- Ah, the new Bitcoin whales, those grand architects of market mayhem, are reshaping the very fabric of our financial reality, driving demand whilst artfully constraining the available supply. How delightfully dramatic! 🎭

- This exquisite dance of dynamics may very well ignite a price movement that would make even the most stoic of investors swoon in delight.

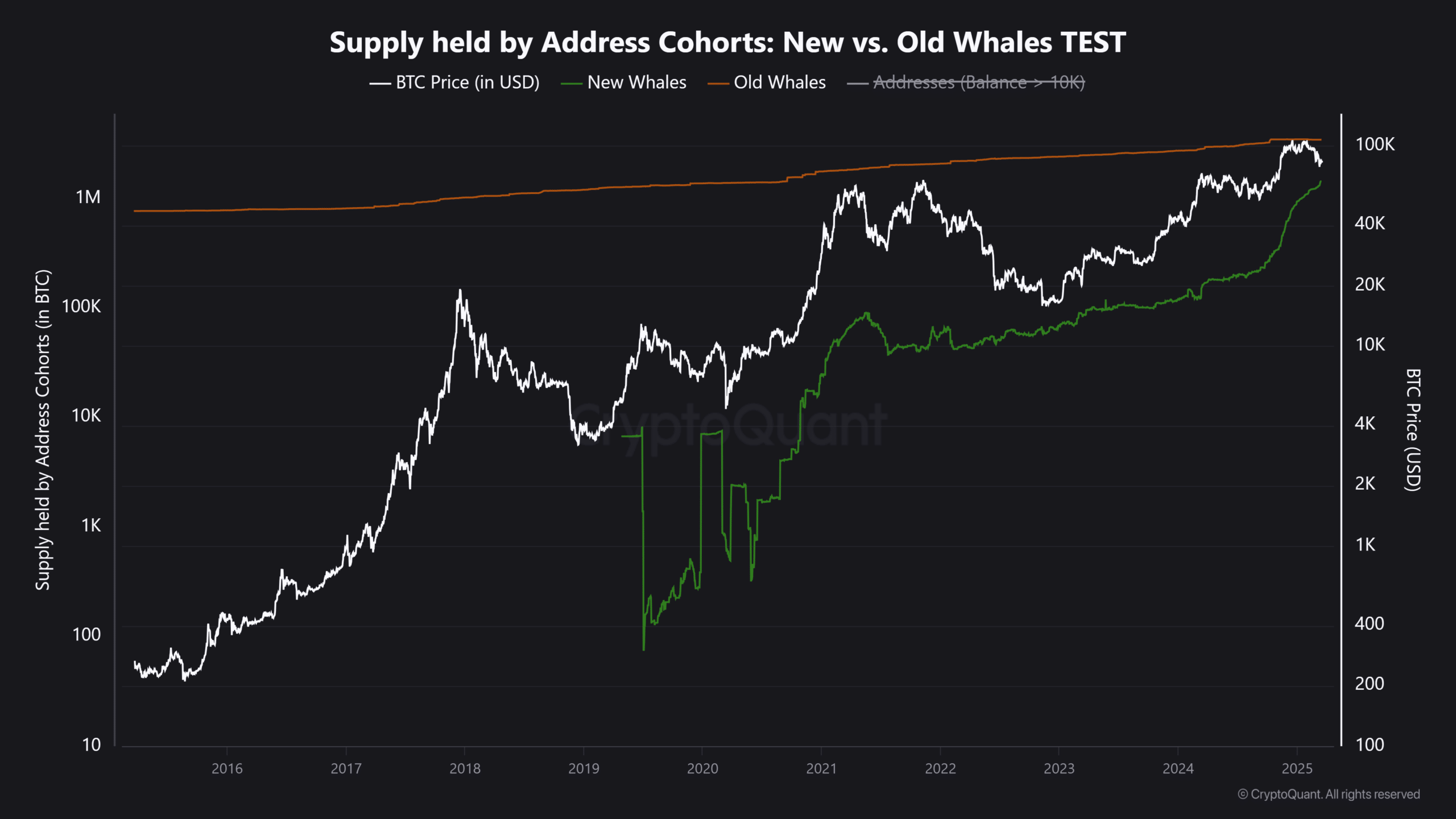

High-net-worth wallets, those glittering treasures holding over 1,000 Bitcoin [BTC], are accumulating with the fervor of a lovesick poet, signaling an unwavering confidence in our dear Bitcoin. Since the fateful month of November 2024, these new whales have added a staggering 1 million BTC to their coffers, with a cheeky 200,000 added just this month. 💸

One might observe that a brief holding period (less than 6 months) indicates a conviction so strong, it could rival the most passionate of romances. This relentless buying pressure suggests that recent “dips” are being absorbed like a fine wine, reducing the likelihood of prolonged corrections. 🍷

In a market dominated by a risk-off sentiment, retail capital remains a ghostly apparition, yet to return. In this curious climate, the continued accumulation of these new whales could very well establish a robust price floor, reinforcing Bitcoin’s support in this theatrical cycle.

