-

In the last seven days, MKR has surged by 6.17% defying current market odds.

With increased whale activity, MKR’s buying pressure has pushed price up.

As an experienced crypto analyst, I have closely monitored MakerDAO (MKR) in the last few days, and I am impressed by its resilience amidst market volatility. In just the past seven days, MKR has surged by a significant 6.17%, defying current market odds. This surge can primarily be attributed to increased whale activity, which has pushed the price up, as evidenced by a recent post from IcryptoAI highlighting smart money accumulation.

I, as an analyst, have observed that MakerDAO’s [MKR] value has been on an upward trend in the last week, even amidst market instability. At present, I notice a 2.01% increase in MKR’s value over the past 24 hours.

The continuous rise of MKR in contrast to the overall drop in the cryptocurrency market has fueled curiosity and rumors surrounding the reasons for its growth.

Initially, the price increase is driven by shrewd investors’ buying activity. According to a recent post on X by IcryptoAI, this is the case.

” $MKR topped the list of accumulation by Smart Money in the past 24 hours.”.

IcryptoAI further explained that,

At present, the wallet contains 100.81 million MKR, equivalent to approximately 256,860 dollars. Furthermore, the wallet is home to 1,590 DMT units, which amount to around 144,930 dollars.

Whales’ actions with regard to whales, coupled with the persistent cryptocurrency market growth, have led several crypto analysts to ponder MKR‘s potential market direction.

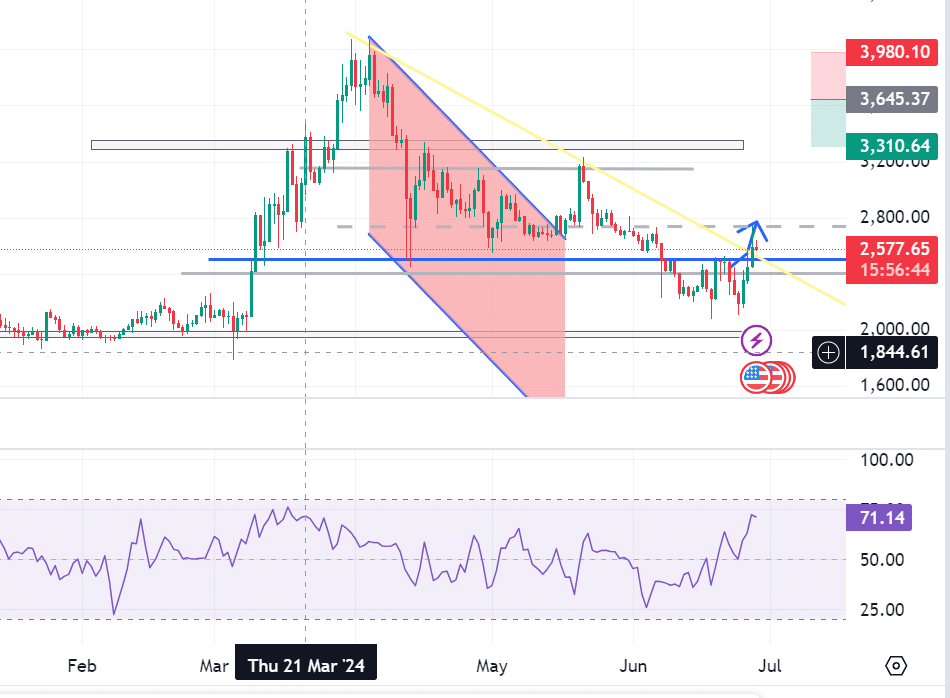

For instance, crypto analyst, @market maker predicts a rally towards $4k.

He added that,

“A potential falling wedge pattern is being tested, with horizontal resistance level in play. A break above this resistance could trigger a sharp bullish rally towards $4000.”

Analysts predict a significant price surge for Mkr if it successfully breaks out and retests the established falling wedge pattern on the daily chart.

What do MKR fundamentals indicate?

