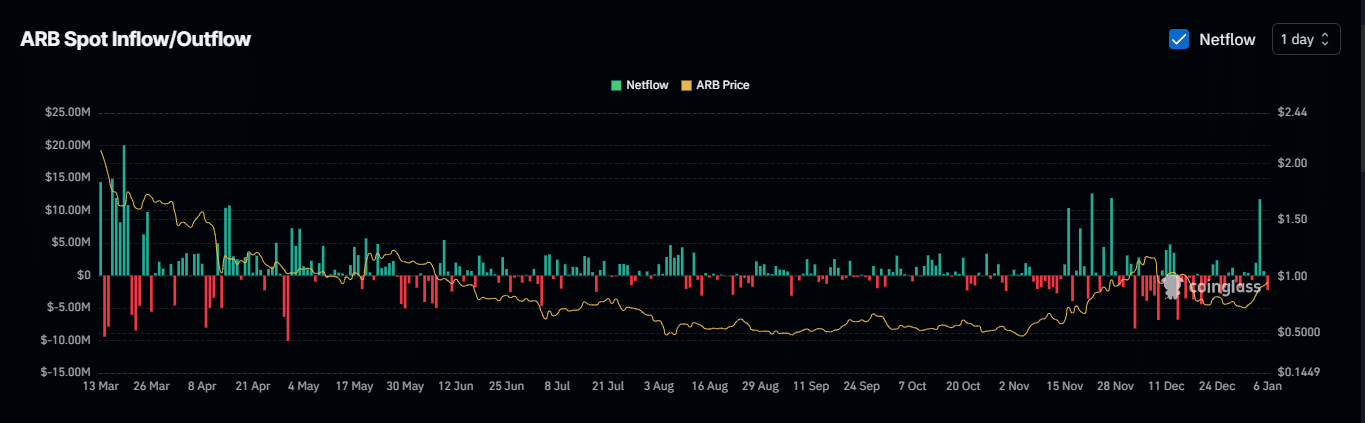

- ARB recently recorded a significant net outflow chain, a trend that often leads to price declines.

- However, both whales and retail investors have absorbed selling pressure, betting on ARB’s potential for further gains.

Following a 19.37% drop over the past month, Arbitrum [ARB] has now shifted direction. Over the last week, it’s risen by an impressive 24.03%, and its positive trend continues with a 4.85% increase in just the last day.

The latest findings indicate that the recovery of ARB is predominantly fueled by active involvement from both large investors (whales) and individual traders (retail). Although the current atmosphere suggests continued expansion, there are potential threats to this upward trend.

Massive chain outflow poses a risk to ARB gains

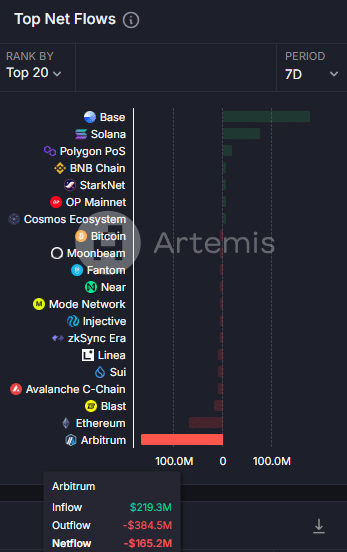

ARB encountered a substantial setback over the last week, with its interconnected outflows registering the most prominent decrease among ARB, Ethereum, Avalanche, SUI, and Injective, marking the highest negative netflow for this seven-day period.

During this timeframe, data provided by Artemis showed that the net flow of ARB’s chain was a significant negative $165.2 million, which represents the largest outflow observed so far.

As a researcher studying blockchain dynamics, I express the concept of chain netflow as the overall transfer of assets within this decentralized network. This metric is derived by subtracting the total outgoing assets (from all addresses) from the incoming assets received.

