Précis

- It appears that the illustrious BTC whales have returned with great fervor, amassing a staggering sum exceeding $2 billion in this most fleeting of intervals.

- The burgeoning outflows from exchanges, coupled with other auspicious indicators, suggest that the price of this digital asset may soon embark upon a most upward journey.

Whales Have Filled Their Bags to the Brim

The esteemed analyst, Mr. Ali Martinez, has disclosed on the platform known as X that these large investors have, in a mere span of two days, procured over 20,000 BTC. One must wonder if they have taken to heart the adage, “A penny saved is a penny earned!”

Whales have bought over 20,000 #Bitcoin $BTC in the last 48 hours!

— Ali (@ali_charts) May 29, 2025

According to Mr. Martinez’s chart, the collective holdings of this distinguished group of investors now exceed 4.7 million assets, which constitutes approximately 23.7% of the circulating supply. One might say, “A whale of a catch!”

The accumulation by these whales is generally perceived as a most bullish sign, perhaps a harbinger of a price rally. It indicates a burgeoning confidence in the asset, which may very well entice smaller investors to join this merry bandwagon.

Many users on X have reacted with great enthusiasm, speculating whether the illustrious Michael Saylor might be among those contributing to this buying frenzy. His company has ascended to the status of the world’s largest corporate holder of bitcoin, whilst he himself boasts a personal fortune of over 17,000 BTC, as he so graciously confirmed last year.

Additional Bullish Elements to Consider

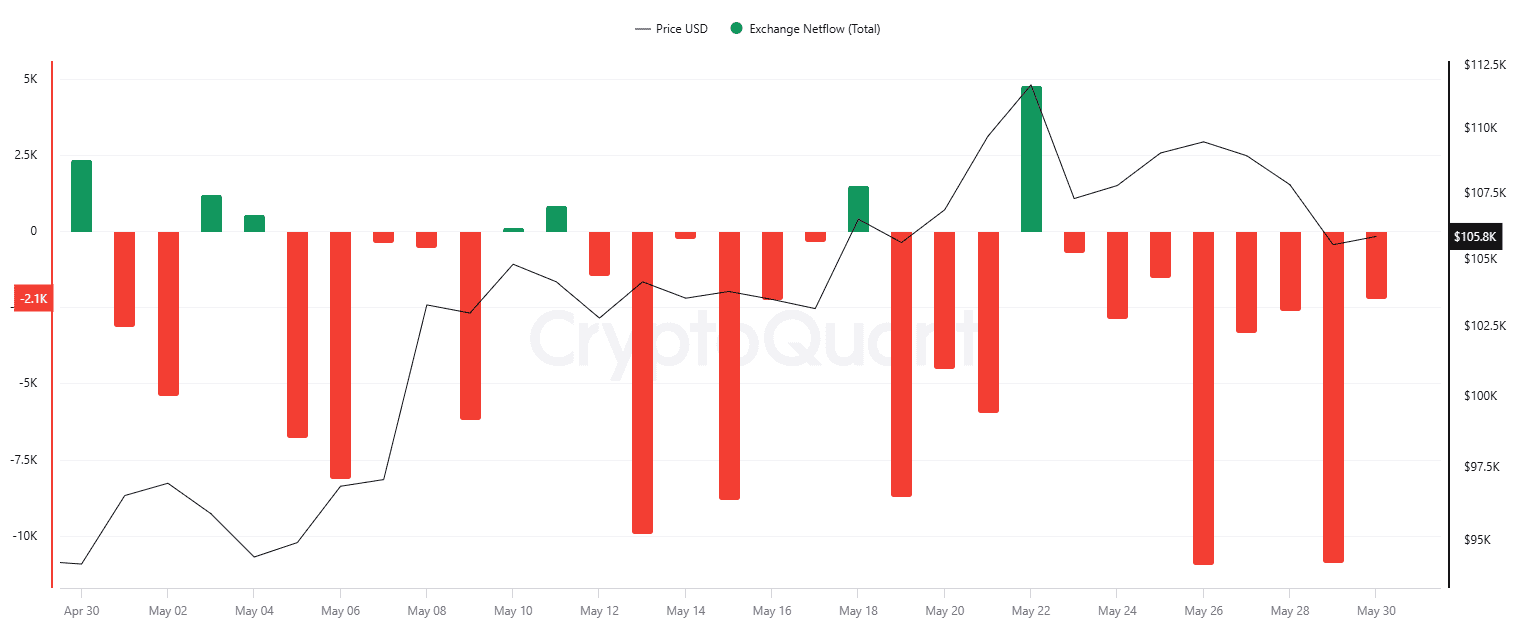

The aforementioned actions of the whales are not the sole indicators suggesting that the price of BTC may soon embark upon a rally. Over the past month, the supply of this asset on exchanges has dwindled significantly. Mr. Martinez has revealed that 30,000 BTC have been spirited away from centralized platforms during this period, while the accompanying chart indicates that net flows from exchanges have been positive on but seven occasions in the last thirty days.

This shift suggests a movement towards self-custody solutions, thereby alleviating immediate selling pressures. How very prudent!

Furthermore, one must consider Bitcoin’s Relative Strength Index (RSI), a most telling measure of the speed and magnitude of recent price changes, which ranges from 0 to 100. When this ratio descends below 30, it typically indicates that the asset may be oversold and poised for a resurgence. Conversely, a reading above 70 is often interpreted as a bearish sign. At present, the RSI has been on a downward trajectory, currently hovering just above the lower threshold. How thrilling!

For those who wish to delve deeper into the myriad factors that may incite enhanced volatility in BTC’s price in the near term, I invite you to peruse our dedicated article here.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

2025-05-30 18:46