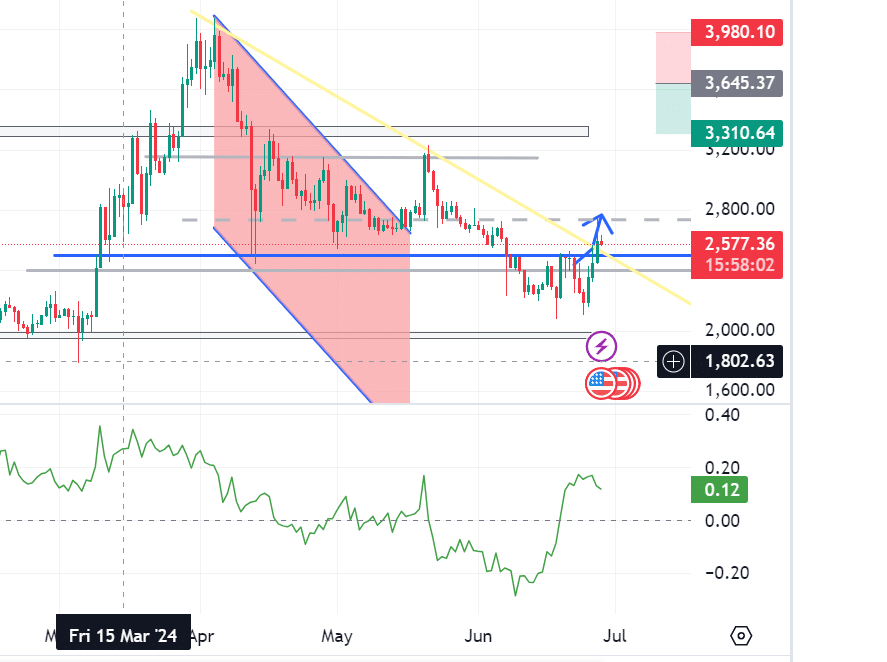

As an analyst, I’d interpret MKR‘s Money Flow Index (MFI) reading of 72 at present as a sign of strong buying pressure. This level signifies that buying activities are more substantial than selling ones, making it a bullish indicator. An MFI at this stage typically suggests that the uptrend may persist.

As a researcher analyzing the market trends, I’ve noticed that MKR‘s Relative Strength Index (RSI) currently stands at 55, which is notably higher than its moving average RSI of 45. This disparity suggests a robust bullish trend for MKR in the market.

When the cross between the moving averages based on RSI (Relative Strength Index) occurs above the current RSI value, it indicates a robust uptrend and heightened buying activity as the RSI continues to rise.

As a researcher, I’ve observed that MKR‘s Chaikin Money Flow (CMF) reading of 0.15 indicates a strong buying pressure in the market. This signifies that more money is flowing into buying than selling, leading to an accumulation of the asset. The dominant buying activity suggests a bullish trend and a favorable market sentiment.

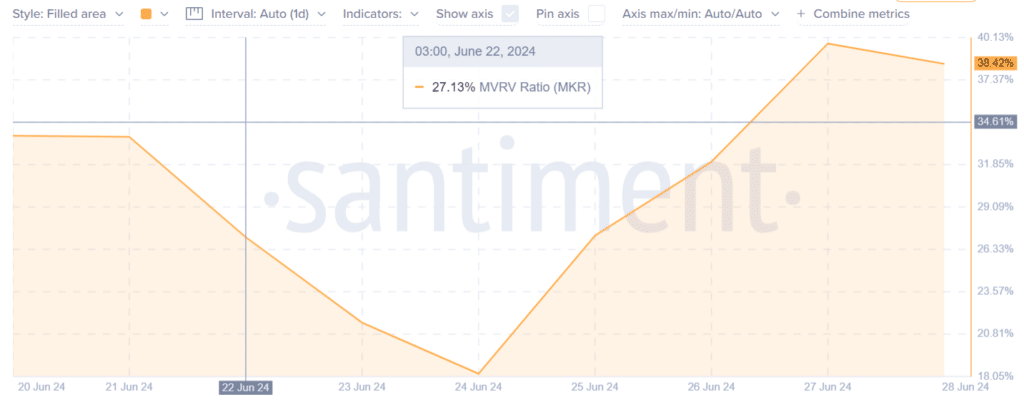

Based on AMBCrypto’s assessment of Santiment’s data, the coin currently has an MVRV Ratio of 38.42%. In simpler terms, this means that the coins in circulation are trading 38.42% above their realized value, which is the price at which they were previously sold.

