- So, Ethereum‘s total netflow just had a glow-up, with a fabulous +3.75k ETH change in the last 24 hours. Who knew crypto could be so dramatic?

- ETH Whale accumulation is like the pre-party hype before a big event, and their 24-hour net buy of $1,020,676 is the glittering invitation we all want!

Ethereum [ETH] is doing the cha-cha between accumulation and sell-offs, determining its short-term moves while long-term trends are like that mysterious friend who always knows where the party is at.

In the last 24 hours, whales and smart DEX traders (SDT) have been net buyers, signaling a party of accumulation. Whales splurged with a buy volume of $6,942,812, outshining their sell volume of $5,922,136. Talk about a shopping spree!

SDT joined the fun, with a buy volume of $2,803,388 against a sell volume of $1,957,518. It’s like a crypto version of “who wore it best?”

These moves show that institutional and experienced traders are feeling pretty confident about ETH’s future price. 🤑

But wait! Smart Money (SM) decided to play the villain by selling $1,659,691 while only buying $969,774. Classic plot twist!

Despite this selling drama, the buy-side dominance kept the bearish vibes at bay. In a shorter 6-hour timeframe, everyone seemed to be on their best behavior. Whales net bought $180,399, SDT posted $84,023, and SM added a tiny net buy of $44,296. It’s like they’re all waiting for the next big signal before making any bold moves.

Whale accumulation, often a precursor to bullish moves, was evident with a 24-hour net buy of $1,020,676, reinforcing a positive outlook. SDT’s $845,870 net buy further supported strategic accumulation. It’s like they’re all in on a secret!

In contrast, SM’s net sell of $689,917 suggested profit-taking but lacked the volume to change the market’s mood. If whale and SDT buying keeps up, Ethereum could be testing critical resistance levels soon. But if SM starts selling more, we might be in for a corrective phase. Yikes!

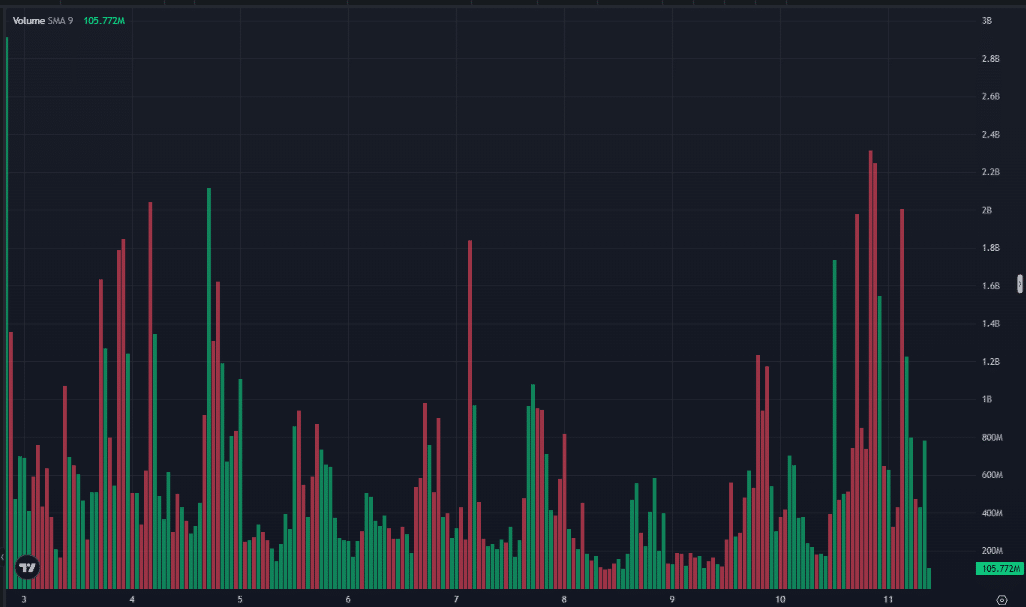

Assessing market momentum

Further, net volume analysis reinforced the bullish sentiment observed in large trader activity. Over 24 hours, whales accumulated a net buy of $1,020,676, reflecting strong positioning. It’s like they’re all flexing their crypto muscles!

SDT followed with a net buy of $845,870, while SM registered a net sell of $689,917. The net volume balance favored buyers, strengthening ETH’s short-term outlook. Go team!

Shorter-term trends indicate reduced market aggression. Over the past six hours, whales recorded a net buy of $180,399, SM contributed $44,296, and SDT achieved $84,023. Everyone’s being a bit shy, waiting for the right moment to shine.

Historically, extended net buying has driven ETH to higher price targets. But watch out! Intensified selling pressure could lead to a pullback. Drama alert!

Tracking sustained net buying is essential to confirm a bullish continuation, while increasing net selling may signal profit-taking or potential downside risk. It’s like a soap opera, but with more numbers!

ETH market implications

ETH total netflow experienced a positive shift in the last 24 hours, recording a +3.75k ETH change. But broader trends reveal a complex picture, like trying to understand your friend’s love life.

Over the past three months, netflows averaged -430.58k ETH, signaling persistent outflows. March 10, 2025, saw netflows dip to -215.42k ETH before rebounding. It’s like a rollercoaster ride!

The 7-day netflow change showed a promising +239.52k ETH, while the 30-day figure stood at -99.69k ETH, indicating lingering out

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-03-12 03:07