-

CryptoQuant founder claims that whales are getting ready for altcoin season.

Another market analyst, Benjamin Cowen, cautions for such calls amidst rising BTC dominance.

As a researcher with years of experience in the crypto space, I’ve seen my fair share of altcoin season calls and, let me tell you, they’ve become as predictable as a full moon! Each new call brings a mix of excitement and skepticism, much like a kid on Christmas morning who’s been told there might be presents under the tree.

At the start of August, there are renewed predictions for an “Alt” coin surge, with only a few weeks until September – when we might see the Federal Reserve lower interest rates for the first time. This latest forecast comes from CryptoQuant, a company specializing in cryptocurrency data analysis.

It’s not the first time market analysts have predicted an ‘altcoin season’, and it may not be the last. However, so far, these predictions made since the current cycle began towards the end of last year, haven’t come true.

Will whales make this Alt season call different?

So, what makes this latest Alt season call different? Whales, also known as smart money.

Based on the words of CryptoQuant’s founder Ki Young Ju, it appears that whales are making significant preparations in anticipation of the upcoming altcoin market surge.

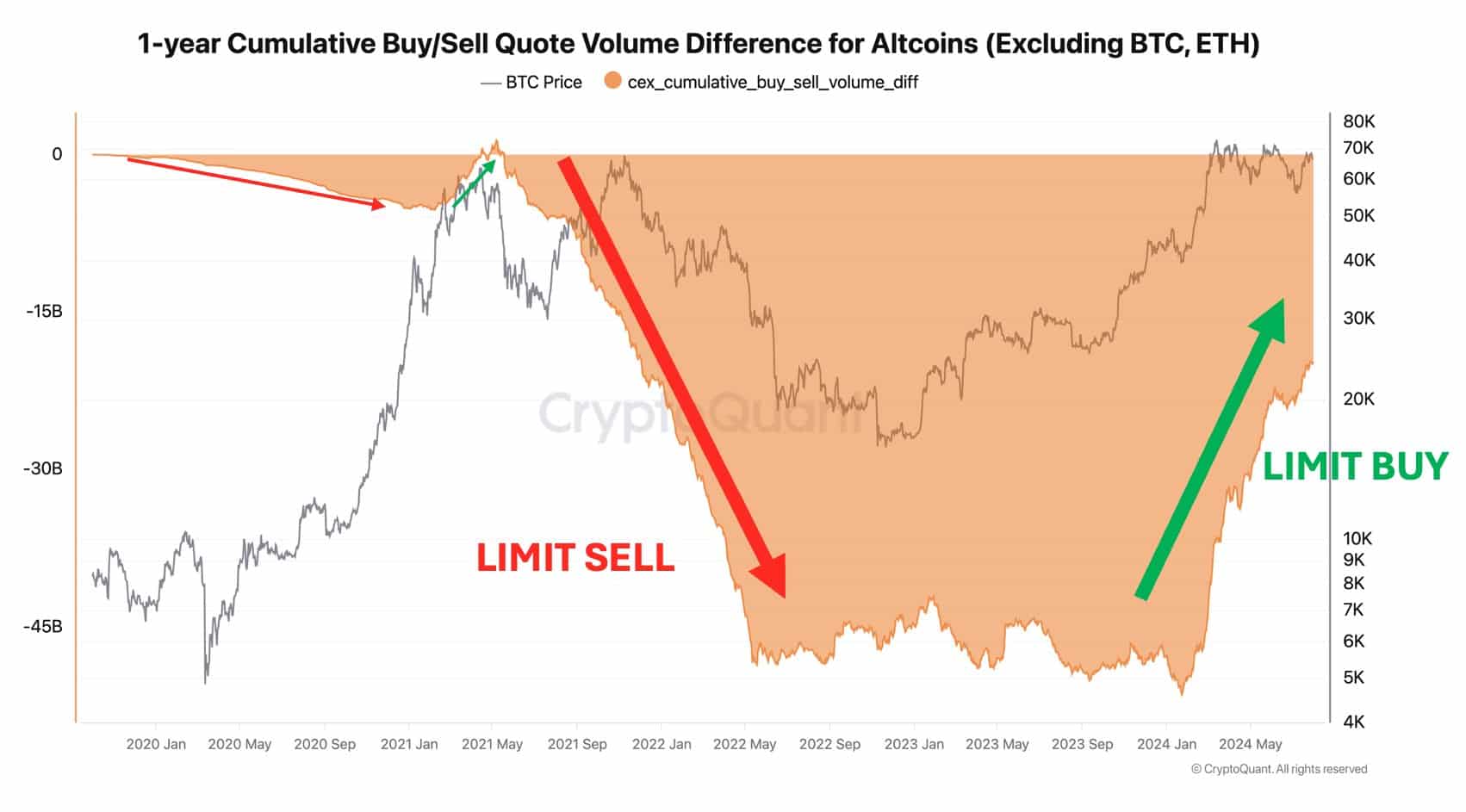

As a crypto investor, my outlook is rooted in the rising gap between the one-year cumulative buy and sell volumes of altcoins.

This metric tracks the altcoin demand from whales and institutions. A rising trend suggests strong demand from whales, while a declining trend underscores less demand.

The attached chart shows that the metric is rising, indicating a massive whale appetite and position for a possible altcoin season.

SwissBlock, a cryptocurrency market analysis company helmed by the founders of Glassnode, has expressed a comparable view on an upcoming Alt season. According to their analysts, the current state of the altcoin market resembles the trend from late 2020 to early 2021, which resulted in a substantial 400% surge for altcoins.

The analysis was based on correlation with US Small Cap (Mini Russell 2000 Index Futures). Notably, other analysts, like Quinn Thompson of Lekker Capital, have cited the positive correlation between Small Caps and crypto.

However, not all analysts are boarding the Alt season call.

Known cryptocurrency expert, Benjamin Cowen, expressed a more conservative perspective, predicting that the dominance of Bitcoin might reach approximately 60% by the year’s end. This potential rise in Bitcoin’s influence may negatively impact the overall altcoin market.

As an analyst, I’ve noticed a steady increase in Bitcoin’s dominance over the market, bucking weekly predictions of an “alt season.”

Cowen indicated that the potential decrease in ALT/BTC might be significant, potentially increasing risks for Altcoins. In 2019, similar trends were observed a month prior to the Fed’s interest rate reduction, suggesting a possible repetition of this pattern.

To put it simply, many market analysts did not follow the advice for altcoin season, based on the latest information available. Interestingly, data from 22 indicators of the Altcoin Season Index shows that as of now, the market is predominantly in a Bitcoin phase.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- LPT PREDICTION. LPT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-08-02 04:08