- Whales bought 210 million DOGE during the recent price correction.

- The market structure saw multiple higher lows as it rebounded on 2-hour timeframe.

As a seasoned analyst with years of experience dissecting market trends and investor behavior, I find myself intrigued by the recent activity surrounding Dogecoin [DOGE]. The significant buying spree by whales, totaling approximately 210 million DOGE, during the price correction is a clear indication that these large holders believe in the potential for future growth.

In the past few weeks, there’s been a considerable increase in the total Dogecoin [DOGE] held by whales who own between 10 million and 100 million coins. This rise coincides with increased buying activity among these large investors during periods of price drops, suggesting strong market interest and potential for price recovery.

It’s clear that the significant investors (often referred to as “whales”) in Dogecoin have been quite busy lately, with an estimated 210 million DOGE coins being added to their existing holdings.

Buying patterns frequently cause prices to either remain steady or increase because they decrease the number of items available for sale on the open market. As a result, Dogecoin (DOGE) stands poised to benefit from the attention of high-volume traders.

This shows that investors have high faith in the possibility of price rises in the future, as indicated by their actions towards the stakeholders.

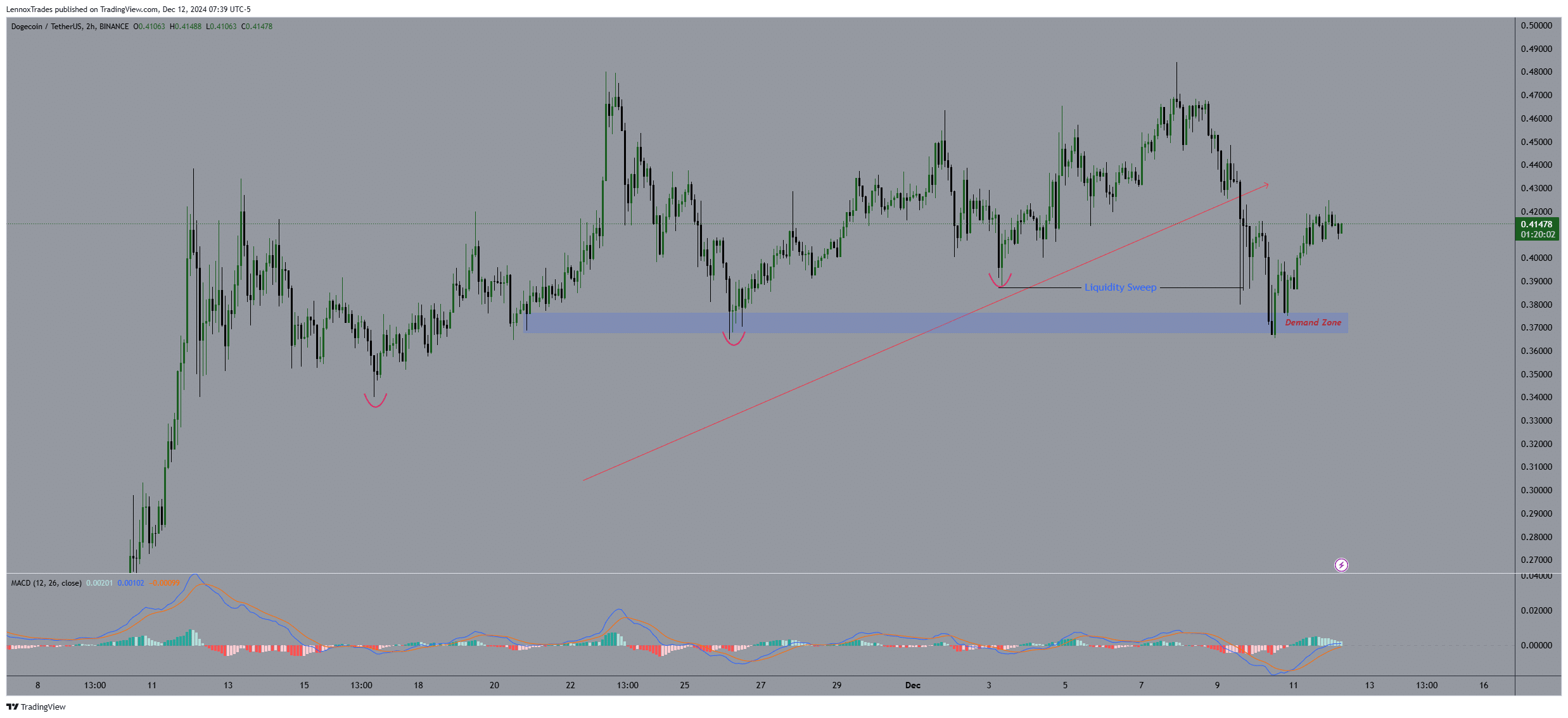

DOGE’s MACD crossover

Over a span of two hours, the Doge’s price movement exhibited a pattern of progressively rising bottoms, suggesting a positive or upward trend. At present, the price has resumed trading above the 0.40 dollar mark.

At important transition moments such as $0.33, $0.36, and $0.4, these higher minimum values formed a pattern consistent with an upward trend. This pattern indicated that the demand to buy was persistently stronger than the urge to sell.

During a specific period, a ‘Liquidity Sweep’ occurred, causing the price to momentarily drop under the $0.36 mark but then bounce back. This occurrence appears to indicate a trial of the buyers’ determination and resilience.

In simpler terms, the ‘Demand Zone’ functioned as a significant region where buyers showed great interest in previous market consolidations. This zone might serve as a base that pushes Dogecoin (DOGE) above $0.5 before experiencing another downturn.

As a researcher, I observed an occurrence of a bullish crossover with the Moving Average Convergence Divergence (MACD) indicator. Specifically, the MACD crossed above its signal line, signaling a possibility for sustained upward trend continuation.

The bullish indication matched up well with the structural analysis on the price graph, implying a favorable outlook on the market’s attitude towards Dogecoin.

Should this trend carry on, there’s a possibility that the value of Dogecoin might escalate beyond its previous peak at $0.5, fueled by robust investor demand and optimistic indicators from the Moving Average Convergence Divergence (MACD).

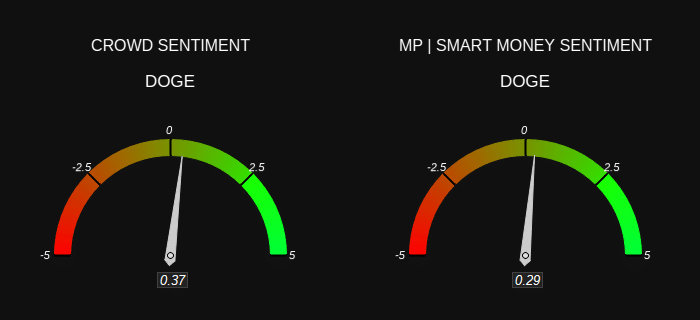

Market sentiment

Further examination revealed a strong agreement between the public’s outlook on Dogecoin (DOGE) and that of savvy investors, as they both showed optimistic views towards it.

The “Public Feeling” registered at 0.37, leaning slightly towards the optimistic side on the scale. This suggested a relatively optimistic outlook among regular investors.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

The “Smart Money Sentiment,” similarly showed a positive but slightly more cautious sentiment at 0.29, also in the positive range.

It seems that both individual investors and institutional investors (smart money) exhibit a degree of positivity towards Dogecoin. This sentiment arises following the coin’s recent price drop and recovery, suggesting a general optimism or bullish attitude among them.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-12-13 07:03