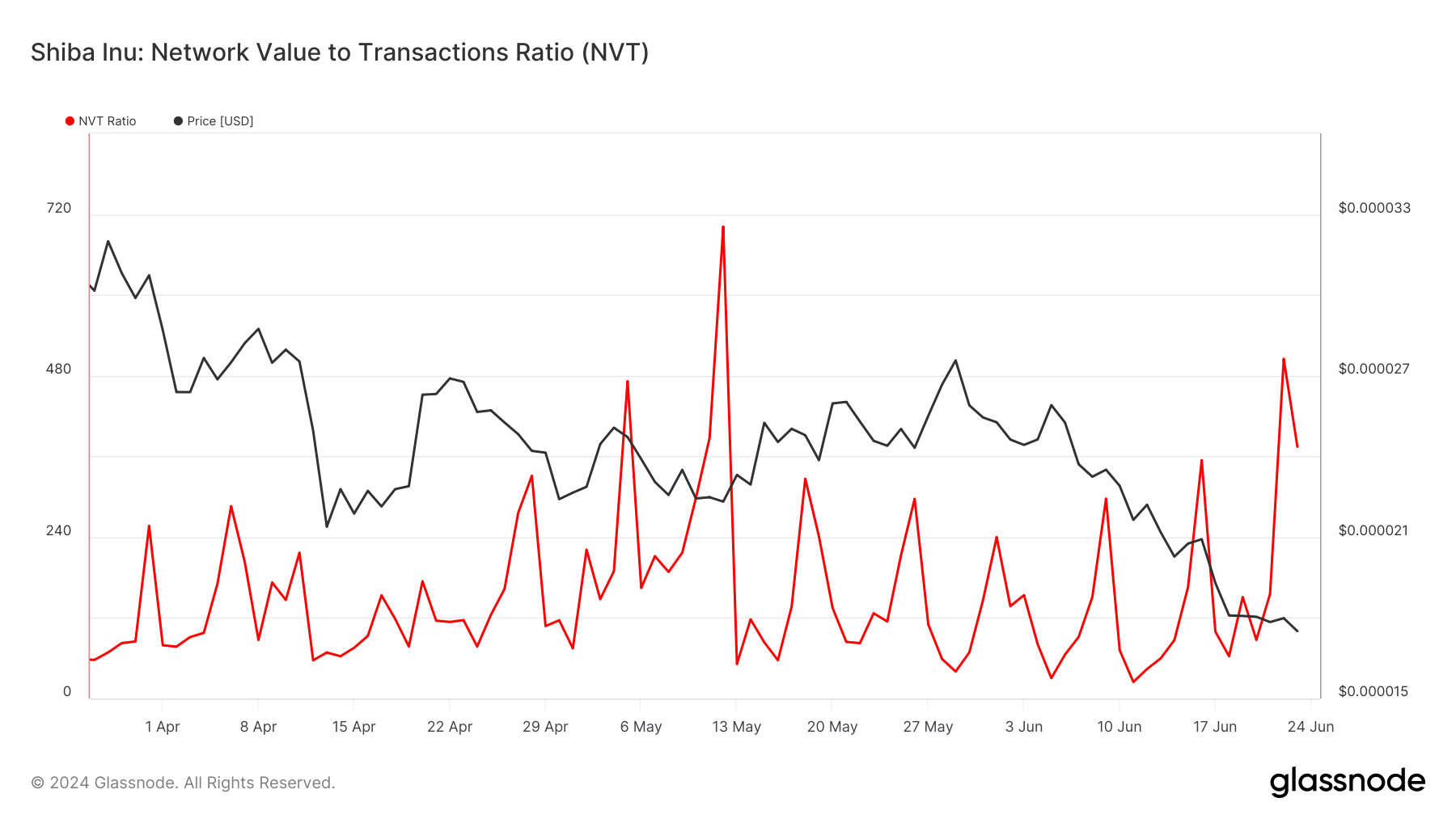

As a crypto investor, if my holdings in SHIB continue to decline and the price keeps going down, there’s a possibility that SHIB’s price may reach as low as $0.000014. The NVT Ratio, which I closely monitor, is indicating a potential further decrease in price.

