-

RENDER saw massive whale interest, signaling a market rebound.

Whales had huge market influence and owned nearly 92% of RENDER’s supply.

As a seasoned crypto investor with battle-hardened instincts honed through years of navigating the ever-shifting sands of the digital asset market, I find myself intrigued by the recent developments surrounding RENDER [RENDER]. The surge in whale interest and the subsequent accumulation of nearly 92% of the token’s supply is a clear sign that the big players see potential for significant growth.

As a researcher, I’ve noticed an impressive surge in the value of [RENDER] network, accompanied by heightened whale activity, which coincides with the recent rebound of Artificial Intelligence (AI) and Decentralized Finance (DeFi) sectors.

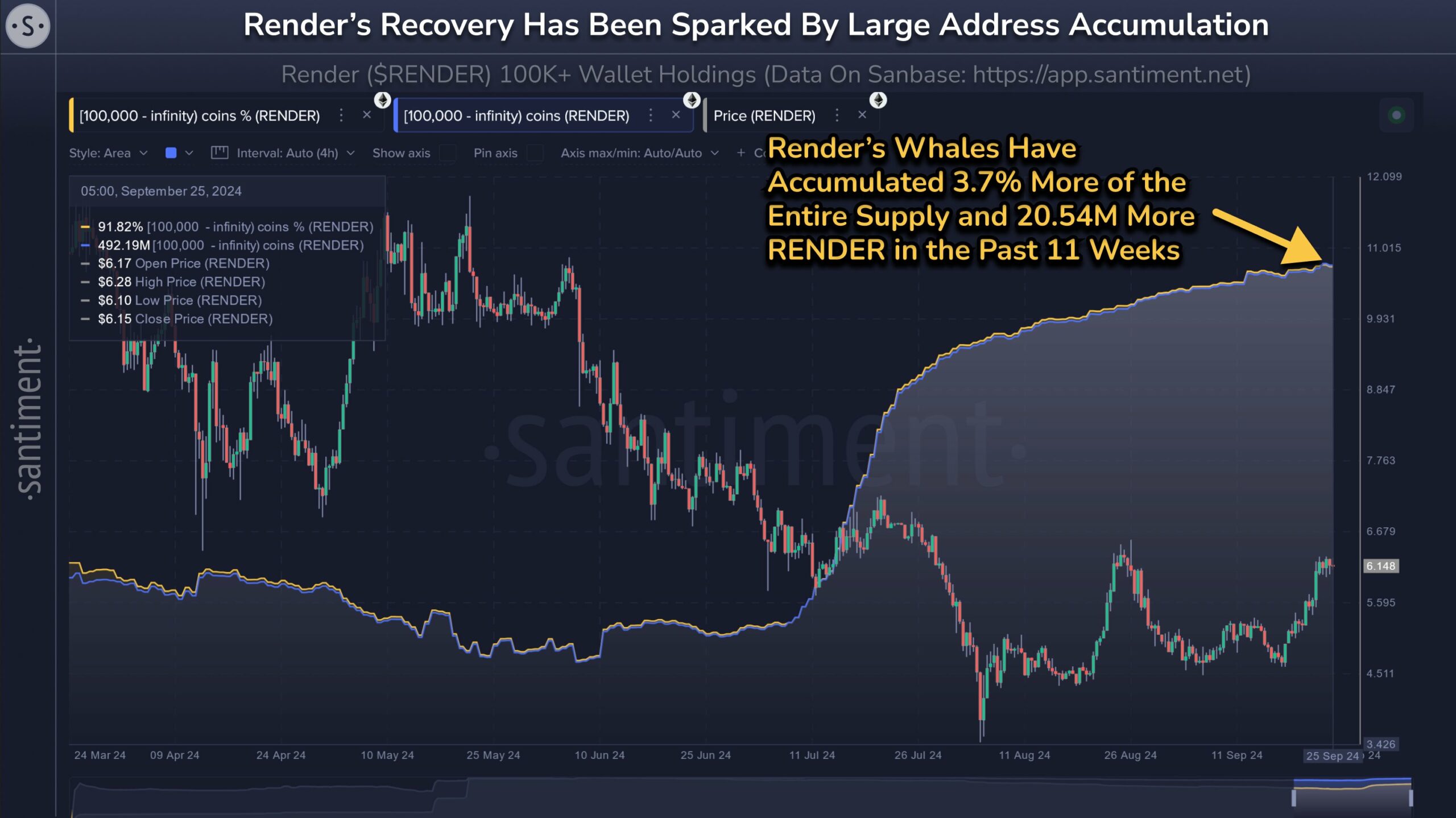

Based on information from Santiment, there has been a growth in the holdings of large investors (often referred to as “whales”) in the crypto asset RENDER, following its recent market rebound.