In simpler terms, when a network flow shows a decrease (negative) in user activity towards an asset, as observed by ARB, it often suggests less engagement from users and decreasing trust in the asset’s value. This decline in confidence could potentially result in a drop in the asset’s price.

Even though there might be some challenges ahead, AMBCrypto states that ‘whales’ (large investors) have managed to minimize potential losses by taking up the selling pressure, thus momentarily stabilizing the market.

Whales prevent further ARB decline

Although the overall flow of transactions within ARB’s network showed substantial negativity, a large-scale transaction from one significant investor (often referred to as a ‘whale’, who controls over 1% of the asset’s total supply) has contributed to maintaining the stability of the asset, thereby preventing a sudden decrease in its price.

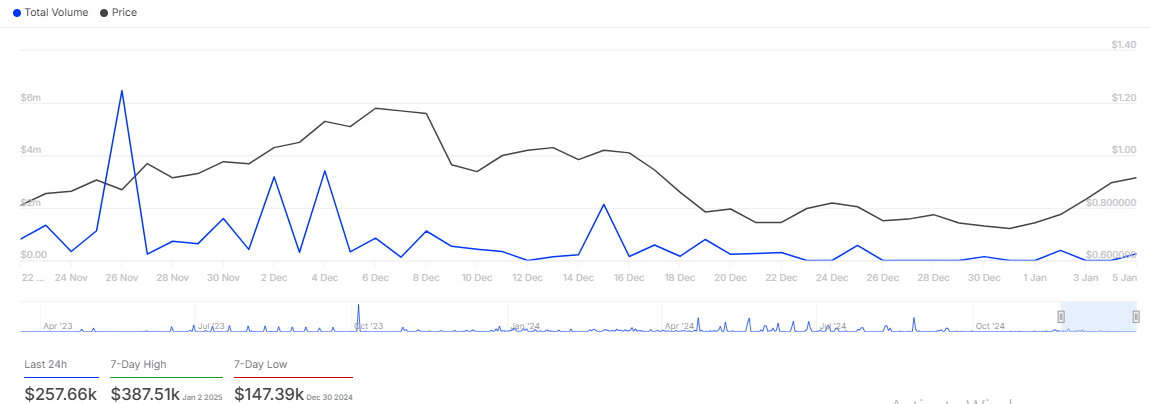

According to IntoTheBlock’s data, there’s been a significant increase in large transactions over the last day. A single transaction included 281,420 ARB, which equates to approximately $257,660. This substantial purchase order seems to have occurred concurrently with a 4% price rise during that period.

IntoTheBlock

Large-scale purchases by whales can create a domino effect throughout the entire market. In this instance, their action ignited greater interest among individual investors, thereby bolstering ARB’s revival.

Retail demand surges higher

As whales help stabilize the cost of Arbitrum, small-scale investors are fueling a surge in positive trends. Market statistics suggest that these individual traders are becoming increasingly confident and active.

One significant factor to consider is the Funding Rate, which has consistently increased and currently stands at 0.0082%. This trend suggests optimistic market feelings, as long-term traders are willing to pay extra to keep their contracts alive.

At the same time, open interest has risen by 8.81%, reaching a total of $256.01 million. This surge indicates more derivative contracts left unresolved, signaling increased speculation in the market leaning towards ARB.

Furthermore, it appears that more and more spot traders are shifting their ARB tokens from exchange platforms into personal wallets for extended storage. In the last 24 hours alone, over $2.39 million worth of ARB has been taken off exchanges, which could result in a potential shortage of supply.

Read Arbitrum’s [ARB] Price Prediction 2024–2025

In other words, this means that the amount of Arbitrum available for trade on the exchange is limited, which might lead to an increase in prices since the demand seems to be greater than the current supply.

As a researcher, I find myself confidently predicting that should these tendencies continue, I foresee Arbitrum maintaining its positive trajectory and potentially recording even more significant advancements in the short run.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2025-01-07 01:43