As I sit here, sipping my tea and pondering the mysteries of the cryptocurrency universe, I am reminded of the oft-repeated adage: “the trend is your friend.” And, dear reader, it appears that Chainlink is on the cusp of a most thrilling adventure. 🎉

The confluence of factors, a symphony of chart patterns, address-level activity, and ecosystem expansion, has drawn the attention of analysts and traders alike. It’s a bit like a game of musical chairs, except instead of chairs, it’s a mad dash to accumulate LINK before the music stops. 🎶

According to the esteemed analyst Cryptorphic, Chainlink price is forming a symmetrical triangle pattern on the 4-hour chart, a structure often associated with upcoming volatility. It’s a bit like a coiled spring, waiting to unleash its fury upon the world. 🔥

The critical breakout level to watch is $14.10, a threshold that, if breached, could unleash a torrent of buying activity. It’s a bit like a dam waiting to burst, and when it does, the resulting flood could be quite…illuminating. 💡

If LINK price moves decisively above the $14.10 resistance, the next potential upside targets lie at $15.60 and $17.14. These levels reflect historical resistance zones from recent price action in June and May, respectively. It’s a bit like a game of hopscotch, except instead of hopping, it’s a mad dash to accumulate LINK. 🏃♀️

The Long-Term View: A Sea of Tranquility

Analyst Gustavo has outlined a positive long-term view for Chainlink price, projecting a potential value of $17.31 by 2025, supported by strong ecosystem growth. It’s a bit like a calm sea, with nary a ripple in sight. 🌟

Moreover, projections suggest that LINK could reach between $62.84 and $140.07 by 2031, depending on adoption rates and protocol expansion. The strong buy sentiment among long-term holders is tied to these structural factors rather than short-term price swings. It’s a bit like a game of chess, except instead of pieces, it’s a battle of wits between bulls and bears. 🏰

LINK Whale Wallets: The Unsung Heroes

Analyst Ali provided an on-chain perspective using the In/Out of the Money Around Price (IOMAP) metric from IntoTheBlock. The model identified $12.87 to $13.26 as a key support zone, where over 53.91 million LINK were accumulated by more than 20,000 addresses. It’s a bit like a secret society, except instead of handshakes and passwords, it’s a cabal of LINK enthusiasts. 🤫

The chart marked $15.30 as a critical threshold; clearing it could remove considerable overhead pressure and allow the price to move freely. The IOMAP data also shows that only 0.67% of LINK supply is currently “at the money,” while over 63% remains “out of the money,” creating potential for upward price repricing if resistance is breached. It’s a bit like a game of Jenga, except instead of blocks, it’s a delicate balance of supply and demand. 🤹♀️

Consolidation Phase: The Calm Before the Storm

Ongoing Chainlink price consolidation near $13.50 has created anticipation among technical analysts and traders. The repeated defense of support zones, combined with higher lows, signals that buyers are gradually regaining control. It’s a bit like a game of tug-of-war, except instead of ropes, it’s a battle of wills between bulls and bears. 🏹

However, the absence of strong volume spikes indicates that a full breakout confirmation remains pending. Analysts are closely monitoring a move above $14.10 as the initial catalyst for a trend shift. It’s a bit like a game of dominoes, except instead of tiles, it’s a delicate balance of market sentiment. 🤯

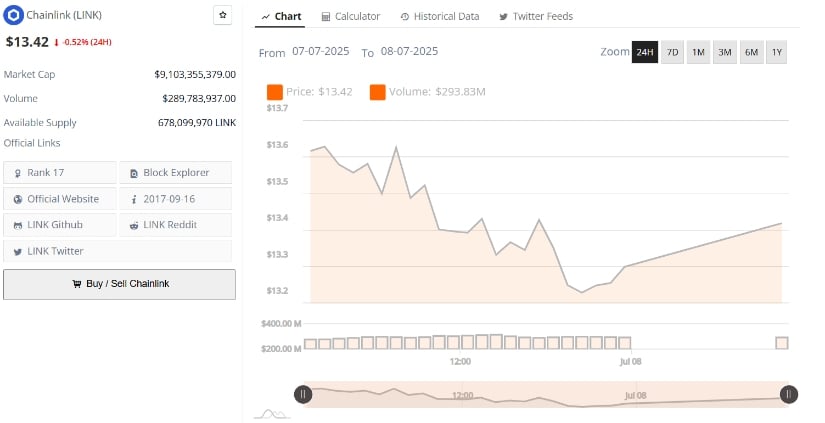

Chainlink Price Recovers After Intraday Dip

According to BraveNewCoin data, Chainlink (LINK) witnessed a volatile 24-hour trading session, dipping steadily from $13.80 to a low near $13.00 before rebounding sharply to close at $13.67. The decline persisted through most of the July 4–5 window, reflecting cautious investor sentiment during lower liquidity periods. It’s a bit like a rollercoaster ride, except instead of hills and valleys, it’s a wild swing of market emotions. 🎠

Throughout this period, Chainlink price maintained a trading volume of approximately $321.81 million, while its market capitalization remained firm at $9.26 billion. Despite the mid-day weakness, the rapid recovery near the $13.00 mark suggests this level is acting as short-term support. It’s a bit like a game of catch, except instead of balls, it’s a delicate balance of market forces. 🤹♀️

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- 10 Movies That Were Secretly Sequels

- Best Werewolf Movies (October 2025)

- These Are the 10 Best Stephen King Movies of All Time

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- USD JPY PREDICTION

2025-07-08 22:36