Over the past three months, they managed to secure an additional 3.7% (equating to approximately 20.54 million tokens), which now gives them a commanding control over 92% of the total supply.

High-value wallets holding 100K or more RENDER tokens, categorized as ‘sharks’ and ‘whales,’ have amassed an additional 20,540,000 coins (valued at approximately $126.3 million) over the course of 11 weeks. These large investors currently control about 91.82% of the total RENDER supply.

Should you copy whales?

large investors frequently place substantial bids as a strong indication of their confidence that the asset’s value will increase significantly in the coming months, particularly during Q4, given their optimistic outlook.

The token was up 26% in September amid an overall lift-off in the AI sector.

Over the past few weeks since the dip in August, I’ve noticed that my RENDER investment has stayed below the $6.3 mark, which was its lowest point in Q3. On a daily basis, however, this altcoin appears to have formed a promising bullish double-bottom pattern, with $6.2 serving as the neckline. This could be a potential sign of recovery if we see a breakout above this level.

A strong upward surge might propel RENDER‘s value by approximately 30% and surpass $8, or exceed its 200-day Moving Average.

In order for the recovery to continue, the market price needs to surpass $6.2. There’s a substantial resistance area, denoted as red, around the $7 level, which could potentially hinder further growth and be favorable to the bears.

If the token jumps above $7, the next bullish target would be $10.

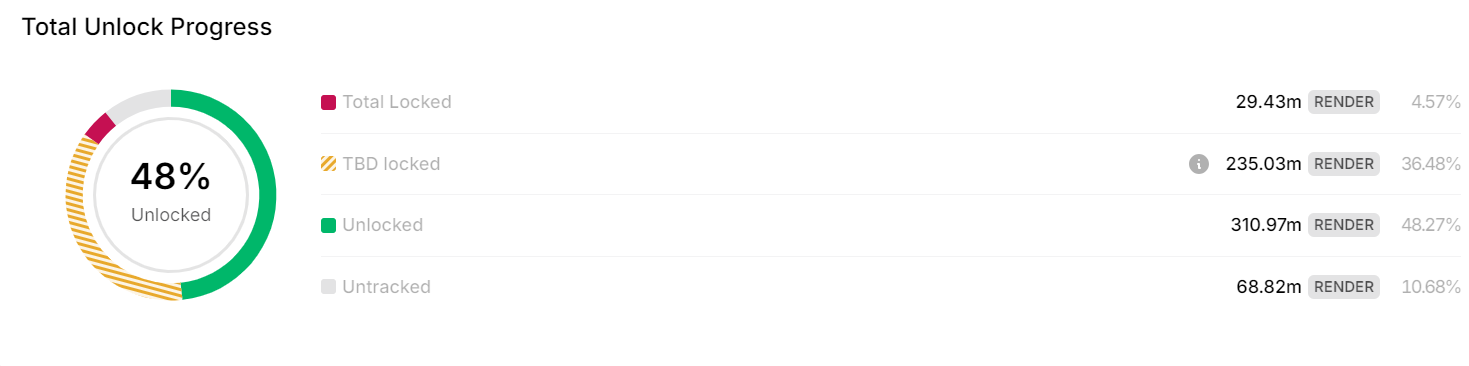

Despite RENDER’s attractive risk-reward (RR) ratio, there was still a significant supply overhang from token unlocks.

Based on the information from Token Unlocks, approximately 60% of their total token supply, which amounts to 644 million units, has been made accessible so far.

235 million tokens (TBD) are currently locked away, associated with treasury operations. At this moment, there’s no scheduled release date or official timeframe for when these tokens will become accessible.

The huge supply overhang could affect prices if released to the market unexpectedly.

Therefore, since whales held significant influence over the RENDER market, they were able to set prices. Consequently, it would be wise for speculators to observe the behavior of these whales to determine suitable times for entering and exiting the market in order to maximize profits.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-09-26 17:11