Is SHIB overpriced?

NVT stands for Network Value to Transactions (NVT). This helps to determine if coins are overvalued or undervalued.

When the NVT Ratio runs elevated, it signifies that the market capitalization is surpassing the transaction volume at an accelerated rate. In such circumstances, the network and associated token might be considered overpriced.

As a researcher studying network valuation, I’ve observed that a low NVT (Network Value to Transaction) ratio indicates an undervalued network. This situation arises when the number of transactions taking place on the network exceeds its current market capitalization.

On June 22nd, the value indicator for Shiba Inu reached its peak. Consequently, SHIB might have been overvalued at that time, increasing the likelihood of a drop down to $0.000014 as forecasted.

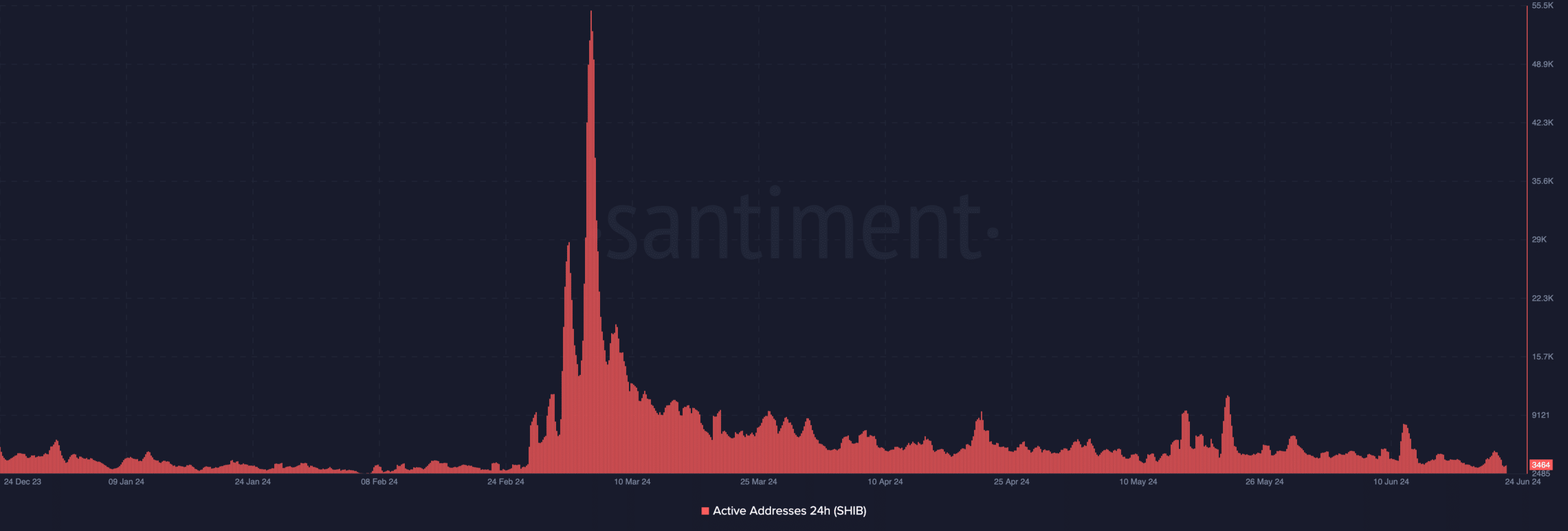

As an analyst, I’ve observed that the daily active address count on the Shiba Inu network reached a noticeably low level. This metric signifies the number of unique users engaging in transactions within the network.

Is your portfolio green? Check the Shiba Inu Profit Calculator

When the metric rises, it’s a positive indication for buyers. On the other hand, a fall in the metric may suggest that users are departing from the network, which could potentially lead to a downward trend in price.

As a researcher examining Shiba Inu (SHIB), I’ve observed a relatively small quantity in circulation. This observation implies that the demand for SHIB is likewise limited. Consequently, reaching higher price levels within a brief timeframe could prove to be a formidable task.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-06-25 09:11