Bitcoin’s liquidity profile is shifting

The rapid accumulation of new whale addresses is akin to a fresh breeze of capital wafting through the stale corridors of finance, as reflected in the data below.

Total holdings by these entities (1,000+ BTC, less than 6 months old) have surged from a modest 345k BTC to a staggering 1.5 million BTC. At the current market price of $83,580, this represents a princely sum of approximately $125 billion in Bitcoin. 💰

Meanwhile, the long-term whale holdings (those BTC held for several years, like a fine vintage) have declined from 3.48 million to 3.45 million BTC, aligning perfectly with Bitcoin’s price correction from its $109k all-time high on the 20th of January to a mere $96k on the 6th of February. How tragic! 😢

The sell-side liquidity from both old whales and the weak-hearted has been absorbed by these new whales, whose 200,000 accumulation this month has heroically prevented BTC from retracing below $78k. A true act of valor! 🦸♂️

New Bitcoin whales signal strength: What’s next?

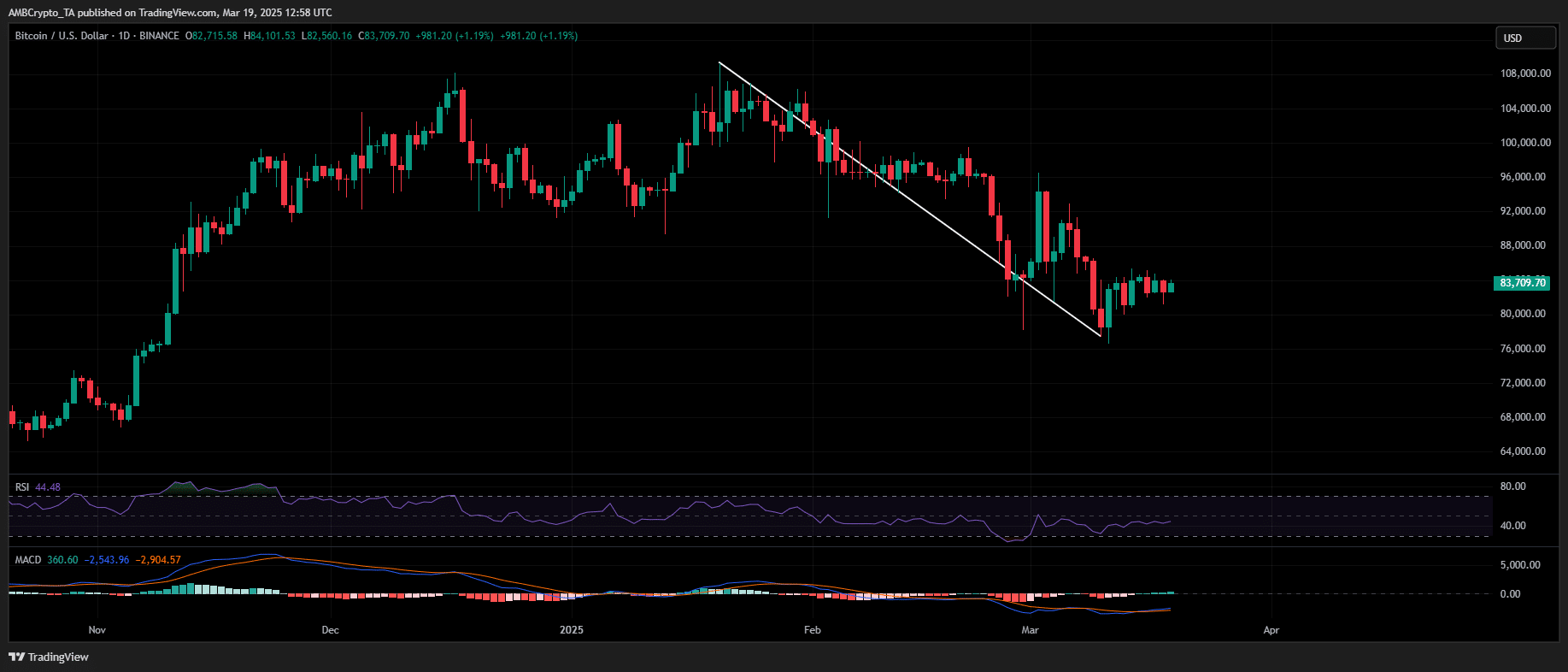

Bitcoin’s recent price swings – from its glorious ATH of $109k to its disheartening drop below $80k – have been largely influenced by the distributions of old whales and the whims of macro-driven liquidity shifts. Such drama! 🎭

However, the inflows from these new whales are reinforcing support, mitigating the downside risks with the grace of a ballet dancer. If this accumulation continues at its current levels, the probability of BTC retesting its all-time high increases, much to the delight of the hopeful. 🌟

Additionally, macro factors, such as potential rate cuts, once Trump’s economic reset takes effect, could further strengthen Bitcoin’s long-term trajectory, positioning $150k–$160k as a viable long-term target. How positively optimistic! 🌈

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2025-03-19 23:07