As an analyst, I can interpret the current Market Value Realized Value (MVRV) ratio, which indicates that holders have achieved a 38.42% profit on their initial investment cost. This signifies a thriving market condition where investors are experiencing gains without pushing prices to unsustainable levels that could potentially trigger a significant correction.

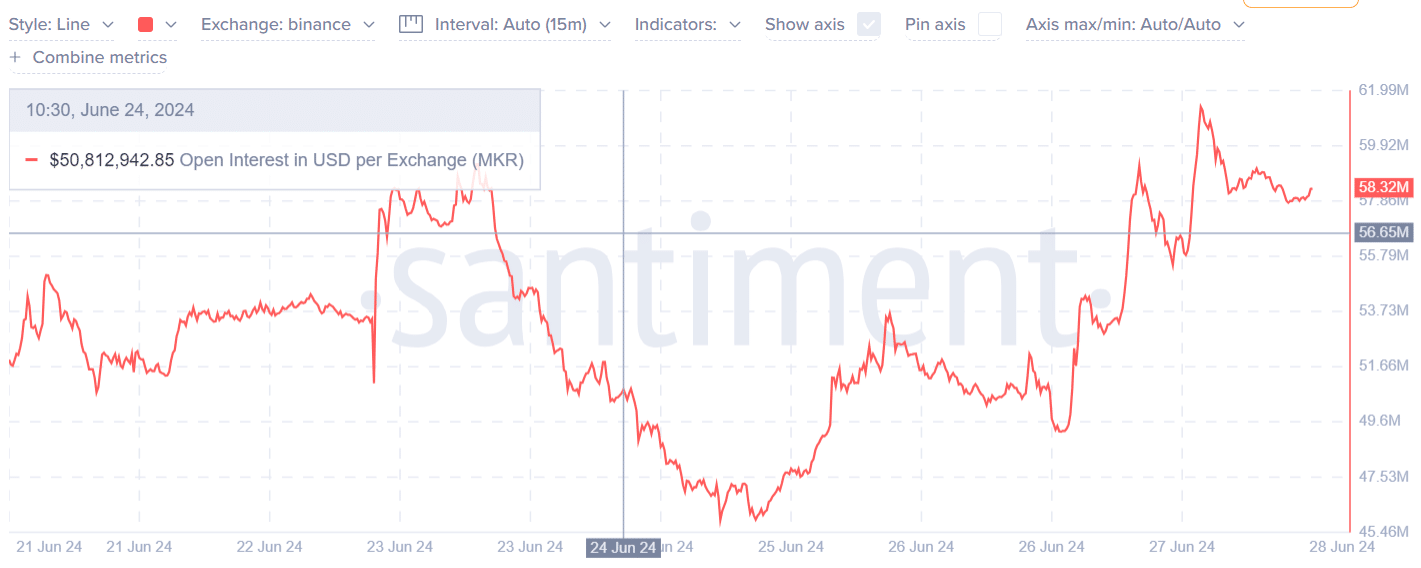

Our findings show that open interest for MKR has increased significantly across exchanges over the past week. The minimum open interest was recorded at $45.8 million, while the maximum reached an impressive $61.48 million.

A higher number of open positions across exchanges indicates increased trading action and investor involvement. This heightened market activity signifies growing faith in MKR‘s trajectory and resilience, making it a positive indicator for potential price growth.

How far will Maker surge?

Currently, MKR is being bought and sold for around $2600.76 in the market. The market forecast continues to be optimistic based on several signs, including the Cumulative Moving Average (CMF).

How much are 1,10,100 MKRs worth today?

As an analyst, I’ve observed that based on Moving Average Indicators (MFI) and Relative Strength Index (RSI), the bullish market trend is likely to persist, contingent upon the sustained momentum. Consequently, if MKR manages to uphold this positive momentum, it could potentially advance towards the next resistance level at approximately $2738. Subsequently, should this uptrend continue, we may witness the long-anticipated milestone of $3000 for MKR.

If a market correction occurs, it is expected that the price will find some support around the $2503 level before potentially falling further down to approximately $2403.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-06-28 19:04